Flat CPI data on Wednesday and negative PPI data on Thursday faced off against what commentators considered to be a hawkish Fed policy announcement. Economically-sensitive areas of the market sold off broadly and hard as a narrow band of big-stock AI-Meme tech names kept the NASDAQ Composite, NASDAQ 100, and to a lesser extent the S&P 500 Index buoyant while broader indexes like the NYSE Composite and the Russell 2000 Indexes sold off.

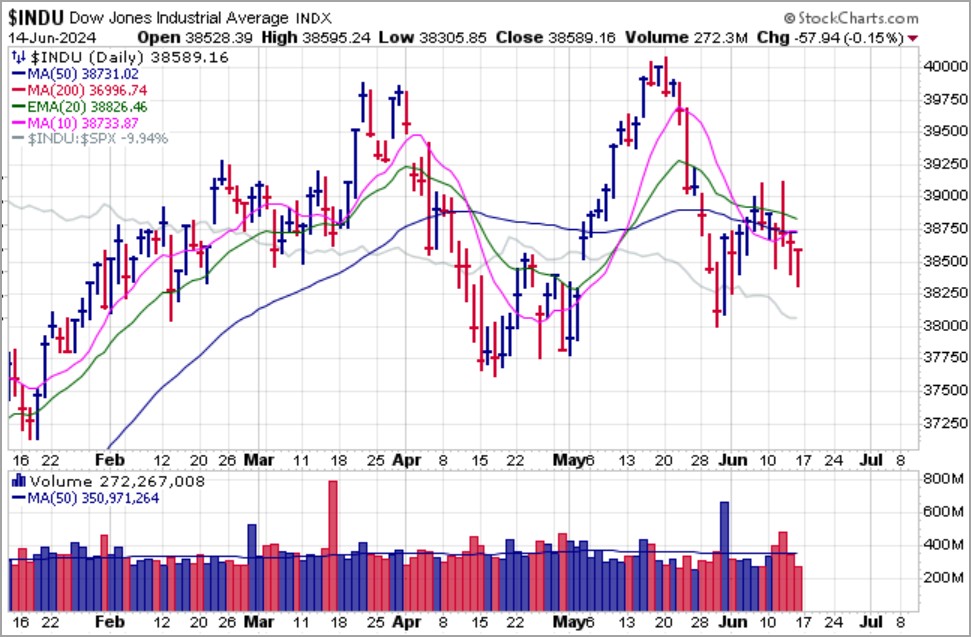

The Dow Jones Industrials, while a very narrow 30-stock index, is a highly diverse list of mega-cap names from a variety of industries, many economically-sensitive, while far less tech-intensive than the NASDAQ or S&P 500. It too has acted considerably worse than those two indexes and is currently stuck below its 50-day moving average. In fact, while the NASDAQ Index and the S&P 500 make all-time highs, the Dow, NYSE Composite, and Russell 2000 Indexes are in corrections.

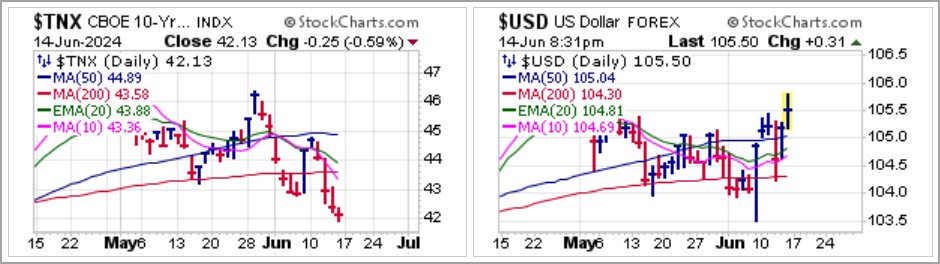

Breadth has remained very poor with decliners leading 20-7 on the NYSE and 30-12 on the NASDAQ on Friday. The action is odd as it is accompanied by a continued decline in interest rates, which we might expect after soft CPI and PPI data this past week, but the U.S. Dollar rallied. The decline in the 10-Year Treasury Yield ($TNX) implies Treasury buying, which along with the rising dollar may be due to safe haven buying after troublesome European elections this past week.

Bitcoin ($BTCUSD) broke down as well, breaching the 20-dema on Tuesday and then closing just above the 50-dma on Friday after shaking out at the line earlier in the day. Technically, while the 20-dema triggered a short entry, Friday's MAU&R at the 50-dma triggers a long entry using the 50-dma as a tight selling guide.

Like Bitcoin, precious metals, as alternative currencies, are attempting to find support. The SPDR Gold Trust (GLD) regained its 10-dma on Friday but close just below the 20-dema. If it can regain the 20-dema then a potential MAU&R long entry could be triggered. Meanwhile, silver via the iShares Silver Trust (SLV) found ready support along the 50-dma last week and, like the GLD, is making a move for the 20-dema.

This remains a difficult market where strong uptrends in the NASDAQ indexes and the S&P 500 are offset by corrections in the other major market indexes. Normally, one would expect that soft inflation data would spark a massive rally in the major market indexes across the board. But when tempered by a hawkish but likely clueless Fed that still does not truly perceive what is going on in a manner similar to when it initially waved off higher inflation as merely transitory back in 2021, we get a sloppy market that lacks a clear trend underneath the surface as a severe bifurcation between economically-sensitive stocks and a handful of big-stock AI-Meme names takes hold.

The Market Direction Model (MDM) switched to a BUY signal on Wednesday, August 12, 2024.