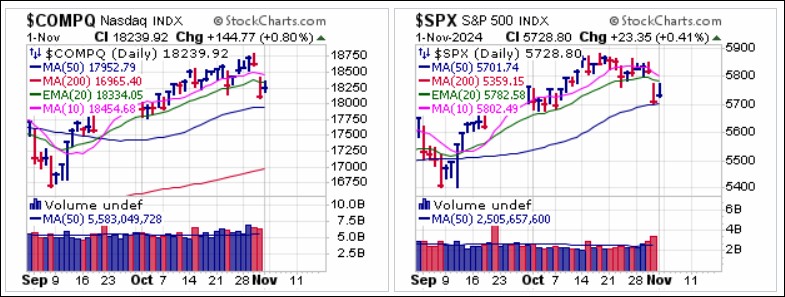

Major market indexes have broken down from recent highs following less-than-stellar earnings from key big-stock NASDAQ names. The NASDAQ Composite and S&P 500 both broke below 20-dema support on Friday and then rallied back up into resistance at the line as they found support near their 50-day moving averages but reversed into the close to end Friday below 20-dema resistance.

Meanwhile, the Dow, NYSE Composite, and small-cap Russell 2000 busted 50-dma support on Thursday but on Friday the Dow and the Russell 2000 were able to regain their 50-day lines but reversed at 20-dema resistance. Meanwhile the NYSE Composite failed to clear what is now 50-dma resistance.

Meanwhile, the Dow, NYSE Composite, and small-cap Russell 2000 busted 50-dma support on Thursday but on Friday the Dow and the Russell 2000 were able to regain their 50-day lines but reversed at 20-dema resistance. Meanwhile the NYSE Composite failed to clear what is now 50-dma resistance. The week's earnings story can be assessed through the charts of the six big-stock NASDAQ names that reported during the week. Post-close on Tuesday post-close Alphabet (GOOGL) reported and pleased investors such that it posted a BGU move on Wednesday, but that move has since failed. On Wednesday after the close, Meta Platforms (META) and Microsoft (MSFT) reported, and both stocks disappointed investors, leading to downside breaks on Thursday. Both reported strong quarterly earnings Wednesday evening. META earnings per share: $6.03, above estimates of $5.22, revenue: $40.6 billion, above estimates of $40.2 billion. MSFT earnings per share: $3.30, above estimates of $3.10, revenue: $65.6 billion, above estimates of $64.57. Yet both companies gapped lower because of concerns around the companies’ massive AI spending plans for the coming quarters.

The week's earnings story can be assessed through the charts of the six big-stock NASDAQ names that reported during the week. Post-close on Tuesday post-close Alphabet (GOOGL) reported and pleased investors such that it posted a BGU move on Wednesday, but that move has since failed. On Wednesday after the close, Meta Platforms (META) and Microsoft (MSFT) reported, and both stocks disappointed investors, leading to downside breaks on Thursday. Both reported strong quarterly earnings Wednesday evening. META earnings per share: $6.03, above estimates of $5.22, revenue: $40.6 billion, above estimates of $40.2 billion. MSFT earnings per share: $3.30, above estimates of $3.10, revenue: $65.6 billion, above estimates of $64.57. Yet both companies gapped lower because of concerns around the companies’ massive AI spending plans for the coming quarters.Post-close on Thursday Apple (AAPL), Amazon.com (AMZN), and Intel (INTC) reported earnings. AAPL disappointed slightly but was already down for the day, dropping another 1.35%% on Friday. AMZN posted a favorable report and then gapped higher in a typical BGU move using the 197.02 intraday low as a selling guide. It traded in a narrow range and made little progress as it also reversed along the 201.20 left-side peak of July 8th after hitting an intraday high of 201.50. That would trigger a double-top short-sale entry using the 201.20 left-side peak as a covering guide. As well, the reversal at the $200 Century Mark would also constitute shortable resistance at the $200 level which is then used as a covering guide. INTC beat estimates but posted a sizable loss of -46 cents, but beat over-lowered estimates to trigger a slight gap-up move on Friday.

Precious metals gold and silver started the week out to the upside, with December Gold Futures posting a new all-time high at $2,801.80 an ounce on Wednesday. Silver rallied to test the prior week's 35.07 an ounce 12-year high but backed down into the end of the week as the iShares Silver Trust (SLV) has dropped below 20-dema support.

Precious metals gold and silver started the week out to the upside, with December Gold Futures posting a new all-time high at $2,801.80 an ounce on Wednesday. Silver rallied to test the prior week's 35.07 an ounce 12-year high but backed down into the end of the week as the iShares Silver Trust (SLV) has dropped below 20-dema support. Bitcoin ($BTCUSD) fell just shy of its all-time high of 73,802.64 on Wednesday when it reached an intraday peak of 73,612.24 before backing down to end the week at 69,496.01.

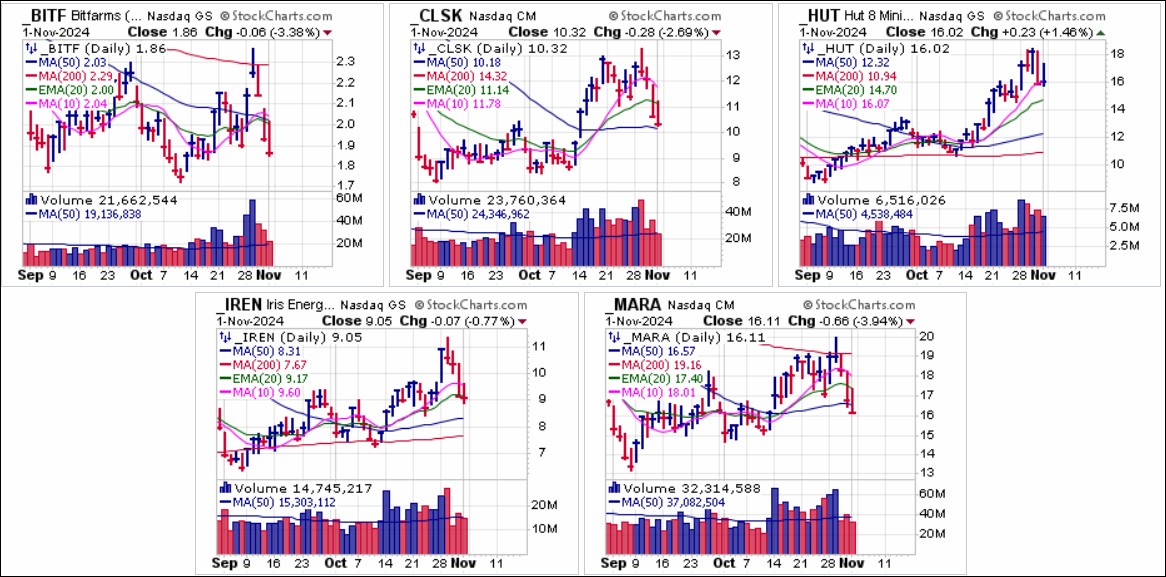

Bitcoin ($BTCUSD) fell just shy of its all-time high of 73,802.64 on Wednesday when it reached an intraday peak of 73,612.24 before backing down to end the week at 69,496.01. Pocket pivots reported this past week in five Bitcoin miners all failed by the end of the week. Bitfarms Ltd. (BITF), CleanSpark (CLSK), Hut 8 Mining Corp. (HUT), Iris Energy (IREN), and Marathon Digital Holdings (MARA) reversed with Bitcoin. Expect heightened volatility in Bitcoin and the miners ahead of elections on Nov 5.

Pocket pivots reported this past week in five Bitcoin miners all failed by the end of the week. Bitfarms Ltd. (BITF), CleanSpark (CLSK), Hut 8 Mining Corp. (HUT), Iris Energy (IREN), and Marathon Digital Holdings (MARA) reversed with Bitcoin. Expect heightened volatility in Bitcoin and the miners ahead of elections on Nov 5.

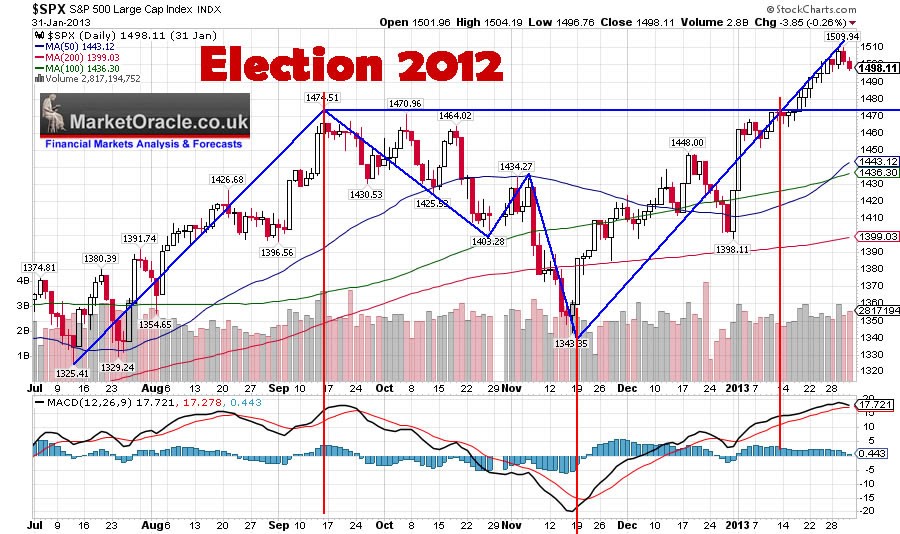

Tuesday's election will no doubt influence the market's direction from current levels. It is impossible to discuss actionable set-ups in an environment where the out come of the elections could have a strong influence. For now, we advise caution until the election results are known unless one wishes to gamble on the outcome, which we do not recommend. It is not possible to predict the elections results despite betting markets and some polls showing Trump in the clear lead due to the potential and intentional mismanagement of votes, and even more so, it is not possible to predict how the market will react to any permutations of the final election results. Longer term, both candidates will print so should contribute greatly to rising global liquidity. But markets may show temporary disappointment if Harris wins because Trump is more pro-Bitcoin, less taxes, less regulations, less government (think Reagan), and more forceful with the Fed chair in terms of lowering interest rates.

The past two elections were bullish for markets. Even the last election where the results were contested by the Trump camp for many weeks did not deter markets from moving higher. Keep in mind QE was expanding in 2016 and on full blast in 2020.

The Market Direction Model (MDM) remains on a BUY signal.