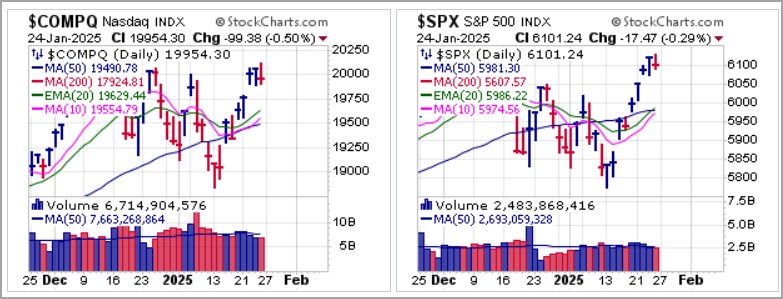

The S&P 500 posted a new all-time high this past week on Thursday but ended the week on a slightly down note. The NASDAQ Composite is also near new highs, but both indexes remain quite extended from the U&R lows of the prior week. At this stage we would expect some consolidation, at best, as the market digests strong gains made on the heels of incoming President Trump's inauguration on Monday. The indexes are now in potential double-top areas which may imply some backing-and-filling is necessary if the market is to eventually move higher.

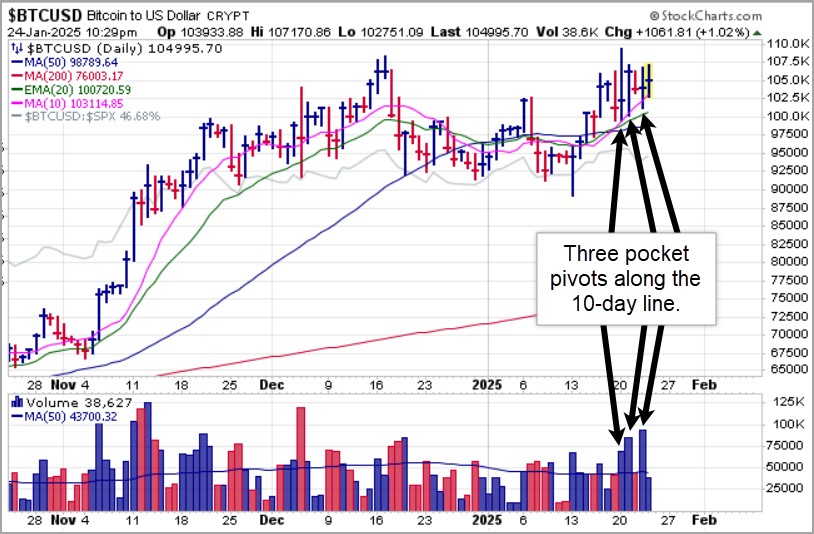

Bitcoin ($BTCUSD) posted three pocket pivots this past week along the 10-day moving average. This reflects some of the anticipation of crypto-legislation from the Trump Administration, but so far $BTCUSD remains within a five-week base after failing on a brief attempt to close at all-time highs earlier in the week. For now the 10-dma and 20-dema would serve as references for buyable support on constructive pullbacks from current levels pending any breakout to new highs.

Taiwan Semiconductor (TSM) was reported on Friday as still actionable from its prior buyable gap-up, but the BGU in fact occurred six trading days ago in a big stall-out near the prior early January highs. Since then TSM rallied to new highs but on Friday again reversed at the 222.20 left-side peak of January 6th which technically triggers a mini-double-top short-sale entry using the 222.20 left-side peak as a covering guide. Remaining nimble in choppy markets is key.

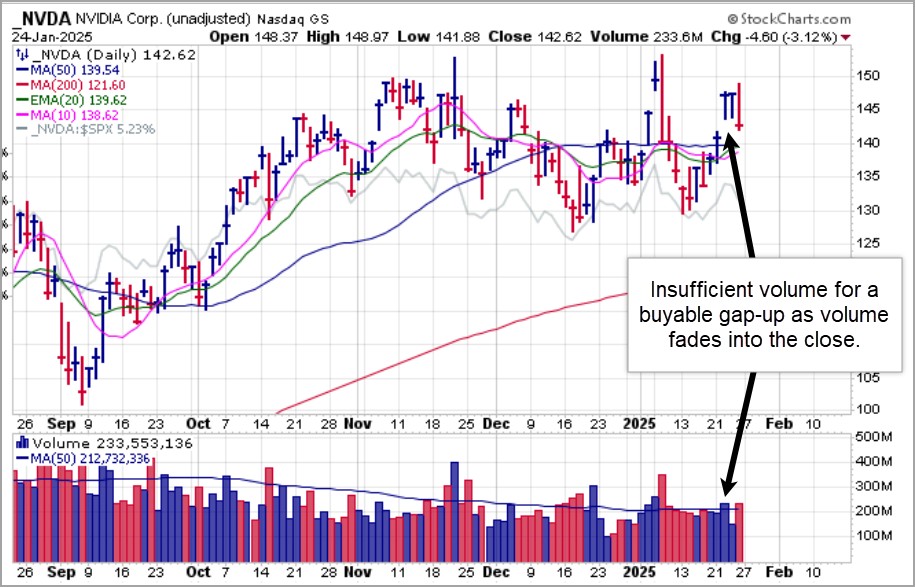

Nvidia (NVDA) was reported on early Wednesday as a potential buyable gap-up (BGU) but by the close volume had faded such that it was insufficient to call a BGU. On Friday NVDA pulled a big outside reversal to the downside as selling volume picked up. For now, there is no valid long entry set-up in the pattern as the stock has rallied into price resistance around the $150 level and reversed.

Nvidia (NVDA) was reported on early Wednesday as a potential buyable gap-up (BGU) but by the close volume had faded such that it was insufficient to call a BGU. On Friday NVDA pulled a big outside reversal to the downside as selling volume picked up. For now, there is no valid long entry set-up in the pattern as the stock has rallied into price resistance around the $150 level and reversed. Agnico-Eagle Mines (AEM) posted a pocket pivot trendline breakout on Tuesday which we reported on Wednesday. A test on Thursday offered a lower-risk entry and by Friday the stock had posted an all-time closing high. As gold comes within 1% of its all-time highs, AEM is distinguishing itself as the leader in the mining sector.

Agnico-Eagle Mines (AEM) posted a pocket pivot trendline breakout on Tuesday which we reported on Wednesday. A test on Thursday offered a lower-risk entry and by Friday the stock had posted an all-time closing high. As gold comes within 1% of its all-time highs, AEM is distinguishing itself as the leader in the mining sector.

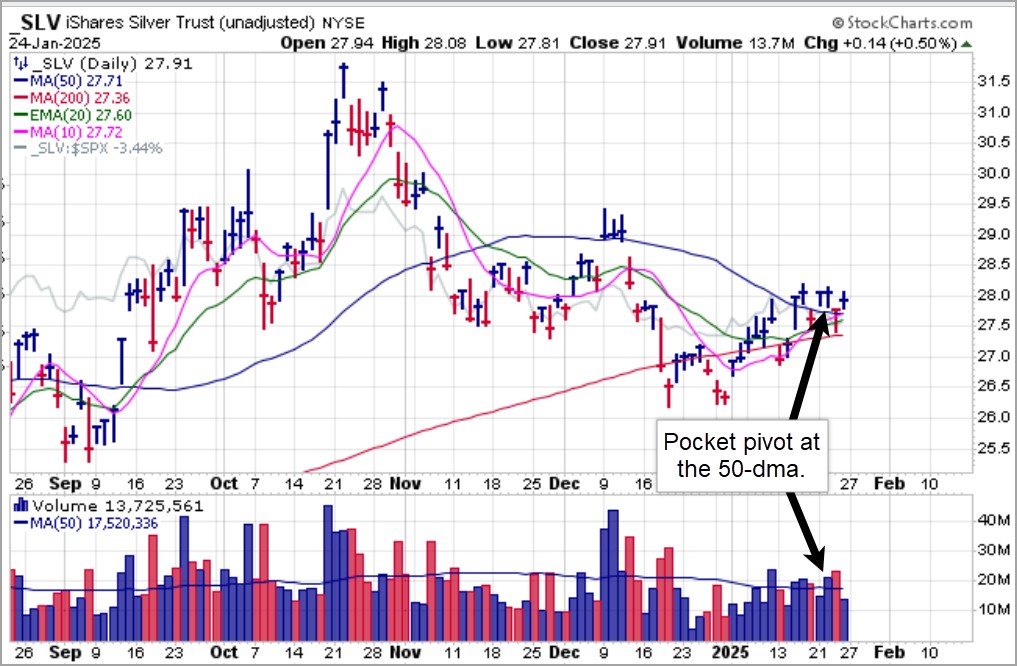

The iShares Silver Trust (SLV) posted a pocket pivot on Wednesday at the 50-dma, its third such pocket pivot at the line over the past seven trading days. However, silver is exhibiting a great deal of volatility as the SLV has broken back below the 50-dma twice over the past five trading days only to recover back above the line each time. It ended Friday just above the 50-dma on light volume as it remains erratic. For now, it appears that the most expedient way to buy SLV is to do so on sharp pullbacks to 200-dma support.

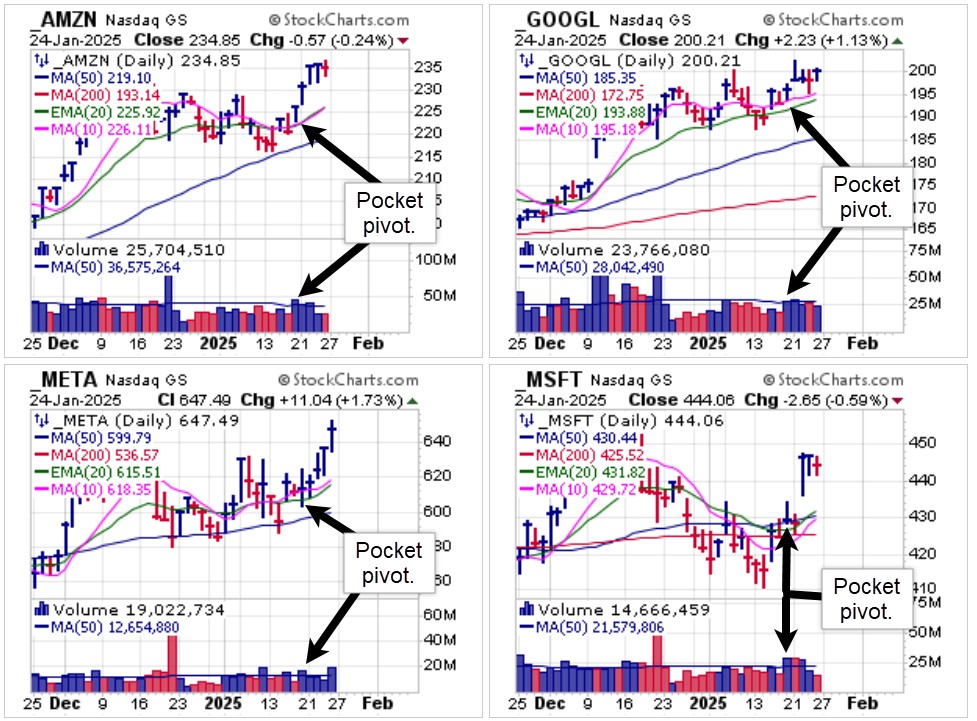

This remains a difficult market where we often see various set-ups fail or act in erratic fashion. Two Fridays ago, on January options expiration, we saw four pocket pivots among big-stock NASDAQ names Amazon.com (AMZN), Alphabet (GOOGL), Meta Platforms (META), and Microsoft (MSFT). Interestingly, all four pocket pivots worked this past week as the stocks pushed to higher highs and are now extended.

This remains a difficult market where we often see various set-ups fail or act in erratic fashion. Two Fridays ago, on January options expiration, we saw four pocket pivots among big-stock NASDAQ names Amazon.com (AMZN), Alphabet (GOOGL), Meta Platforms (META), and Microsoft (MSFT). Interestingly, all four pocket pivots worked this past week as the stocks pushed to higher highs and are now extended.

The market exhibited a certain element of animal spirits this past week as investors were inspired by incoming President Trump's inauguration on Monday. In the process, we have seen some set-ups work but some flounder about or fail to materialize, such as was the case with the potential BGU in NVDA Wednesday morning that faded. Therefore, it is imperative that investors looking to buy BGUs and pocket pivots should seek to keep risk to a minimum by entering as close to a support reference such as the intraday low of a gap-up range in the case of a BGU or the relevant moving average in the case of a pocket pivot. Stay alert!

The Market Direction Model (MDM) switched to a BUY signal on Tuesday, January 21, 2025.