Major market indexes edged higher in what started out as a very volatile week. Weak earnings from semiconductor equipment maker ASML Holdings (ASML) and news that the U.S. was considering expanding its AI chip sales ban to Middle Eastern countries sent the indexes down sharply on Tuesday. By week's end, however, the Dow, S&P 500, and broad NYSE Composite Indexes posted fresh all-time closing highs. The NASDAQ Composite edged closer towards its prior July highs as the global liquidity melt-up continues.

Alternative-currencies synced up this week as Bitcoin ($BTCUSD) kicked into gear as it decisively cleared 200-dma support after failing along the line earlier in September. It is now within 10% of its $73,802.64 all-time high. We had put out a report on Oct 11 that Bitcoin should recover faster than most after the attack on Israel. Further, global liquidity would further spur higher prices in Bitcoin. Meanwhile, gold, which last we noted was forming a three-weeks-tight flag formation, posted new all-time highs on Friday, with December Gold Futures closing Friday at $2,736.40 an ounce. Silver chimed in with a breakout to a new 12-year high with December Silver Futures closing Friday at $33.92 an ounce.

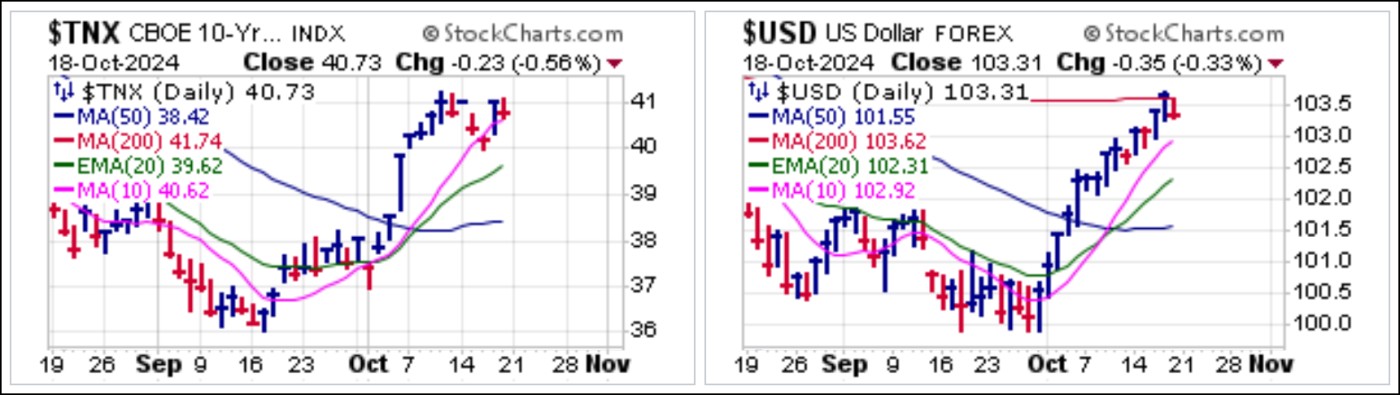

In an odd divergence from their normally inverse correlation to interest rates via the 10-Year Treasury Yield ($TNX) and the U.S. Dollar ($USD), gold and silver rallied all week with rates and the dollar. Perhaps Friday's breakouts to new highs were assisted by a decline in $USD as it runs into 200-dma resistance following a three-week rally off the late September low where it was up 12 out of 14 days in a row before Friday's reversal.

In an odd divergence from their normally inverse correlation to interest rates via the 10-Year Treasury Yield ($TNX) and the U.S. Dollar ($USD), gold and silver rallied all week with rates and the dollar. Perhaps Friday's breakouts to new highs were assisted by a decline in $USD as it runs into 200-dma resistance following a three-week rally off the late September low where it was up 12 out of 14 days in a row before Friday's reversal. On Monday we reported on Grayscale Ethereum Trust (ETHE) as it regained its 50-dma. This in fact occurred on consecutive five-day pocket pivots followed by tight sideways action. We view clusters of five-day pocket pivots in lieu of a single ten-day pocket pivot as a bullish set-up. One might also notice a reverse head & shoulders formation in progress as ETHE attempts to build a bottom.

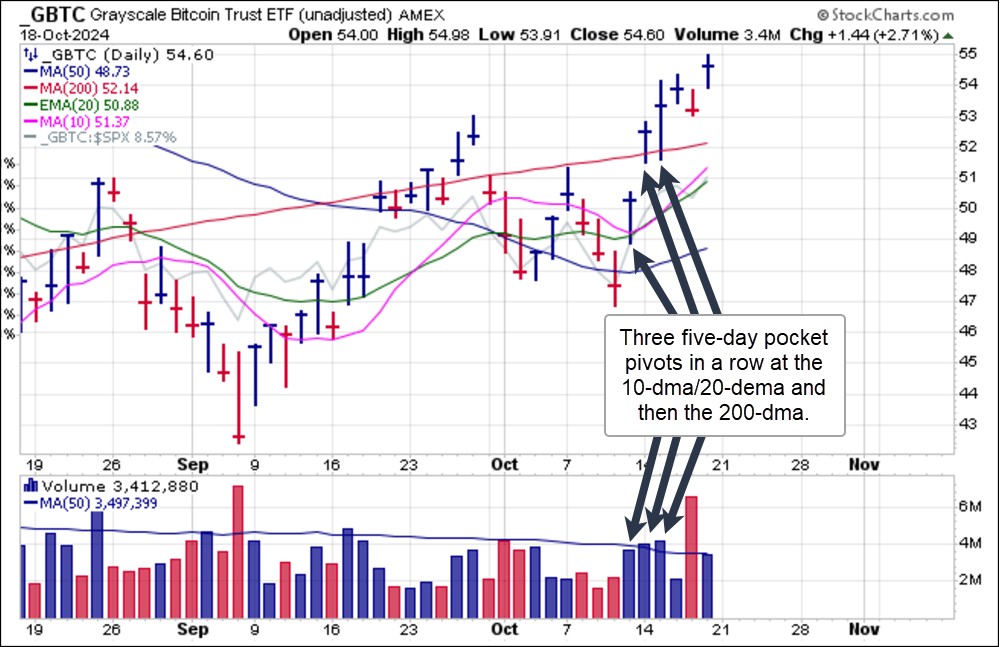

On Monday we reported on Grayscale Ethereum Trust (ETHE) as it regained its 50-dma. This in fact occurred on consecutive five-day pocket pivots followed by tight sideways action. We view clusters of five-day pocket pivots in lieu of a single ten-day pocket pivot as a bullish set-up. One might also notice a reverse head & shoulders formation in progress as ETHE attempts to build a bottom. On Monday we also reported on the Grayscale Bitcoin Trust (GBTC) as it cleared its 200-dma on the second of what eventually became three five-day pocket pivots in a row. The first occurred two Fridays ago as GBTC gapped above the 10-dma and 20-dema, and the second and third occurred along the 200-dma on Monday and Tuesday. GBTC then followed Bitcoin higher from there to close the week at higher highs.

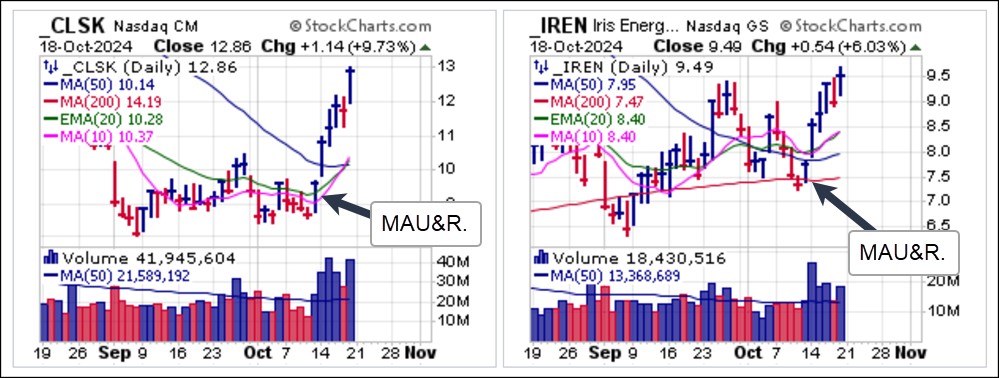

On Monday we also reported on the Grayscale Bitcoin Trust (GBTC) as it cleared its 200-dma on the second of what eventually became three five-day pocket pivots in a row. The first occurred two Fridays ago as GBTC gapped above the 10-dma and 20-dema, and the second and third occurred along the 200-dma on Monday and Tuesday. GBTC then followed Bitcoin higher from there to close the week at higher highs. In our Focus List Review of two weeks ago we noted that crypto-miners CleanSpark (CLSK) and Iris Energy (IREN) had posted MAU&Rs along moving average support but commented that, 'While the moves over the past two days represent moving average undercut & rally (MAU&R) types of long set-ups, the fate of these stocks rests with the overall trend of Bitcoin which for now has remained choppy and unresolved.'

In our Focus List Review of two weeks ago we noted that crypto-miners CleanSpark (CLSK) and Iris Energy (IREN) had posted MAU&Rs along moving average support but commented that, 'While the moves over the past two days represent moving average undercut & rally (MAU&R) types of long set-ups, the fate of these stocks rests with the overall trend of Bitcoin which for now has remained choppy and unresolved.' Once Bitcoin finally and decisively regained its 200-dma, both stocks came through with fresh MAU&R moves and long entry triggers. CLSK did so along its 10-dma and 20-dema while IREN did so along its own 200-dma. Both stocks have since shot higher in sync with Bitcoin.

As gold and silver rallied to new highs this past week, mining stocks caught fire. On Tuesday we reported on two silver miners, First Majestic Silver (AG) and MAG Silver (MAG) as pocket pivots. AG posted a pocket pivot at its 10-dma and then on Thursday sold off on a market misinterpretation of its Q3 production numbers. This led to a quick shakeout at the 10-dma on a bounce of 20-dema support as AG rocketed 15.32% higher on a big-volume breakout Friday as investors realized that the company is on track to become one of the world's largest silver and silver-equivalent miners in the world now that it is acquiring leading junior silver miner Gatos Silver (GATO).

We also reported on MAG Silver (MAG) as a potential pocket pivot early on Tuesday, but volume levels receded by the close and no pocket pivot volume signature was seen. The stock did, however, hold a sharp bounce off 10-dma support and then shot higher into the end of the week as silver miners followed silver to new 12-year highs.

We also reported on MAG Silver (MAG) as a potential pocket pivot early on Tuesday, but volume levels receded by the close and no pocket pivot volume signature was seen. The stock did, however, hold a sharp bounce off 10-dma support and then shot higher into the end of the week as silver miners followed silver to new 12-year highs. On Friday we reported on AST Spacemobile (ASTS) as a long entry following Wednesday's pocket pivot at the 50-dma. On Friday the stock posted volume that was -56.4% below average triggering a VDU long entry at the 50-dma which is now used as a selling guide.

On Friday we reported on AST Spacemobile (ASTS) as a long entry following Wednesday's pocket pivot at the 50-dma. On Friday the stock posted volume that was -56.4% below average triggering a VDU long entry at the 50-dma which is now used as a selling guide.

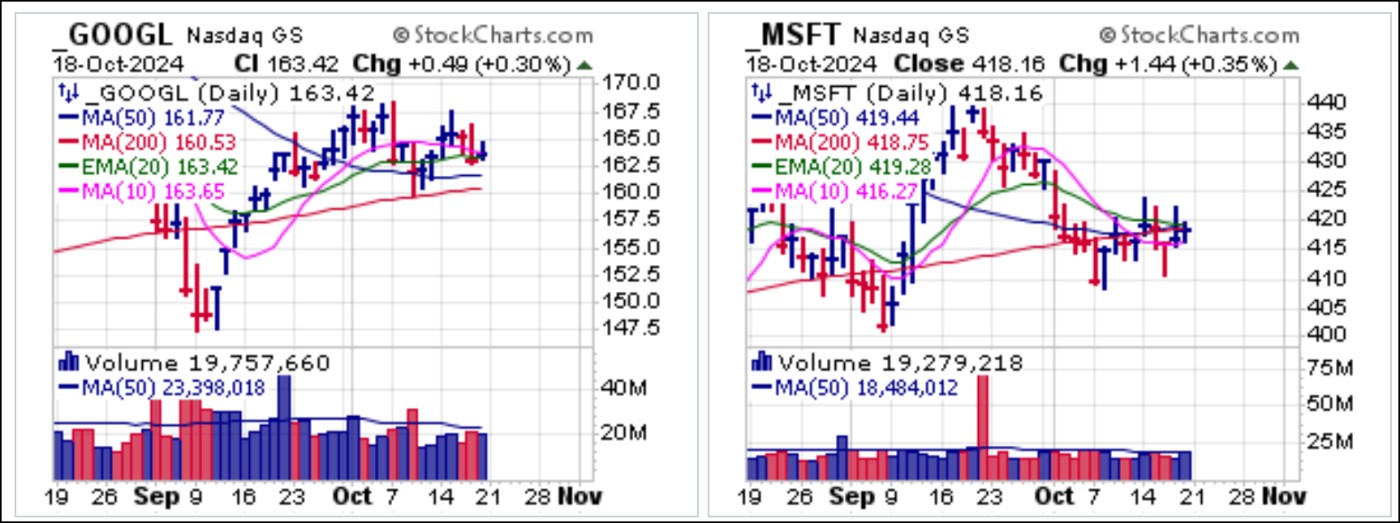

On Monday we reported on potential MAU&R moves in Alphabet (GOOGL) and Microsoft (MSFT), but both moves fizzled out. This attests to the general lack of resolution in the big-stock tech area of the market. But, as we wrote on October 4th, "...it may make sense to look for new themes and new industry groups participating in leading-edge technologies. Fixating on the same old, potentially overplayed and over-owned areas of the market may be less effective so investors should consider broadening their horizons. Remember, Bill O'Neil never put an "O" for Old in CANSLIM."

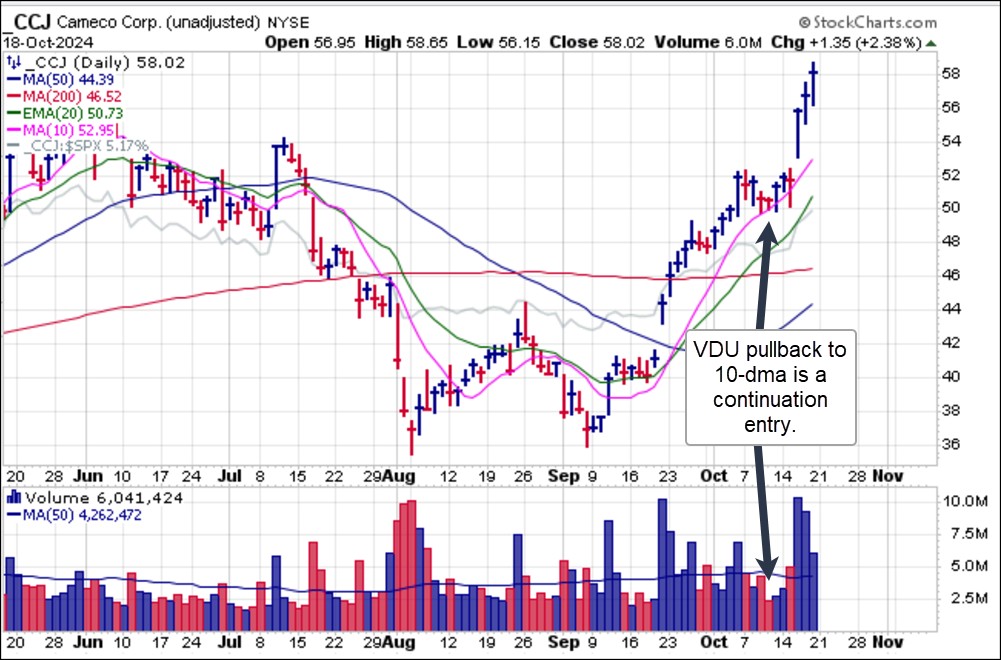

That approach has paid off handsomely. We have been following Cameco (CCJ) all the way up with a variety of reports and discussions in the Focus List Review. Most recently on October 9th we reported on the low-volume pullback to the 10-dma following an extended continuation pocket pivot signature that would be buyable on any pullback to the 10-day line. We saw that pullback occur early in the week before CCJ gapped higher on Wednesday. Certainly, a monster stock as Halloween approaches.

Another October monster stock has been small modular nuclear reactor producer NuScale Power (NUS). Two Fridays ago we reported on a pocket pivot in the stock which played out as a single five-day pocket pivot on the heels of the prior MAU&R the day before at the 20-dema. That led to a near immediate rocket move to new highs beyond the $20 price level. Nice work if you can get it, and it was possible to get it based on our reports.

Another October monster stock has been small modular nuclear reactor producer NuScale Power (NUS). Two Fridays ago we reported on a pocket pivot in the stock which played out as a single five-day pocket pivot on the heels of the prior MAU&R the day before at the 20-dema. That led to a near immediate rocket move to new highs beyond the $20 price level. Nice work if you can get it, and it was possible to get it based on our reports. On October 2nd we reported on another small modular nuclear reactor developer, Oklo (OKLO) as it posted a pocket pivot along its 10-dma. At the time the stock looked extended, but it then went on to clear the 200-dma two days later before pulling back. As we noted in our October 2nd report, a pullback to the original pocket pivot would offer a better entry, and we saw that on Monday morning as OKLO posted a supporting pocket pivot at the 20-dema. It then rocketed higher for the rest of the week, more than doubling in just four days. A steady stream of positive news for the nuclear power sector benefitted all of the nuclear power names we have discussed in recent reports.

On October 2nd we reported on another small modular nuclear reactor developer, Oklo (OKLO) as it posted a pocket pivot along its 10-dma. At the time the stock looked extended, but it then went on to clear the 200-dma two days later before pulling back. As we noted in our October 2nd report, a pullback to the original pocket pivot would offer a better entry, and we saw that on Monday morning as OKLO posted a supporting pocket pivot at the 20-dema. It then rocketed higher for the rest of the week, more than doubling in just four days. A steady stream of positive news for the nuclear power sector benefitted all of the nuclear power names we have discussed in recent reports. Space-stock cousin to ASTS, lunar lander maker Intuitive Machines (LUNR) was reported on as an MAU&R at the 20-dema on October 11th, two Fridays ago. The stock has since edged higher as it continues to work on what is now a four-week base. We would watch for any pullbacks to the rising 10-dma and/or 20-dema as possible lower-risk long entries from here.

Space-stock cousin to ASTS, lunar lander maker Intuitive Machines (LUNR) was reported on as an MAU&R at the 20-dema on October 11th, two Fridays ago. The stock has since edged higher as it continues to work on what is now a four-week base. We would watch for any pullbacks to the rising 10-dma and/or 20-dema as possible lower-risk long entries from here. Overall a monumental week for the various stocks and areas of the market we have been focusing on in recent VoSI reports. The big move in gold, silver, mining stocks, Bitcoin, crypto-miners, space stocks, and most notably the nuclear power space all made for a week with much profit potential.

Overall a monumental week for the various stocks and areas of the market we have been focusing on in recent VoSI reports. The big move in gold, silver, mining stocks, Bitcoin, crypto-miners, space stocks, and most notably the nuclear power space all made for a week with much profit potential.The Market Direction Model (MDM) remains on a BUY signal.