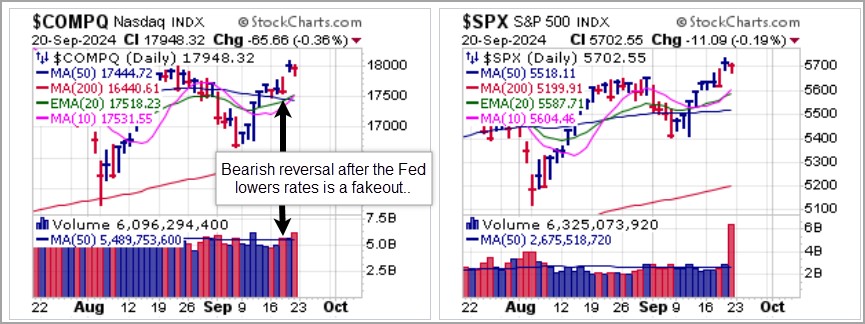

It was an eventful week for the market replete with thrills and spills, including a 1/2% rate cut from the Fed on Wednesday. As would be expected, the market immediately rallied on the news, but once Fed Chair Jerome Powell began his press conference the rally faltered and the indexes reversed in a very bearish move. It appeared by the close on Wednesday that the market read the Fed's 1/2% rate cut as indicative of trouble on the horizon for the economy and potentially a Black Swan, large or small, on the horizon.

But futures regained their footing overnight on Wednesday and by Thursday morning the market was gapping up big. It held that move and then moved into Friday's quarter-end quadruple witching options expiration that saw the major market indexes sell-off on the day on heavy volume, but which did not appear to entirely derail the Thursday gap-up.

It is clear that the Fed is surrendering to inflation given that inflation remains at consistent, rising levels. Fedhead Powell tried to spew the phony line that the economy is in such a "good place" that the Fed could afford to lower rates 1/2%. So if they had lowered rates 3/4% would that have implied that the economy is booming? Somehow, the logic escapes us, and it is clear the Fed sees something on the horizon.

It is clear that the Fed is surrendering to inflation given that inflation remains at consistent, rising levels. Fedhead Powell tried to spew the phony line that the economy is in such a "good place" that the Fed could afford to lower rates 1/2%. So if they had lowered rates 3/4% would that have implied that the economy is booming? Somehow, the logic escapes us, and it is clear the Fed sees something on the horizon.The rate cut was bullish for precious metals as gold posted a new all-time high by the end of the week. The The continuous Gold Futures ($GOLD) contract ended the week at $2,646.10 an ounce as it appears headed for the $2700 level.

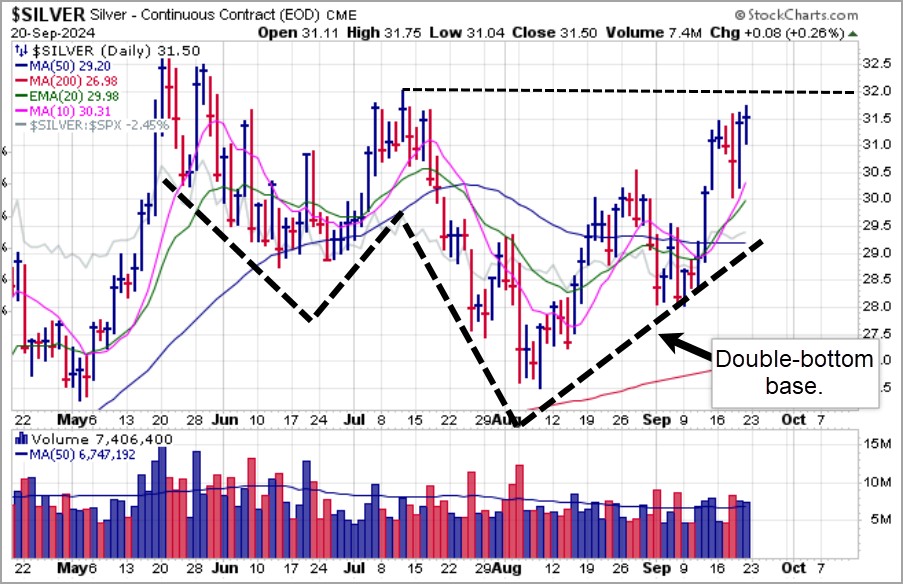

Silver is again behaving like gold, that is like a monetary metal, as it follows gold's lead. The white metal is now challenging the mid-point of a double-bottom formation as it looks to break out to higher highs. If it can clear the mid-point of the pattern at 32.02, then it may be clear to push substantially higher. For now, the action in precious metals is extremely bullish, particularly in light of the Fed's 1/2% rate cut.

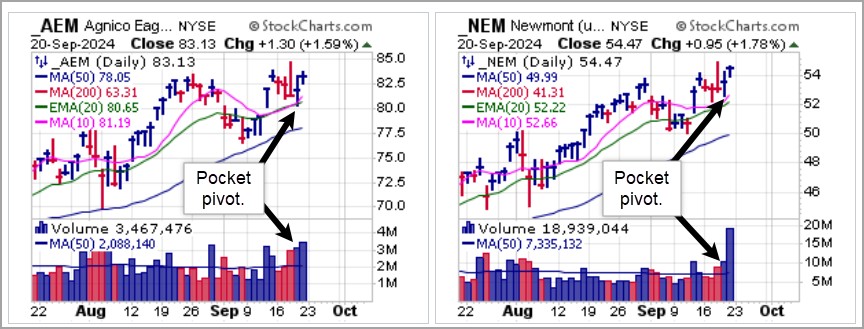

Silver is again behaving like gold, that is like a monetary metal, as it follows gold's lead. The white metal is now challenging the mid-point of a double-bottom formation as it looks to break out to higher highs. If it can clear the mid-point of the pattern at 32.02, then it may be clear to push substantially higher. For now, the action in precious metals is extremely bullish, particularly in light of the Fed's 1/2% rate cut. On Friday morning we reported on pocket pivots in Agnico-Eagle Mines (AEM) and Newmont Corp. (NEM). Both stocks edged higher on heavy OpEx-related volume on Friday with NEM posting new higher closing highs.

On Friday morning we reported on pocket pivots in Agnico-Eagle Mines (AEM) and Newmont Corp. (NEM). Both stocks edged higher on heavy OpEx-related volume on Friday with NEM posting new higher closing highs. Gil also discussed McEwen Mining (MUX) in a VooDoo Report on Friday as the stock set up along the 50-dma. By the close on Friday it posted a bottom-fishing pocket pivot (BFPP) at the 50-dma which is actionable using the 50-day line as a tight selling guide.

Gil also discussed McEwen Mining (MUX) in a VooDoo Report on Friday as the stock set up along the 50-dma. By the close on Friday it posted a bottom-fishing pocket pivot (BFPP) at the 50-dma which is actionable using the 50-day line as a tight selling guide. Bitcoin ($BTCUSD) is exhibiting its usual volatility but rallied on the Fed rate cut before running into resistance at the 200-day moving average on Friday. The action reflects a great deal of indecisiveness in the crypto space, and we would like to see this tighten up and consolidate in a constructive manner. This would provide a more sound launch pad for further upside as $BTCUSD has chopped around in what is now a relatively wide 26-week base.

Bitcoin ($BTCUSD) is exhibiting its usual volatility but rallied on the Fed rate cut before running into resistance at the 200-day moving average on Friday. The action reflects a great deal of indecisiveness in the crypto space, and we would like to see this tighten up and consolidate in a constructive manner. This would provide a more sound launch pad for further upside as $BTCUSD has chopped around in what is now a relatively wide 26-week base.

Grayscale Bitcoin Trust (GBTC) was looking like it would post a pocket pivot on Thursday morning as its volume run rate was robust, which we reported on at the time. As the day wore on, volume petered out badly but GBTC still held along 50-dma support and stayed there on Friday as volume dried up sharply. It is unclear whether this will hold up unless Bitcoin ($BTCUSD) can clear 200-dma resistance (see chart above).

MicroStrategy (MSTR) was looking like it might post a pocket pivot on Thursday as well as volume levels were robust early in the day. Volume fell just short of a valid pocket pivot but was certainly heavy as the stock cleared and held the 50-dma. It held again at the line on Friday but further upside will of course likely be dependent on whether Bitcoin ($BTCUSD) can clear 200-dma resistance.

MicroStrategy (MSTR) was looking like it might post a pocket pivot on Thursday as well as volume levels were robust early in the day. Volume fell just short of a valid pocket pivot but was certainly heavy as the stock cleared and held the 50-dma. It held again at the line on Friday but further upside will of course likely be dependent on whether Bitcoin ($BTCUSD) can clear 200-dma resistance.

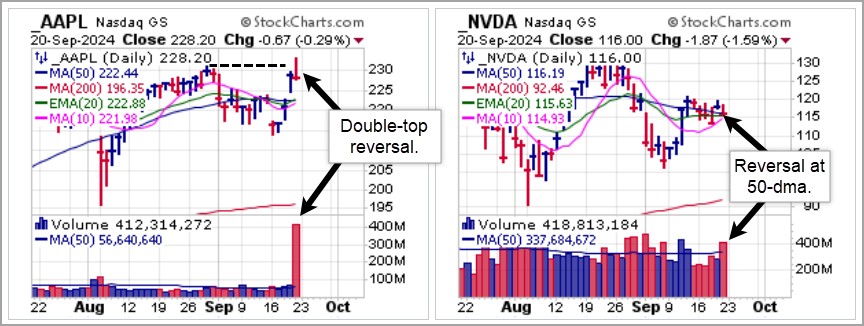

On Thursday morning we reported on potential buyable gap-ups (BGUs) in Apple (AAPL) and Nvidia (NVDA) but both stocks saw volume falter from higher opening run rates to post insufficient volume for BGUs. AAPL's move did qualify as an extended pocket pivot pushing up through the 50-dma but on Friday the stock reversed badly at the 232.92 left-side peak of August 29th to trigger a double-top short-sale entry on heavy OpEx volume. NVDA, meanwhile, failed to post enough volume for a BGU or a pocket pivot and on Friday closed back below the 50-dma on heavy OpEx volume. The action in these stocks underscores the fact that in this market what looks good one day can quickly falter, making the idea of trying to call pocket pivot or BGU long entries much like an exercise in throwing mud at a wall and hoping something sticks. MicroStrategy (MSTR) was looking like it might post a pocket pivot on Thursday as well as volume levels were robust early in the day. Volume fell just short of a valid pocket pivot but was certainly heavy as the stock cleared and held the 50-dma. It held again at the line on Friday but further upside will of course likely be dependent on whether Bitcoin ($BTCUSD) can clear 200-dma resistance.

MicroStrategy (MSTR) was looking like it might post a pocket pivot on Thursday as well as volume levels were robust early in the day. Volume fell just short of a valid pocket pivot but was certainly heavy as the stock cleared and held the 50-dma. It held again at the line on Friday but further upside will of course likely be dependent on whether Bitcoin ($BTCUSD) can clear 200-dma resistance.

In some cases, some of the mud does stick, but for how long? That asked, the favorable trend in global liquidity along with rate cuts observed across major central banks bodes well for stocks, especially leading names such as big tech and certain commodities. Meta Platforms (META) was trading at volume levels sufficient for a potential buyable gap-up on Thursday but volume tapered off as the day progressed and did not qualify for a valid BGU. It did, however, post a pocket pivot breakout which was also actionable and ended the week at fresh all-time highs.

In some cases, some of the mud does stick, but for how long? That asked, the favorable trend in global liquidity along with rate cuts observed across major central banks bodes well for stocks, especially leading names such as big tech and certain commodities. Meta Platforms (META) was trading at volume levels sufficient for a potential buyable gap-up on Thursday but volume tapered off as the day progressed and did not qualify for a valid BGU. It did, however, post a pocket pivot breakout which was also actionable and ended the week at fresh all-time highs. Steelmaker Nucor (NUE) was also trading brisk volume on Thursday as a potential BGU but volume faltered and finished the day at 33% above average, not sufficient for a BGU or a pocket pivot. This remains a non-actionable name on that basis.

Steelmaker Nucor (NUE) was also trading brisk volume on Thursday as a potential BGU but volume faltered and finished the day at 33% above average, not sufficient for a BGU or a pocket pivot. This remains a non-actionable name on that basis.

Industrial metals have been on a comeback off the recent September lows, but among these uranium stocks have been the most robust. On Friday big-stock uranium producer Cameco (CCJ) posted a bottom-fishing buyable gap-up (BFBGU) using the intraday low at 43.25 as a selling guide. CCJ and other uranium names rallied sharply on Friday on news that Constellation Energy Corporation (CEG) announced it had signed a 20-year power purchase agreement with Microsoft (MSFT) that will help launch the Crance Clean Energy Center and restart the infamous Three Mile Island Unit 1.

A wild and wooly week for the market, but despite the Fed's 1/2% rate cut finding serious new leadership in this market is difficult. The precious metals sector remains an area of leadership focus, and has been actionable along the way. Aside from that, very few stocks are flashing robust new long entry signals so the situation remains fluid in this regard. As it develops, assuming that the market avoids a correction, we will report on actionable names if and as we see them materialize in real-time. Stay tuned.

The Market Direction Model (MDM) remains on a BUY signal.