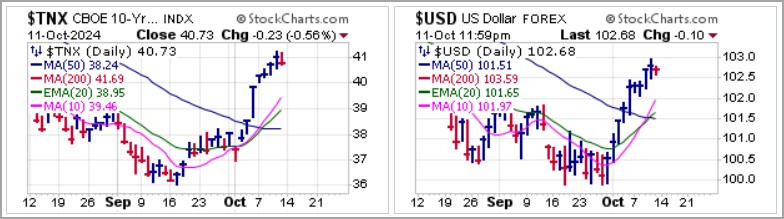

Major market indexes continue to spin around as both the Consumer Price Index (CPI) and Producer Price Index (PPI) numbers failed to catalyze any significant moves on a percentage basis. A slightly higher CPI on Thursday sent the indexes down slightly, while a slightly lower PPI sent them slightly higher. Nevertheless, the NASDAQ Composite was able to post a higher high on Friday while the S&P 500 posted its second all-time high of the week.

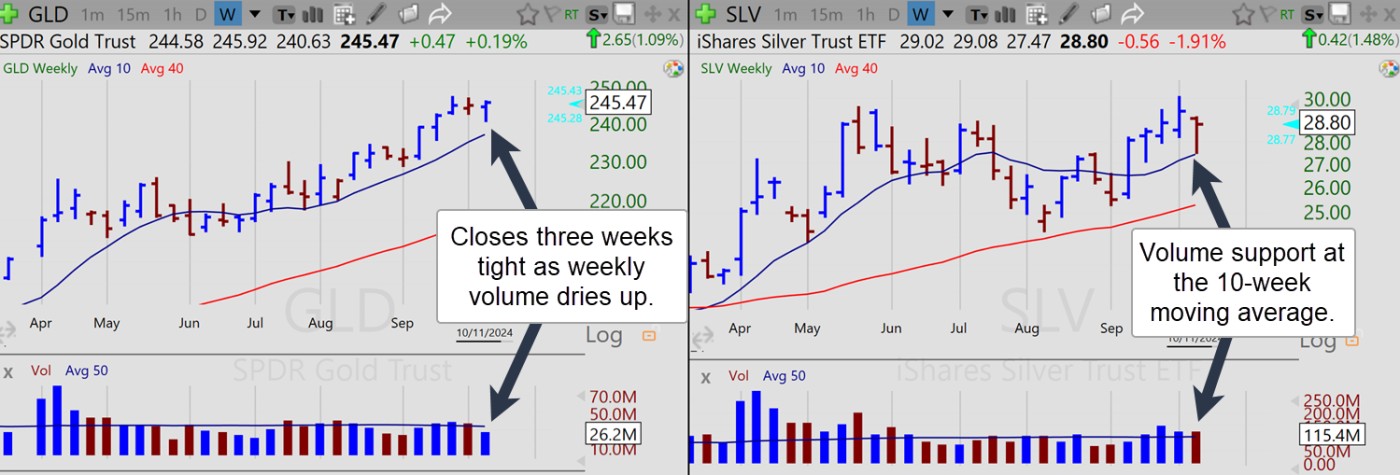

Despite the rise in rates and the dollar, gold and silver continue to act well, ignoring the usual inverse correlation to rates and the $USD. On the weekly charts, the SPDR Gold Trust (GLD) is showing a bullish three-weeks-tight (3WT) flag formation as weekly volume declines while the iShares Silver Trust (SLV) bounced smartly off 10-week moving average support. Central banks have been large and sustained buyers of gold, and they are not doing so to trade.

This greatly alters the landscape of underlying conditions for the yellow metal as it has become the #2 global reserve asset, behind $USD and ahead of the Euro. Silver has lagged gold, remaining some $20 below its all-time highs achieved 12 years ago but the weekly chart shows a constructive base in the making with the usual volatility that is typical of the white metal.

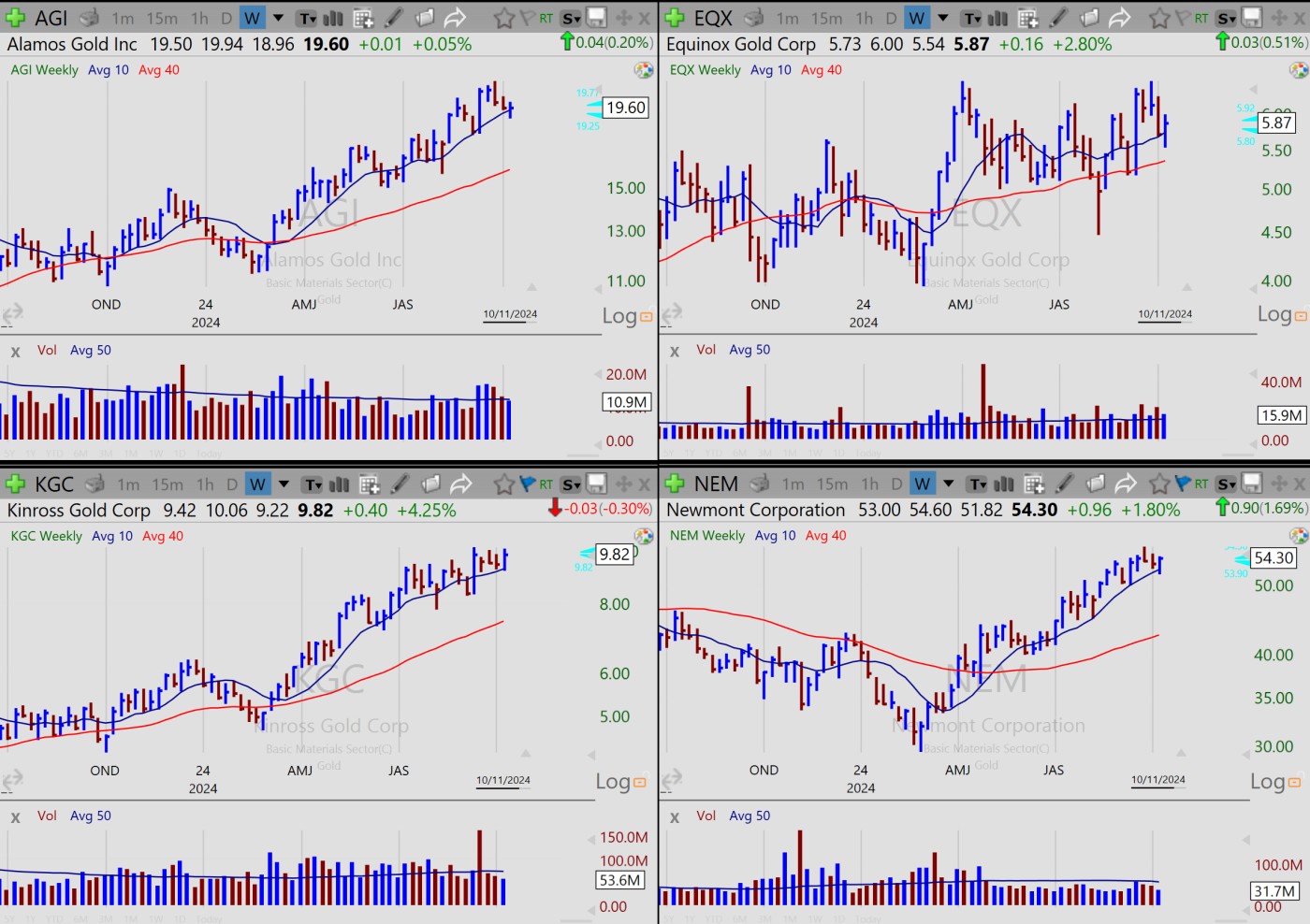

Quality senior and junior gold gold miners also acted constructively this past week as they consolidate recent gains in September. Here we see junior miners Alamos Gold (AGI), Equinox Gold (EQX), Kinross Gold (KGC), and Newmont Corp. (NEM) shaking out and bouncing along 10-week moving average support on the weekly charts.

Quality senior and junior gold gold miners also acted constructively this past week as they consolidate recent gains in September. Here we see junior miners Alamos Gold (AGI), Equinox Gold (EQX), Kinross Gold (KGC), and Newmont Corp. (NEM) shaking out and bouncing along 10-week moving average support on the weekly charts. Bitcoin ($BTCUSD) has remained mostly a choppy trading vehicle where it has more recently triggered short-sale entries at the 200-dma followed by long entries at the lower 50-dma. After triggering a short entry at the 200-dma six days ago on the daily chart below, $BTCUSD then posted a moving average U&R at the 50-dma on Friday following the soft PPI data. Technically, that was a moving average U&R long entry signal using the 50-dma as a selling guide, so far good enough for a move back up to 200-dma resistance.

Bitcoin ($BTCUSD) has remained mostly a choppy trading vehicle where it has more recently triggered short-sale entries at the 200-dma followed by long entries at the lower 50-dma. After triggering a short entry at the 200-dma six days ago on the daily chart below, $BTCUSD then posted a moving average U&R at the 50-dma on Friday following the soft PPI data. Technically, that was a moving average U&R long entry signal using the 50-dma as a selling guide, so far good enough for a move back up to 200-dma resistance. We reported on big-stock Cameco (CCJ) as a U&R at the 10-dma but it also posted a VDU volume signature as it tested 10-dma support, a potential long entry using the 10-day line as a selling guide. The stocks has rallied quite coherently as it follows the 10-day line higher after posting a bottom-fishing BGU three weeks ago as it cleared the 50-dma.

We reported on big-stock Cameco (CCJ) as a U&R at the 10-dma but it also posted a VDU volume signature as it tested 10-dma support, a potential long entry using the 10-day line as a selling guide. The stocks has rallied quite coherently as it follows the 10-day line higher after posting a bottom-fishing BGU three weeks ago as it cleared the 50-dma. As uranium names like CCJ rally, small modular nuclear reactor maker NuScale Power (SMR) posted a five-day pocket pivot at its 10-dma on Friday. After a sharp run-up in June and July, SMR has been attempting to round out the right side of a potential new base. It has been and continues to be buyable on pullbacks to the 10-dma and 20-dema as it works its way through overhead and resistance and up the right side of what is so far a cup formation.

As uranium names like CCJ rally, small modular nuclear reactor maker NuScale Power (SMR) posted a five-day pocket pivot at its 10-dma on Friday. After a sharp run-up in June and July, SMR has been attempting to round out the right side of a potential new base. It has been and continues to be buyable on pullbacks to the 10-dma and 20-dema as it works its way through overhead and resistance and up the right side of what is so far a cup formation. Intuitive Machines (LUNR) posted a moving average U&R at its 20-dema on Friday. We reported on that during the day and would watch for any pullbacks to the 10-dma or 20-dema as potential lower risk entries. We would also note that LUNR has rallied back above the 7.44 intraday low of its September 20th buyable gap-up (BGU) move so also constitutes a price U&R using the 7.44 BGU intraday low as a selling guide.

Intuitive Machines (LUNR) posted a moving average U&R at its 20-dema on Friday. We reported on that during the day and would watch for any pullbacks to the 10-dma or 20-dema as potential lower risk entries. We would also note that LUNR has rallied back above the 7.44 intraday low of its September 20th buyable gap-up (BGU) move so also constitutes a price U&R using the 7.44 BGU intraday low as a selling guide. We reported on ride-sharer Uber (UBER) as it posted a buyable gap-up (BGU) move on Friday using the 81.86 intraday low as a tight selling guide. At the time we reported on UBER it was trading about 3% above the intraday low. It ended the day another 2.4% higher to close at 86.34 where it is now extended. Pullbacks closer to the 81.86 intraday low would offer potential lower-risk entries from here so can be watched for.

We reported on ride-sharer Uber (UBER) as it posted a buyable gap-up (BGU) move on Friday using the 81.86 intraday low as a tight selling guide. At the time we reported on UBER it was trading about 3% above the intraday low. It ended the day another 2.4% higher to close at 86.34 where it is now extended. Pullbacks closer to the 81.86 intraday low would offer potential lower-risk entries from here so can be watched for. This remains a difficult market where the most significant upside progress has been seen in industrial metals like uraniums, aluminums, and coppers coming off lows of early September as underplayed commodity-related names. You saw some strong gap-up moves in aluminums Alcoa (AA) and Century Aluminum (CENX) on Friday, but volume was not sufficient to call BGUs.

This remains a difficult market where the most significant upside progress has been seen in industrial metals like uraniums, aluminums, and coppers coming off lows of early September as underplayed commodity-related names. You saw some strong gap-up moves in aluminums Alcoa (AA) and Century Aluminum (CENX) on Friday, but volume was not sufficient to call BGUs.  The Market Direction Model (MDM) remains on a BUY signal.

The Market Direction Model (MDM) remains on a BUY signal.