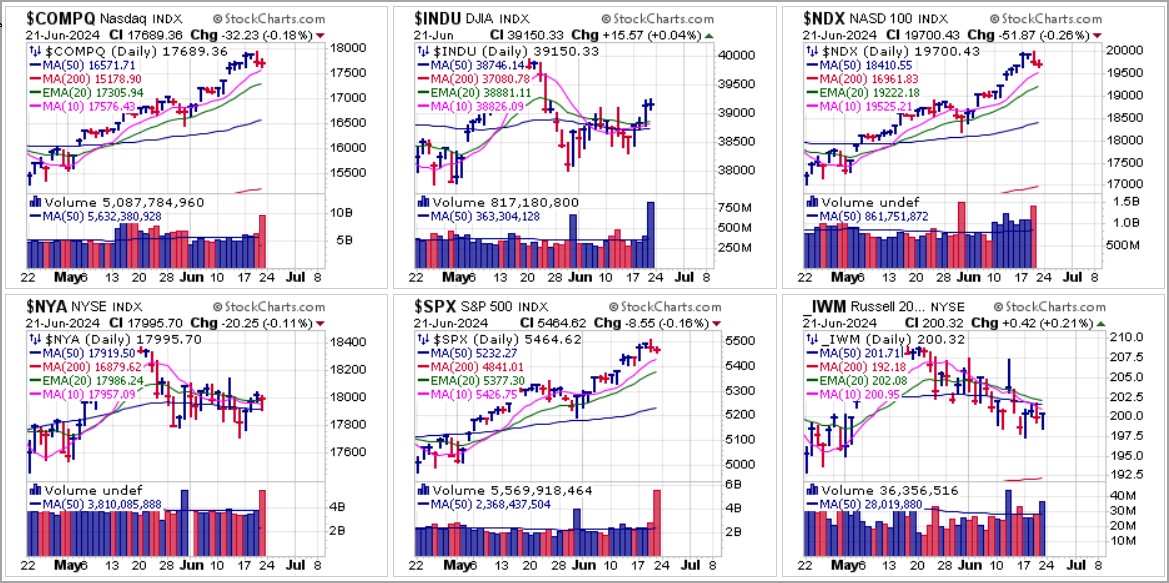

Major market indexes survived a $5.1 trillion multi-witching options expiration on Friday as predicted heavy volatility failed to materialize and all of the major market indexes traded within a relatively tight band. The NASDAQ Composite, NASDAQ 100, and S&P 500 Index all ended the week with two down days as volume spiked on Friday's options expiration. They remain in firm uptrends as the other major market indexes, the Dow, the NYSE Composite, and the small-cap Russell 2000 Indexes remain in 4-5 week corrections.

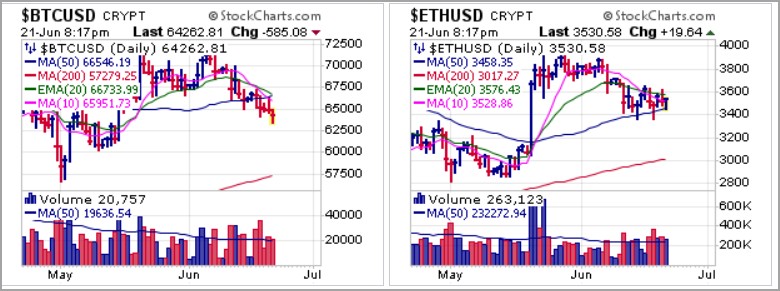

Bitcoin ($BTCUSD) has been battered throughout June as it has trended steadily lower, most recently triggering a short-sale entry at the 50-dma on Thursday before moving lower on Friday. Interestingly, as $BTCUSD comes down, Ethereum ($ETHUSD) continues to hold support at its own 50-dma, shaking out along the line twice over the past two weeks.

Crypto miners were slammed to end the week, but CleanSpark (CLSK) and Marathon Digital Holdings (MARA) have yet to break 50-dma support while Riot Platforms (RIOT) triggered a short-sale entry at its own 50-dma on Friday.

After clearing 20-dema and/or 50-dma resistance on Thursday, both gold and silver were hit with heavy selling on Friday. The VanEck Merk Gold Trust (OUNZ) and the Aberdeen Physical Silver Shares (SIVR) both reversed to the downside as OUNZ broke 50-dma support and the SIVR dipped back below 20-dema support.

We remain cautious as the market stalls along current highs. Meanwhile, the narrow pile-in to AI-Meme names has continued as the broader market suffers. Interestingly, SPY and QQQ short interest are now at their lowest levels in history, while the CBOE Volatility Index ($VIX) has closed below 20 for 160 days now, the longest stretch since 2018.

The Market Direction Model (MDM) remains on a BUY signal.