As stocks stumble around the hottest game in town since the election has been crypto, with King Crypto, Bitcoin ($BTCUSD) bursting to all-time highs as it approaches the $100,000 mark. On the weekly chart the most recent breakout looks similar to the October 2023 breakout from a 27-week base. This time around $BTCUSD is emerging from a 34-week base. If the current move plays out similarly to the 2023 breakout we could see prices reach $135,000 to $150,000 as a possible intermediate-term price target projection.

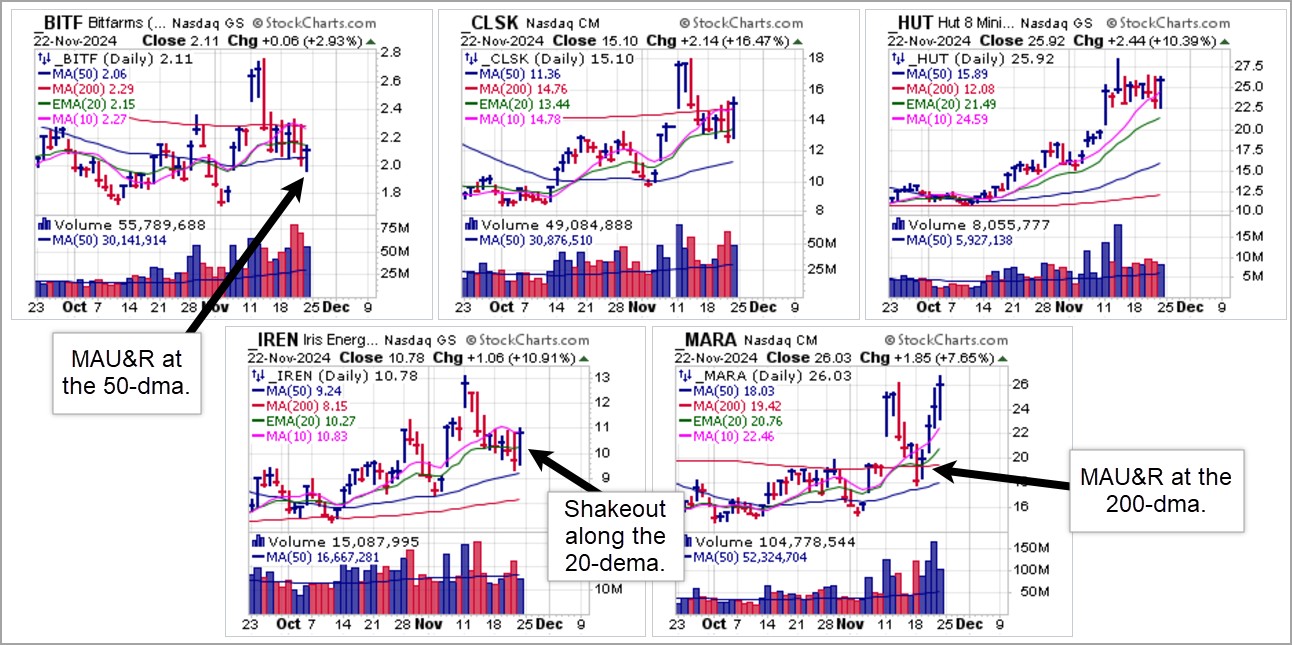

Crypto-stocks that we have reported on over the past month or so have performed inconsistently relative to Bitcoin itself. However, we can discern that among the five names below, Hut 8 Mining (HUT) appears to be forming the most coherent bull flag formation as moves sideways along 10-dma support which is a reference for potential long entries within the flag. The others have posted various shakeouts and moving average undercut & rally (MAU&R) maneuvers that may be buyable along the moving average where the shakeout and U&R is occurring. As you can see in the table below, HUT $Bitcoin value-to-market cap ratio leads the pack.

Crypto-stocks that we have reported on over the past month or so have performed inconsistently relative to Bitcoin itself. However, we can discern that among the five names below, Hut 8 Mining (HUT) appears to be forming the most coherent bull flag formation as moves sideways along 10-dma support which is a reference for potential long entries within the flag. The others have posted various shakeouts and moving average undercut & rally (MAU&R) maneuvers that may be buyable along the moving average where the shakeout and U&R is occurring. As you can see in the table below, HUT $Bitcoin value-to-market cap ratio leads the pack. | Company | Ticker | Market Cap ($B) | Bitcoin Holdings | Value ($B) | Value-to-Market Cap Ratio |

|---|---|---|---|---|---|

| MicroStrategy | MSTR | 86 | 331,200 | 31.1 | 0.362 |

| Tesla | TSLA | 1010 | $1.5B | ~1.5 | ~0.00148 |

| Block | SQ | 55 | ~8,027 | ~0.749 | ~0.0136 |

| Coinbase | COIN | 14 | 9,000 | ~0.837 | ~0.0597 |

| CleanSpark | CLSK | 3.6 | 8,701 | ~0.810 | ~0.225 |

| Galaxy Digital | GLXY | 5.94 | 8,100 | ~0.754 | ~0.127 |

| Stone Ridge | N/A | N/A | >10,000 | ~930M | N/A |

| Hut 8 Mining Corp | HUT | 1 | 8,000 | ~744M | ~0.744 |

| Riot Platforms | RIOT | 1.5 | 7,200 | ~669M | ~0.446 |

Marathon Digital Holdings (MARA) is the starkest example of a classic MAU&R where it streaks right through the 200-dma and then pulls an about-face the next day before streaking back up to the prior week's highs. Not an easy set-up to buy into, but a rewarding one if a trader understands what they are doing with respect to handling what was a very clean and actionable MAU&R at the 200-dma.

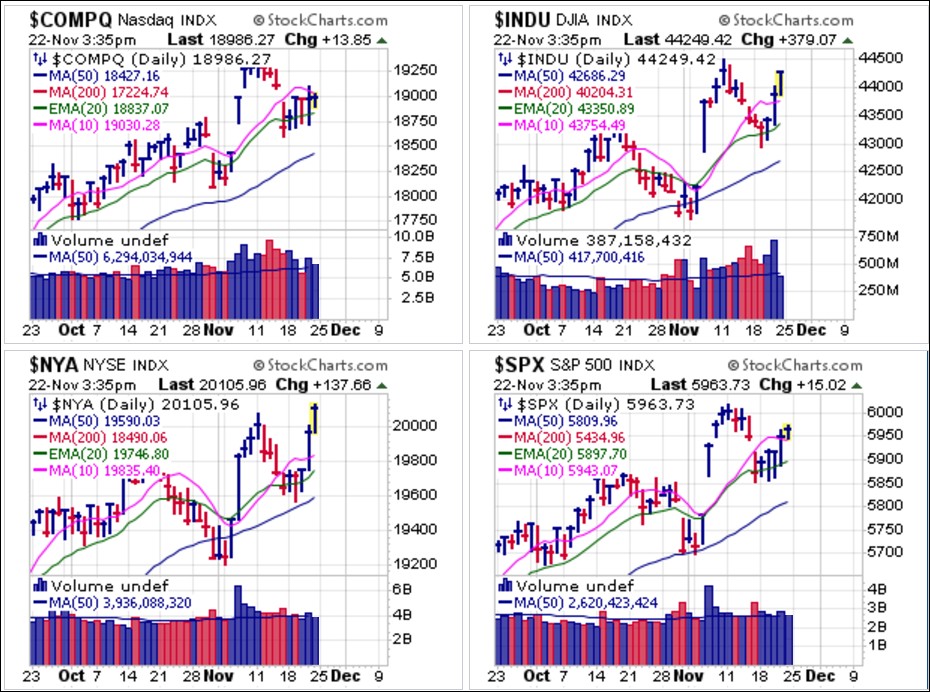

Meanwhile, the market remains a mixed bag as the indexes chop back and forth after breaking down off their recent all-time highs the week before on persistent inflation data and a hawkish tone from Fed Chair Jerome Powell at his speech in Dallas two Thursdays ago. Big-stock techs that have led the market until recently remain stagnant other areas of the market emerge. Thus, the tech-centric NASDAQ Composite and S&P 500 Indexes lag while the non-tech-centric broad 2000-plus stock NYSE Composite Index pushed to all-time highs on Friday. Volume was lighter across the board, however.

Meanwhile, the market remains a mixed bag as the indexes chop back and forth after breaking down off their recent all-time highs the week before on persistent inflation data and a hawkish tone from Fed Chair Jerome Powell at his speech in Dallas two Thursdays ago. Big-stock techs that have led the market until recently remain stagnant other areas of the market emerge. Thus, the tech-centric NASDAQ Composite and S&P 500 Indexes lag while the non-tech-centric broad 2000-plus stock NYSE Composite Index pushed to all-time highs on Friday. Volume was lighter across the board, however. Big earnings this past week from Nvidia (NVDA), or at least what were supposed to be big, market-moving earnings, turned out to be mostly a big nothing burger on Thursday following the Wednesday earnings release. A few percent back and forth finally result in what looked like a pocket pivot for NVDA along the 20-dema.

Big earnings this past week from Nvidia (NVDA), or at least what were supposed to be big, market-moving earnings, turned out to be mostly a big nothing burger on Thursday following the Wednesday earnings release. A few percent back and forth finally result in what looked like a pocket pivot for NVDA along the 20-dema. Palo Alto Networks (PANW) also reported earnings on Wednesday and after spinning around on Thursday the stock found its feet and posted an objective pocket pivot, also along its 20-dema, on heavy volume. On Friday, however, PANW's pocket pivot faltered as the stock closed just below 20-dema support on heavy selling volume. This triggers a short-sale entry at the 20-dema which is then used as a selling guide.

Palo Alto Networks (PANW) also reported earnings on Wednesday and after spinning around on Thursday the stock found its feet and posted an objective pocket pivot, also along its 20-dema, on heavy volume. On Friday, however, PANW's pocket pivot faltered as the stock closed just below 20-dema support on heavy selling volume. This triggers a short-sale entry at the 20-dema which is then used as a selling guide. The market gives the impression of a general movement out of overplayed and over owned big-stock techs, a theme we have noted in recent weeks as semiconductors have sold off and other big-stock techs have slumped. Six of the biggest NASDAQ techs shown below illustrate this, with Tesla (TSLA) being the one outlier as it benefits from a strong Trump halo effect given CEO Elon Musk's close association with the Trump campaign and coming administration.

The market gives the impression of a general movement out of overplayed and over owned big-stock techs, a theme we have noted in recent weeks as semiconductors have sold off and other big-stock techs have slumped. Six of the biggest NASDAQ techs shown below illustrate this, with Tesla (TSLA) being the one outlier as it benefits from a strong Trump halo effect given CEO Elon Musk's close association with the Trump campaign and coming administration. On Thursday, Gil reported via the VoSI VooDoo Report on silver, citing the VDU pullback to 10-dma support in the iShares Silver Trust (SLV) at that time. That was an actionable long entry and the SLV then pushed higher on Friday. We now keep an eye on 20-dema resistance as any move above that would certainly add to a bullish recovery after a sharp, three-week sell-off from 12-year highs that were posted in late October.

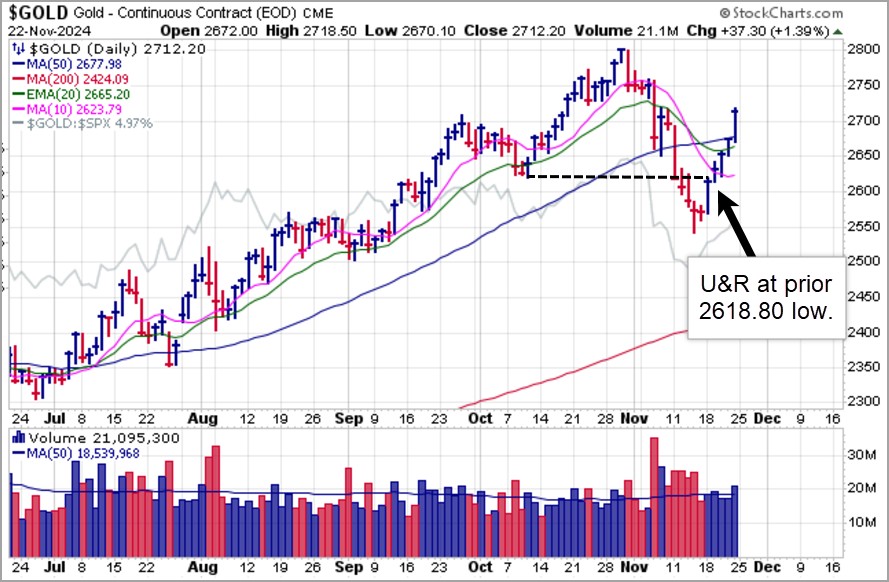

On Thursday, Gil reported via the VoSI VooDoo Report on silver, citing the VDU pullback to 10-dma support in the iShares Silver Trust (SLV) at that time. That was an actionable long entry and the SLV then pushed higher on Friday. We now keep an eye on 20-dema resistance as any move above that would certainly add to a bullish recovery after a sharp, three-week sell-off from 12-year highs that were posted in late October. Gold has been on a tear after a panic sell-off amid the Trump election victory, but the yellow metal came back strongly this past week. In the process it posted a U&R at the prior $2618.80/oz. low of early October as it streaks past the $2700 level and is now 3.2% away from its prior all-time high of $2,801.20 on the continuous futures contract. In our view, the success of Trump 2.0 will necessitate a declining dollar, and this should be bullish for gold, silver, and Bitcoin in 2025.

Gold has been on a tear after a panic sell-off amid the Trump election victory, but the yellow metal came back strongly this past week. In the process it posted a U&R at the prior $2618.80/oz. low of early October as it streaks past the $2700 level and is now 3.2% away from its prior all-time high of $2,801.20 on the continuous futures contract. In our view, the success of Trump 2.0 will necessitate a declining dollar, and this should be bullish for gold, silver, and Bitcoin in 2025. It will also likely be bullish for commodities in general. Gil also reported on 2024 copper leader Hudbay Minerals (HBM) in the VoSI VooDoo Report on Thursday as it posted a VDU pullback into 20-dema support where it was buyable using the line as a selling guide. That would remain the case on any further pullbacks to the line, although it remains within buying range after Friday's close. The copper space may be one to watch in 2025, and we will report on set-ups within the group if and as they materialize in real-time.

It will also likely be bullish for commodities in general. Gil also reported on 2024 copper leader Hudbay Minerals (HBM) in the VoSI VooDoo Report on Thursday as it posted a VDU pullback into 20-dema support where it was buyable using the line as a selling guide. That would remain the case on any further pullbacks to the line, although it remains within buying range after Friday's close. The copper space may be one to watch in 2025, and we will report on set-ups within the group if and as they materialize in real-time. This remains a difficult market, and while many thought that the Trump election might soothe geopolitical tensions in the world, that proved not to be the case this past week. Over the weekend the Biden Administration authorized Ukraine to use long-range U.S. ATACMS missile.

This remains a difficult market, and while many thought that the Trump election might soothe geopolitical tensions in the world, that proved not to be the case this past week. Over the weekend the Biden Administration authorized Ukraine to use long-range U.S. ATACMS missile.That prompted a response from Russia that it was revising its nuclear doctrine whereby it could respond to conventional weapons attacks with nuclear weapons if its security were threatened. Then Ukraine launched UK-supplied long-range, air-launched Storm Shadow missiles, which have only served to escalate tensions. Thus, the potential for headline risk remains a possibility in this market, and investors should remain alert but cautious should this situation continue to escalate.

The Market Direction Model (MDM) remains on a BUY signal.