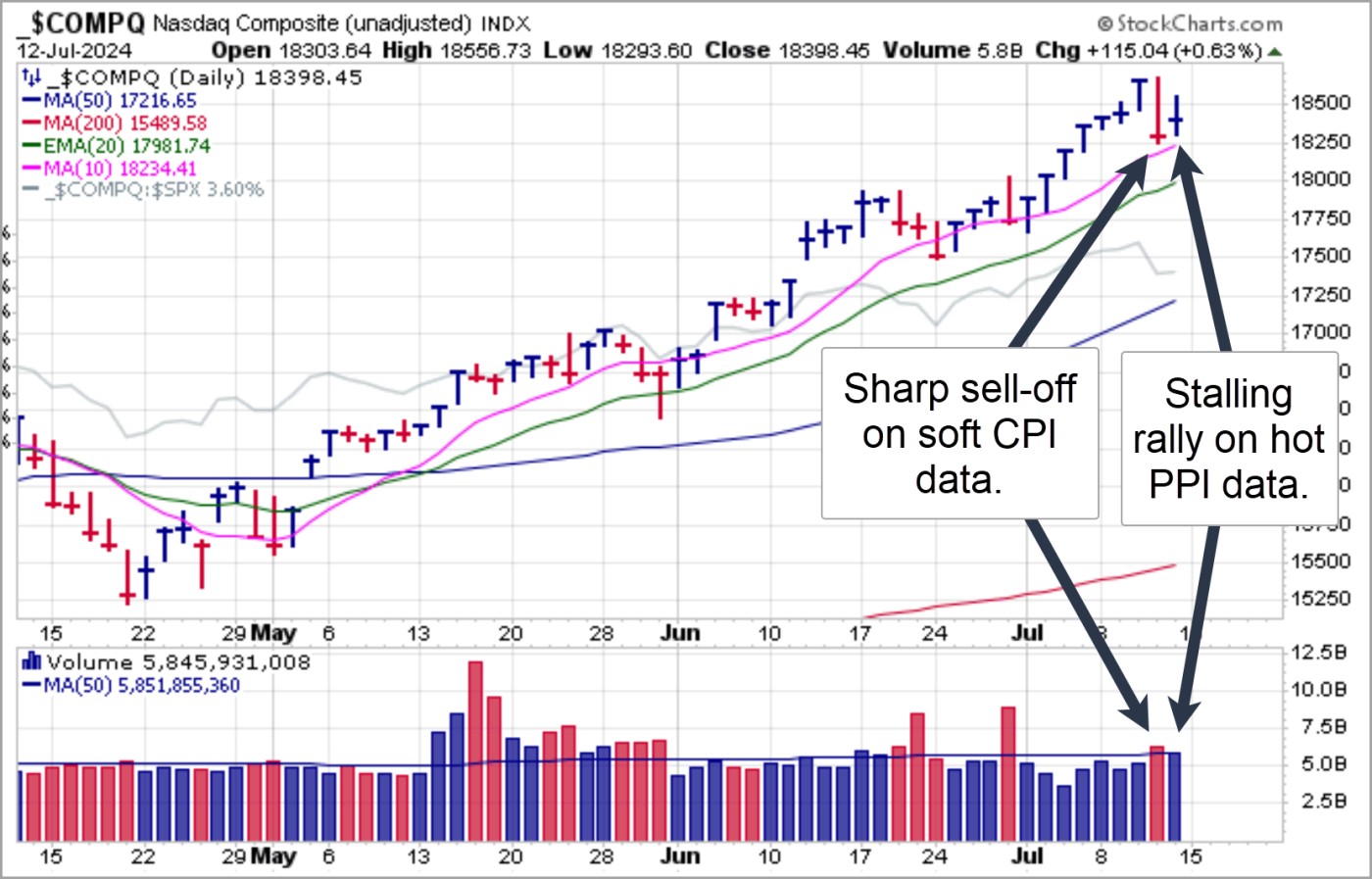

Light CPI data on Thursday, as the headline rate came in at -0.1% vs. expectations of 0.1% and core CPI printed 0.1% vs. expectations of 0.2% had an unexpected effect on tech-heavy indexes like the NASDAQ Composite, NASDAQ 100, and S&P 500 as all three indexes sold off hard on heavy volume. Just as unexpectedly, hot PPI data where the headline number printed 0.2% vs. estimates of 0.1% and core PPI came in at 0.4% vs. expectations of 0.1% led to a positive market response all around, but by the close the tech-heavy indexes stalled to close in the lower half of their price ranges. Overall, surprising, unexpected responses to first light CPI data on Thursday and then hot PPI data on Friday.

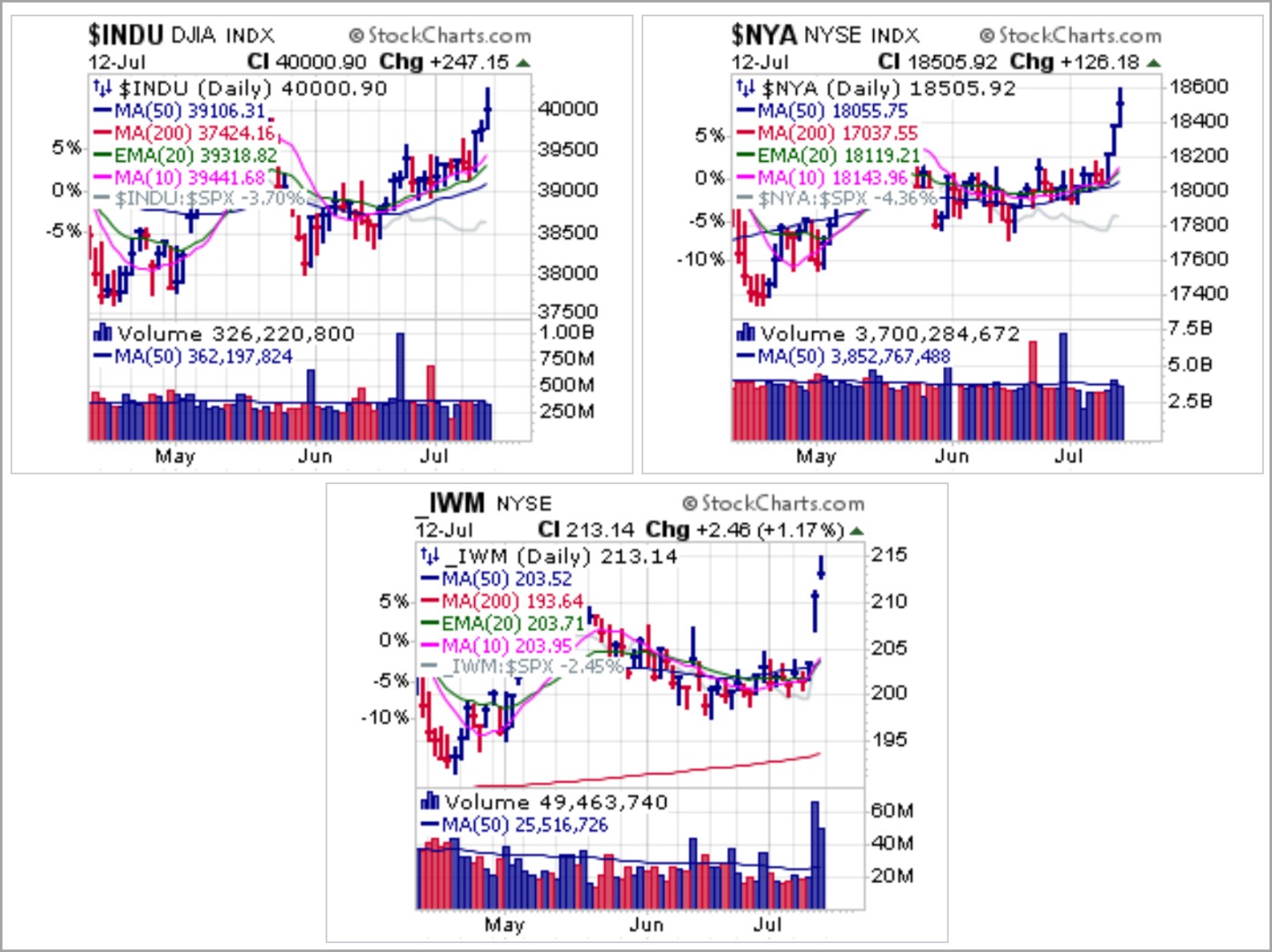

Non-tech-heavy indexes, the Dow, the NYSE Composite, and the small-cap Russell 2000 responded positively to the contradicting inflation reports by rallying on the light CPI data on Thursday as techs sold off and then rallying again on the hot PPI data on Friday. These indexes, which are much less exposed to tech, have outperformed over the past three days and may indicate a potentially defensive rotation into underplayed, lower PE and PE-expansion areas of the market. This remains unclear for now.

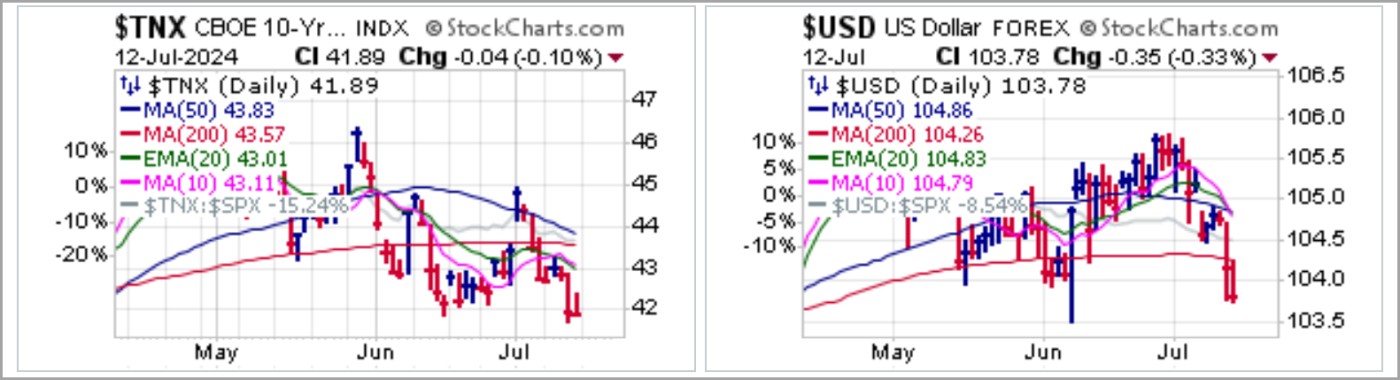

Interest rates via the Ten-Year Treasury Yield ($TNX) and the U.S. Dollar ($USD) both sold off in response to light CPI data on Thursday and after initial upside reactions following the hot PPI data surprisingly turned tail and posted lower closing lows to end the week. It appears that the generally consistent inverse correlation and link between interest rates and the dollar vs. inflation is losing its grip, and this may be telling us something about where the market thinks the economy is headed.

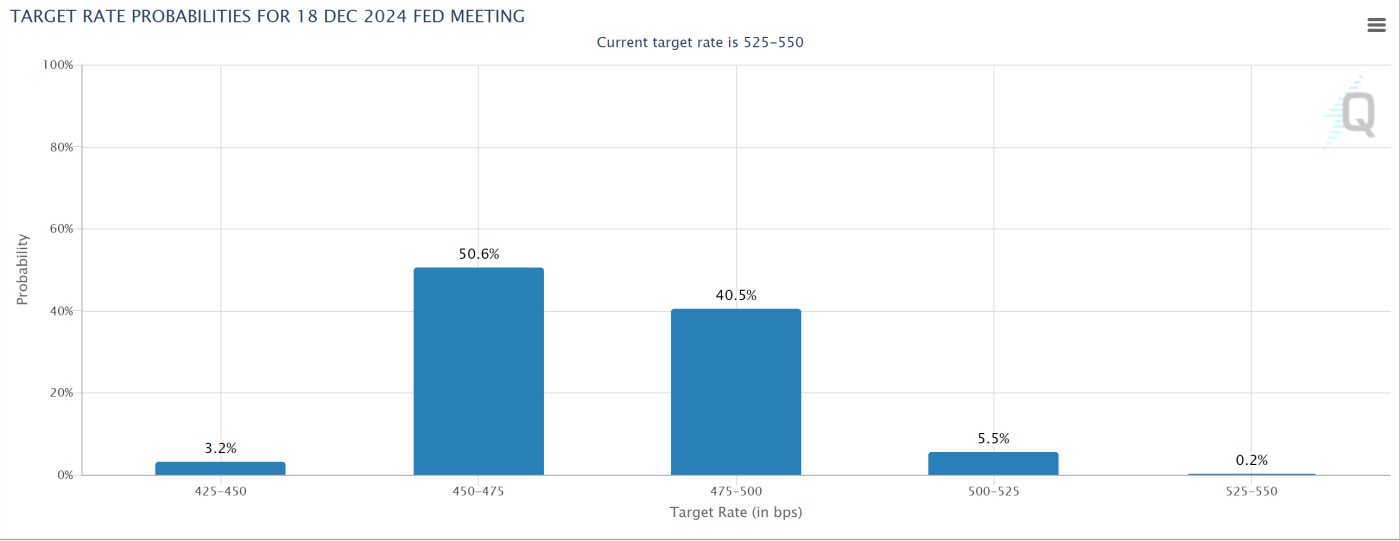

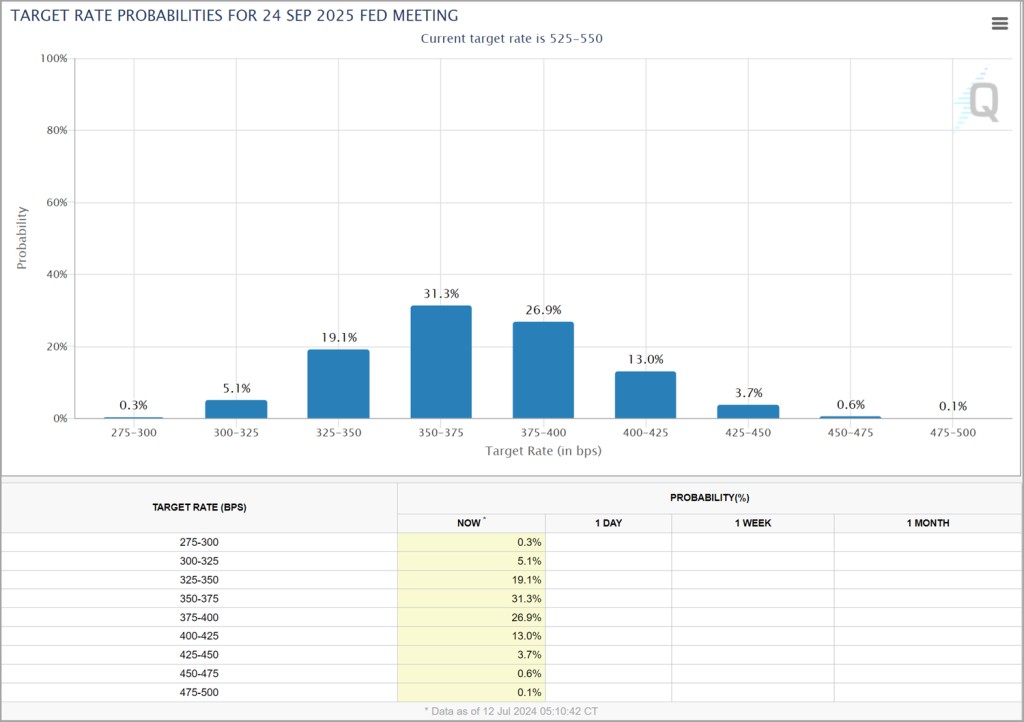

Indeed, the CME FedWatch Tool shows that interest rate futures are now pricing in three rate cuts from the Fed by the end of this year.

Should the economy weaken at an accelerated pace, we could see 50 bps instead of 25 bps cuts. The Fed may also choose to renew QE which could help stem losses in stocks depending on how much fiat they created.

If we go all the way out, the market is currently expecting 7 rate cuts by September 2025 to bring the target rate to 350-375 bps down from 525-550 bps.

Bitcoin ($BTCUSD) is attempting to regain the 200-dma on Sunday, but trading volume remains quite light as the big-crypto crypto currency wedges back above the line. We will see how well it holds the 200-dma this week amid all the bizarre and seemingly contradictory cross-currents we are seeing currently in the markets.

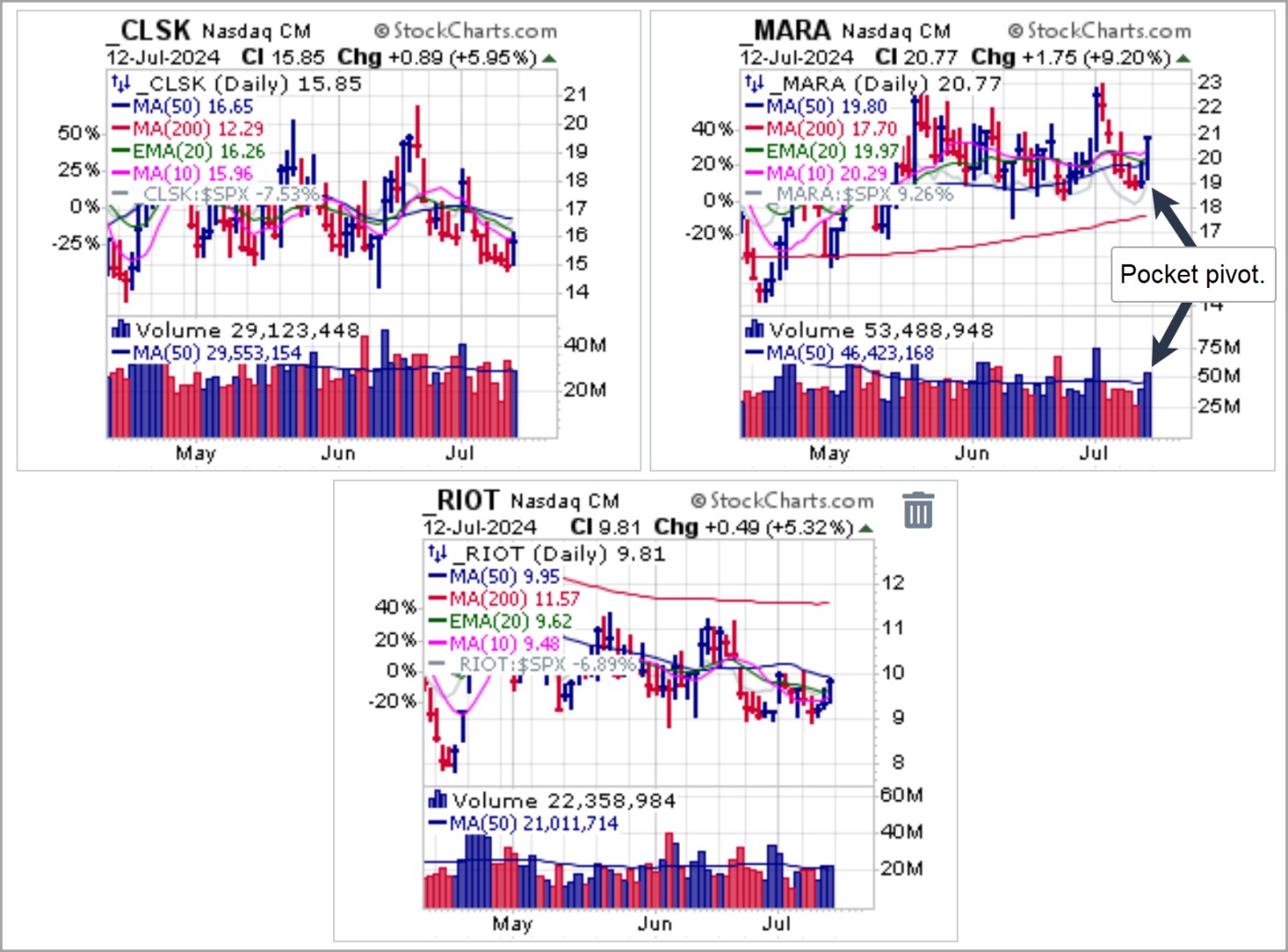

We reported on crypto stocks CleanSpark (CLSK), Marathon Digital Holdings (MARA), and Riot Platforms (RIOT) as potential short-sale entries on Friday but all three stocks found their feet and attempted to rally. MARA even posted a pocket pivot as it recovered back above its 50-dma as the recovery in $BTCUSD back above the 200-dma helped keep this stocks buoyant off the week's prior lows.

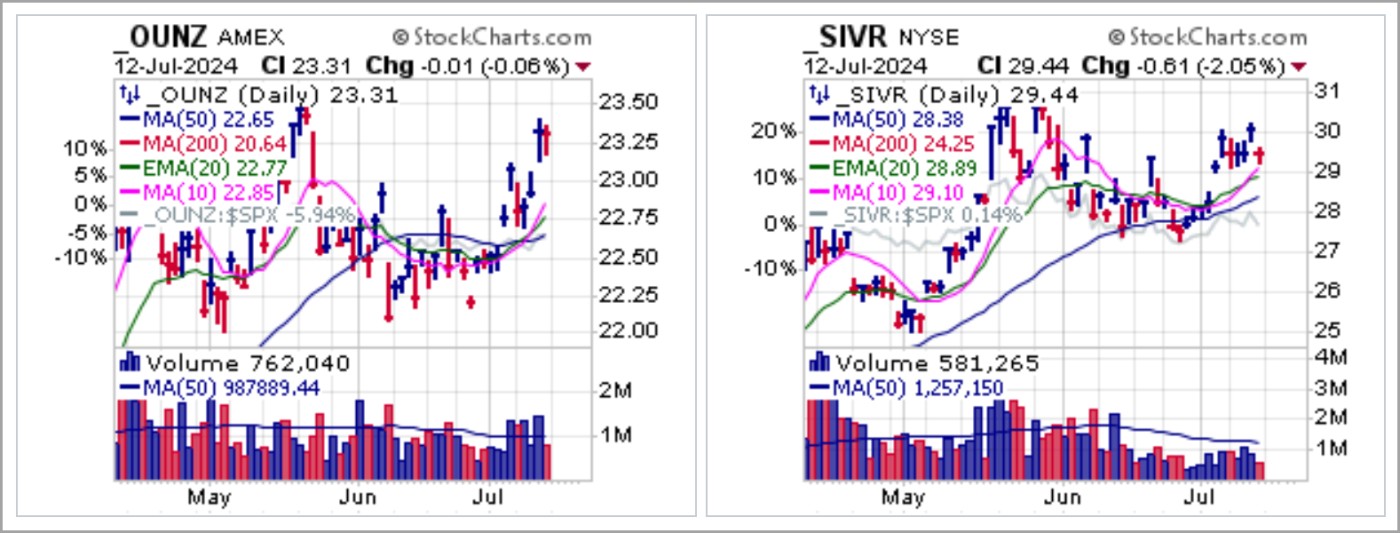

Gold and silver continue to hold up near recent highs with gold futures again back above the $2400 level and within 2% of all-time highs. The VanEck Merk Gold Trust (OUNZ) recovered from an early sell-off on Friday morning in response to the hot PPI data while the Aberdeen Physical Silver Shares (SIVR) pulled back and held 10-dma support. In the face of hot PPI data on Friday, precious metals held up well after prior strong moves off the late June lows, surprisingly enough.

We reported on other names this past week, including big-stock uranium name Cameco (CCJ) as it posted a pocket pivot coming up through the 50-dma. Uranium stocks in general rallied sharply on Wednesday after President Biden signed a nuclear power initiative bill as the government now realizes the need for more reliable, powerful, and consistent power generation methods as solar and wind fail to live up to the green energy hype given the rapidly rising need for more electricity.

As precious metals have rallied off their late June lows, so have precious metals stocks, and on Wednesday we reported on a strong pocket pivot move in silver miner MAG Silver (MAG). It has continued higher since as it now approaches the May highs.

Pinterest (PINS) was reported on as a short-sale set-up on Wednesday as well as it broke below the 20-dema. It has since broken further to the downside and triggered a second short-sale entry as it dipped below the 50-dma on Thursday. On Friday, it gapped further below the line and for now weak rallies back up into the 50-day line would bring the stock back into short-sale range so can be watched for.

This remains a difficult if not confusing market environment replete with daffy divergences as the market appears to be discounting a rapidly slowing economy which has the ability to meaningfully suck liquidity out of the system, bringing asset prices down. For now, the Market Direction Model (MDM) remains on a BUY signal.