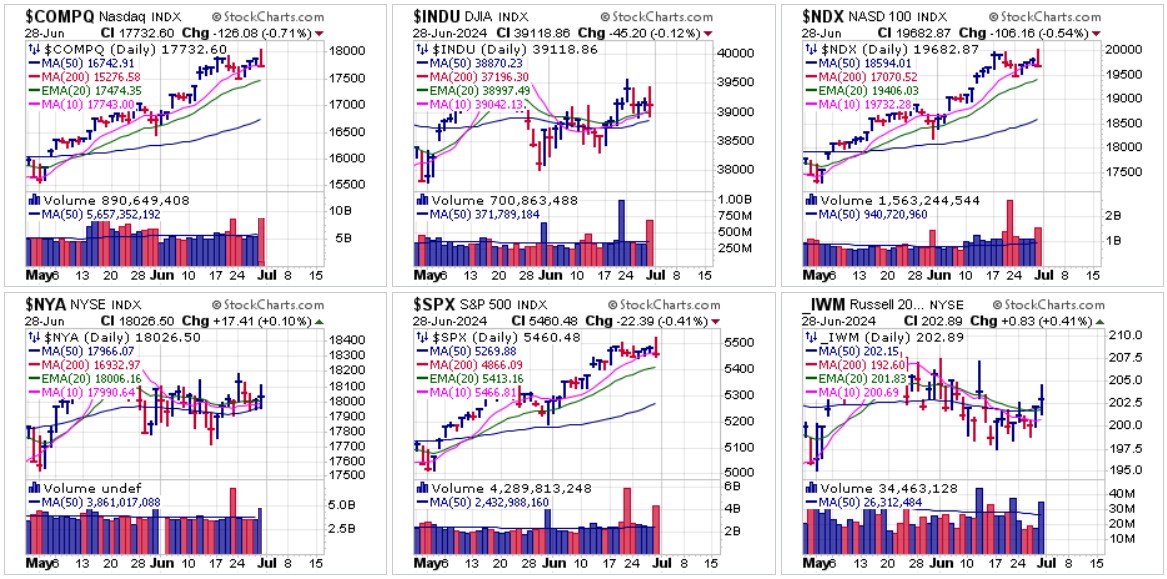

The market continues to struggle to make further progress on the upside as measured by the tech-heavy NASDAQ Composite, NASDAQ 100, and S&P 500 Indexes. Money has persisted in holding up the big-stock AI-Meme techs, but upside progress in this area of the market has stalled. On Friday, a sharp rally early in the day following the release of the latest Consumer Sentiment report, reversed as all the tech-heavy indexes went tail up, while the Dow, NYSE Composite, and Russell 2000 Indexes spun around on heavy volume, likely due to the final trading day of H1 2024.

Meanwhile, big-stock AI Meme semiconductors are starting to waver, as the Philadelphia Semiconductor Index ($SOX) begins to fail at 10-dma support, reversing at the line sharply on Friday. If it busts the 20-dema then we could see a broader market correction take hold, but for now the 20-day line represents critical support for a number of big-stock semiconductor leaders.

Meanwhile, big-stock AI Meme semiconductors are starting to waver, as the Philadelphia Semiconductor Index ($SOX) begins to fail at 10-dma support, reversing at the line sharply on Friday. If it busts the 20-dema then we could see a broader market correction take hold, but for now the 20-day line represents critical support for a number of big-stock semiconductor leaders. The action of the $SOX is evident in the action of one of its largest components, Micron Technology (MU) which triggered a short entry at its 20-dema on Thursday after disappointing on earnings Wednesday after the close. This remains a potential short near the underside of the 20-dema which would then serve as a covering guide.

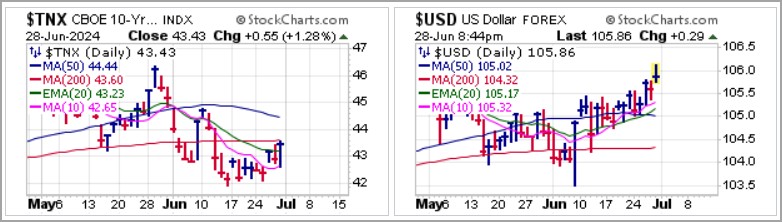

The action of the $SOX is evident in the action of one of its largest components, Micron Technology (MU) which triggered a short entry at its 20-dema on Thursday after disappointing on earnings Wednesday after the close. This remains a potential short near the underside of the 20-dema which would then serve as a covering guide. Early on Friday the latest PCE inflation data was released, and met expectations. Nevertheless, interest rates and the dollar did not respond dovishly as both the 10-Year Treasury Yield ($TNX) and the U.S. Dollar ($USD) both rallied.

Early on Friday the latest PCE inflation data was released, and met expectations. Nevertheless, interest rates and the dollar did not respond dovishly as both the 10-Year Treasury Yield ($TNX) and the U.S. Dollar ($USD) both rallied. Bitcoin ($BTCUSD) appears set to test 200-dma support. This comes weeks after it initially triggered a short-sale entry along the 50-dma as it failed at the line.

Bitcoin ($BTCUSD) appears set to test 200-dma support. This comes weeks after it initially triggered a short-sale entry along the 50-dma as it failed at the line.

Alternative currencies in general are having a tough time of it lately. Gold and silver remain near recent lows as they fail to clear moving average resistance as measured by the daily chart of the SPDR Gold Shares (GLD) and the iShares Silver Trust (SLV). Again, a bearish response to the in-line PCE data.

This market remains difficult on an individual stock basis, so we advise caution.

This market remains difficult on an individual stock basis, so we advise caution.The Market Direction Model (MDM) remains on a BUY signal. Stealth QE remains intact but global liquidity has been trending lower. The recent reversal in major names such as NVDA will be watched closely.