The Trump Train left the station on Tuesday early in the day as early election returns showed a divergence from prior patterns as Republicans brought in votes. Moving slowly at first, it steadily gathered momentum as Election Day wore on and then accelerated into bullet train status overnight on Tuesday, leading to the Dow's 1508.05-point rally, its largest post-election rally in 128 years. The NYSE-based indexes, the Dow, NYSE Composite, and S&P 500 reflect the post-election ebullience as it runs its course and the charts begin to show some price compression as they get extended and the daily price ranges narrow.

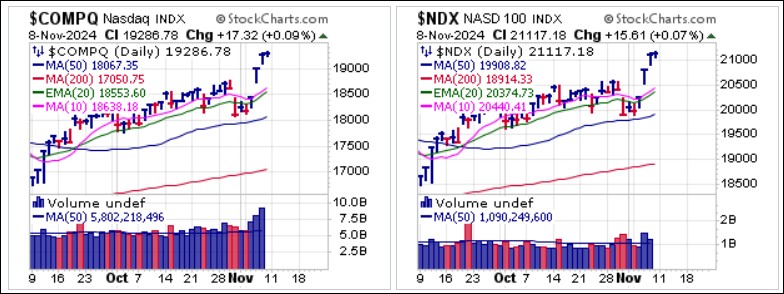

The tech-centric NASDAQ Indexes, the NASDAQ Composite and the NASDAQ 100, reflect a similar extension and price compression. One cannot, however, conclude that this indicates imminent reversals in a Trump Train round-trip back to where it left the station. It could simply be the start of a consolidation and digestion period as the market sorts through and discounts the future that will be 3-6 months from now.

The tech-centric NASDAQ Indexes, the NASDAQ Composite and the NASDAQ 100, reflect a similar extension and price compression. One cannot, however, conclude that this indicates imminent reversals in a Trump Train round-trip back to where it left the station. It could simply be the start of a consolidation and digestion period as the market sorts through and discounts the future that will be 3-6 months from now.

Bitcoin ($BTCUSD) which is perceived as benefitting greatly from a pro-crypto Trump Administration broke out to new highs this week. As of Sunday, King-Crypto has now cleared the $80,000 level for the first time as it gets ever more extended.

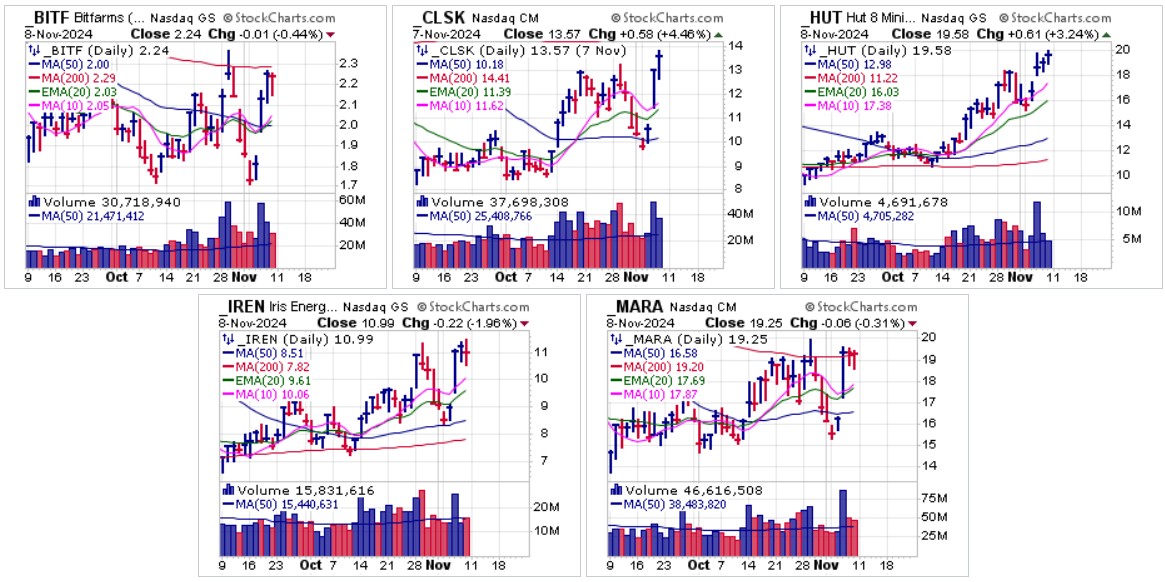

Crypto miners rallied with $BTCUSD after the election but still have room to go before breaking out to new highs. Currently, these are now extended as they push towards the prior week's highs. As $BTCUSD continues through the $80,000 level, however, we would expect these stocks to follow along at their own pace.

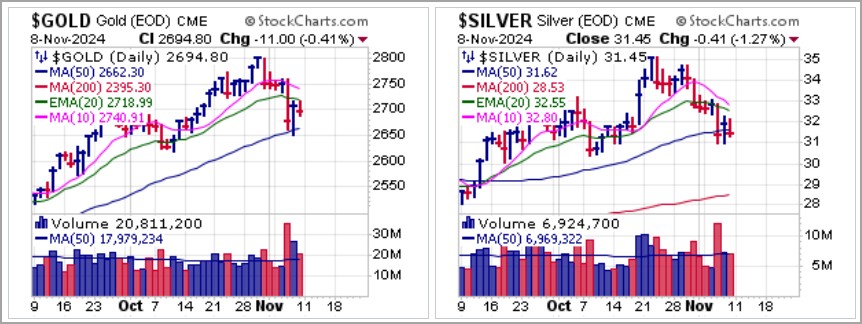

Precious metals began pulling back two weeks ago after the BRICs conference came and went, and this past week sold off further as election uncertainty faded. Given the moves both had had heading into late October, some base-building and consolidation would be expected.

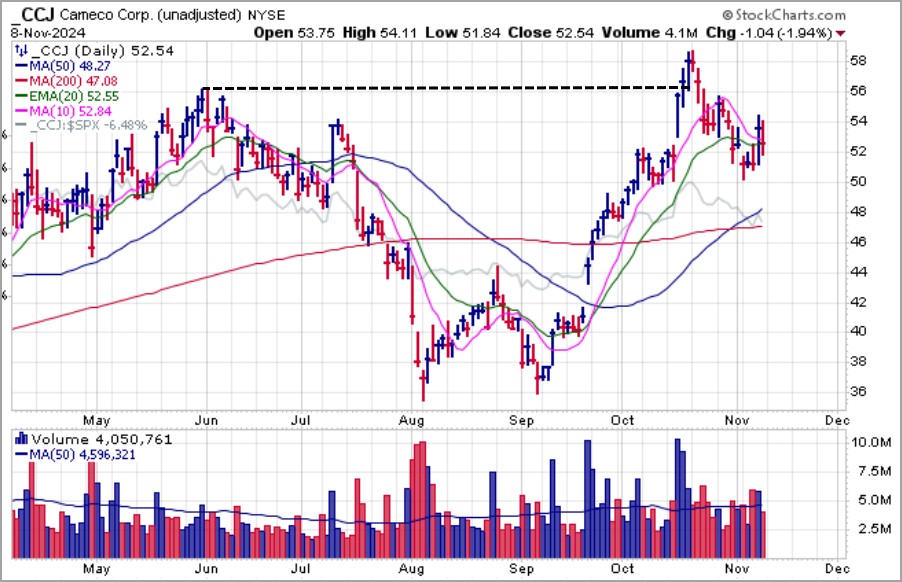

Uraniums have pulled back off recent highs over the past three weeks, with Cameco (CCJ), which we first reported on as a BGU back in late September, posting a double-top short-sale entry at its 56.24 left-side peak of May 31st. The pullback looks like a normal reaction after a massive, straight-up-from-the-bottom move off the September lows, and CCJ may, at the very least, require a period of base-building before setting up again.

Small modular nuclear power maker NuScale Power (SMR) was first reported on as a pocket pivot back on October 11th, and it has trended sharply higher since then. On Friday it broke out to new highs on big volume as it now approaches a 100% price increase

Small modular nuclear power maker NuScale Power (SMR) was first reported on as a pocket pivot back on October 11th, and it has trended sharply higher since then. On Friday it broke out to new highs on big volume as it now approaches a 100% price increase Freeport-McMoRan (FCX) was reported on Thursday as a possible pocket pivot but closed down for the day. Nevertheless, this was also a supporting pocket pivot and MAU&R at the 50-dma and 200-dma. It led to a gap-up move on Thursday, and then a gap-down move on Friday as it came right back to the 50-day and 200-day to post yet another MAU&R move. We tend to think that copper will remain a critical industrial metal and so continue to favor opportunistic entries as these names pull back and consolidate prior sharp price moves in September.

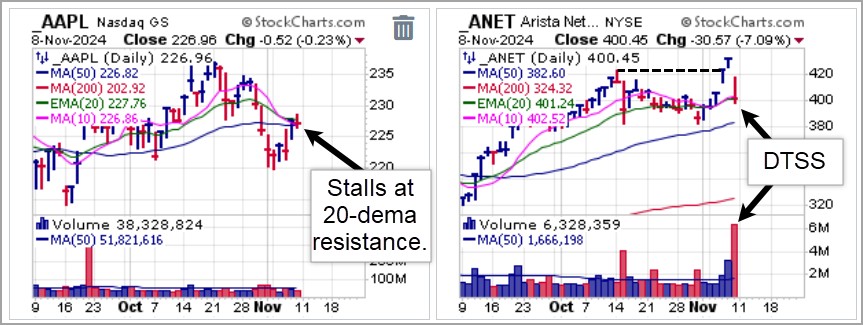

Freeport-McMoRan (FCX) was reported on Thursday as a possible pocket pivot but closed down for the day. Nevertheless, this was also a supporting pocket pivot and MAU&R at the 50-dma and 200-dma. It led to a gap-up move on Thursday, and then a gap-down move on Friday as it came right back to the 50-day and 200-day to post yet another MAU&R move. We tend to think that copper will remain a critical industrial metal and so continue to favor opportunistic entries as these names pull back and consolidate prior sharp price moves in September. Techs are a mixed bag, and not all names in the space found themselves in a bullish state of nirvana. For example, Apple (AAPL), a stock that Warren Buffet has been dumping hand over fist over the past few months, ran into 20-dema resistance on Friday but held above the 50-day line. Should it bust the 50-dma it would trigger a short-sale entry at that point. Big-stock telecom leader Arista Networks (ANET) was certainly a beneficiary of the election results as it broke out to all-time highs on big volume Thursday. It then reported earnings that afternoon and gapped lower on Friday, triggering a double-top short-sale (DTSS) entry and closing below 10-dma and 20-dema support.

Techs are a mixed bag, and not all names in the space found themselves in a bullish state of nirvana. For example, Apple (AAPL), a stock that Warren Buffet has been dumping hand over fist over the past few months, ran into 20-dema resistance on Friday but held above the 50-day line. Should it bust the 50-dma it would trigger a short-sale entry at that point. Big-stock telecom leader Arista Networks (ANET) was certainly a beneficiary of the election results as it broke out to all-time highs on big volume Thursday. It then reported earnings that afternoon and gapped lower on Friday, triggering a double-top short-sale (DTSS) entry and closing below 10-dma and 20-dema support.

The Market Direction Model (MDM) remains on a BUY signal.