Market indexes broke out to all-time highs on Thursday as the Dow traded above the 40,000 level for the first time in market history. That move was short-lived as the index then backed off to close at 39,869.38. Meanwhile, NASDAQ volume levels have been off the charts over the past several days with the highest volume occurring on Thursday as the index stalled and churned before closing negative.

On Friday, the index sold off but held relatively unchanged by the close. Volume on Thursday was the highest single-day's volume in history for the NASDAQ Exchange as volume over the past four days has been extremely heavy due to trading in a handful of NASDAQ-listed penny stocks trading several billion shares each over the past few days. Despite some heavy downside volume on Thursday and Friday, the NASDAQ Composite held up at all-time closing highs for the week, and it is clear that the volume is certainly not meaningful as a result of the penny-stock distortion. We will perhaps get a better picture of index volume in the coming week as the penny-stock mania hopefully subsides.

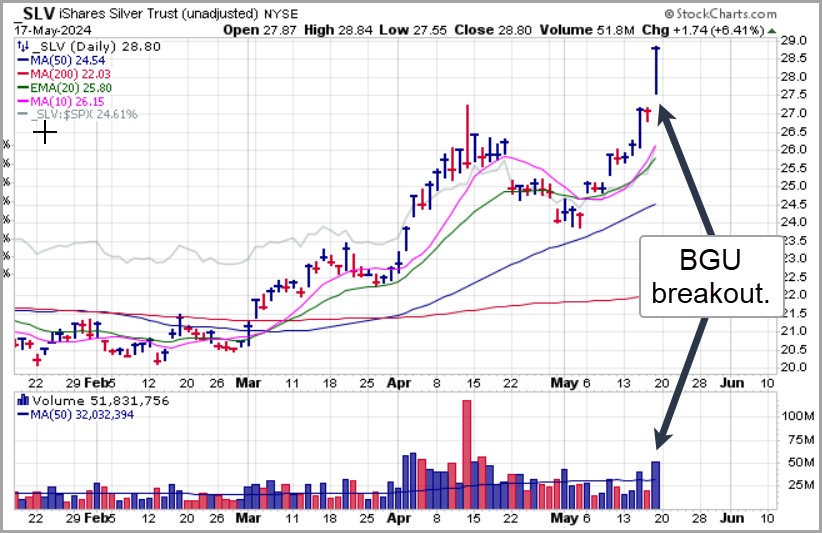

Silver broke out to a new eleven-year high on Friday as it cleared the $30 level for the first time since early 2021. Silver futures ended Friday at $31.71 an ounce, up $1.82 on the day. That sent the iShares Silver Trust (SLV) on a buyable gap-up type of breakout from an extended position off the lows, using the 27.55 intraday low as a selling guide.

Silver broke out to a new eleven-year high on Friday as it cleared the $30 level for the first time since early 2021. Silver futures ended Friday at $31.71 an ounce, up $1.82 on the day. That sent the iShares Silver Trust (SLV) on a buyable gap-up type of breakout from an extended position off the lows, using the 27.55 intraday low as a selling guide.

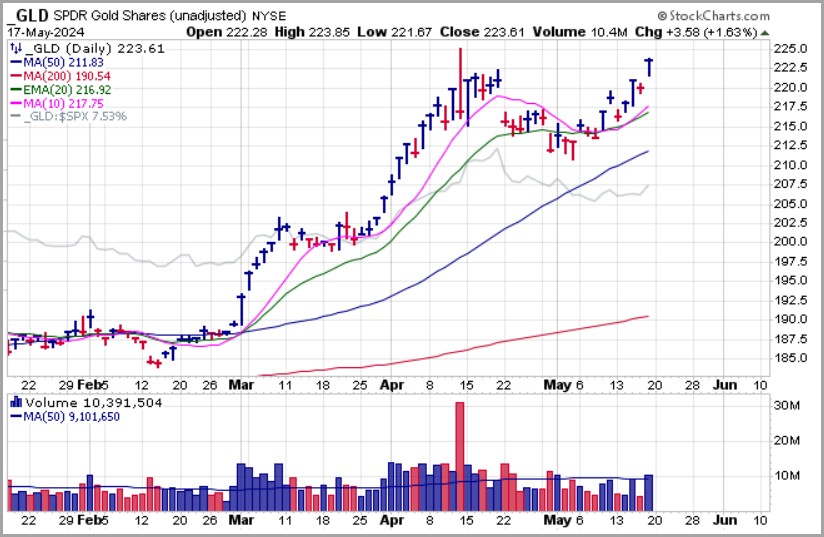

Gold rallied back up towards its prior $2448.80 high set last month, closing at $2421.50 an ounce. The SPDR Gold Trust (GLD), which we reported on last week as it posted an MAU&R at the 20-dema seven days ago on the daily chart, logged an all-time closing high on Friday, finishing the week at 223.61 in a pocket pivot breakout.

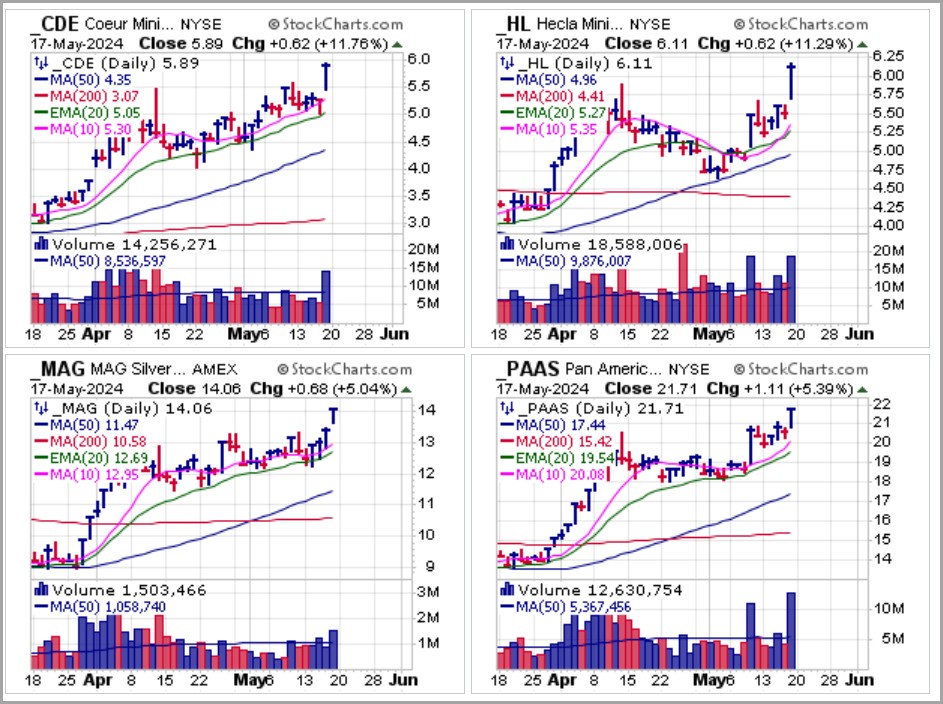

A rush into precious metals miners sent the group rocketing higher, such as First Majestic Silver (AG) which posted a pocket pivo trendline breakout from a short cup-with-handle formation.

A rush into precious metals miners sent the group rocketing higher, such as First Majestic Silver (AG) which posted a pocket pivo trendline breakout from a short cup-with-handle formation. Other examples of strong-volume breakouts in silver miners were seen in Coeur Mining (CDE), Hecla Mining (HL), MAG Silver, and Pan-American Silver (PAAS) as the group keyed off the strong move in the white metal on Friday.

Other examples of strong-volume breakouts in silver miners were seen in Coeur Mining (CDE), Hecla Mining (HL), MAG Silver, and Pan-American Silver (PAAS) as the group keyed off the strong move in the white metal on Friday. Bitcoin ($BTCUSD) posted a pocket pivot move on Wednesday as it regained its 50-day moving average and continued higher to end the week as moved in synchrony with the precious metals.

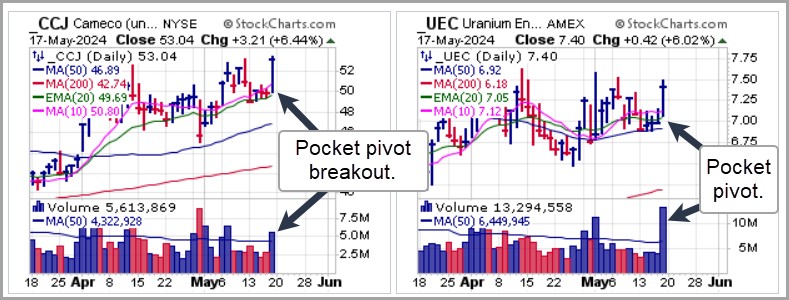

Bitcoin ($BTCUSD) posted a pocket pivot move on Wednesday as it regained its 50-day moving average and continued higher to end the week as moved in synchrony with the precious metals. Cameco (CCJ) posted a pocket pivot breakout. Uranium Energy Corp. (UEC) posted a strong-volume pocket pivot off and through the 10-dma, 20-dema, and 50-dma.

Cameco (CCJ) posted a pocket pivot breakout. Uranium Energy Corp. (UEC) posted a strong-volume pocket pivot off and through the 10-dma, 20-dema, and 50-dma. While precious metals, base metals like aluminums, coppers, and uranium, along with $BTCUSD all performed quite well on Friday, tech names failed to participate as NASDAQ advancing stocks trailed decliners by 2028 to 2176. The action on Friday spoke to a potential sea change and rotation into hard assets and commodity names while higher PE-expansion techs took a break. More evidence is needed to draw any firm conclusions however, as we move into the new trading week.

While precious metals, base metals like aluminums, coppers, and uranium, along with $BTCUSD all performed quite well on Friday, tech names failed to participate as NASDAQ advancing stocks trailed decliners by 2028 to 2176. The action on Friday spoke to a potential sea change and rotation into hard assets and commodity names while higher PE-expansion techs took a break. More evidence is needed to draw any firm conclusions however, as we move into the new trading week.The Market Direction Model (MDM) remains on a BUY signal that was issued on Friday, May 10, 2024.