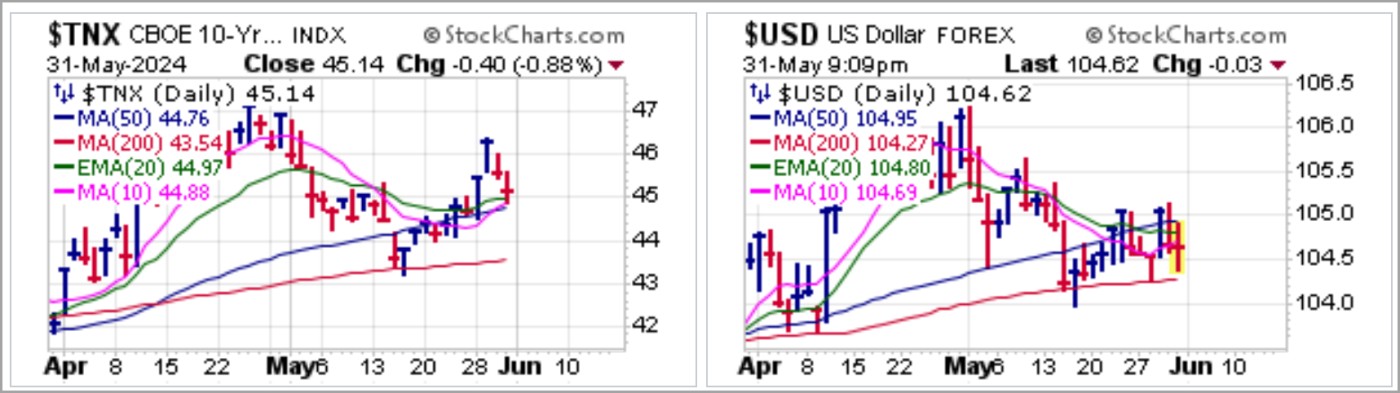

Both the Q1 2024 GDP Deflator Q1 second estimate on Thursday and the Personal Consumption Expenditures (PCE) inflation data on Friday came in slightly cooler than expected. The GDP deflator came in at 3.0% vs. expectations of 3.1% while core PCE inflation came in 0.2% vs. expectations of 0.3% while the headline number printed at expectations of 0.3%. Interest rates as measured by the 10-Year Treasury Yield ($TNX) and the U.S. Dollar ($USD) both declined in response.

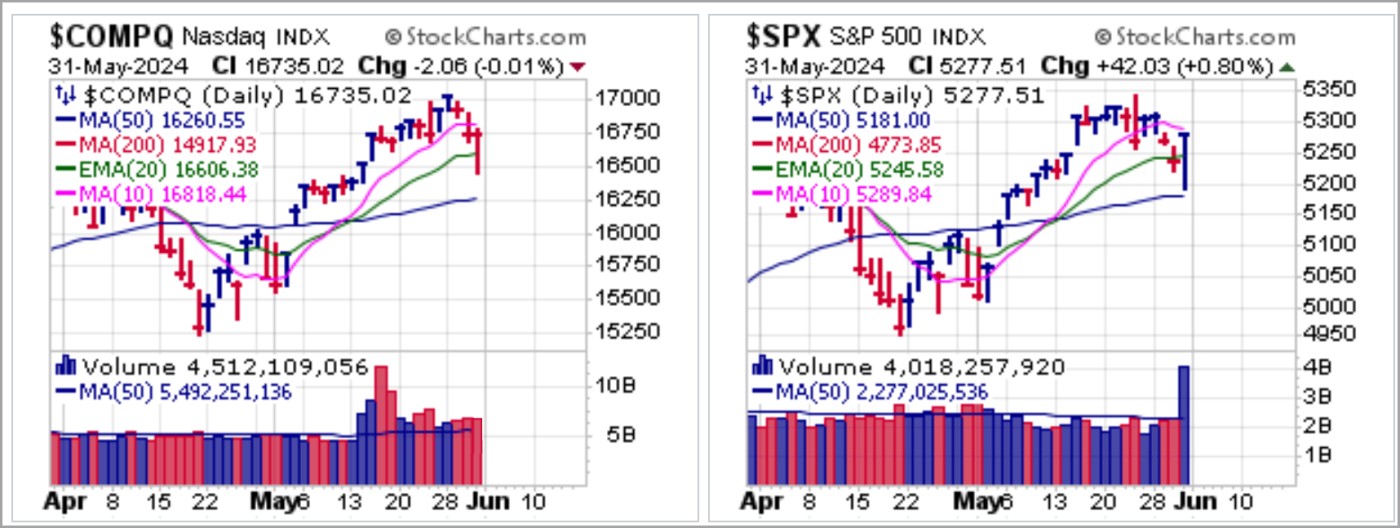

Nevertheless, the market sold off anyway as the NASDAQ Composite broke below 20-dema support and the S&P 500 came in to test its 50-dma early in the day on Friday. However, around mid-day the indexes began to find their feet and rally sharply as the NASDAQ finished with a big shakeout along the 20-dema and the S&P 500 held volume support at its 50-dma. There was no news catalyst for the recovery, other than the fact that the markets finally realized that both interest rates and the dollar had declined in response to cooler-than-expected inflation data.

The general inverse correlation between interest rates and the dollar vs. alternative currencies also diverged on Friday as Bitcoin($BTCUSD) sold off to test the 20-dema. By Friday's close it shook out along the 20-dema, setting up a moving average undercut & rally long entry at the 20-day line which would then serve as a tight selling guide.

The general inverse correlation between interest rates and the dollar vs. alternative currencies also diverged on Friday as Bitcoin($BTCUSD) sold off to test the 20-dema. By Friday's close it shook out along the 20-dema, setting up a moving average undercut & rally long entry at the 20-day line which would then serve as a tight selling guide. Gold and silver came down as well, with the SPDR Gold Shares (GLD) testing the 50-dma as volume declined to -65% below average. Technically, that would be a VDU long entry at the 50-dma which is then used as a selling guide. Silver via the iShares Silver Trust (SLV) sliced through 10-dma support on Friday before approaching 20-dema support. At the same time, silver futures (not shown) hit a low of $30.366 an ounce on Friday, just above the $30.35 prior peak of February 2021. The SLV rallied off its intraday lows towards the end of the day as it tests 20-dema support. If GLD can hold 50-dma support on the VDU pullback then we would expect SLV to hold 20-dema support.

Gold and silver came down as well, with the SPDR Gold Shares (GLD) testing the 50-dma as volume declined to -65% below average. Technically, that would be a VDU long entry at the 50-dma which is then used as a selling guide. Silver via the iShares Silver Trust (SLV) sliced through 10-dma support on Friday before approaching 20-dema support. At the same time, silver futures (not shown) hit a low of $30.366 an ounce on Friday, just above the $30.35 prior peak of February 2021. The SLV rallied off its intraday lows towards the end of the day as it tests 20-dema support. If GLD can hold 50-dma support on the VDU pullback then we would expect SLV to hold 20-dema support. The Market Direction Model (MDM) remains on a BUY signal.

The Market Direction Model (MDM) remains on a BUY signal.