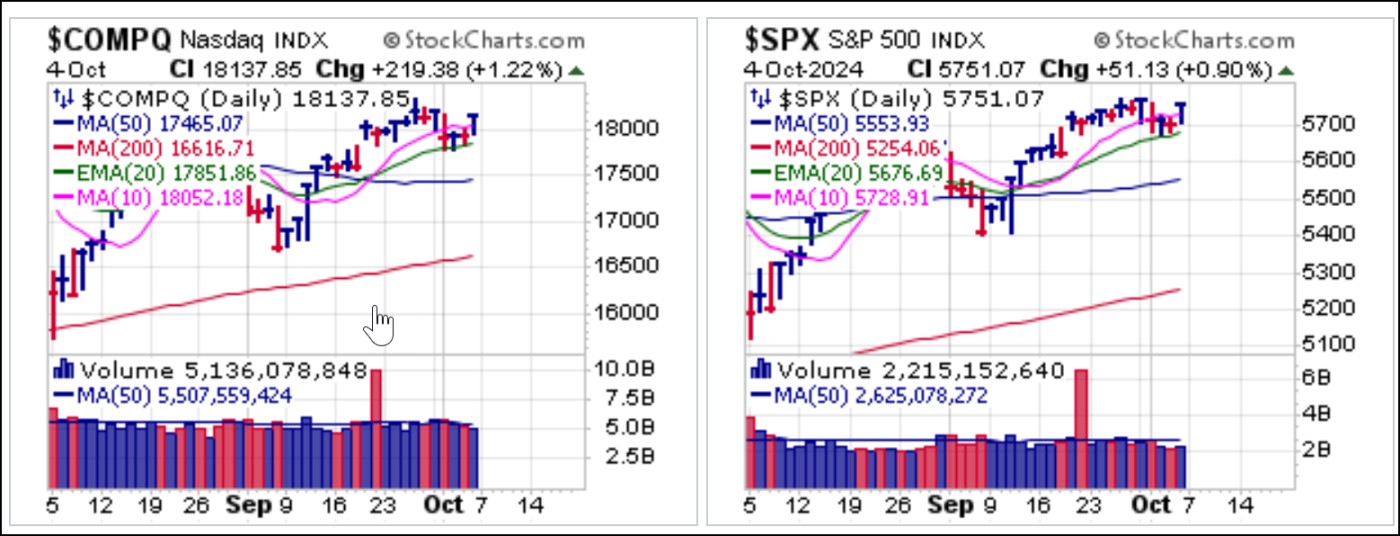

Major market indexes ended the week on a positive note as they remain mostly near recent highs. The positive Friday close came on the heels of an allegedly hot Bureau of Labor Statistics jobs report that showed an increase of 223,000 new private non-farm payrolls vs. estimates of 150,000. The market now appears to be in a good news is good news mode as the indexes rallied on lighter volume. However, the big jobs beat was entirely a function of the highest monthly increase in government workers ever seen. The report also refrained from making the usual seasonal adjustment to account for teachers returning to work in September.

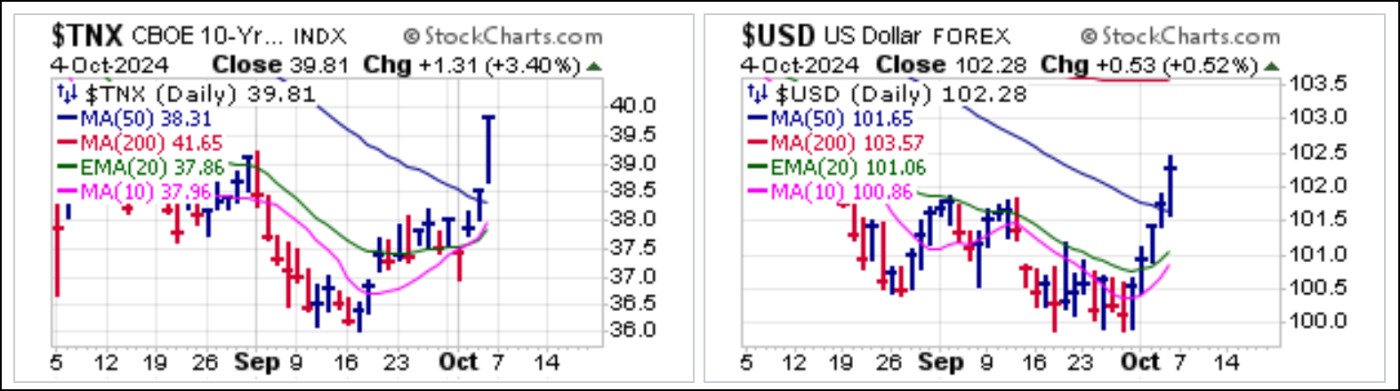

Even with the jobs data's odd omissions and overstatements, interest rates via the 10-Year Treasury Yield ($TNX) and the U.S. Dollar ($USD) soared, confirming the impression of a hot jobs number. CMEFedWatch now predicts two rate cuts of 25 bps by the end of the years instead of one 50 bps and one 25 bps.

Even with the jobs data's odd omissions and overstatements, interest rates via the 10-Year Treasury Yield ($TNX) and the U.S. Dollar ($USD) soared, confirming the impression of a hot jobs number. CMEFedWatch now predicts two rate cuts of 25 bps by the end of the years instead of one 50 bps and one 25 bps.

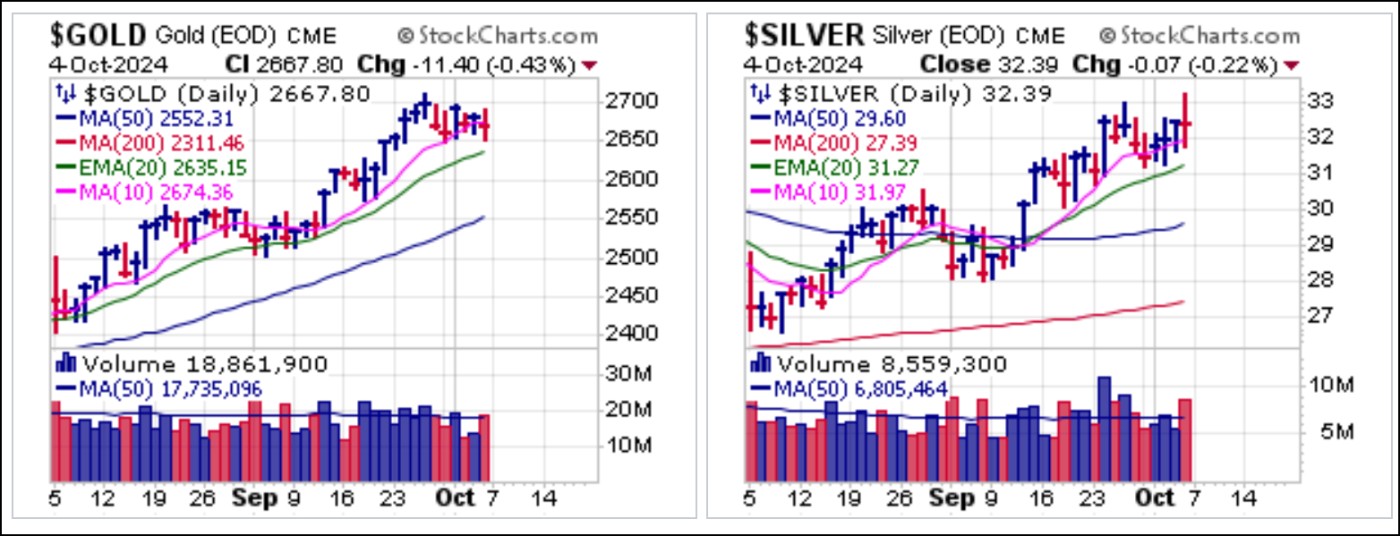

And despite the big rise in rate and especially the $USD, precious metals gold and silver did not move much at all as they closed relatively tight within current sideways consolidations and close to recent highs.

In fact, Silver Futures broke out to a new 12-year high on Friday morning, reaching a high of 33.02 before backing down to closed roughly flat on the day, down seven cents.

As silver moved higher early in the day, so did silver miners discussed in recent Focus List Review reports with the exception of Coeur Mining (CDE) which announced that it was buying single-mine operator Silvercrest Metals (SILV). The stock was hammered as it gapped lower but held 200-dma support. Hecla Mining (HL) continues to hold 20-dema support and the top of its prior base breakout. MAG Silver (MAG) which may itself be a buyout candidate, posted a strong-volume pocket pivot at the 10-dma on Friday, perhaps in sympathy to the CDE for SILV buyout.

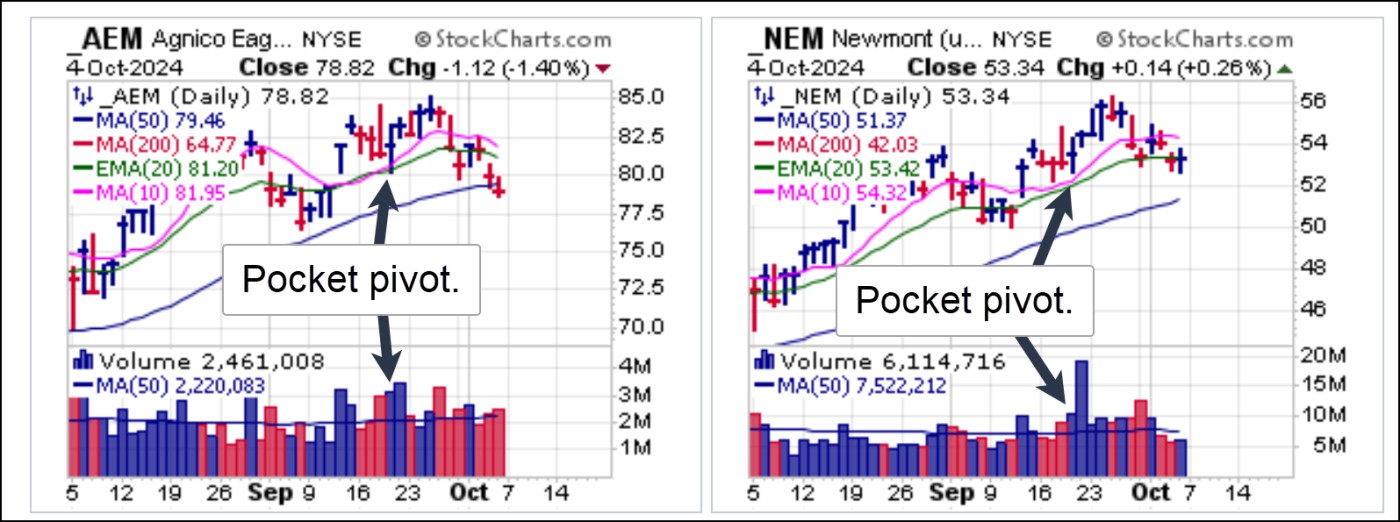

Gold miners reported on as a pocket pivots on September 19th, Agnico-Eagle Mines (AEM) and Newmont Corp. (NEM). Both stocks moved higher before peaking a week later and pulling back again. AEM has now dropped below its 50-dma in a bearish move Friday, while NEM attempts to hang along 20-dema support. One member asked whether AEM's chart represented O'Neil "Ascending Base" formation but AEM is simply in a rising trend channel. The key point about ascending bases that many overlook or forget is that they can only form during a bear market, not during overall market uptrends.

Bitcoin ($BTCUSD) also rallied on Friday but only after breaking hard earlier in the week to trigger a short-sale entry as it busted 200-dma support. Friday's bounce occurred off 50-dma support before running into 20-dema resistance where it has since stalled.

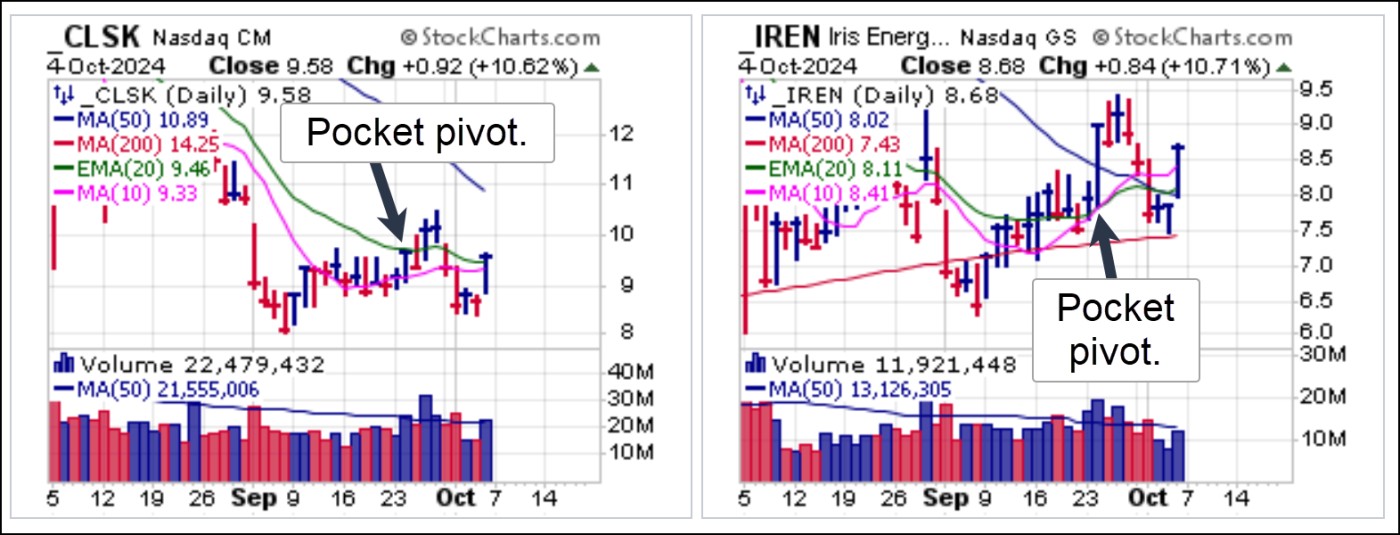

The breakdown in $BTCUSD quashed the pocket pivot attempts in crypto-miners that we reported on last week, CleanSpark (CLSK) and Iris Energy (IREN). As $BTCUSD goes so go the crypto-miners, so as Bitcoin busted 200-dma support, these two stocks fell through various moving average support levels before turning back to the upside later in the week synchrony with $BTCUSD. While the moves over the past two days represent moving average undercut & rally (MAU&R) types of long set-ups, the fate of these stocks rests with the overall trend of Bitcoin which for now has remained choppy and unresolved.

Coinbase Holdings (COIN) was also reported as a pocket pivot on the same day as CLSK and IREN. It also failed after pushing into 50-dma resistance and immediately reversing. It remains below 10-dma and 20-dema resistance.

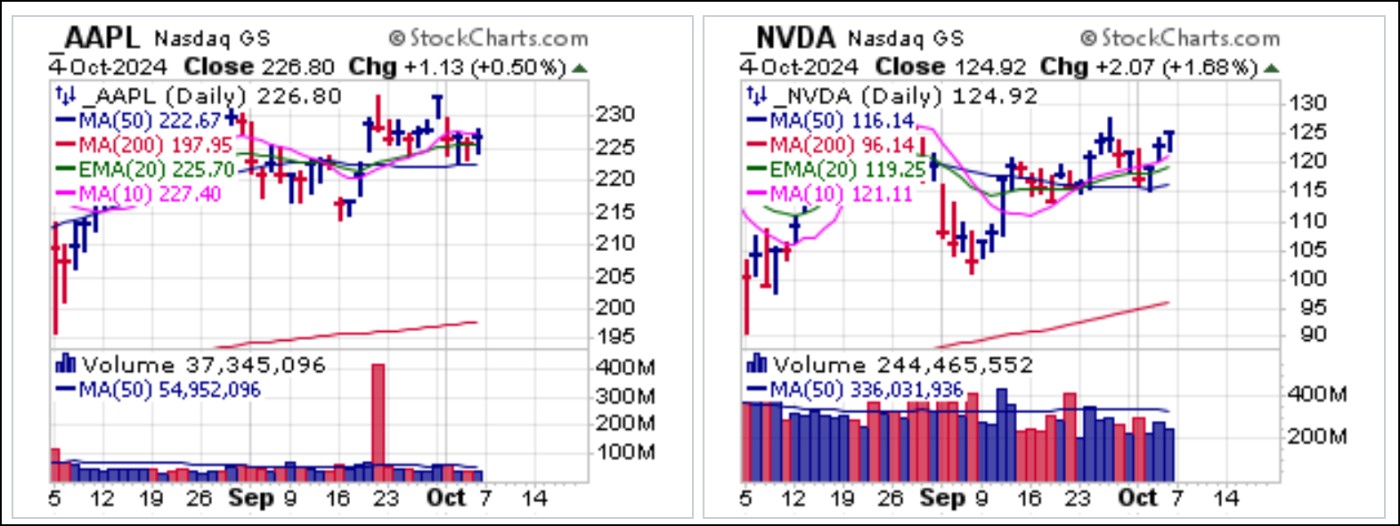

This market is a tough customer. Two names that we reported on as possible pocket pivots and/or BGUs two weeks ago, Apple (AAPL) and Nvidia (NVDA), ended up being neither that day but yet have been able to hold moving average support as they track sideways in more or less constructive consolidations.

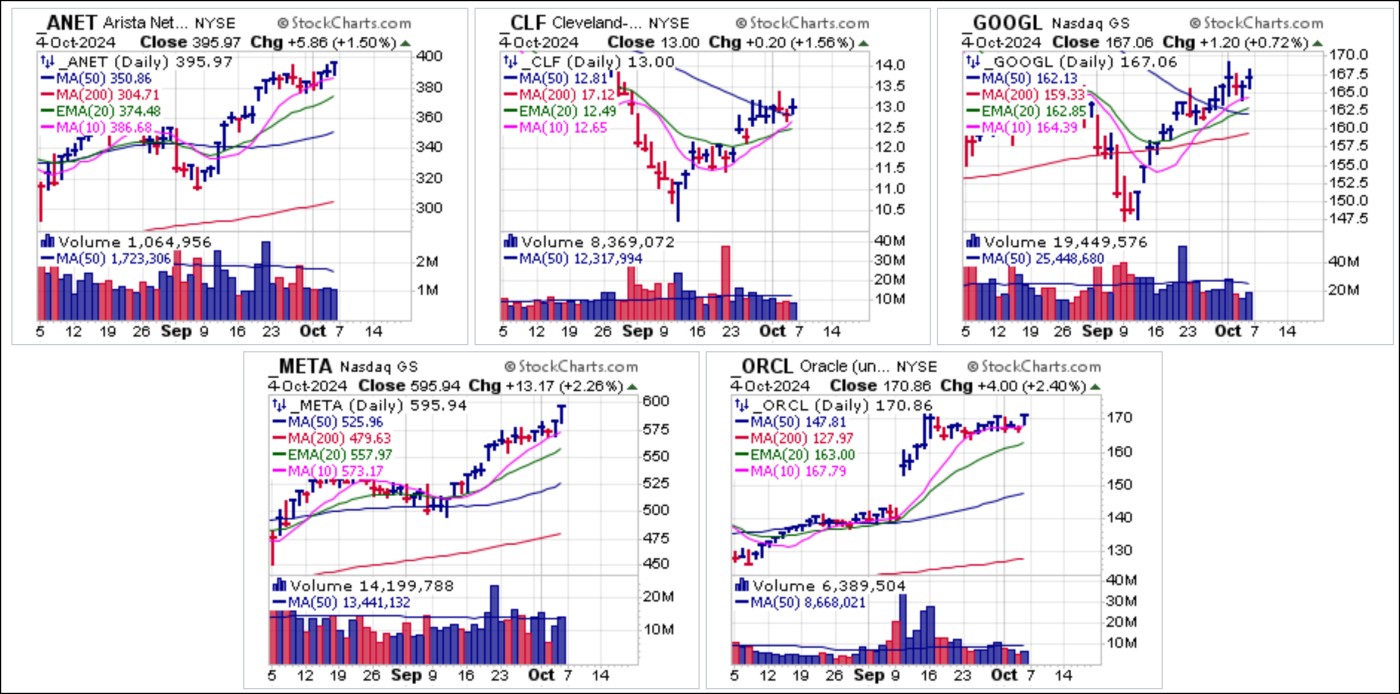

This market is a tough customer. Two names that we reported on as possible pocket pivots and/or BGUs two weeks ago, Apple (AAPL) and Nvidia (NVDA), ended up being neither that day but yet have been able to hold moving average support as they track sideways in more or less constructive consolidations. On Wednesday we issued several reports regarding potential pocket pivots and VDU set-ups Arista Networks (ANET), Cleveland-Cliffs (CLF), Alphabet (GOOGL), Meta Platforms (META), and Oracle (ORCL). All five stocks have edged higher since, but the moves have not been substantial. Nevertheless, the set-ups are working, even if only marginally, for now. Furthermore, it is a sign of strength that they held up despite the sharp pullbacks in the major market averages due to the attack on Israel by Iran earlier in the week.

On Wednesday we issued several reports regarding potential pocket pivots and VDU set-ups Arista Networks (ANET), Cleveland-Cliffs (CLF), Alphabet (GOOGL), Meta Platforms (META), and Oracle (ORCL). All five stocks have edged higher since, but the moves have not been substantial. Nevertheless, the set-ups are working, even if only marginally, for now. Furthermore, it is a sign of strength that they held up despite the sharp pullbacks in the major market averages due to the attack on Israel by Iran earlier in the week.  The sixth name we reported on that day as a possible pocket pivot was nano-nuclear power company Oklo (OKLO) as it was posting a pocket pivot at its 10-dma. That looked extended at the time as the stock ran into 200-dma resistance, but after holding tight near the highs on Thursday OKLO then posted a second pocket pivot as it slashed above its 200-dma, making for a pair of pockets in just three days.

The sixth name we reported on that day as a possible pocket pivot was nano-nuclear power company Oklo (OKLO) as it was posting a pocket pivot at its 10-dma. That looked extended at the time as the stock ran into 200-dma resistance, but after holding tight near the highs on Thursday OKLO then posted a second pocket pivot as it slashed above its 200-dma, making for a pair of pockets in just three days. The nuclear power space has been quite robust lately, as we have even seen lowly utility stocks running on the promise of building and operating more nuclear power plants. Two weekends ago we discussed the BGU in big-stock uranium producer Cameco (CCJ) that occurred on massive volume September 20th. The stock has continued to rocket higher since then. This is one area of the market that investors should remain focused on as the rapidly growing support for nuclear power, both by the government and the public, represents a sea-change for the long-maligned, misrepresented, and misunderstood nuclear power industry.

The nuclear power space has been quite robust lately, as we have even seen lowly utility stocks running on the promise of building and operating more nuclear power plants. Two weekends ago we discussed the BGU in big-stock uranium producer Cameco (CCJ) that occurred on massive volume September 20th. The stock has continued to rocket higher since then. This is one area of the market that investors should remain focused on as the rapidly growing support for nuclear power, both by the government and the public, represents a sea-change for the long-maligned, misrepresented, and misunderstood nuclear power industry. If this market is indeed headed higher on the heels of more Fed rate cuts to come and the wave of global liquidity, then it may make sense to look for new themes and new industry groups participating in leading-edge technologies. Fixating on the same old, potentially overplayed and over-owned areas of the market may be less effective so investors should consider broadening their horizons. Remember, Bill O'Neil never put an "O" for Old in CANSLIM.

If this market is indeed headed higher on the heels of more Fed rate cuts to come and the wave of global liquidity, then it may make sense to look for new themes and new industry groups participating in leading-edge technologies. Fixating on the same old, potentially overplayed and over-owned areas of the market may be less effective so investors should consider broadening their horizons. Remember, Bill O'Neil never put an "O" for Old in CANSLIM.The Market Direction Model (MDM) remains on a BUY signal.