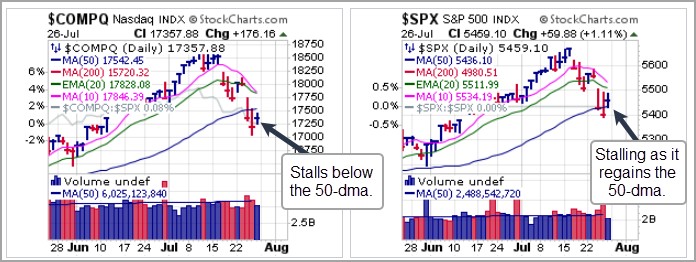

Tech-centric indexes suffered mightily this past week as the NASDAQ Composite, the NASDAQ 100, and the S&P 500 Indexes all broke below their 50-day moving averages. By the end of the week the S&P was able to recover back above the 50-day line, but this remains a broken market. On Friday, the indexes attempted to recover but the NASDAQ stalled below 50-dma resistance while the S&P regained the 50-dma but stalled along the line. The NASDAQ has now declined -8.77% off the early July highs as it settles into the high end of an intermediate correction range. With nothing in the way of huge surprises from the week's inflation data, including the GDP Deflator on Thursday and the PCE inflation number on Friday, the market maintains a bearish tone for now.

Precious metals gold and silver have both sold off this past week, but gold has held up much better. While silver dangles well below prior price support along the 28.58 and 28.73 June lows and well below its 50-day moving average, Comex Gold remains within earshot of its 2488.40 peak set last week. On Friday gold shook out along the 50-day line which would represent a moving average undercut & rally (MAU&R) long entry for the yellow metal using the 50-dma as a selling guide.

Precious metals gold and silver have both sold off this past week, but gold has held up much better. While silver dangles well below prior price support along the 28.58 and 28.73 June lows and well below its 50-day moving average, Comex Gold remains within earshot of its 2488.40 peak set last week. On Friday gold shook out along the 50-day line which would represent a moving average undercut & rally (MAU&R) long entry for the yellow metal using the 50-dma as a selling guide. Meanwhile, Bitcoin $BTCUSD held 50-dma support on a volatile pullback to the line on Thursday, and ended the week at higher highs. Former President Trump spoke at the Bitcoin 2024 Conference over the weekend where he said he would have the U.S. government keep their seized Bitcoin but stopped short of promising to establish an official U.S. bitcoin strategic reserve currency. He would also fire Gary Gensler and prevent the creation of a central bank digital currency (CBDC). This was all met with some enthusiasm for $BTCUSD but selling from Mt. Gox holders remains an issue.

Meanwhile, Bitcoin $BTCUSD held 50-dma support on a volatile pullback to the line on Thursday, and ended the week at higher highs. Former President Trump spoke at the Bitcoin 2024 Conference over the weekend where he said he would have the U.S. government keep their seized Bitcoin but stopped short of promising to establish an official U.S. bitcoin strategic reserve currency. He would also fire Gary Gensler and prevent the creation of a central bank digital currency (CBDC). This was all met with some enthusiasm for $BTCUSD but selling from Mt. Gox holders remains an issue. When it came to individual stocks, carnage was the name of the game this past week. Alphabet (GOOGL) and Tesla (TSLA) on Tuesday after the close. That got the selling party started as both stocks gapped lower. GOOGL posted freshly lower lows on Friday while TSLA remains in a bear flag. Earnings have overall come in strong in prior quarters so these stocks are priced to perfection. GOOGL earnings came in less than perfect thus it's gap down price action.

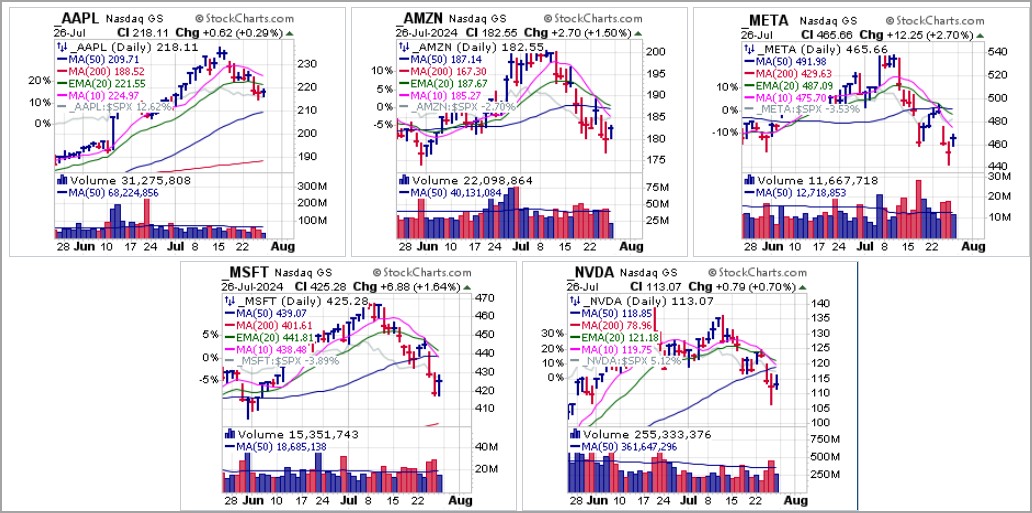

When it came to individual stocks, carnage was the name of the game this past week. Alphabet (GOOGL) and Tesla (TSLA) on Tuesday after the close. That got the selling party started as both stocks gapped lower. GOOGL posted freshly lower lows on Friday while TSLA remains in a bear flag. Earnings have overall come in strong in prior quarters so these stocks are priced to perfection. GOOGL earnings came in less than perfect thus it's gap down price action. The remaining members of the so-called Magnificent Seven, Apple (AAPL), Amazon.com (AMZN), Meta Platforms (META), Microsoft (MSFT), and Nvidia (NVDA) are in steady cascading declines off the highs of early July. The only one of the bunch still above its 50-dma is AAPL, but this has just triggered a short-sale entry as it drops below its 200-dma. Keep in mind that these names will be reporting earnings next week, so it remains to be seen whether earnings can resurrect these severely damaged charts.

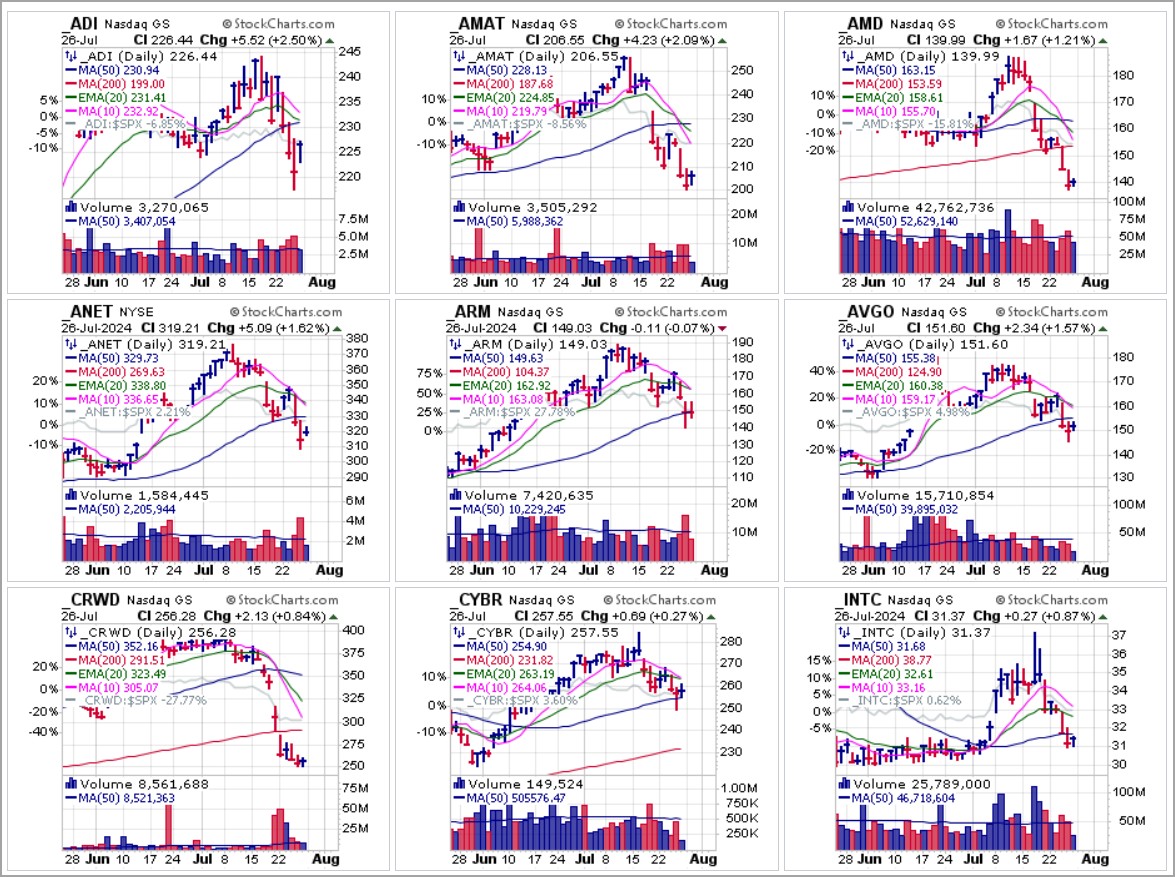

The remaining members of the so-called Magnificent Seven, Apple (AAPL), Amazon.com (AMZN), Meta Platforms (META), Microsoft (MSFT), and Nvidia (NVDA) are in steady cascading declines off the highs of early July. The only one of the bunch still above its 50-dma is AAPL, but this has just triggered a short-sale entry as it drops below its 200-dma. Keep in mind that these names will be reporting earnings next week, so it remains to be seen whether earnings can resurrect these severely damaged charts. A sampling of nine big-stock semiconductor and other tech names below shows downside cascading action at every turn. Along the way, you can see short-sale entry triggers as these names continue to break moving average support. Most of these names are now sitting below their 50-day moving averages while Advanced Micro Devices (AMD) and CrowdStrike (CRWD) now dwell below their 200-day moving averages.

A sampling of nine big-stock semiconductor and other tech names below shows downside cascading action at every turn. Along the way, you can see short-sale entry triggers as these names continue to break moving average support. Most of these names are now sitting below their 50-day moving averages while Advanced Micro Devices (AMD) and CrowdStrike (CRWD) now dwell below their 200-day moving averages.  Earnings from several big-stock marquee names this week, including AAPL, AMZN, MSFT, INTC, AMD, ANET, ARM, LRCX, META, QCOM, and WDC, among others could determine whether current correction continues or whether the market can find its feet. In addition, the latest Fed policy announcement is due out on Wednesday while on Friday we will see the latest Bureau of Labor Statistics jobs report, so there will be plenty of catalysts that have the potential to keep things lively again this coming trading week.

Earnings from several big-stock marquee names this week, including AAPL, AMZN, MSFT, INTC, AMD, ANET, ARM, LRCX, META, QCOM, and WDC, among others could determine whether current correction continues or whether the market can find its feet. In addition, the latest Fed policy announcement is due out on Wednesday while on Friday we will see the latest Bureau of Labor Statistics jobs report, so there will be plenty of catalysts that have the potential to keep things lively again this coming trading week.The Market Direction Model (MDM) remains on a BUY signal. Despite the action from big technology names, a Market Lab Report sent out earlier this week stated, "In parallel to today, late 2018 saw diminished levels of QE and slowing economies so in consequence, major averages were sloppy and trading in wide bands. For the first half of 2018, they would selloff hard then grind back up to new highs. Thus the Market Direction Model since then opted to capture wider bands as the market tended to trend higher but in a sloppy manner given the tug-o-war between QE vs. slowing economies. During these times, the model took fewer signals to capture major trends which helped minimize whipsaws. This meant being able to ride major trends longer. This is a different style to those who wish to trade the markets on a shorter term basis. Of course, one can place their own sell stop in alignment with their risk tolerance. We advise members to risk significantly less capital than normal should volatility levels become elevated. During such periods, the Market Direction Model will take greater risk by allowing larger losses during such periods to avoid getting whipsawed."

Earnings beats have been the norm so it will be revealing as earnings roll out this quarter. In the most recent market correction, major averages found their floors relatively quickly then started higher again. Should earnings disappoint this time and/or should the economy show further signs of slowing, the model would switch out of its buy signal. Whether it switched to cash or sell would depend on the severity of earnings misses and the degree of economic slowing.