Current Focus List

The VoSI Focus List is a compilation and reference list of stocks for which Pocket Pivot or Buyable Gap-Up Reports have been issued and which have been deemed suitable for inclusion on the Focus List. Not all stocks for which a Pocket Pivot or Buyable Gap-Up report has been issued will necessarily be added to the list. It is not intended as a "buy list" or a list of immediately actionable recommendations. Stocks on the list may or may not be in proper buy positions, and investors should exercise discretion and proper judgement in determining when and where stocks on the Focus List can be purchased. The following notes are intended to assist in this process. Please note that members can enlarge the Focus List image by clicking on the body of the email and then holding the Control Key while pressing the "+" key until it is large enough to read.

General Observations:

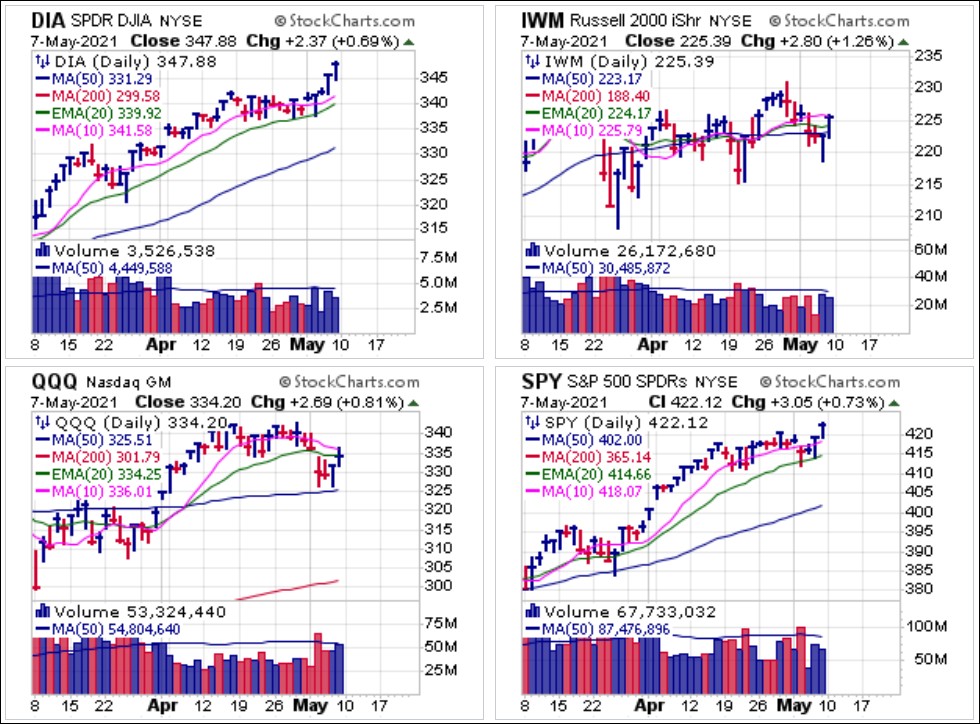

The market remains in a highly bifurcated state where commodity-related names are rallying, helping to drive both the Dow and the S&P 500 Index to new highs while techs and growth names lag, some quite severely. Thus we see the NYSE-based indexes push to new highs while the NASDAQ Composite, NASDAQ 100, and Russell 2000 Indexes lag, as the charts below clearly show. One could easily argue that the action in the QQQ is shortable as it stalled Friday at the 20-day exponential moving average.

The action becomes more evident on a large chart of the NASDAQ Composite, which closed Friday in the lower half of its trading range on light volume, despite the big move in the S&P and Dow.

We remain firmly entrenched in the commodity-inflation trade against the backdrop of a declining dollar, which should also help to lift prices of alternative-currencies, including crypto-currencies, gold, silver, platinum and other hard assets that exist as stores of value outside the realm of fiat.

The Market Direction Model (MDM) remains on a BUY signal.

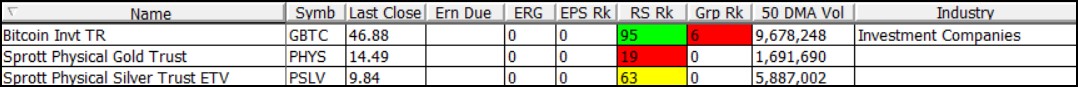

Etherium has stolen the show over the past couple of weeks as Bitcoin continues to hang along its 50-day moving average. The Grayscale Bitcoin Trust (GBTC) reflects this as resistance along the line on its daily chart below. We do not see any long entries in the chart currently, so it remains a matter of waiting and watching as Bitcoin takes a backseat to Etherium and continues to consolidate with the potential for further downside if it cannot soon push more decisively above the 50-day line. Should Ethereum continue its outperformance, this will ultimately help Bitcoin push higher, if history is any guide.

Precious metals have also been on fire lately as Bitcoin takes a well-deserved break. The Sprott Physical Gold Trust (PHYS) is streaking towards its 200-day moving average as gold futures push above the $1800 level. It is extended at this point, with the last buy point occurring on the pullback to the 20-day exponential moving average as we discussed in last weekend's Focus List Report.

The Sprott Physical Silver Trust (PSLV) posted two buyable gap-ups this past week, one on Monday and one on Thursday as it pushed higher and is now testing the highs of late February. It was last buyable along its 50-day moving average last week as we discussed in last weekend's Focus List Report. Unlike the PHYS, the PSLV is now well above all four of the primary moving averages that we watch. Both gold and silver were initially buyable on the undercut & rally (U&R) moves that occurred in late March/early April, and they have steadily moved higher from there. Both PHYS and PSLV have offered excellent vehicles for playing the current commodity-inflation trade.

In our view, it is much easier to find conviction in the commodity-inflation trade, and Friday's very weak jobs number of 266,000 jobs recovered in the wake of the pandemic vs. expectations of as much as 1 million jobs and whisper numbers of 2 million jobs put the wind firmly at the back of the trade. We continue to favor vehicles that represent hard assets and non-fiat alternative currencies. This can also include industrial metals, agricultural commodities, and other areas of the market that make up the realm of "stuff," that is tangible materials and products that will see higher prices as commodity-inflation gathers momentum.