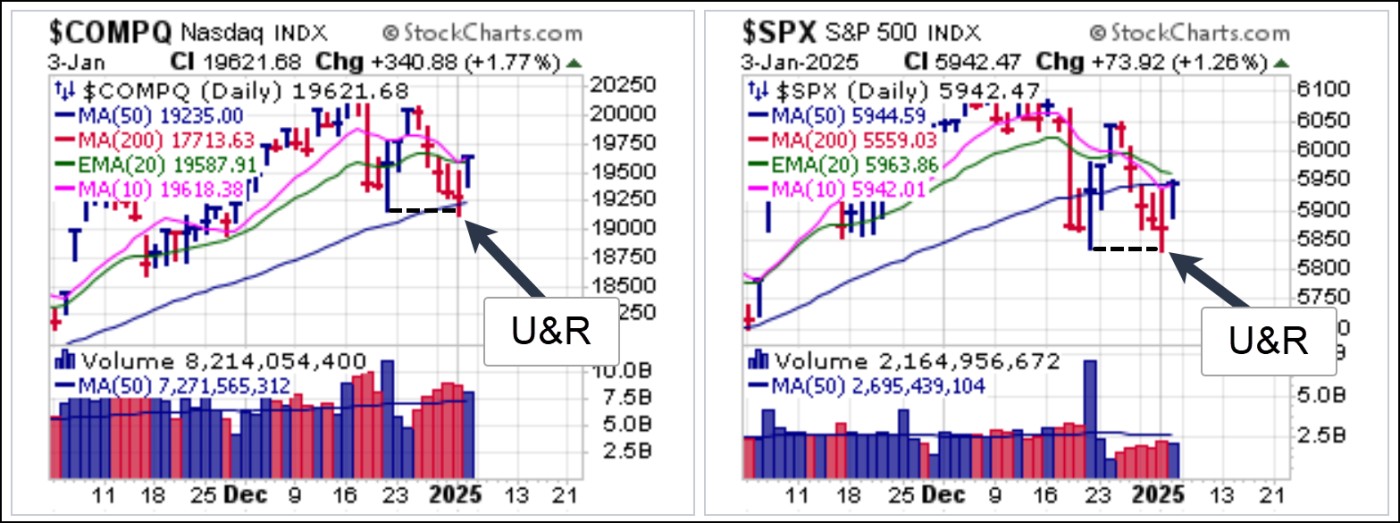

The market ended 2024 on a weak note Tuesday and started the New Year off in similar fashion on Thursday, with the NASDAQ Composite and S&P 500 posting five straight down days before rallying on Friday. Note that both indexes posted mini-U&Rs along the lows of two weeks ago with the NASDAQ also posting a moving average U&R at its 50-dma. Thus Friday's oversold rally was logical from a technical standpoint, but it is not clear how far these moves will carry as we move past the general Christmas/New Year's holiday period.

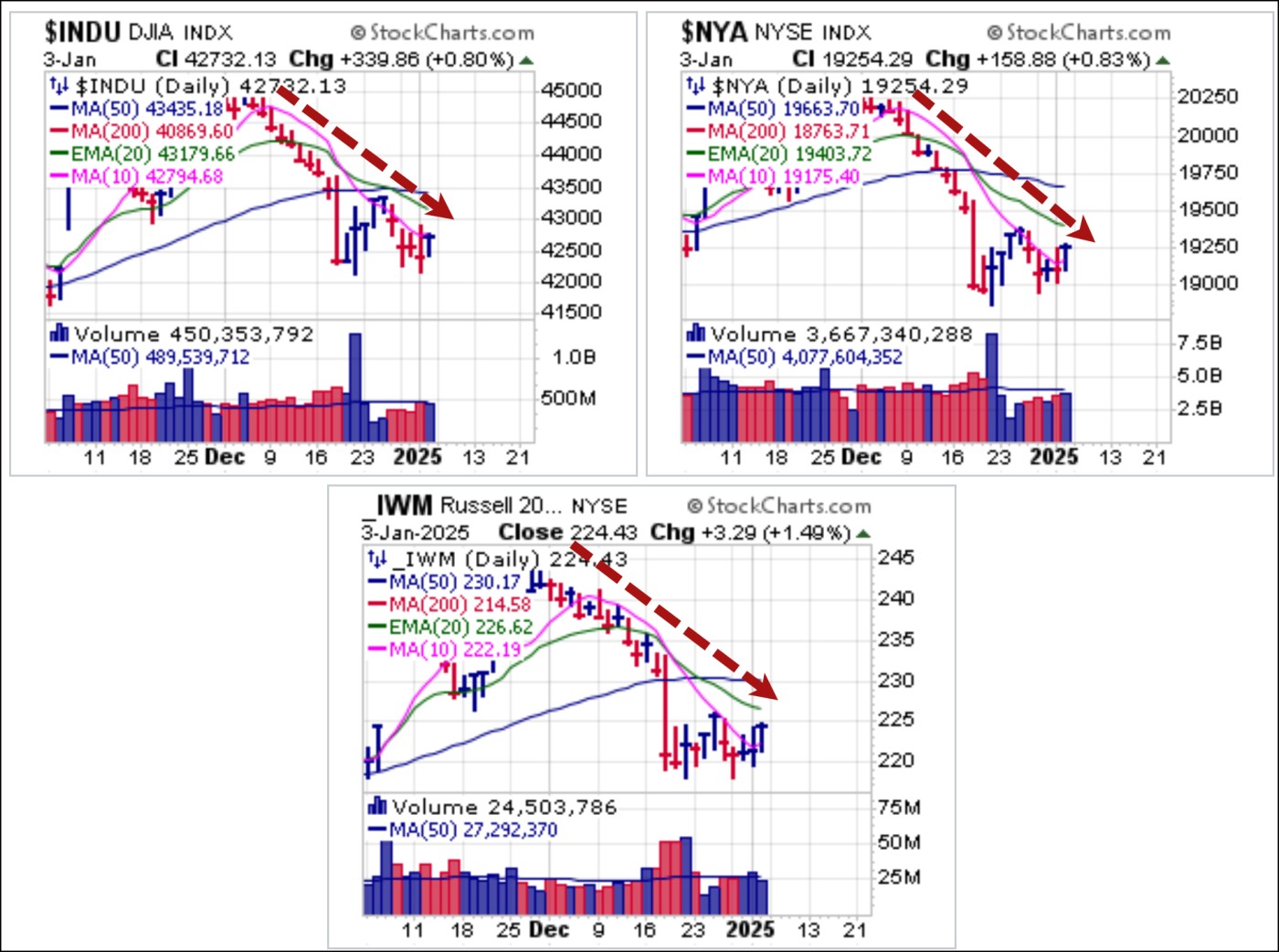

Meanwhile, the less tech-centric market indexes, the

Dow,

NYSE Composite, and small-cap

Russell 2000 all remain within bear flags after peaking in late November and then declining December. The action over the past two weeks has been more typical of a bear flag as these indexes consolidate the prior initial leg down off the late November/early December highs. We remain cautions on stocks for now.

Bitcoin ($BTCUSD) continues to consolidate below the $100k level. We can see that the breach of 50-dma support was not a serious negative for $BTCUSD since, as we wrote last weekend as it dipped below the 50-dma, "We would not draw firm conclusions either way, however, since price support can hold up better than moving average support where the moving average is rising sharply as it catches up with $BTCUSD's big move in November."

And in fact what we see is that $BTCUSD did in fact hold price support as it shook out along two prior lows in the pattern at $91,741.97 and $92,144.03, respectively, before ending the week on Friday above 50-dma support. We noted last week, we would look for continued consolidation as the market awaits concrete legislative proposals from the incoming Trump Administration.

The Market Direction Model (MDM) switched to a CASH/NEUTRAL signal on Thursday, January 2, 2025.

This information is provided by MoKa Investors, LLC DBA Virtue of Selfish Investing (VoSI) is issued solely for informational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. Information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of available data. VoSI reports are intended to alert VoSI members to technical developments in certain securities that may or may not be actionable, only, and are not intended as recommendations. Past performance is not a guarantee, nor is it necessarily indicative, of future results. Opinions expressed herein are statements of our judgment as of the publication date and are subject to change without notice. Entities including but not limited to VoSI, its members, officers, directors, employees, customers, agents, and affiliates may have a position, long or short, in the securities referred to herein, and/or other related securities, and may increase or decrease such position or take a contra position. Additional information is available upon written request. This publication is for clients of Virtue of Selfish Investing. Reproduction without written permission is strictly prohibited and will be prosecuted to the full extent of the law. ©2025 MoKa Investors, LLC DBA Virtue of Selfish Investing. All rights reserved.