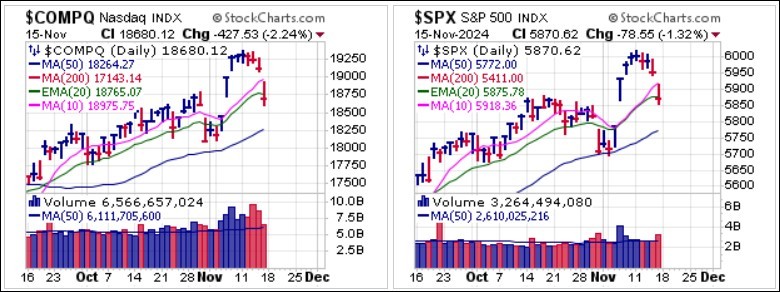

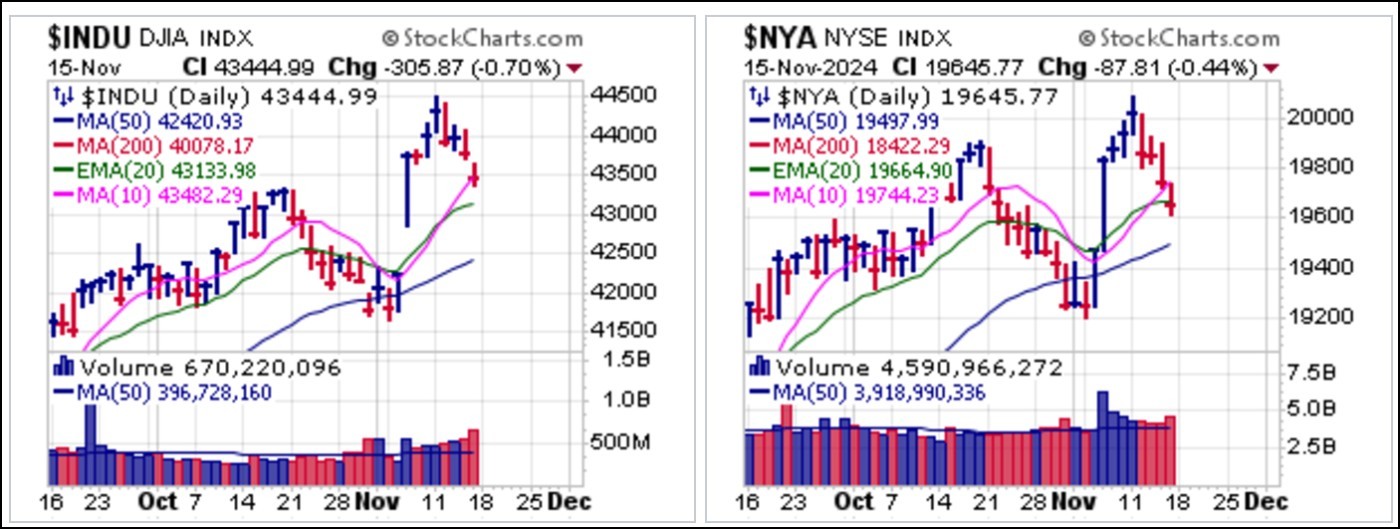

Stocks were smashed into the end of the week as in-line Consumer Price Index (CPI) and Producer Price Index (PPI) revealed that the trend in price levels is still to the upside. By Thursday mid-day Fed Chair Jerome Powell sounded a hawkish tone in a speech he made in Dallas, making the already shaky market situation ever more obvious. The NASDAQ Composite and S&P 500 both gapped below their 10-day lines and then slashed lower to close below their 20-demas in bearish moves.

The Dow and NYSE Composite Indexes were already rolling over earlier in the week after posting all-time highs on Monday.

Big-stock NASDAQ names took the brunt of the selling into the end of the week.

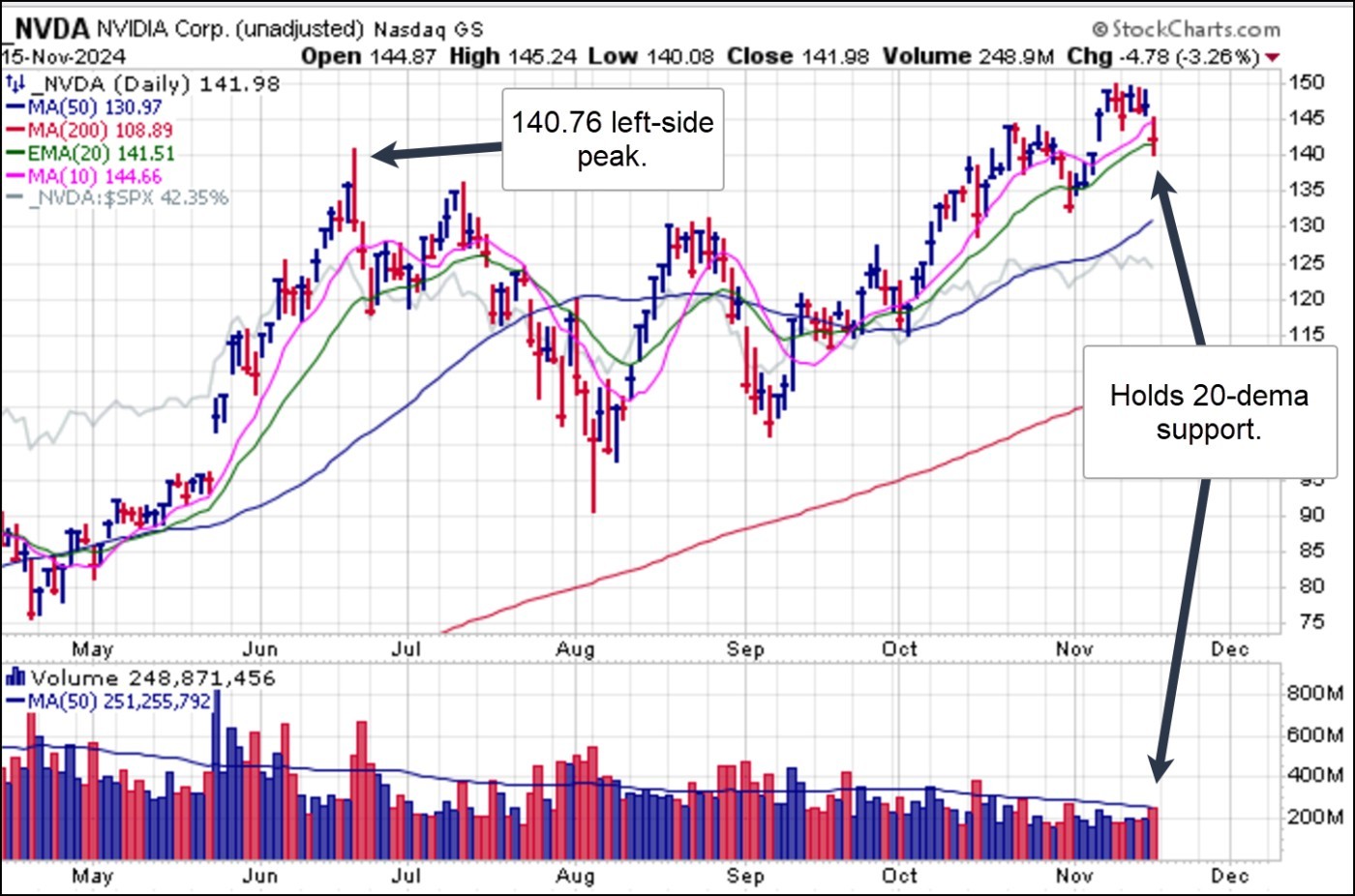

In what will be a quiet week on the economic data front the big event of the week will likely be Nvidia (NVDA) earnings on Wednesday after the close. The stock has recently broken out to all-time highs on weak volume, and on Friday came in to test 20-dema support. While we would not advise taking fresh positions, we will be watching this closely for any actionable price action that transpires once earnings are out. As well, NVDA's earnings report will likely have a broad-reaching sympathy effect on other big-stock AI-related tech names.

The only positive area of the market was crypto, with Bitcoin ($BTCUSD) posting fresh all-time highs as it cleared the $90,000 level. On Sunday morning as we write, it is now dipping back below the $90,000 level from a very extended position.

Oddly enough, crypto miners that we reported on last week did not follow $BTCUSD higher. Hut 8 Mining Corp. (HUT) was the only exception as it held near its mid-week highs by Friday's close. The other four, Bitfarms Ltd. (BITF), CleanSpark (CLSK), Iris Energy (IREN), and Marathon Digital Holdings (MARA) all turned sharpy south on Wednesday. BITF and CLSK busted 200-dma support on Thursday, while IREN comes in to test 20-dema support and MARA retreats back into support along the 10-dma, 20-dema, and 200-dma.

Bearish action this past week is flashing a warning signal as big-stock techs take some severe selling heat amid weakness in many other areas of the market, with the crypto-currency diverging somewhat while crypto stocks failed to match crypto-currencies on the upside heading into week's end. Review trailing stops and tread carefully.

The Market Direction Model (MDM) remains on a BUY signal.