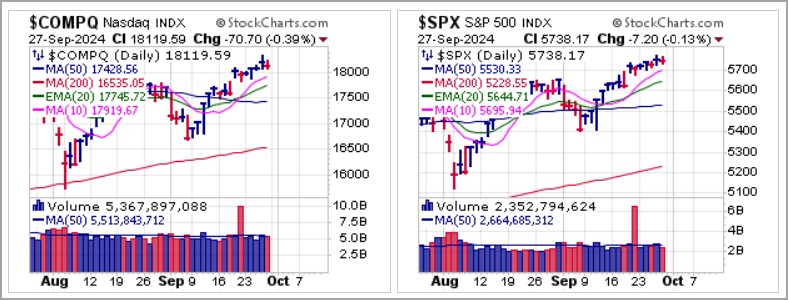

U.S. markets received a major jolt throughout the middle three days of the week as China via the People's Bank of China unloaded three salvoes of bazooka stimulus, sending Chinese stocks rocketing higher and boosting U.S. stocks higher. As the news wore off at the end of the week the major market indexes showed some loss of momentum and may be vulnerable to a near-term pullback unless China unleashes more rounds from its stimulus bazooka over the weekend. The NASDAQ Composite and the S&P 500 both pulled in on Friday as volume contracted following opening rallies.

Both the Dow and NYSE Composite Indexes posted all-time intraday highs on Friday morning before reversing to close near their intraday lows. Both indexes sit in potential double-top positions where pullbacks would not be unexpected.

Both the Dow and NYSE Composite Indexes posted all-time intraday highs on Friday morning before reversing to close near their intraday lows. Both indexes sit in potential double-top positions where pullbacks would not be unexpected.

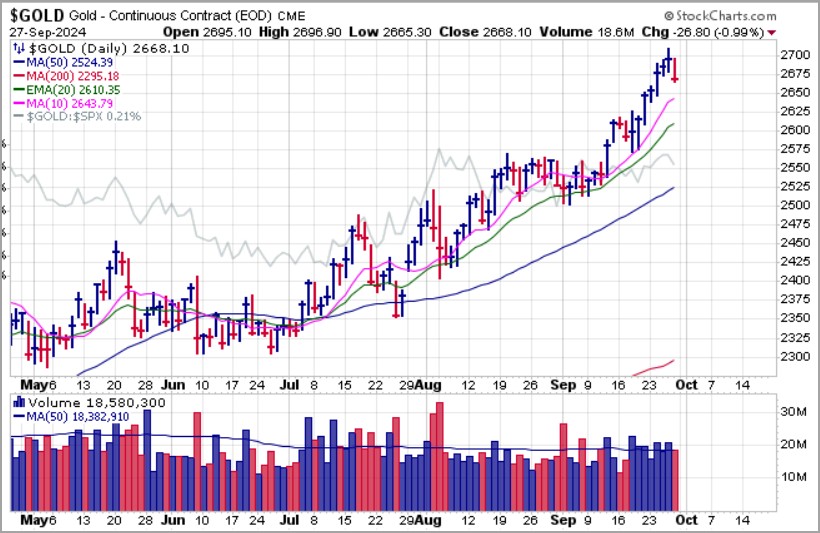

The other big news came in the form of a series of ongoing new highs for gold as Comex Gold Futures cleared the $2700 level for the first time in history at 2708.90 before pulling back less than 1% on Friday. Given the parabolic move in the yellow metal since the late June lows, a pullback at this point is certainly not unexpected with the 10-dma serving as the first reference for potential moving average support. The pullback gives investors a chance to gauge the strength of gold as it either pulls back further or holds tight near the highs and consolidates, or simply moves to all-time highs again this week.

Silver also rallied to new highs on Thursday, clearing the prior 32.75 mid-May high to print 33.02, its highest price since December 2012, before backing down on Friday. Comex Silver Futures are now testing the 10-dma which may provide a potential long entry point using the line as a selling guide.

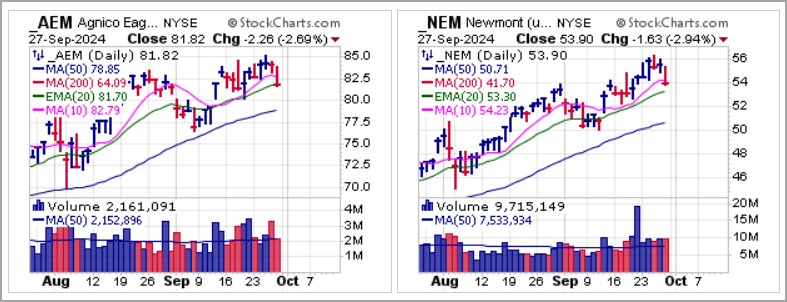

Last week we reported on pocket pivots on two institutional favorites among the gold miners, Agnico-Eagle Mines (AEM) and Newmont Corp. (NEM). Both stocks moved higher and briefly posted higher highs by mid-week and are now pulling in to test 20-dema support. This may bring them back into buyable range so should be watched for constructive action/support at the 20-demas this coming week.

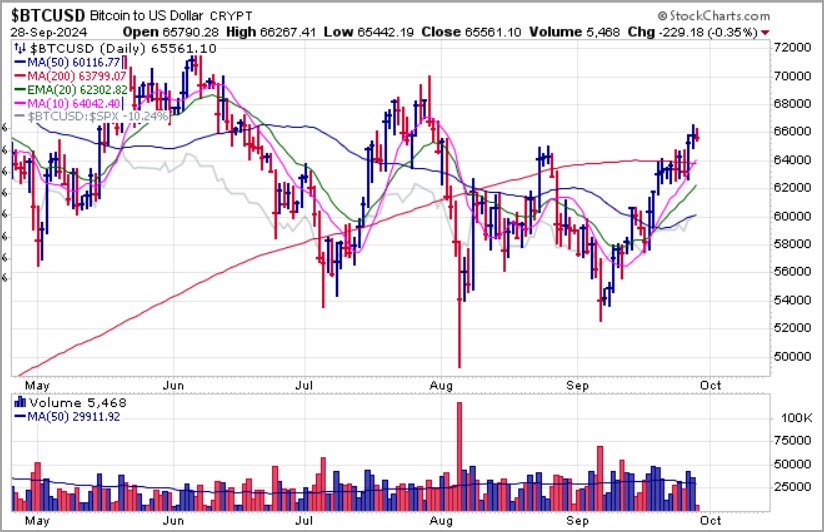

Bitcoin ($BTCUSD), which is ironically banned in China, moved higher on the PBOC's stimulus announcements to clear 200-dma resistance where it held by the end of the week. Overall, $BTCUSD remains in what is now a 29-week consolidation with short-term trends developing within the confines of the base while the longer-term trend remains flat. But China's balance sheet correlates nicely with Bitcoin's price. This yearly cash injection is likely a big reason why, in 2023 (while the US was restricting liquidity with increased interest rates), we saw $BTC and $ETH follow the pattern of blasting off through Q4, and into Q1 of the following year. It looks as if similar will repeat.

Global liquidity also correlates well with the price of Bitcoin.

On Thursday we reported on crypto miners CleanSpark (CLSK) and Iris Energy Ltd. (IREN) as they were posting pocket pivot volume signatures. CLSK's move was a bona fide pocket pivot as it came off its 50-dma while IREN was extended but had posted a bona fide pocket pivot two days earlier.

Coinbase Global (COIN) was also reported on as a pocket pivot on Thursday and it has continued higher. It is now well extended from the pocket pivot entry near the 20-dema as it approaches potential resistance at the 50-day moving average.

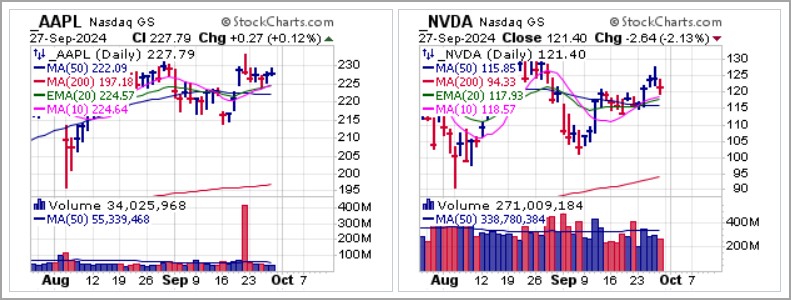

Despite a 1/2% rate cut from the Fed two Wednesdays ago and three days of bazooka stimulus coming out of China, tech stocks have remained mostly flat. Two big-stock names we reported on two weeks ago, Apple (AAPL) and Nvidia (NVDA), have simply moved sideways as the favorable monetary and stimulus news elicits no significant response. That said, the major trend in big tech names remains up given the wave of global liquidity. Keep in mind that nothing goes up in a straight line so both short and long plays can be actionable as leading stocks trend higher with pauses and corrections along the way.

The Market Direction Model (MDM) remains on a BUY signal.