The market ended a short Thanksgiving Holiday week on a positive note as the S&P 500 posted a new all-time high on a short Friday trading session. Techs were allowed some respite on news that the Biden Administration would ease some of the restrictions on chip sales to China.

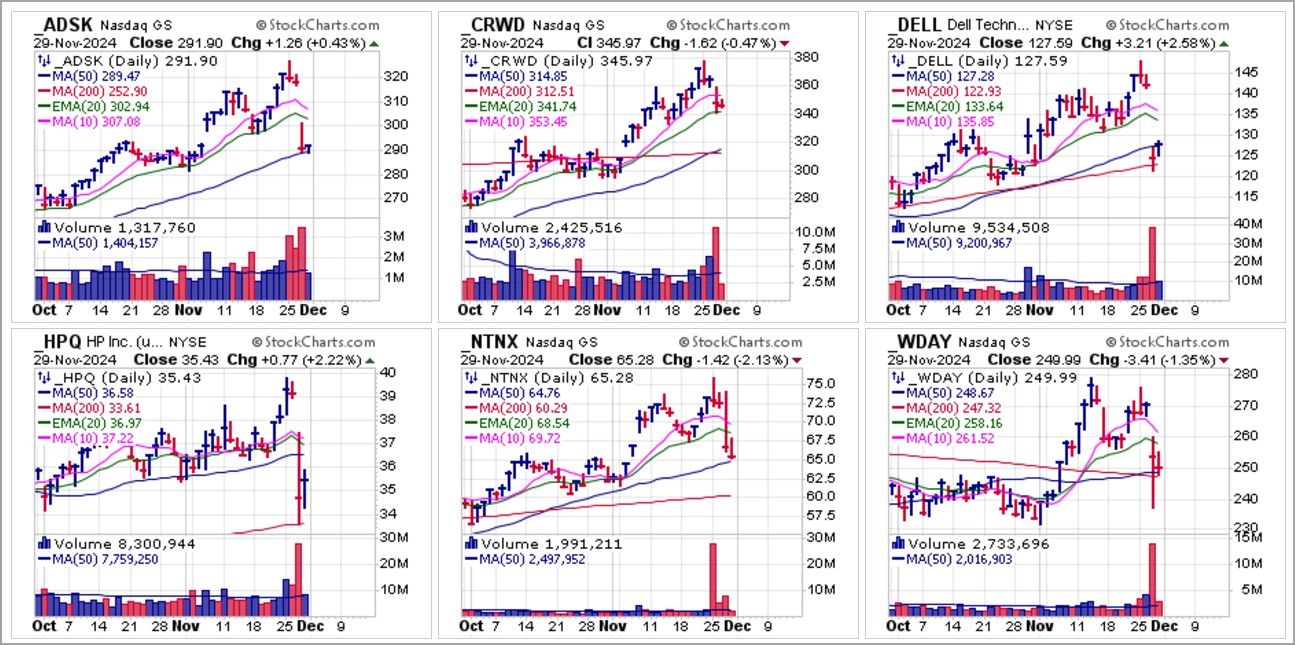

Tech had been hit hard on Wednesday after several big-stock tech leaders, shown in the group chart below, came undone after reporting earnings Tuesday afternoon. Techs have had their troubles more recently as overplayed and over owned names become saturated with longs and many start to report slowing earnings and sales.

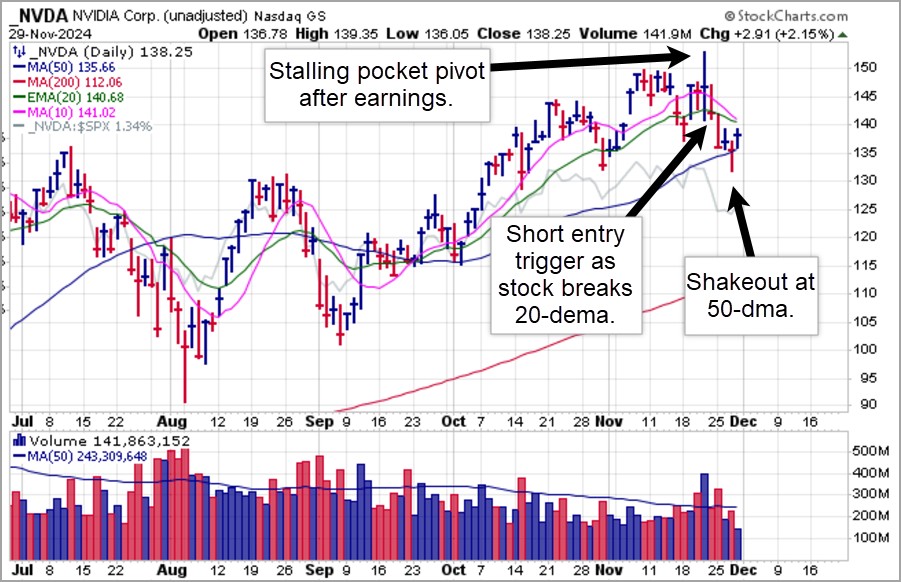

Even the biggest of the big-stock AI-Meme and semiconductor leaders, Nvidia (NVDA) has had its share of woes after reporting earnings the prior week. That initially played out as a big stalling pocket pivot but immediately failed as the stock broke below 20-dema support, triggering a short-sale entry at that point. On Wednesday it descended through the 50-dma early in the day but by the close was able to recover and finish out the day back above the line. That was technically an MAU&R type of set-up at the 50-day line and NVDA then rallied closer to potential 20-dema resistance on Friday.

Bitcoin ($BTCUSD) posted its first sharp pullback since streaking higher throughout the first part of November in an expression of the post-election Trump Halo Effect by breaking below 10-dma support early in the week but holding above 20-dema support. 20-dema support becomes more important as a reliable area of moving average support given the extended and steep nature of $BTCUSD's run in November. A low volume rally into the end of the week brings King Crypto back up towards the $100,000 level which for now appears to serve as a sort of psychological resistance. Some backing-and-filling may be in store as we head into December, with 20-dema support being a key to level to watch for potential add points on pullbacks.

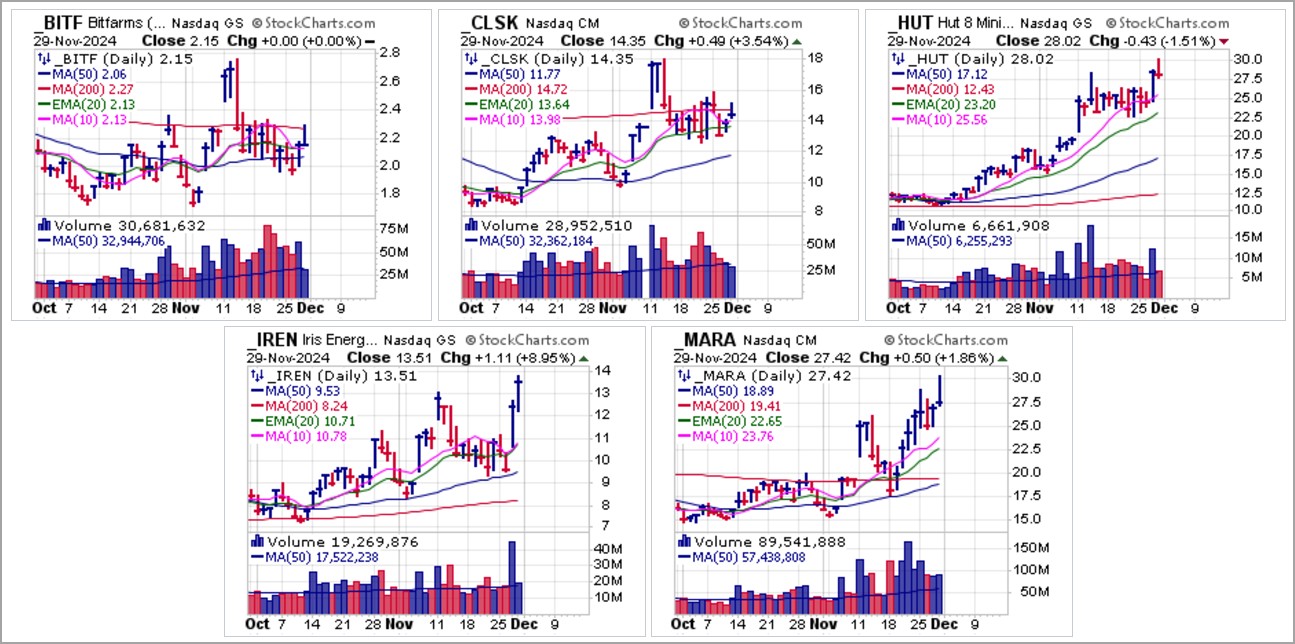

Crypto-related stocks continue to be a mixed bag. The five names we have reported on during November have had their share of sharp ups and down. Last weekend we note that Hut 8 Mining (HUT) appeared to be the most constructive as it formed a reasonably tight flag formation and indeed it did break out on Wednesday on heavy volume. Friday saw a small reversal but for now this breakout holds and remains within buying range. Other names, such as Iris Energy (IREN) and Marathon Digital Holdings (MARA) have posted sharp recoveries as both stocks pushed to higher highs this past week. Meanwhile, Bitfarms Ltd. (BITF) and CleanSpark (CLSK) both played out as short-sale entries after reversing at 200-dma resistance on Friday.

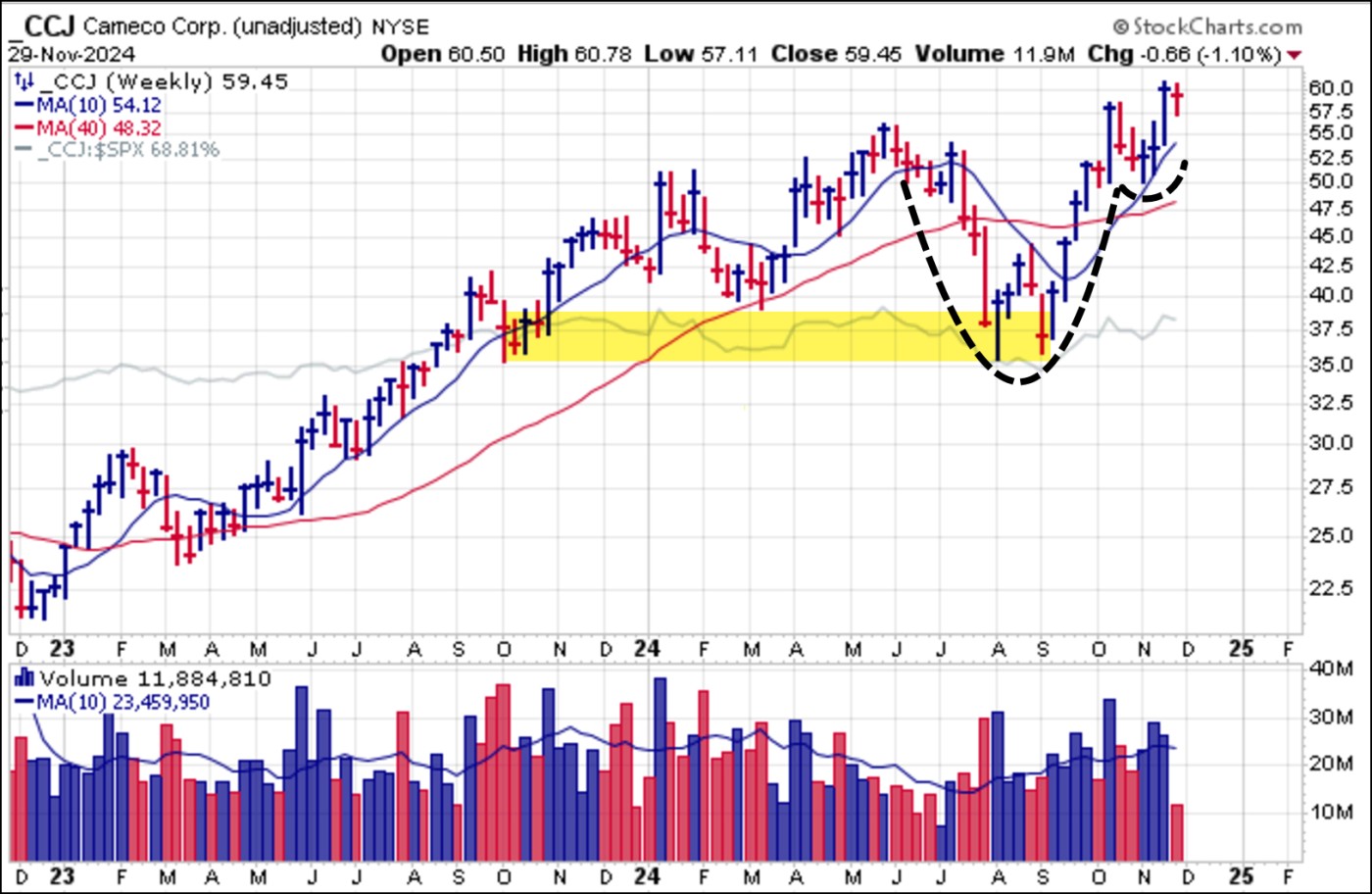

Crypto-related stocks continue to be a mixed bag. The five names we have reported on during November have had their share of sharp ups and down. Last weekend we note that Hut 8 Mining (HUT) appeared to be the most constructive as it formed a reasonably tight flag formation and indeed it did break out on Wednesday on heavy volume. Friday saw a small reversal but for now this breakout holds and remains within buying range. Other names, such as Iris Energy (IREN) and Marathon Digital Holdings (MARA) have posted sharp recoveries as both stocks pushed to higher highs this past week. Meanwhile, Bitfarms Ltd. (BITF) and CleanSpark (CLSK) both played out as short-sale entries after reversing at 200-dma resistance on Friday. Recent news out of Russia, including cutting uranium exports to the U.S., has kept the nuclear power space buoyant. This includes the small modular reactor names we have reported on previously, Oklo (OKLO) and NuScale Power (SMR), not shown, but also pure uranium plays like big-stock uranium Cameco (CCJ). The stock is attempting to break out of a large cup-with-handle formation where the lows of the cup undercut some major areas of support on the weekly chart. While CCJ may spend more time building a handle, this base could help it set up for another leg up in the New Year.

Recent news out of Russia, including cutting uranium exports to the U.S., has kept the nuclear power space buoyant. This includes the small modular reactor names we have reported on previously, Oklo (OKLO) and NuScale Power (SMR), not shown, but also pure uranium plays like big-stock uranium Cameco (CCJ). The stock is attempting to break out of a large cup-with-handle formation where the lows of the cup undercut some major areas of support on the weekly chart. While CCJ may spend more time building a handle, this base could help it set up for another leg up in the New Year. The big event of the week will allegedly be the Bureau of Labor Statistics' monthly jobs report on Friday. A strong a number, so the pundits say, could put the Fed's expected 0.25% rate on hold when it comes out with its latest policy announcement on December 18. In between those two events, we will also see the latest Consumer Price Index (CPI) and Producer Price Index (PPI) numbers on December 11 and 12, respectively.

The big event of the week will allegedly be the Bureau of Labor Statistics' monthly jobs report on Friday. A strong a number, so the pundits say, could put the Fed's expected 0.25% rate on hold when it comes out with its latest policy announcement on December 18. In between those two events, we will also see the latest Consumer Price Index (CPI) and Producer Price Index (PPI) numbers on December 11 and 12, respectively.The Market Direction Model (MDM) remains on a BUY signal.