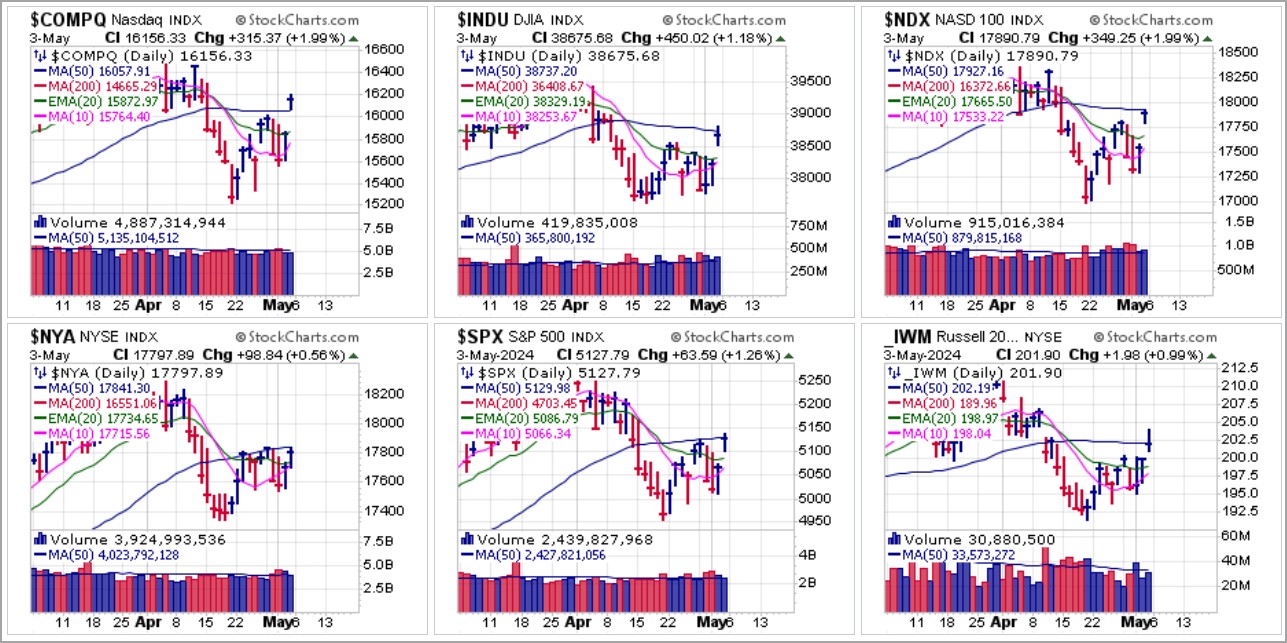

Major market indexes endured another volatile week. A weak Bureau of Labor Statistics jobs report on Friday sent the indexes rallying sharply higher, but of the six major indexes on the NASDAQ Composite was able to clear its 50-day moving average on lighter volume. The jobs report came in at 175,000 jobs vs. expectations of 250,000 while the unemployment rate rose to 3.9% from 3.8%. The number also included a statistical Birth-Death Model adjustment which added +363,000 jobs to the tally. Thus, without this arbitrary adjustment a job loss of 188,000 would have been reported. The report Fed into the rate cut narrative driving stocks higher.

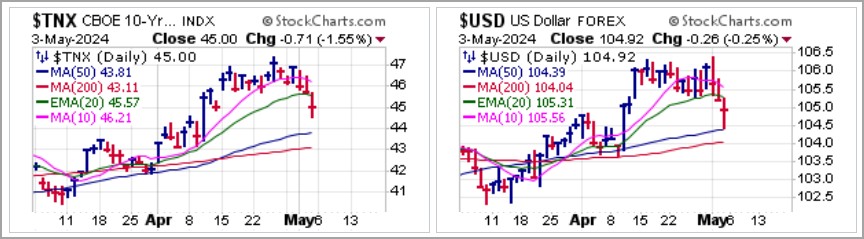

Interest rates as measured by the 10-Year U.S. Treasury Yield ($TNX) and the U.S. Dollar ($USD) both declined in response to the weak jobs report but rallied off their intraday lows on Friday.

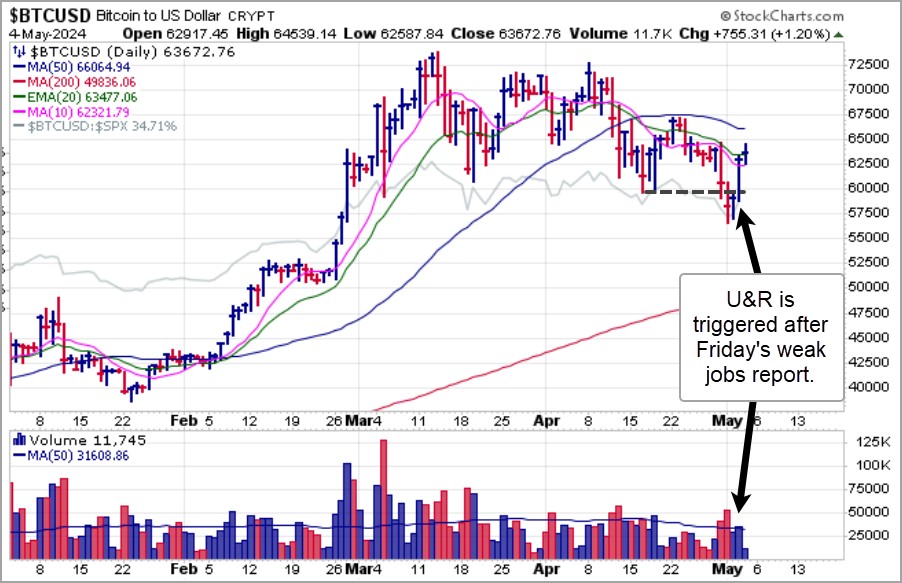

Bitcoin ($BTCUSD) rallied in response to the report, posting another U&R attempt after undercutting recent chart lows.

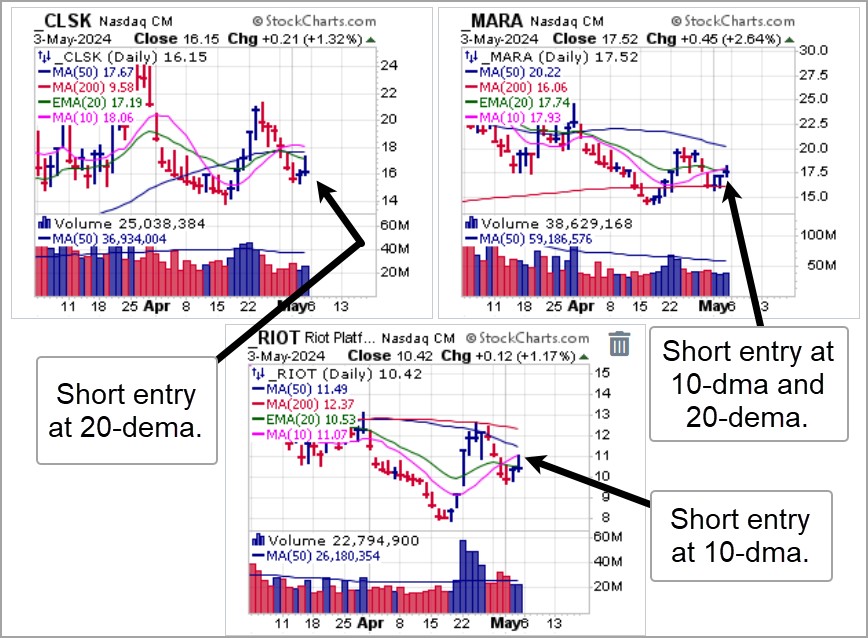

Crypto-mining stocks CleanSpark (CLSK), Marathon Digital Holdings (MARA), and Riot Platforms (RIOT) continue to play out as downtrending short-sale targets. All three are now living below their 50-dmas and rallies on Friday in sympathy to $BTCUSD merely brought them up into shortable moving average resistance at their 10-dma and/0r 20-dema.

From an individual stock perspective it is difficult to make the case for a roaring new market rally. Volume was light among most big-stock semiconductors and other AI Meme techs. In cases where volume was strong, such as with Arista Networks (ANET), the move carried right into 50-dma resistance where it may present a short-sale entry using the 50-day line as a covering guide.

Despite the market rally off the lows of two weeks ago, we have seen very little, if anything that presents what in our view would be an optimal long entry set-up. Even a bottom-fishing buyable gap-up (BFBGU) such as we saw in Apple (AAPL) on Friday after earnings stalled and reversed badly off the intraday highs on heavy volume. Technically, this would still be a BGU using an entry as close to the intraday low at 182.66 as possible while using that same low as a tight selling guide. Good luck!

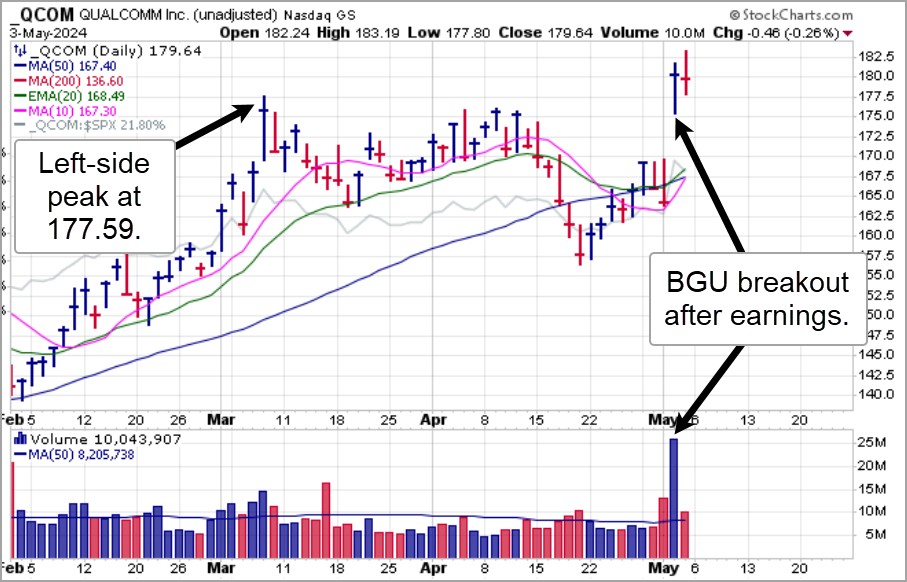

Even a BGU breakout in Qualcomm (QCOM) seen on Thursday after it reported earnings on Wednesday evening did not see any follow-through on Friday despite the big index rally. Technically, this remains a BGU using Thursday's intraday low at 175.29 as a tight selling guide. We would also be alert to an y potential double-top short-sale (DTSS) set-up that could develop if QCOM breaks below the 177.59 left-side peak and then quickly fails at the 175.29 BGU low.

This remains a challenging environment dominated by speculation over just how long the Fed will keep rates at current levels in the face of a potentially weakening economy and persistent inflation. Certainly, there appears to be no discussion of raising rates to quell the steady rise in price levels throughout the economy, perhaps necessitated by the fact that the U.S. government debt continues to grow at nearly $1 trillion every three months. Reflecting this highly news-driven uncertainty, the Market Direction Model (MDM) switched to a SELL signal on Wednesday, May 1, 2024 from a CASH/NEUTRAL signal on May 24th, then switched back to a CASH signal on Friday, May 3rd. For now it remains on a CASH/NEUTRAL signal. Stealth QE will increase on June 1 based on this reduction in the Treasury runoff cap. M2 % change from a year ago is about to turn positive, but until the inflation and interest rate situation improves, whether stealth QE and the tapering of the taper can push stock and crypto markets back into uptrends remains to be seen. Are we in store for chop suey markets?