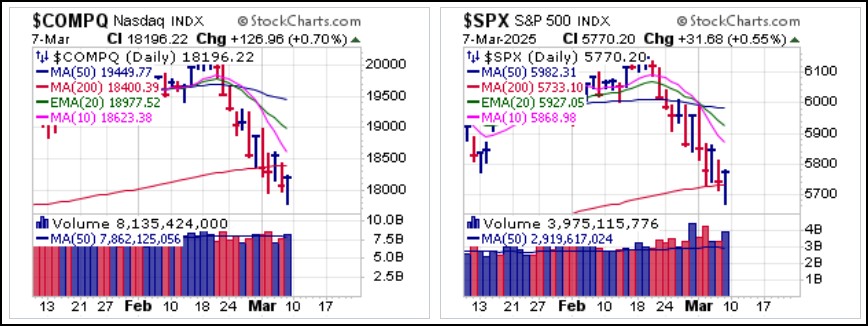

Stocks ended their worst week in six months with a small reaction rally, but the NASDAQ Composite finished the week below 200-dma support. The S&P 500, however, was able to regain its 200-dma and breaking below the line early on Friday in a moving average undercut & rally (MAU&R) type of move. With individual stocks down big across the board after a more than two-week decline off the highs of late January, we will see whether this sets the stage for at least an oversold reaction rally this coming week. That said, the market remains in a correction.

Tech stocks continued their decline with little recovery on Friday. While we sent out several Short-Sale Set-Up (SSS) reports out on Wednesday and Thursday, keep in mind that these stocks are already oversold, and are currently hanging around moving average resistance. In the case of stocks down along their 200-day moving average, the potential for a turn increases and thus the 200-dma must be used as a tight covering guide.

Oracle (ORCL), for which a reports was sent out on Wednesday, before it broke 200-dma support, is a good example. The break through the 200-dma worked as a short-sale entry until the stock undercut the prior January 13th low. Per the book Short-Selling with the O'Neil Disciples, that was a short-sale cover signal with the idea of potentially re-shorting the stock into any rally back up towards or into moving average resistance.

Depending on how far the market is able to rally from Friday's turnaround lows, if at all, ORCL could rally up to the 200-dma or even as high as the descending 10-dma, 20-dema, or 50-dma. Flexibility is key at this stage of the game given the sharp decline in the stock and many others like it from the highs of three weeks ago.

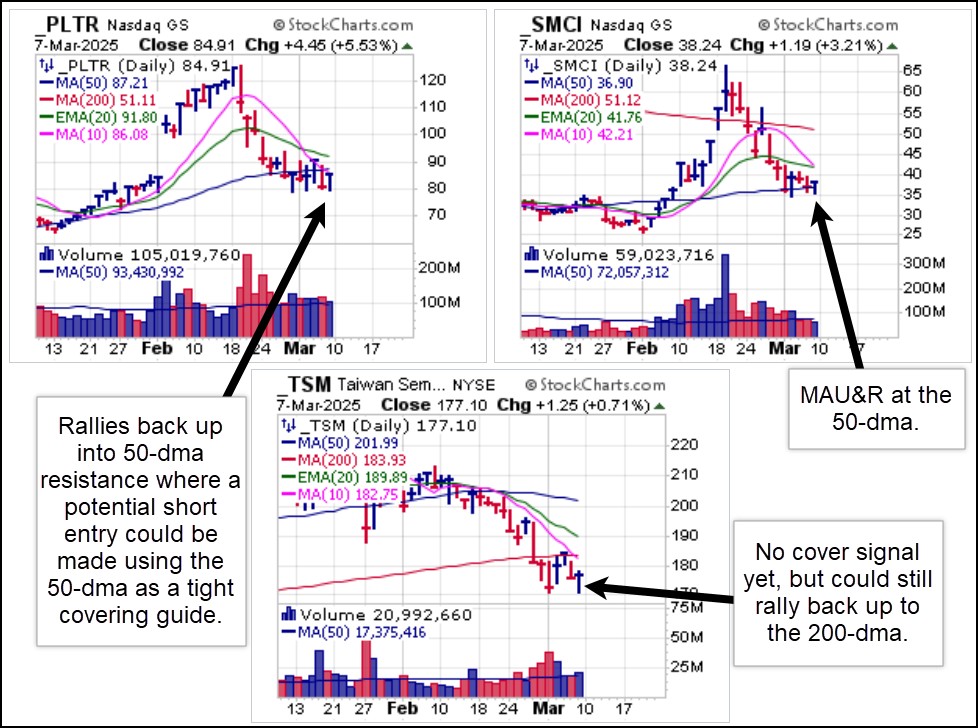

We also sent out SSS Reports on Palantir (PLTR), Super Micro Computer (SMCI), and Taiwan Semiconductor (TSM) this past week. The charts below explain the current positions and potential actions depending on how the stocks play out from here.

We also sent out SSS Reports on Palantir (PLTR), Super Micro Computer (SMCI), and Taiwan Semiconductor (TSM) this past week. The charts below explain the current positions and potential actions depending on how the stocks play out from here. Two weeks ago we reported on Applied Materials (AMAT), Arm Holdings (ARM), Salesforce.com (CRM), Micron Technology (MU), and ServiceNow (NOW) as short-sale entries along moving average support/resistance and they have proceeded steadily lower from there into the end of this past week. As the charts show, these are getting extended to the downside so could be ready to start working on bear flag types of consolidations. Certainly, these are not shortable at this stage of the short-selling game.

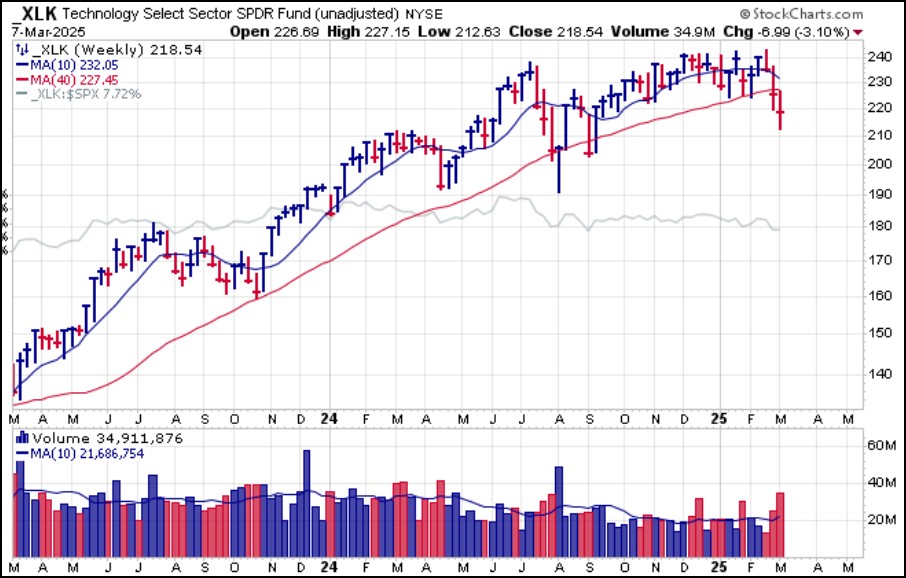

Two weeks ago we reported on Applied Materials (AMAT), Arm Holdings (ARM), Salesforce.com (CRM), Micron Technology (MU), and ServiceNow (NOW) as short-sale entries along moving average support/resistance and they have proceeded steadily lower from there into the end of this past week. As the charts show, these are getting extended to the downside so could be ready to start working on bear flag types of consolidations. Certainly, these are not shortable at this stage of the short-selling game. The weekly chart of the SPDR Select Sector Technology (XLK) ETF shows the first pair of closes below the 40-week moving average in the past two years. The extension below the 40-week line also may imply the potential for a rally back up to the 40-week moving average if the general market can stage a sufficient reaction rally.

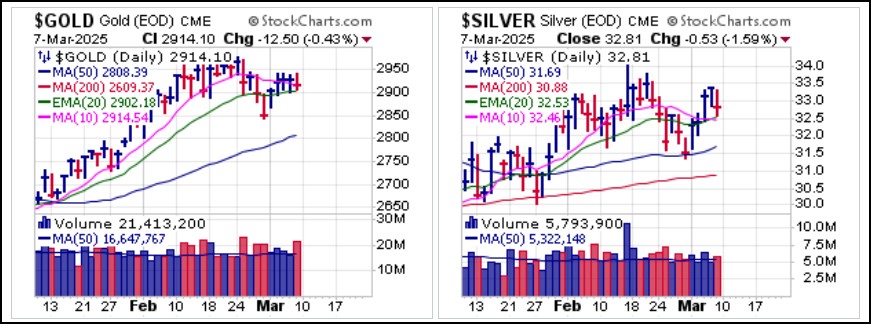

The weekly chart of the SPDR Select Sector Technology (XLK) ETF shows the first pair of closes below the 40-week moving average in the past two years. The extension below the 40-week line also may imply the potential for a rally back up to the 40-week moving average if the general market can stage a sufficient reaction rally. Gold remains the top-performing asset of 2025, and has outperformed the S&P 500 over the past year, 35% vs. 11%, respectively. It remains in a short consolidation near all-time highs as it pulls into 20-dema support which could represent a lower-risk entry position. Silver is doing the same thing, and would also be in a lower-risk entry position at the 20-dema which is then used as a tight selling guide.

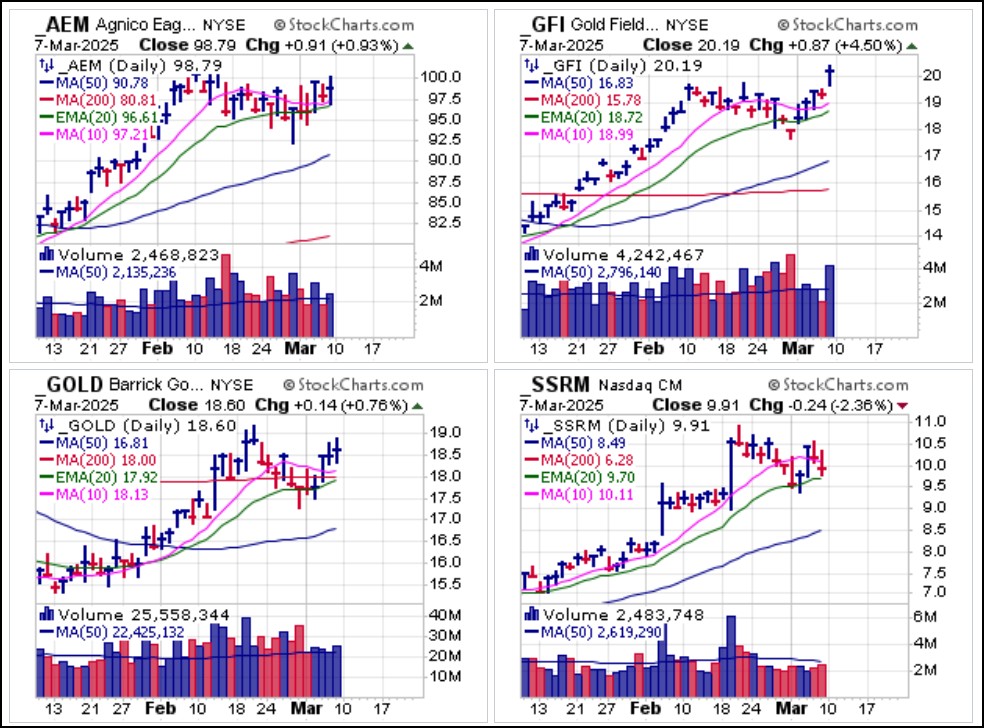

Gold remains the top-performing asset of 2025, and has outperformed the S&P 500 over the past year, 35% vs. 11%, respectively. It remains in a short consolidation near all-time highs as it pulls into 20-dema support which could represent a lower-risk entry position. Silver is doing the same thing, and would also be in a lower-risk entry position at the 20-dema which is then used as a tight selling guide. In a market as broadly decimated as this current market is, it is very rare to find anything forming, or even attempting to form, a constructive base. But, as gold and silver continue to act constructively, for now, we also see quality mining stocks going about the business of building bases as the market declines. These are certainly names to keep a close eye on as any reaction rally in beaten-down areas of the market could prompt breakouts, pocket pivots, and U&Rs in any of these as potential long entry set-ups.

In a market as broadly decimated as this current market is, it is very rare to find anything forming, or even attempting to form, a constructive base. But, as gold and silver continue to act constructively, for now, we also see quality mining stocks going about the business of building bases as the market declines. These are certainly names to keep a close eye on as any reaction rally in beaten-down areas of the market could prompt breakouts, pocket pivots, and U&Rs in any of these as potential long entry set-ups.Note that among these four gold miners, Agnico-Eagle Mines (AEM), Gold Fields Ltd. (GFI), American Barrick (GOLD), and junior miner SSR Mining (SSRM), GFI in fact broke out of a four-week base on Friday in a gap-up move that was very close to qualifying as a buyable gap-up (BGU) with volume up 49% vs. the required 50%. But then, does the market rally worry about a 1% variance in volume? Probably not, since this is also an actionable breakout as well.

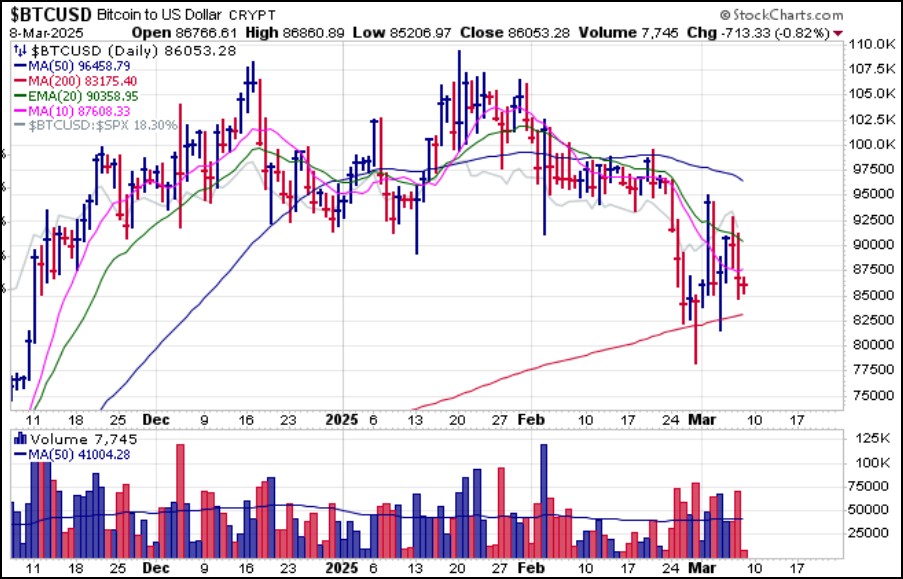

On Friday President Trump signed an Executive Order creating a "Strategic Bitcoin Reserve" and then held a Crypto Summit at the White House with various Bitcoin advocates and promoters. The new Reserve will consist of previously confiscated crypto while the summit led to no new initiatives. In response, Bitcoin ($BTCUSD) slumped after an early rally on Friday, reversing at the 20-dema to trigger a short-sale entry at that point. At the time of this writing over the weekend, it is again testing 200-dma support.

On Friday President Trump signed an Executive Order creating a "Strategic Bitcoin Reserve" and then held a Crypto Summit at the White House with various Bitcoin advocates and promoters. The new Reserve will consist of previously confiscated crypto while the summit led to no new initiatives. In response, Bitcoin ($BTCUSD) slumped after an early rally on Friday, reversing at the 20-dema to trigger a short-sale entry at that point. At the time of this writing over the weekend, it is again testing 200-dma support.

The Market Direction Model (MDM) switched to a SELL signal on Thursday, March 6, 2025.