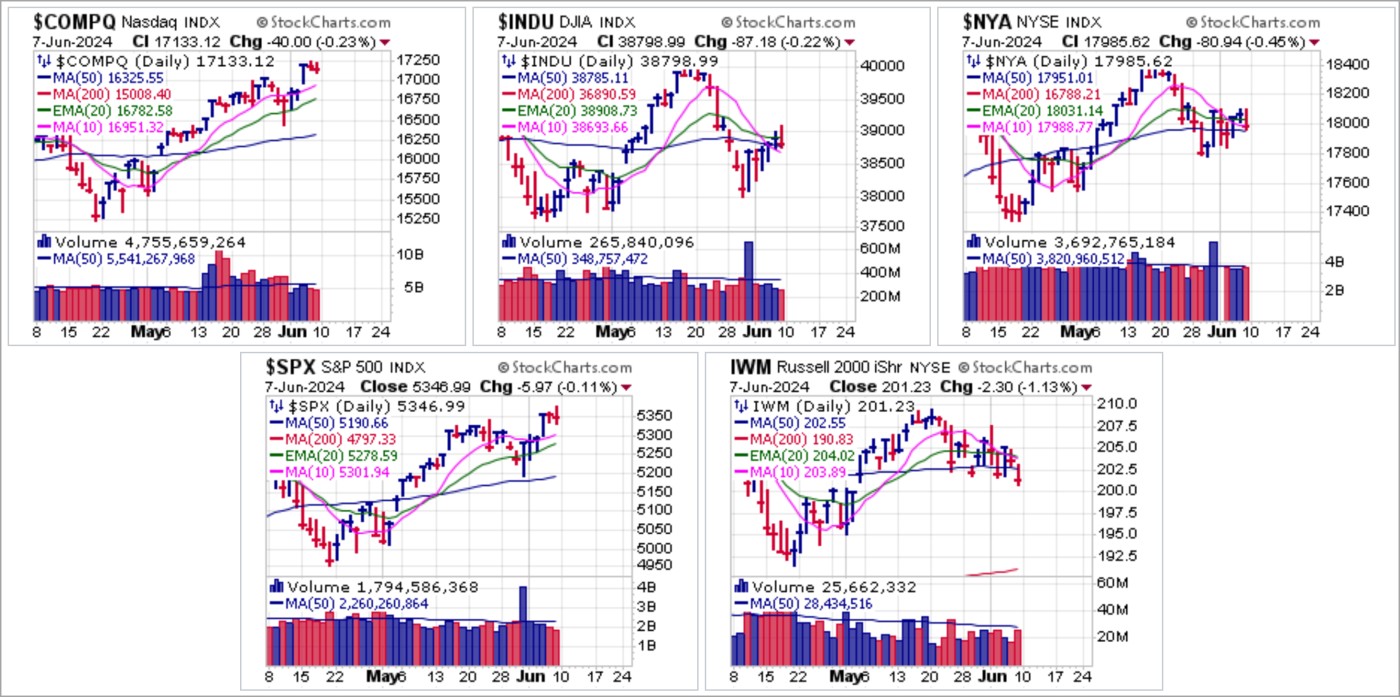

The NASDAQ Composite and S&P 500 Indexes both posted all-time highs this past week, but leadership has been narrowing drastically as the rest of the market lags badly. This is evident when we compare the NASDAQ and S&P to the charts of the Dow, the broad NYSE Composite Index and the very broad small-cap Russell 2000 Index as represented by the iShares Russell 200 ETF (IWM).

On Friday, the Bureau of Labor Statistics released its monthly jobs report, and again we saw a statistically skewed beat on the Establishment Survey of 272,000 new non-farm payrolls vs. expectations of 185,000. Adding to the Orwellian perversity of the report, the Household Survey, which counts workers rather than jobs while the Establishment Survey counts jobs, even if they are part-time jobs, posted a significant loss of -408,000.

Embedded in the Establishment Survey as well was the fact that in May full-time employment declined by -625,000 jobs, the largest drop since December 2023 while part-time jobs increased by 286,000. Combined with the Birth-Death Model adjustment, the BLS magically produces a 272,000 jobs increase. As one commentator put it, it was the most absurd jobs report in years where the Establishment Survey shows a robust jobs market but the more accurate Household Survey shows a dire jobs market.

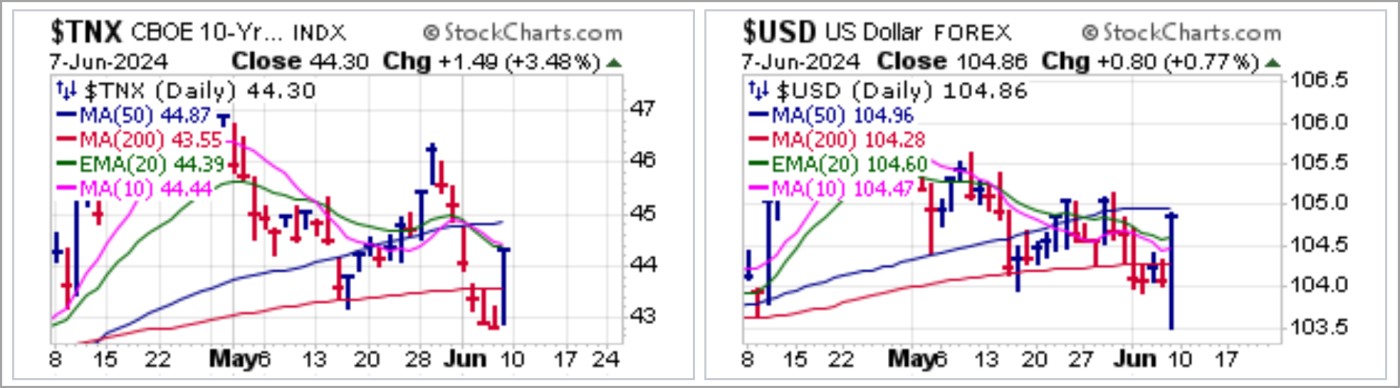

Interest rates as represented by the Ten-Year Treasury Yield ($TNX) and the U.S Dollar ($USD) both went with the strong jobs market narrative and spiked to the upside as they attempt to reverse multi-week downtrends.

Bitcoin ($BTCUSD) broke to the downside in response to the jobs number but held support at the 20-dema. It remains in a large cup-with-handle or, as some might consider it to be, a reverse head & shoulders formation. For now, the 20-dema remains meaningful support and should be watched carefully.

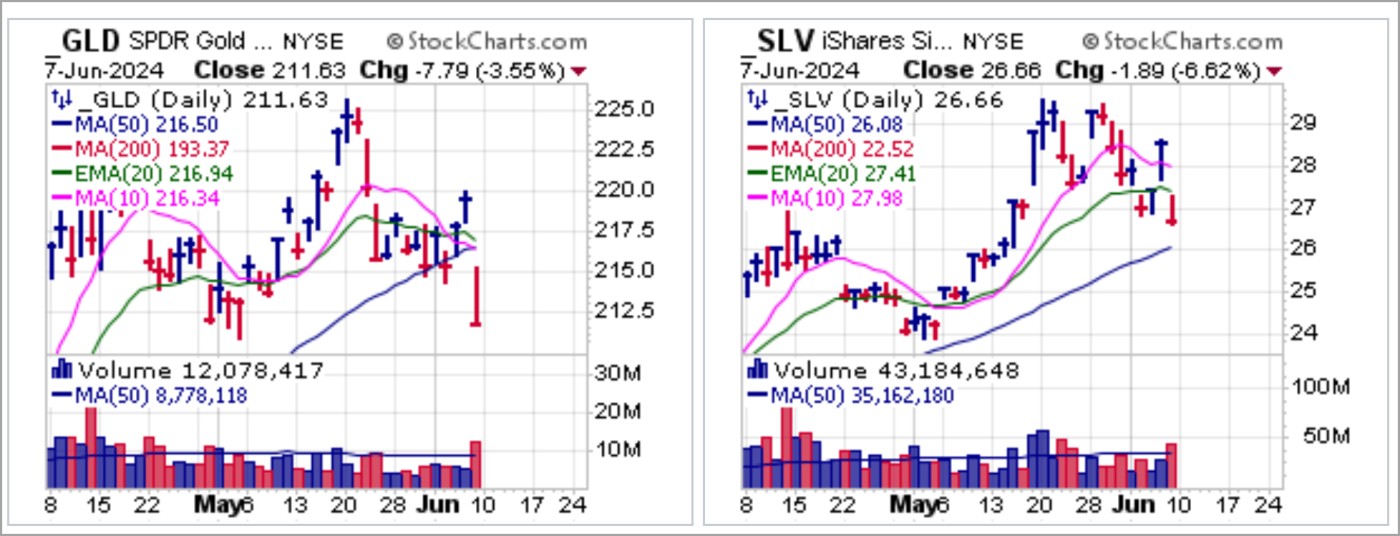

Precious metals, gold and silver, both broke lower on the jobs report, but they were also negatively impacted by news out of China that the Peoples Bank of China (PBoC) was pausing its 18-month gold buying program as it built up gold reserves and sold U.S. Treasuries. While both the SPDR Gold Trust (GLD) and the iShares Silver Trust (SLV) both looked constructive after posting moving average undercut & rally (MAU&R) long entries on Wednesday, the news out of China was likely the dominant factor in pulling the plug on the metals. The GLD slashed below 50-dma support which it has held since breaking out in March while the SLV broke below 20-dema support as it looks to again test the 50-dma as it did in early May.

From an individual stock perspective we see little to nothing that attracts as an actionable long, and there will be too much critical economic news this week to make any significant commitments beforehand. On Wednesday morning we are expecting the Consumer Price Index (CPI) followed by the monthly Fed policy announcement in the afternoon. On Thursday morning we will get the Producer Price Index (PPI). These are major economic news events that will be sure to have a significant impact on the market's future direction. For now, we elect to keep our powder dry and let events play out as they will. When there is little to do, the best course of action is to do little.

The Market Direction Model (MDM) remains on a BUY signal.