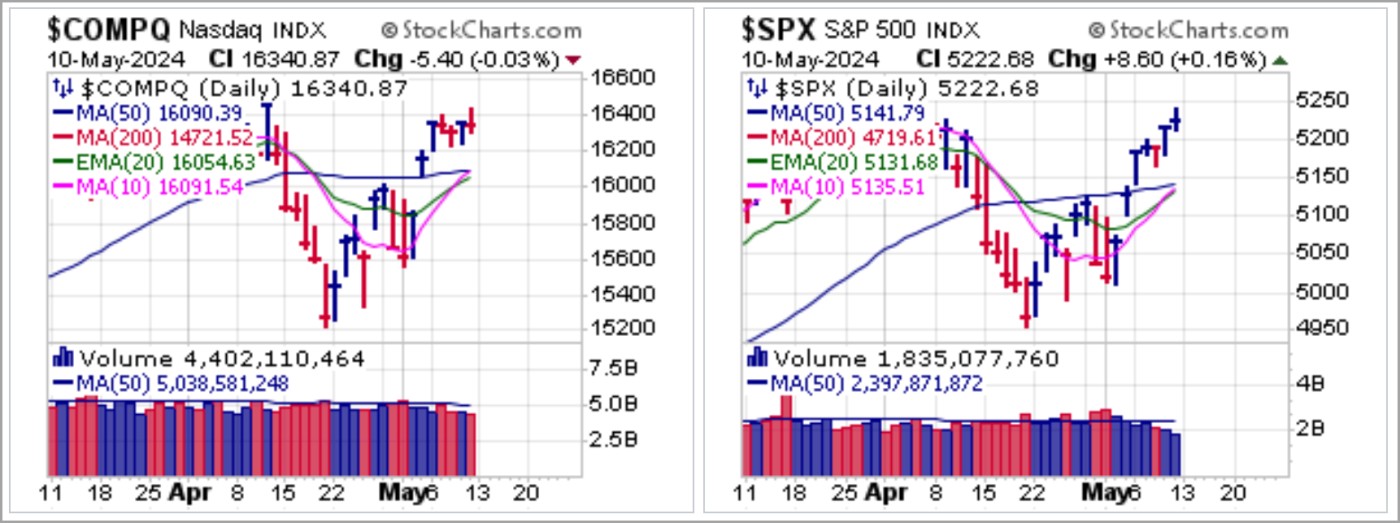

Major market indexes finished the week at or near recent highs as both the NASDAQ Composite and S&P 500 Indexes stalled and churned on Friday with volume slightly lower on the NASDAQ and slightly higher on the NYSE.

The real question for the market is where big money can be made, and currently that is not clear, particularly ahead of a week that will be loaded with important inflation and economic reports with the potential to move the market one way or the other. On Tuesday we will see the Producer Price Index (PPI) and then the Consumer Price Index (CPI) on Wednesday. In addition, several important economic reports are due out this week, including the New York Empire State Manufacturing Index, the Philly Fed Index, Housing Starts, the Leading Indicators Index, and more.

If the inflation data can be spun as cool in conjunction with several weak economic reports than the Fed may have what it needs to lower rates sooner than later. If we see higher inflation and weak economic data then the prospect of stagflation looms, which puts the Fed between a rock and a hard place. If both inflation and the economic data come in strong, then the case for a Fed interest rate increase, something that was raised by Fedheads Austan Goolsbee and Neil Kashkari during a CNBC interview on Friday where they admitted that "there is a high bar for another rate hike, but are not ruling it out."

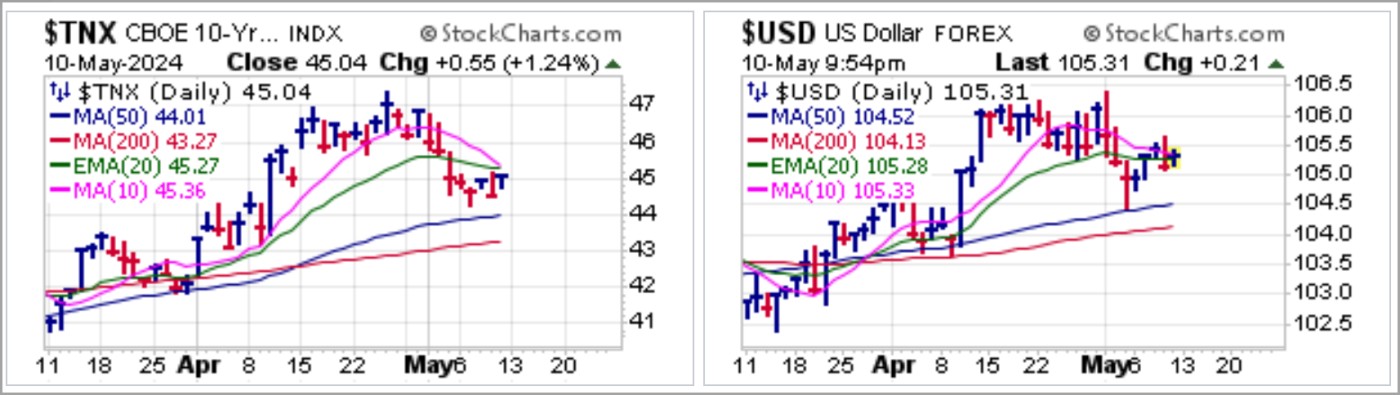

A matrix of possibilities exists with respect to market outcomes this coming week, so investors will have to be on their toes. Interest rates as measured by the 10-Year Treasury Yield ($TNX) and the U.S. Dollar ($USD) declined last week but held their ground this past week, so no serious clues exist there.

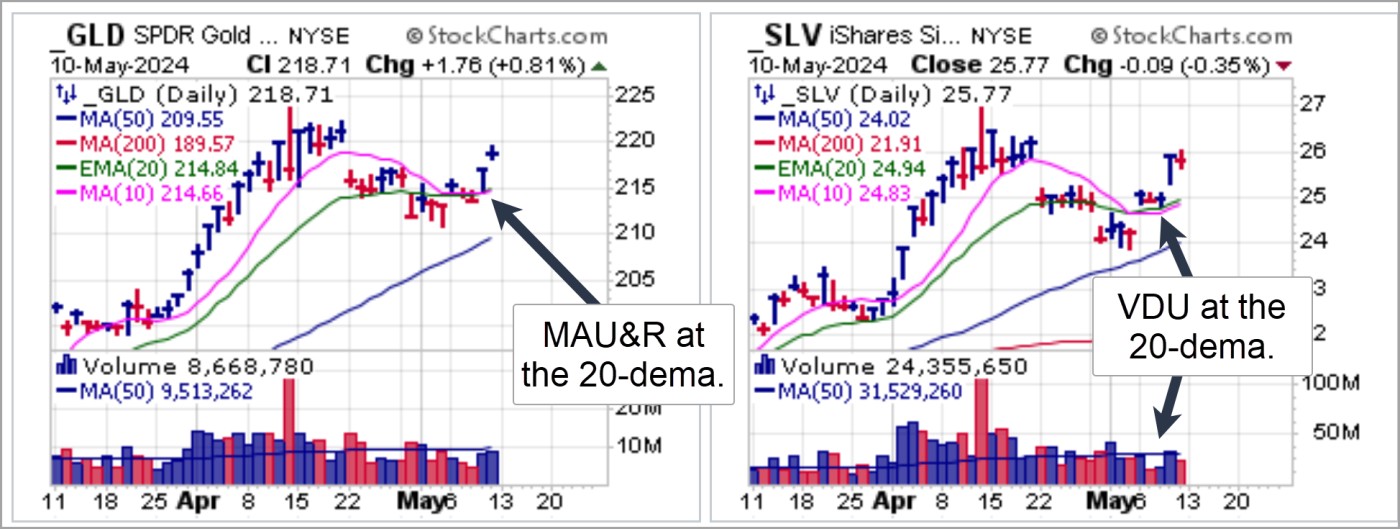

Meanwhile precious metals gold and silver finished the week on a strong note, with the SPDR Gold Trust (GLD) posting a moving average undercut & rally (MAU&R) on Thursday which we reported on early in the day, and the iShares Silver Trust (SLV) gapping higher on Thursday after posting constructive, tight VDU action along its 20-dema. Gold finished the week by rallying further while silver held its ground with volume declining in a constructive pullback.

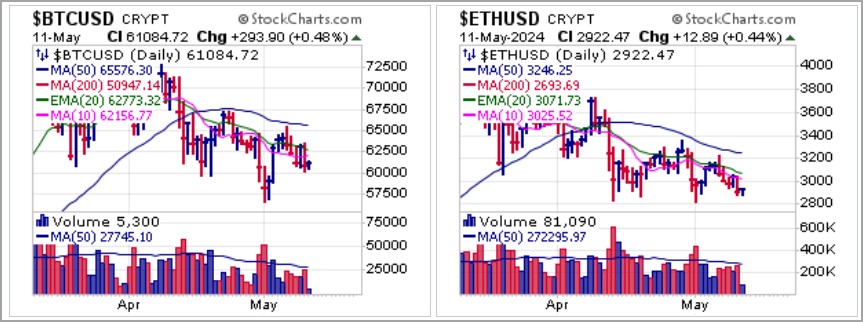

Action in the crypto space ended the week on a decidedly bearish note. Bitcoin ($BTCUSD) and Ethereum ($ETHUSD) both closed Friday with bearish breaks to the downside after reversing at moving average resistance. Over the weekend they are attempting to stabilize, but the divergence between precious metals and crypto-currencies, all of which can have a role as alternative currencies, is not necessarily what we would expect to see if indeed the Fed is looking for an excuse to lower rates.

Crypto stocks CleanSpark (CLSK), Marathon Digital Holdings (MARA), and Riot Platforms (RIOT) all triggered short-sale entries at moving average resistance on Friday. CLSK and MARA both did so as they reversed along the 50-dma with both also triggering short-sale entries as they proceeded lower and busted the 10-dma and 20-dema as well. The weakest of the three, RIOT, simply reversed at 20-dema resistance.

Crypto stocks CleanSpark (CLSK), Marathon Digital Holdings (MARA), and Riot Platforms (RIOT) all triggered short-sale entries at moving average resistance on Friday. CLSK and MARA both did so as they reversed along the 50-dma with both also triggering short-sale entries as they proceeded lower and busted the 10-dma and 20-dema as well. The weakest of the three, RIOT, simply reversed at 20-dema resistance. Taiwan Semiconductor (TSM) was one bright spot as it posted a buyable gap-up (BGU) on Friday after beating on earnings. This remains within buying range using the intraday low at 146.93 as a tight selling guide.

Taiwan Semiconductor (TSM) was one bright spot as it posted a buyable gap-up (BGU) on Friday after beating on earnings. This remains within buying range using the intraday low at 146.93 as a tight selling guide. Overall, we expect a fluid week given the plethora of inflation and economic data coming down the pike. How it all resolves remains an open question, but we will issue alerts as appropriate as the situation crystallizes during the week, assuming that it does. Stay tuned.

Overall, we expect a fluid week given the plethora of inflation and economic data coming down the pike. How it all resolves remains an open question, but we will issue alerts as appropriate as the situation crystallizes during the week, assuming that it does. Stay tuned.The Market Direction Model (MDM) switched to a BUY signal on Friday, May 10, 2024. Tech juggernauts and other leading names looking for further upside. Wednesday's CPI will be telling so this signal may be short-lived if it comes in hot again.