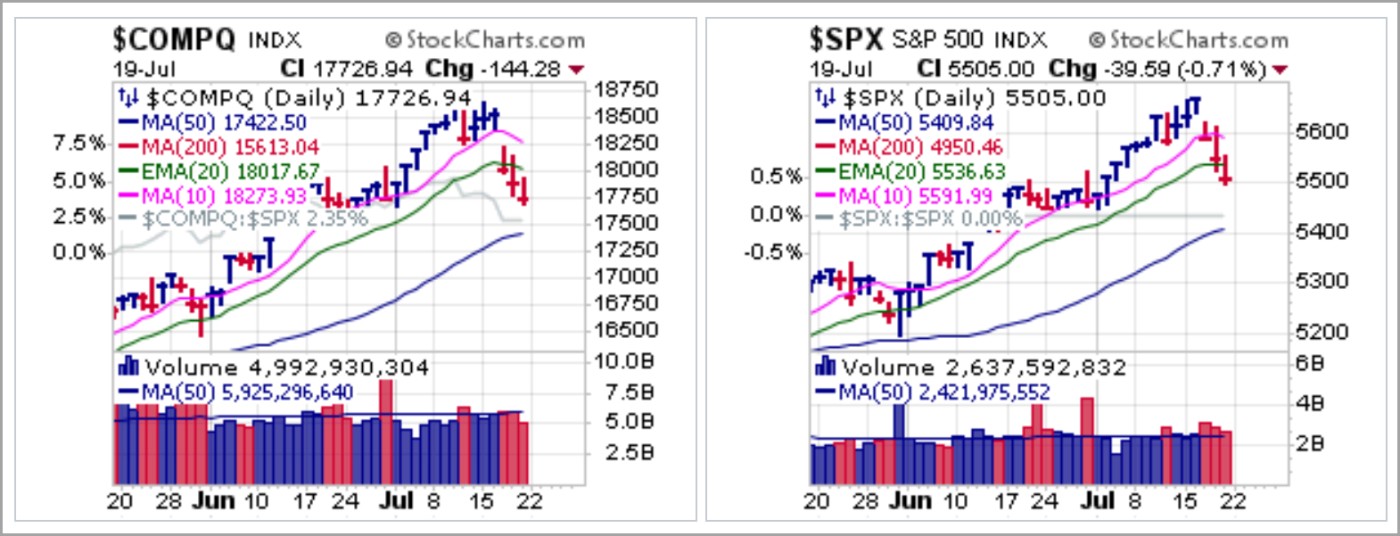

Tech-centric market indexes took a beating this past week as the NASDAQ Composite, NASDAQ 100, and S&P 500 all gapped down on Wednesday and broke 20-dema support as the week wore on. Talk of the Biden Administration considering tougher restrictions on semiconductor sales to China sent techs lower, but signs of cracks within the sector were already brewing.

By the end of the week non-tech-centric indexes, the Dow, NYSE Composite, and small-cap Russell 2000 Indexes were playing catch up on the downside as the market sell-off broadened. This would speak to the idea that the news regarding more restrictions on the semiconductor sector was merely an alibi for the sell-off earlier in the week.

By the end of the week non-tech-centric indexes, the Dow, NYSE Composite, and small-cap Russell 2000 Indexes were playing catch up on the downside as the market sell-off broadened. This would speak to the idea that the news regarding more restrictions on the semiconductor sector was merely an alibi for the sell-off earlier in the week.

Bitcoin ($BTCUSD) recovered in fine style this past week by regaining its 200-dma last weekend and then posting a pocket pivot at the 50-dma on Friday. Any constructive test of the 50-dma could present lower-risk long entries from here. There have been rumors, according to Dennis Porter, co-founder of the non-profit organization Satoshi Act, from so-called "inside sources" who have told him that labeling Bitcoin as a reserve asset is on Trump’s to-do list." While this is obviously unconfirmed, it is known that Trump is far more crypto-friendly than his Presidential rivals and other anti-crypto officials currently running the U.S. government. Trump's improved odds of becoming the next President, again, as a result of last week's assassination attempt, may be a catalyst for the past week's strong action in $BTCUSD.

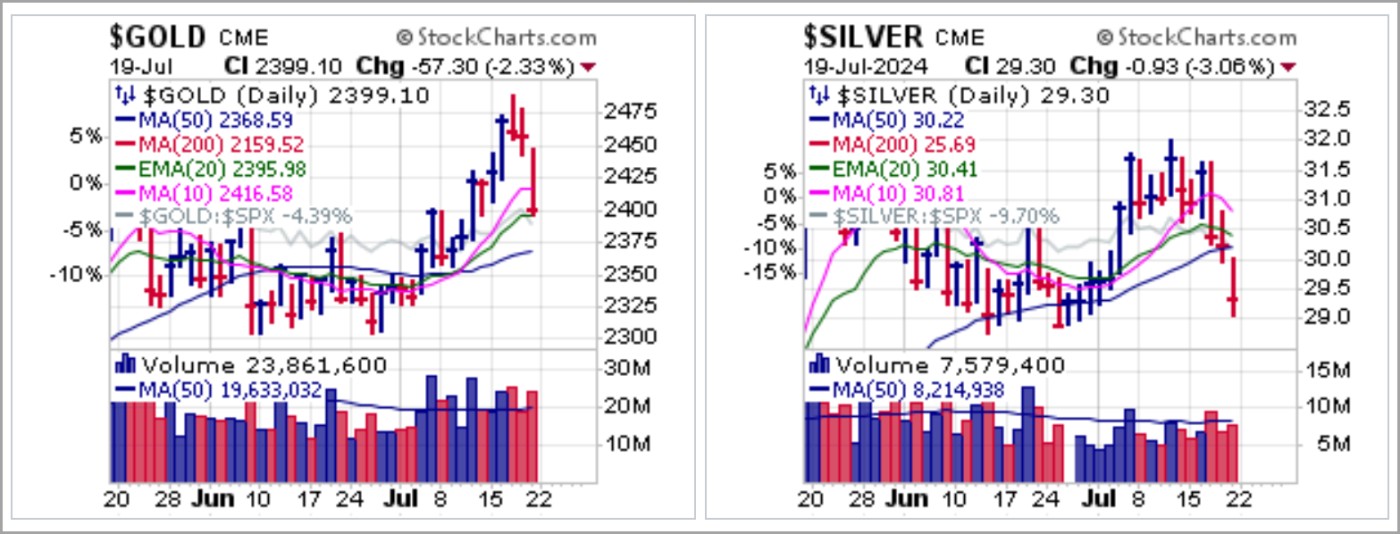

As interest rates and the dollar spiked over the past two days off recent lows, both Comex Gold and Silver Futures have sold off. Gold, however, has pulled back to 20-dema support while silver acts more weakly as it comes in to test the prior lows of its current base. Gold posted an all-time high at $2,488.40 an ounce on Wednesday before reversing. Silver, on the other hand, is a a long way away from all-time highs near the $50 level, and its weaker performance may be indicative of its industrial exposure in a rapidly weakening economy.

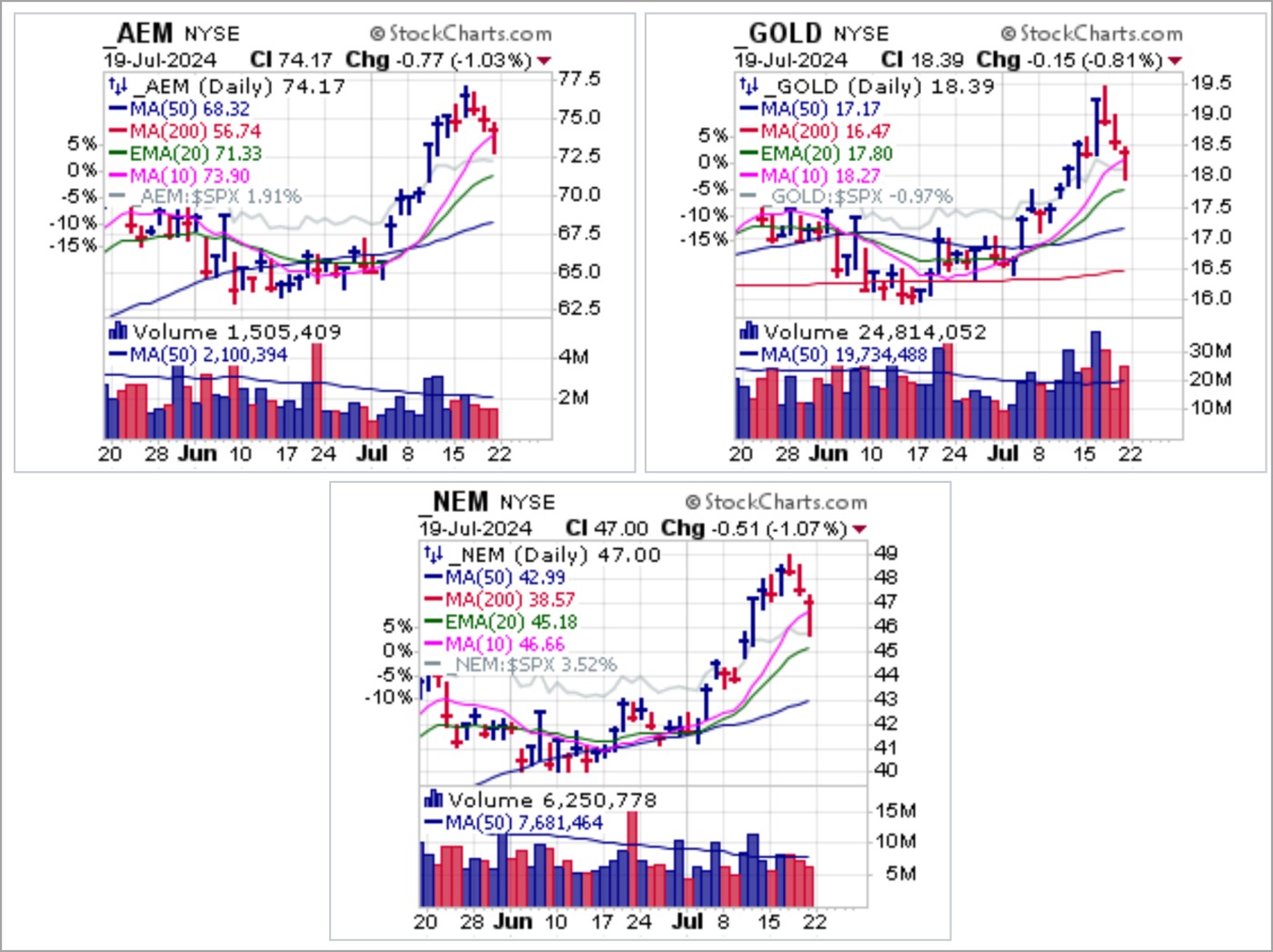

Interestingly, while precious metals stocks sold off with gold and silver, we noted that the three biggest institutional favorites among big-stock gold miners, Agnico-Eagle (AEM), Barrick Gold (GOLD), and Newmont Corp. (NEM) all shook out and posted moving average undercut & rally (MAU&R) long entry triggers at their 10-day moving averages on Friday. Most of these names have been on an upside tear since the beginning of July and the current pullbacks would appear normal within the context of the prior upside.

Interestingly, while precious metals stocks sold off with gold and silver, we noted that the three biggest institutional favorites among big-stock gold miners, Agnico-Eagle (AEM), Barrick Gold (GOLD), and Newmont Corp. (NEM) all shook out and posted moving average undercut & rally (MAU&R) long entry triggers at their 10-day moving averages on Friday. Most of these names have been on an upside tear since the beginning of July and the current pullbacks would appear normal within the context of the prior upside.NEM is expected to report earnings on Wednesday after the close. It is important to remember that at the start of 2024 gold prices were around the $2,000 an ounce level. Since gold has rallied nearly 25%, and even at $2,300-$2,400 the higher general level of gold prices significantly and positively impacts the earnings of mining companies. Thus, it will be interesting to see how higher gold prices figure into NEM's upcoming earnings report, so this may be something to watch closely.

As we move through earnings season this will likely impact and potentially reinforce the current market sell-off. For example, Netflix (NFLX) reported earnings on Thursday afternoon and gapped higher Friday morning at the open. That move did not last long as the stock quickly reversed and triggered short-sale entries at its 10-dma, 20-dema, and finally the 50-dma. It closed a little over 3% below the 50-dma so is technically still within short-sale range. However, we would look for any weak rally back into the 50-dma to bring it back into more optimal short-sale range.

As we move through earnings season this will likely impact and potentially reinforce the current market sell-off. For example, Netflix (NFLX) reported earnings on Thursday afternoon and gapped higher Friday morning at the open. That move did not last long as the stock quickly reversed and triggered short-sale entries at its 10-dma, 20-dema, and finally the 50-dma. It closed a little over 3% below the 50-dma so is technically still within short-sale range. However, we would look for any weak rally back into the 50-dma to bring it back into more optimal short-sale range.

This week we are expecting earnings from Alphabet (GOOGL) and Tesla (TSLA) on Wednesday after the close. Both stocks, however, have already flashed short-sale entry triggers. GOOGL broke below 20-dema support on Wednesday to trigger a short entry and has closed below the 50-dma over the past two trading days. Tesla (TSLA), which has previously been on an upside tear on a flurry of positive news, finally triggered an aggressive short-sale entry as it broke below the 10-dma at the end of the week and now appears set to test the 20-dema.

We will also be expecting earnings from several big-stock semiconductor and AI-Meme names. NXP Semiconductor (NXPI) is expected to report Monday after the close. The stock busted 20-dema and 50-dma support on Friday to trigger a pair of short-sale entries ahead of earnings. On Tuesday afternoon we will get earnings from Seagate Technology (STX) and Texas Instruments (TXN). STX triggered a short-sale entry on Thursday as it broke below 20-dema support while TXN triggered short entries at its 10-dma and then 20-dema on Friday.

KLA Corp. (KLAC) and Qualcomm (QCOM ) are expected to report Wednesday. KLAC triggered a short-sale entry on Tuesday when it gapped through 20-dema support and then ended the week below the 50-dma as it slid to lower lows. QCOM topped over four weeks ago and continued to gap and slide lower this past week. While we prefer to avoid playing earnings roulette by taking positions ahead of earnings, we intend to watch for any post-earnings action that might bring any of these names into better short-sale range.

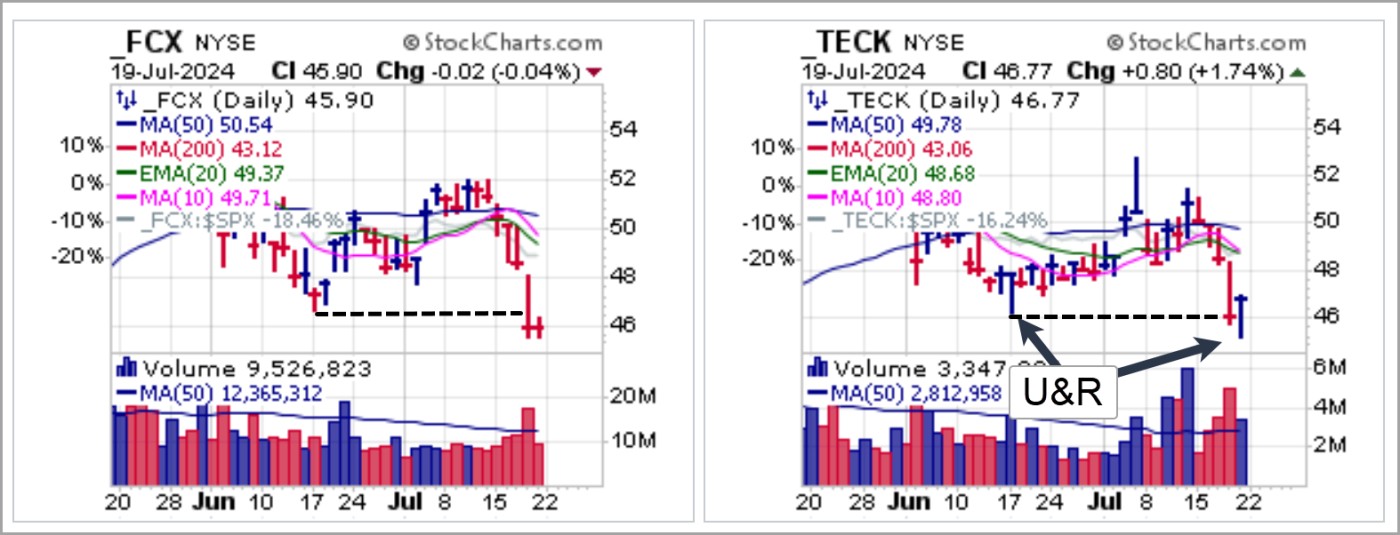

The action of copper names this past week underscores the rapidly slowing economic situation. On Tuesday before the open we are expecting earnings from big-stock copper Freeport-McMoRan (FCX). The stock triggered a short-sale entry at the 50-dma this past Monday and has since slashed its way lower since. It is now sitting just below the mid-June low. Teck Resources (TECK) triggered its own short-sale entry on Tuesday as it slipped below 50-dma support. It slashed lower on Thursday but on Friday posted an undercut & rally (U&R) move as it pushed back above the 46.15 mid-June low.

The NASDAQ Composite has now corrected 5.26% off the highs of seven trading days ago, which would constitute a short-term market correction. This does not, however, mean that the correction is over. That remains a fluid issue, and as we move through the heart of earnings season over the next 2-3 weeks the situation may clarify further.

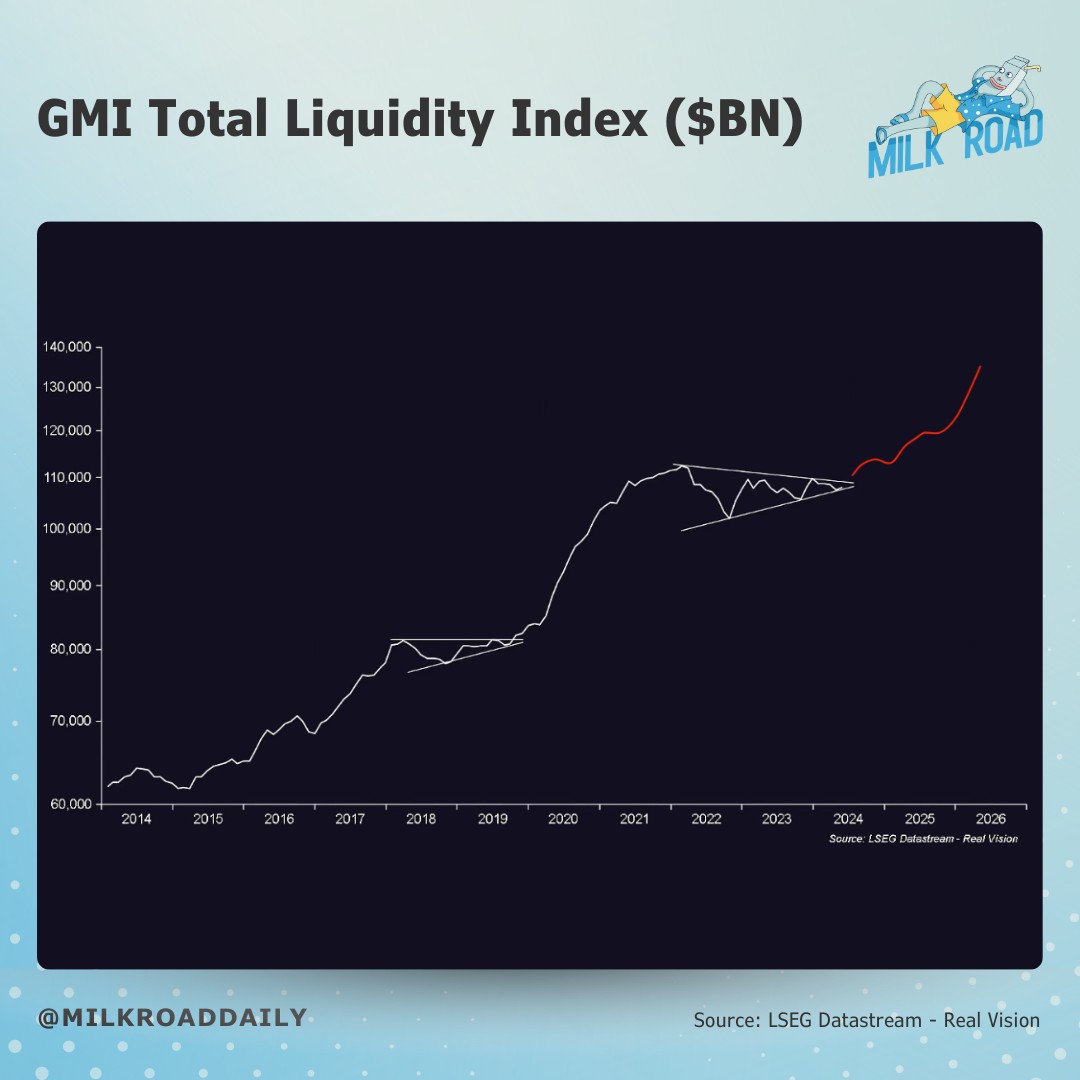

The Market Direction Model (MDM) remains on a BUY signal. Lower inflation and rising unemployment forces the Fed to cut rates. A very telling chart of global liquidity suggests it will inevitably rise due to record levels of debt interest payments, unfunded liabilities, the expanding war effort, and uneconomic global warming laws, among other issues. So while it has fallen in 2024, is it likely to start trending higher later this year. We will keep a close eye on this metric and advise accordingly.