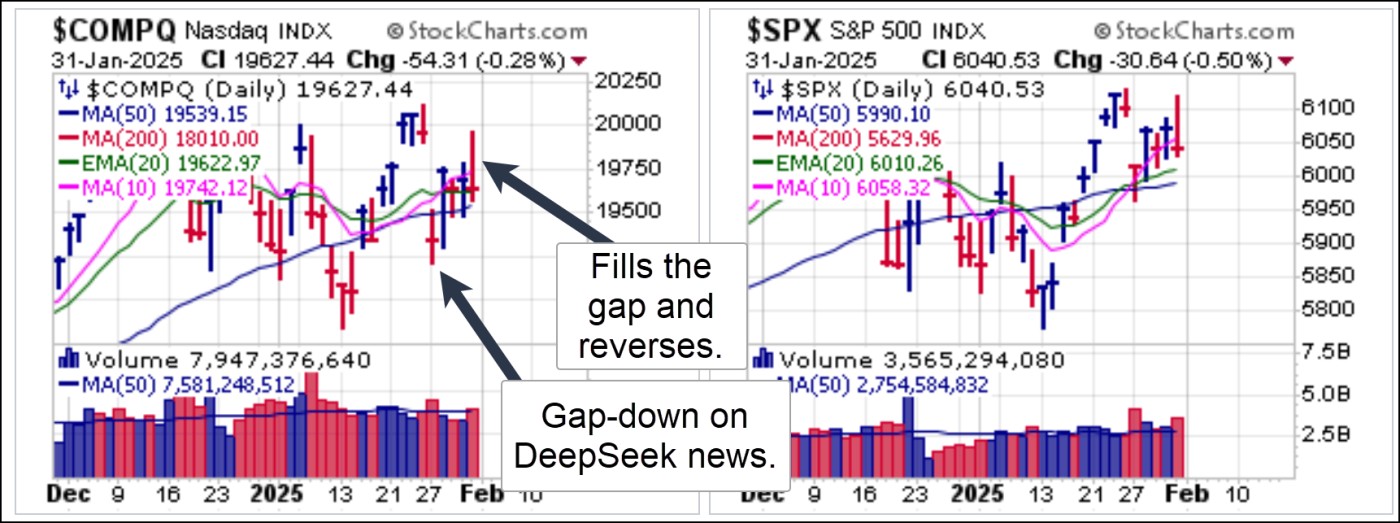

Major market indexes survived a wild week that started with a massive AI-Meme tech sell-off and ended with news that President Trump was slapping 10% tariffs on China and 25% tariffs on Canada and Mexico. The oversold reaction rally reversed at logical resistance as the NASDAQ Composite and S&P 500 both filled the Monday gap-down falling window on Friday.

In between we had the January Fed policy announcement on Wednesday which was initially viewed as hawkish until Fed Chair Jerome Powell started his press conference and attempted to mitigate the hawkishness of the Fed policy announcement's precise language. As well, there were Big-Stock earnings reports from Apple (AAPL), Intel (INTC), Meta Platforms (META), Microsoft (MSFT), ServiceNow (NOW), Tesla (TSLA) and a cast of many others also added to the action in what was overall a spicey week, to say the least.

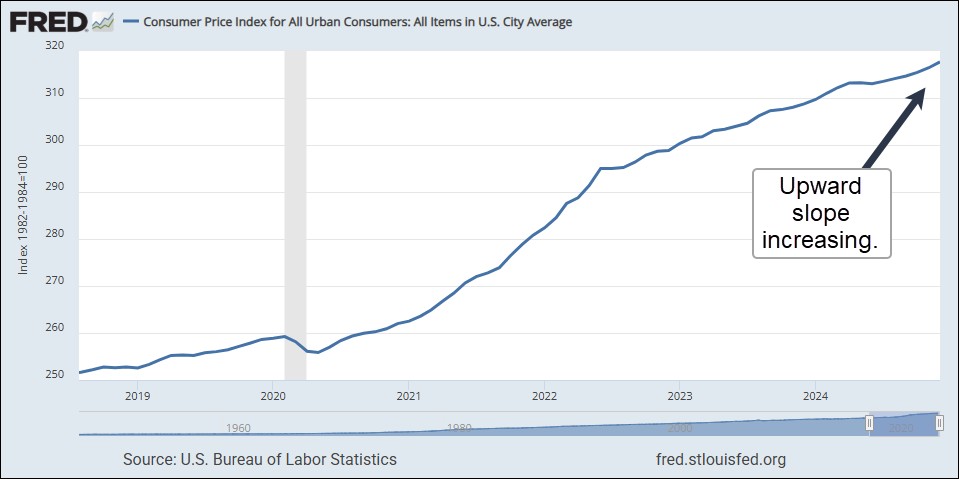

In between we had the January Fed policy announcement on Wednesday which was initially viewed as hawkish until Fed Chair Jerome Powell started his press conference and attempted to mitigate the hawkishness of the Fed policy announcement's precise language. As well, there were Big-Stock earnings reports from Apple (AAPL), Intel (INTC), Meta Platforms (META), Microsoft (MSFT), ServiceNow (NOW), Tesla (TSLA) and a cast of many others also added to the action in what was overall a spicey week, to say the least.Finally, Personal Consumption Expenditures (PCE) inflation data on Friday held no surprises, but the bottom line, whether measured by CPI, PPI, PCE, is that the trend in inflation remains decidedly to the upside. The market reacted positively to the data, however, before being derailed by news of Trump's tariff declarations late in the day on Friday.

We reported on Thursday's buyable gap-up (BGU) in the SPDR Gold Trust (GLD) that day as gold forged new all-time highs. The intraday low of the Thursday's BGU price range was 256.45 which would serve as a selling guide.

Silver moved higher with gold on Thursday as the iShares Silver Trust (SLV) posted its own BGU before backing down on Friday. Friday's pullback closed at 28.51, two cents below the 26.53 intraday low of Thursday's BGU price range. That would keep it within buying range since two cents is miniscule for the white metal which tends to be far more volatile than gold.

As alternative currencies like gold and silver were on the move this week, Bitcoin ($BTCUSD) continues to base-build. After a premature breakout three weeks ago $BTCUSD has taken the time to build a proper cup-with-handle. While the failed breakout may look bearish, note that there was also a big reversal off the lows earlier this past week as $BTCUSD posted a moving average undercut & rally (MAU&R) long entry at the 50-dma on big volume. So while there is clear resistance at the highs and clear support now along the lows of the handle and the 50-dma, the overall pattern has yet to resolve, and a breakout may require news from the Trump Administration regarding concrete crypto-related legislation.

As alternative currencies like gold and silver were on the move this week, Bitcoin ($BTCUSD) continues to base-build. After a premature breakout three weeks ago $BTCUSD has taken the time to build a proper cup-with-handle. While the failed breakout may look bearish, note that there was also a big reversal off the lows earlier this past week as $BTCUSD posted a moving average undercut & rally (MAU&R) long entry at the 50-dma on big volume. So while there is clear resistance at the highs and clear support now along the lows of the handle and the 50-dma, the overall pattern has yet to resolve, and a breakout may require news from the Trump Administration regarding concrete crypto-related legislation. Tesla (TSLA) was reported on Thursday as a potential pocket pivot. It did in fact post a valid pocket pivot along the 50-dma on Thursday, but in the process stalled at the 10-dma and 20-dema. It is likely the move was triggered by news that President Trump would impose 25% tariffs on Canada and Mexico. TSLA does not build cars in either of those countries, so this was viewed as advantageous for the company.

Tesla (TSLA) was reported on Thursday as a potential pocket pivot. It did in fact post a valid pocket pivot along the 50-dma on Thursday, but in the process stalled at the 10-dma and 20-dema. It is likely the move was triggered by news that President Trump would impose 25% tariffs on Canada and Mexico. TSLA does not build cars in either of those countries, so this was viewed as advantageous for the company. This illustrates a key characteristic of this market, which is that stocks can start looking as if they will resolve in one direction or the other, often under the influence of news, but then falter as the action becomes muddled such that it also retains the potential to resolve in the opposite direction from the original set-up. In this case, Thursday's pocket pivot showed resistance at the 10-dma/20-dema confluence. If it were to break below 50-dma support it would trigger a potential short-sale entry at that point. This is typical for a market that we tend to view as more a trading market than an investing market.

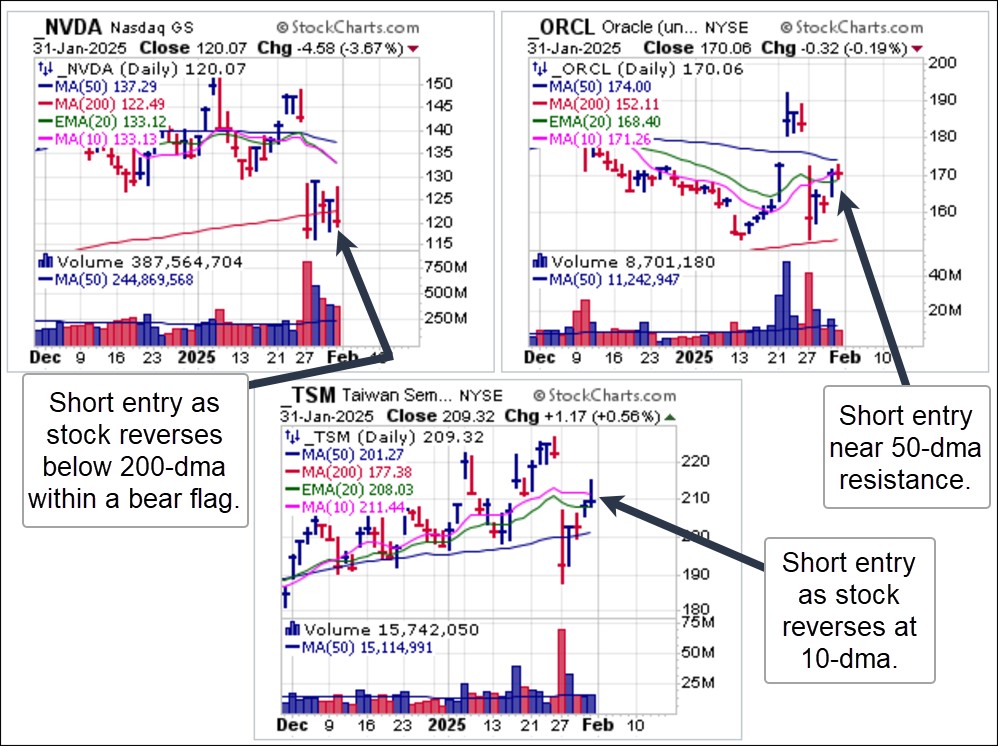

On Wednesday we reported on big-stock AI-Meme techs Nvidia (NVDA), Oracle (ORCL), and Taiwan Semiconductor (TSM) all of which were decimated on the Black Monday AI-stock blow-up on news of DeepSeek, an allegedly cheaper and faster alternative to OpenAI coming out of China. That has triggered a great deal of debate regarding DeepSeek's capabilities, so for now we watch the stocks. In all three of these cases were are watching for rallies that reverse at price or moving average resistance. On Friday we saw NVDA reverse back below its 200-dma as it works through a short four-day bear flag, while ORCL stalled near 50-dma resistance and TSM reversed at 10-dma and 20-dema resistance. These would be treated as typical short-sale entries as discussed in our reports and Short-Selling with the O'Neil Disciples (John Wiley & Sons, 2015) using the moving average in question as a covering guide.

On Wednesday we reported on big-stock AI-Meme techs Nvidia (NVDA), Oracle (ORCL), and Taiwan Semiconductor (TSM) all of which were decimated on the Black Monday AI-stock blow-up on news of DeepSeek, an allegedly cheaper and faster alternative to OpenAI coming out of China. That has triggered a great deal of debate regarding DeepSeek's capabilities, so for now we watch the stocks. In all three of these cases were are watching for rallies that reverse at price or moving average resistance. On Friday we saw NVDA reverse back below its 200-dma as it works through a short four-day bear flag, while ORCL stalled near 50-dma resistance and TSM reversed at 10-dma and 20-dema resistance. These would be treated as typical short-sale entries as discussed in our reports and Short-Selling with the O'Neil Disciples (John Wiley & Sons, 2015) using the moving average in question as a covering guide.

This remains a difficult, news-driven market. The new Trump Administration has demonstrated an ability to move the markets, and to do so significantly, whether the news is throwing $500 billion at AI Data Centers or imposing tariffs on its trading partners. As such, we continue to view this market as more of a trader's market ill-suited to trend-following, position-building investors.

The Market Direction Model (MDM) remains on a BUY signal.