The NASDAQ Composite and NASDAQ 100 Indexes tagged higher highs on Friday morning before reversing and giving up about 2/3rds of their morning gains. Both indexes closed near their intraday lows in bearish shooting star types of formations on the daily price bars. The early rallies were attributable to news that Intel (INTC) is investing $28 billion to build advanced chip factories in Ohio.

Interestingly, the NASDAQ Composite rallied early in the day on Friday through its July all-time high at 18,671.07 and then closed at 18,518.61 to trigger a technical double-top short-sale (DTSS) entry. While this type of short-sale set-up is one Gil generally uses for stocks, we will see whether this reversal at prior all-time highs is significant as we move into a big earnings week with several big-stock NASDAQ names set to report earnings.

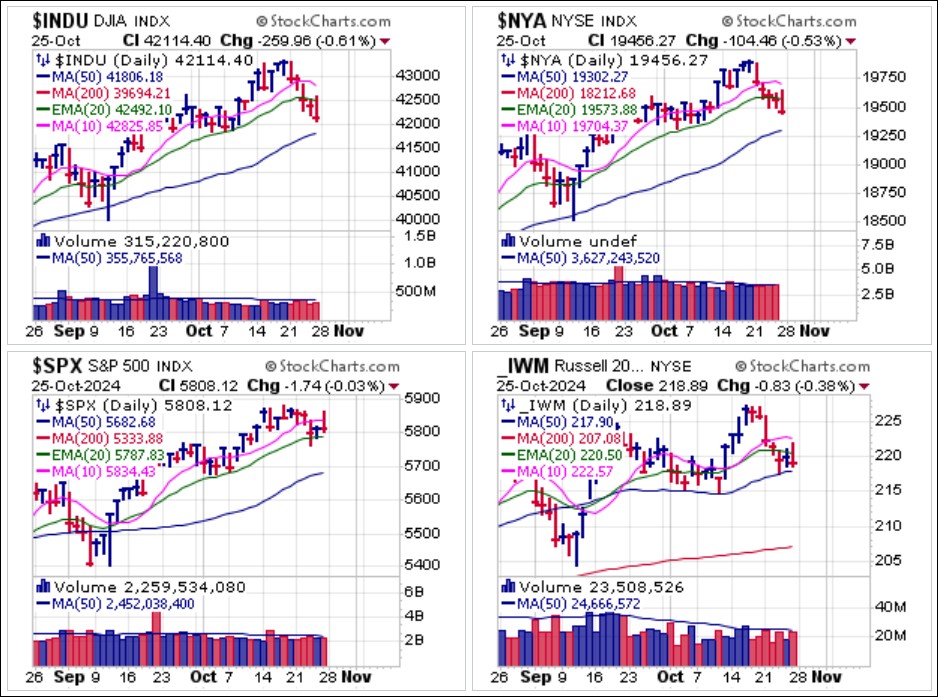

Interestingly, the NASDAQ Composite rallied early in the day on Friday through its July all-time high at 18,671.07 and then closed at 18,518.61 to trigger a technical double-top short-sale (DTSS) entry. While this type of short-sale set-up is one Gil generally uses for stocks, we will see whether this reversal at prior all-time highs is significant as we move into a big earnings week with several big-stock NASDAQ names set to report earnings. The Dow, NYSE Composite, S&P 500, and small-cap Russell 2000 reversed into the red on Friday with all but the S&P triggering short-sale entries on an index basis as they reversed at 20-dema resistance. Overall bearish action among indexes with less of a tech-concentration.

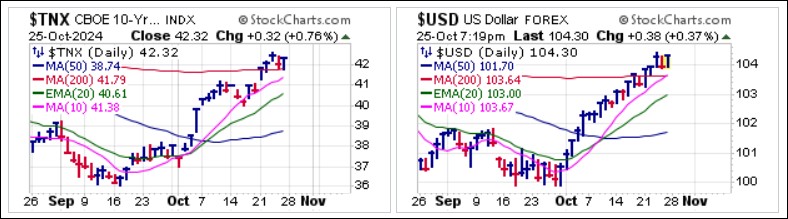

The Dow, NYSE Composite, S&P 500, and small-cap Russell 2000 reversed into the red on Friday with all but the S&P triggering short-sale entries on an index basis as they reversed at 20-dema resistance. Overall bearish action among indexes with less of a tech-concentration. The paradox of continuously rising market interest rates, as represented by the 10-Year Treasury Yield ($TNX) and a continuously rising U.S. Dollar ($USD) juxtaposed against a continuously rising stock market and precious metals, gold and silver has persisted.

The paradox of continuously rising market interest rates, as represented by the 10-Year Treasury Yield ($TNX) and a continuously rising U.S. Dollar ($USD) juxtaposed against a continuously rising stock market and precious metals, gold and silver has persisted.

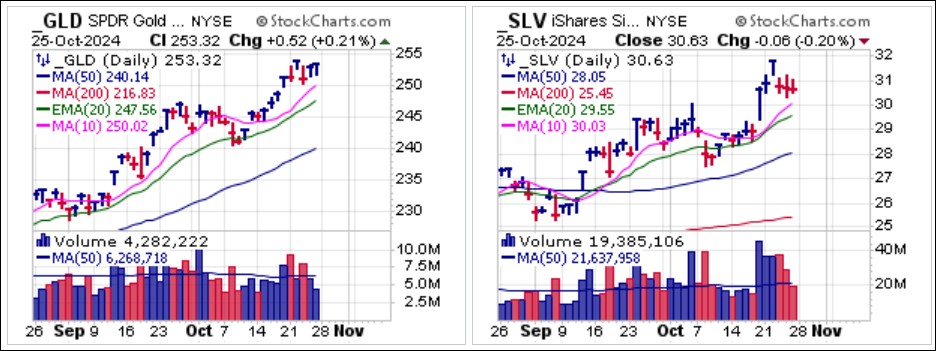

Gold and silver are doing their best to hold recent moves to all-time highs in gold and a new 12-year high in silver. Both the SPDR Gold Trust (GLD) and the iShares Silver Trust (SLV) remain above 10-dma moving average after December Gold Futures hit a new all-time high of $2,772.60/oz. on Tuesday as December Silver Futures printed a peak of $35.07/oz., its highest level since October of 2012.

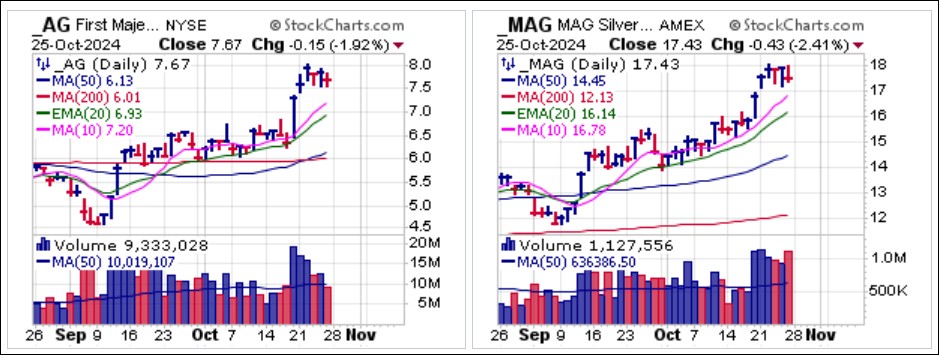

Silver miners First Majestic Silver (AG) and MAG Silver (MAG) also hold near recent highs. Neither stock has come off very much and for now their respective 10-day moving averages would serve as references for potential near-term moving average support.

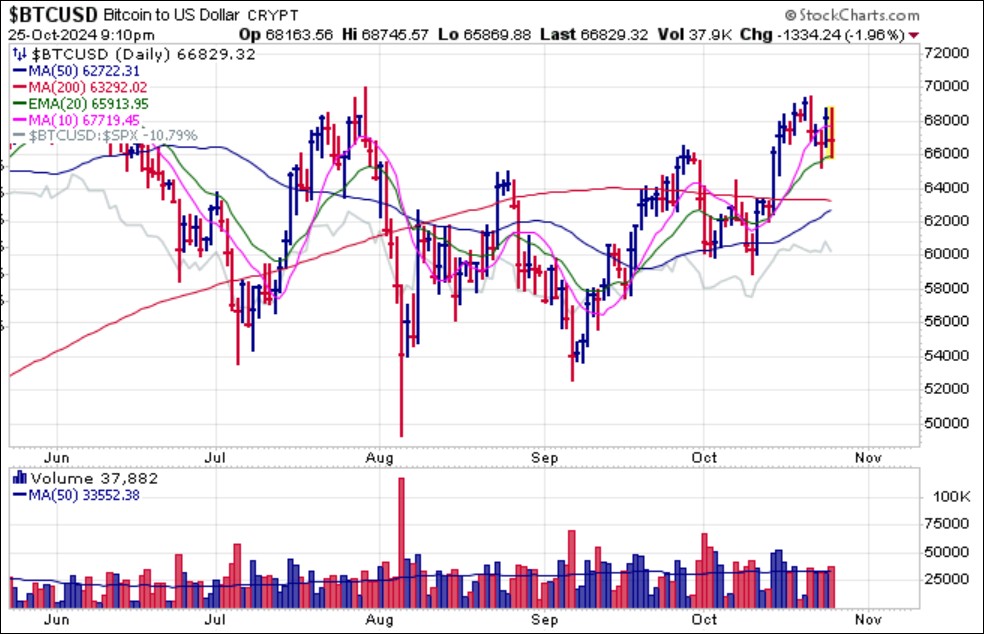

Silver miners First Majestic Silver (AG) and MAG Silver (MAG) also hold near recent highs. Neither stock has come off very much and for now their respective 10-day moving averages would serve as references for potential near-term moving average support. Bitcoin ($BTCUSD) rallied sharply early in the week but eventually reversed at its 10-dma to test 20-dema support which was held as of Friday. It would be constructive to see $BTCUSD hold 20-dema support as a pullback to the 200-dma would retain much of the choppy, trendless character of $BTCUSD's overall chart pattern.

Bitcoin ($BTCUSD) rallied sharply early in the week but eventually reversed at its 10-dma to test 20-dema support which was held as of Friday. It would be constructive to see $BTCUSD hold 20-dema support as a pullback to the 200-dma would retain much of the choppy, trendless character of $BTCUSD's overall chart pattern.

The Grayscale Ethereum Trust (ETHE) has meanwhile failed at 50-dma support after regaining the line two weeks ago. Not a bullish development for ETHE, to be sure. Ethereum sentiment is at rock bottom. We’ve heard it all recently: =L2s are parasitic to L1

The Grayscale Ethereum Trust (ETHE) has meanwhile failed at 50-dma support after regaining the line two weeks ago. Not a bullish development for ETHE, to be sure. Ethereum sentiment is at rock bottom. We’ve heard it all recently: =L2s are parasitic to L1 =L1 can’t scale

=Vitalik isn’t a good leader

=SOL will flip ETH

Nevertheless, ETH near the zero point in inflation plus their upcoming upgrades should help. ETH/BTC always hits major lows before major ETH rallies in past cycles. Watch for a constructive pocket pivot or undercut & rally move once BTC starts to trend higher.

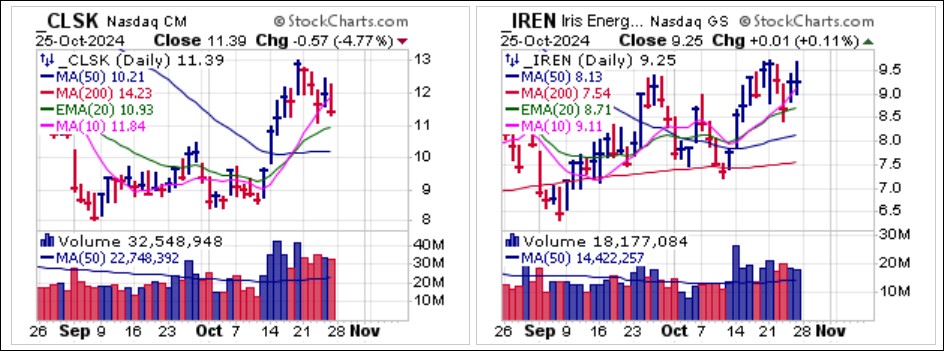

Crypto-miners CleanSpark (CLSK) and Iris Energy (IREN) chop around with $BTCUSD with both testing 20-dema support earlier in the week and holding. If $BTCUSD is able to hold its own 20-dema support then watch for CLSK and IREN to do the same at their own 20-demas.

Crypto-miners CleanSpark (CLSK) and Iris Energy (IREN) chop around with $BTCUSD with both testing 20-dema support earlier in the week and holding. If $BTCUSD is able to hold its own 20-dema support then watch for CLSK and IREN to do the same at their own 20-demas. The nuclear power-related stocks, which were hot last week, have settled down and may be looking to form potential consolidations after torrid moves off the lows of early September. Big-stock uranium Cameco (CCJ) posted its biggest decline this past week since rallying off the early September lows as it dips below 10-dma support. Look for potential support to develop at the 20-dema and keep in mind that the stock, at best, needs to spend some time consolidating the sharp gains seen over the past seven weeks.

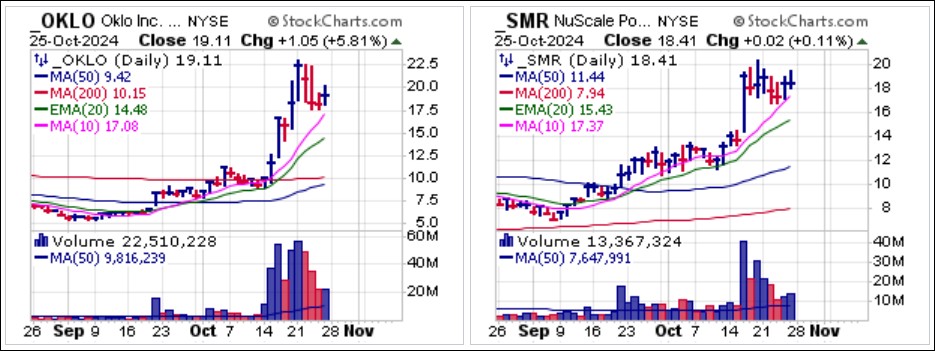

The nuclear power-related stocks, which were hot last week, have settled down and may be looking to form potential consolidations after torrid moves off the lows of early September. Big-stock uranium Cameco (CCJ) posted its biggest decline this past week since rallying off the early September lows as it dips below 10-dma support. Look for potential support to develop at the 20-dema and keep in mind that the stock, at best, needs to spend some time consolidating the sharp gains seen over the past seven weeks. Small modular nuclear reactor concerns Oklo (OKLO) and NuScale Power (SMR) have been little monster stocks over the past two weeks with big gains that have seen both stocks double in price within that time frame. Both remain above 10-dma but we would expect that these stocks need some time to consolidate prior gains. In this regard, we would look for 20-dema support to figure in heavily as it moves up to meet price in each case.

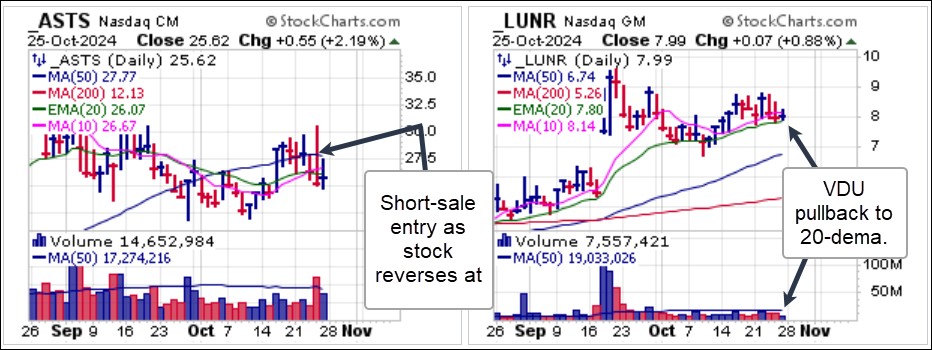

Small modular nuclear reactor concerns Oklo (OKLO) and NuScale Power (SMR) have been little monster stocks over the past two weeks with big gains that have seen both stocks double in price within that time frame. Both remain above 10-dma but we would expect that these stocks need some time to consolidate prior gains. In this regard, we would look for 20-dema support to figure in heavily as it moves up to meet price in each case. AST Spacemobile (ASTS) posted a pocket pivot last week two weeks ago at its 50-dma but that is now failing. The stock was awarded a sizable government contract on Thursday morning, causing it to gap up early in the day before pulling a big outside reversal to the downside as reversed at 50-dma support. That trigger a short-sale entry at the 50-dma which is now used as a covering guide. Meanwhile Lunar lander builder Intuitive Machines (LUNR) on Friday posted a VDU pullback to the 20-dema as volume declined to -60.3% below average. This can be treated as a VDU long entry using the 20-dema as a tight selling guide.

AST Spacemobile (ASTS) posted a pocket pivot last week two weeks ago at its 50-dma but that is now failing. The stock was awarded a sizable government contract on Thursday morning, causing it to gap up early in the day before pulling a big outside reversal to the downside as reversed at 50-dma support. That trigger a short-sale entry at the 50-dma which is now used as a covering guide. Meanwhile Lunar lander builder Intuitive Machines (LUNR) on Friday posted a VDU pullback to the 20-dema as volume declined to -60.3% below average. This can be treated as a VDU long entry using the 20-dema as a tight selling guide.

Earnings from a number of big-stock NASDAQ names such as Apple (AAPL), Amazon.com (AMZN), Alphabet (GOOG), Meta Platforms (META) and Microsoft (MSFT) as we move into the heaviest part of the earnings calendar this coming week may influence the direction of the market. As well, it will be a busy week for economic news with the JOLTS Job Openings report on Tuesday, the ADP Employment Report on Wednesday, the Personal Consumption Expenditures price index on Thursday, and the monthly Bureau of Labor Statistics jobs report on Friday, all of which may have their influence as catalysts for significant market movement. Prepare accordingly.

The Market Direction Model (MDM) remains on a BUY signal.