Major market indexes continued to grind and chop higher this week before running into a pothole on Thursday as the NASDAQ Composite reversed badly on heavy volume but was still able to hold 10-dma support. Nvidia (NVDA) earnings sparked an early rally which reversed in bearish fashion but continued upside in NVDA shares provided the impetus for a rebound rally on Friday. In the process the NASDAQ posted a new all-time closing high on light volume ahead of the long three-day Memorial Day Weekend holiday.

As the market grinds and churns higher, breadth as measured by the NASDAQ Advance-Decline Line shows that the rally has remained relatively narrow. In a robust breakout to new, all-time highs, we might expect to see breadth at least pushing sharply higher, but the NASDAQ's breakout to new highs this past week was accompanied by by steadily declining breadth. This may be a cautionary sign, unless breadth is able to pick up again as it potentially plays catch up to the indexes.

As the market grinds and churns higher, breadth as measured by the NASDAQ Advance-Decline Line shows that the rally has remained relatively narrow. In a robust breakout to new, all-time highs, we might expect to see breadth at least pushing sharply higher, but the NASDAQ's breakout to new highs this past week was accompanied by by steadily declining breadth. This may be a cautionary sign, unless breadth is able to pick up again as it potentially plays catch up to the indexes. Nvidia (NVDA) posted a buyable gap-up (BGU) on Thursday morning after setting an intraday low at 1,015.20 early in the day. Technically the stock remains just barely (5%) within buying range using the 1,015.20 BGU low as a selling guide. It remains one of the very few fundamentally-sound big-stock tech leaders making new highs with the market.

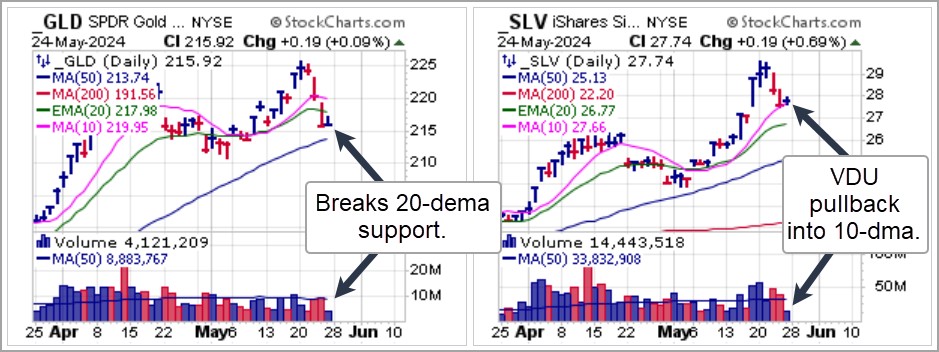

Nvidia (NVDA) posted a buyable gap-up (BGU) on Thursday morning after setting an intraday low at 1,015.20 early in the day. Technically the stock remains just barely (5%) within buying range using the 1,015.20 BGU low as a selling guide. It remains one of the very few fundamentally-sound big-stock tech leaders making new highs with the market. Gold and silver have corrected sharply off recent all-time highs for the yellow metal and fresh 11-year highs for the white metal. The SPDR Gold Trust (GLD) has broken 20-dema support as it looks to test the 50-dma. That is its first test of the 50-dma on the daily chart and the 10-week moving average on the weekly chart since it broke out in early March and decisively cleared the $2,000 level. Meanwhile, the iShares Silver Trust (SLV) is performing relatively better as it attempts to hold support at its 10-day moving average with volume drying up sharply on Friday to -57.3% below average, a VDU long entry using the 10-dma as a selling guide. While much is made of these pullbacks, within the context of the huge moves both GLD and SLV have had since breaking out in early March and early April, respectively, they are relatively well-contained so far.

Gold and silver have corrected sharply off recent all-time highs for the yellow metal and fresh 11-year highs for the white metal. The SPDR Gold Trust (GLD) has broken 20-dema support as it looks to test the 50-dma. That is its first test of the 50-dma on the daily chart and the 10-week moving average on the weekly chart since it broke out in early March and decisively cleared the $2,000 level. Meanwhile, the iShares Silver Trust (SLV) is performing relatively better as it attempts to hold support at its 10-day moving average with volume drying up sharply on Friday to -57.3% below average, a VDU long entry using the 10-dma as a selling guide. While much is made of these pullbacks, within the context of the huge moves both GLD and SLV have had since breaking out in early March and early April, respectively, they are relatively well-contained so far. The alternative-currencies gold and silver have been tracking closely with Bitcoin ($BTCUSD) which shot higher earlier in the week before pulling in to test the 20-dema on Thursday. It ended the week by posting a low-volume pullback to the 20-dema which remains constructive given the sharp upside move in $BTCUSD over the prior week as it cleared the 50-dma. Crypto currencies in general are also benefitting from positive news flow after the SEC approved applications for several new Ethereum ($ETHUSD) ETFs on Friday, and this is carrying over slightly through the long holiday weekend.

The alternative-currencies gold and silver have been tracking closely with Bitcoin ($BTCUSD) which shot higher earlier in the week before pulling in to test the 20-dema on Thursday. It ended the week by posting a low-volume pullback to the 20-dema which remains constructive given the sharp upside move in $BTCUSD over the prior week as it cleared the 50-dma. Crypto currencies in general are also benefitting from positive news flow after the SEC approved applications for several new Ethereum ($ETHUSD) ETFs on Friday, and this is carrying over slightly through the long holiday weekend.

The Market Direction Model (MDM) remains on a BUY signal.