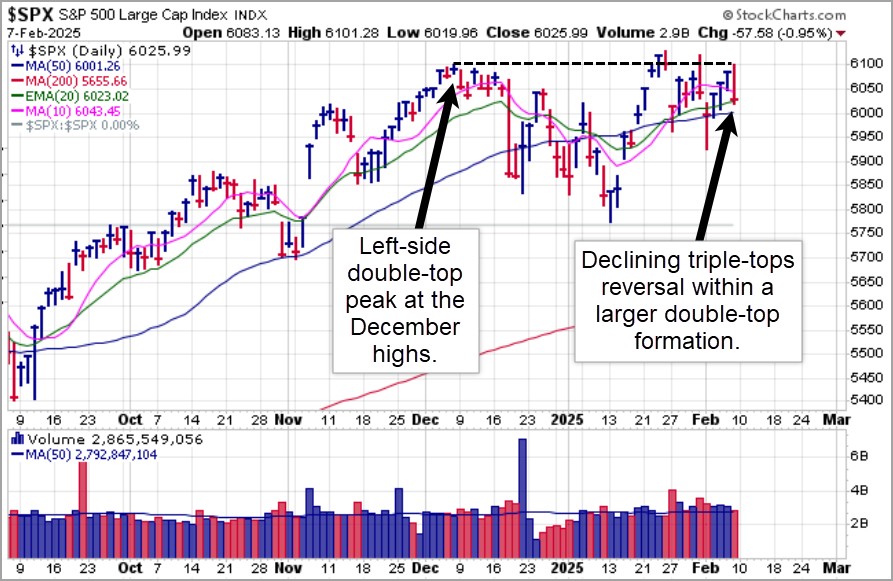

Major market indexes ended the week with a sell-off as a relatively benign jobs number gave way to bearish inflation data from the inflation expectations component in the preliminary February University of Michigan Consumer Sentiment Index which ramped up sharply from 3.3% to 4.3%, the highest levels since November 2023. This sent the indexes reversing into the red as the NASDAQ Composite posted a declining triple-tops reversal.

The S&P 500 Index is in a similar triple-top reversal but also has the additional wrinkle of failing at double-top resistance three times in a row as well, each time doing so on a Friday over the past eleven trading days. Overall, the action remains volatile and trendless, at best, with a bearish tone.

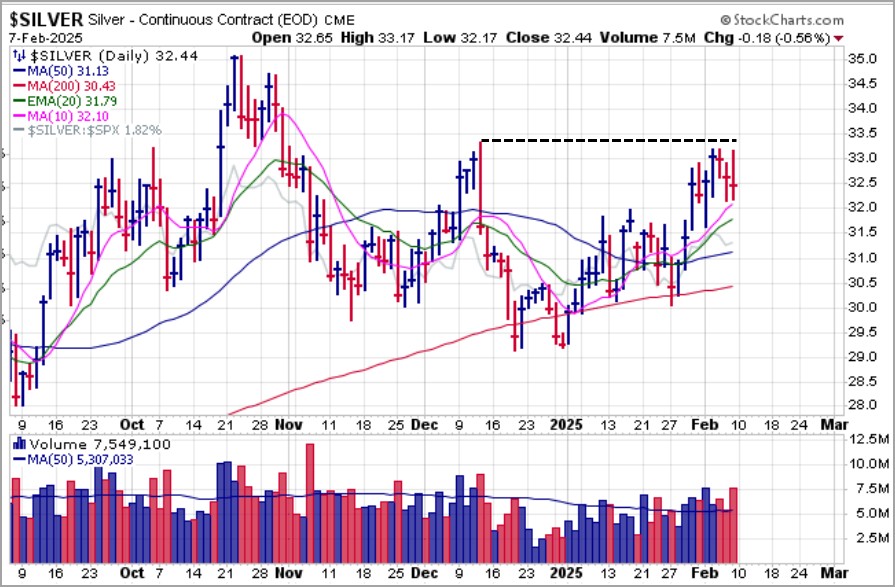

Gold posted a new all-time high on Friday with the nearest futures contract printing $2,910.60 an ounce before backing down to close at $2,887.60 an ounce. Spot gold posted a new record high at $2,885.20 an ounce before settling in to close at $2,861.10. Late in the week several large banks, including Citigroup (C), J.P. Morgan (JPM), and UBS Securities (UBS) got roaringly bullish on gold and gold miners. This comes after a sharp nearly parabolic run in the yellow metal off the mid-December lows and strikes us as some very late and suspect enthusiasm after a big prior price move.

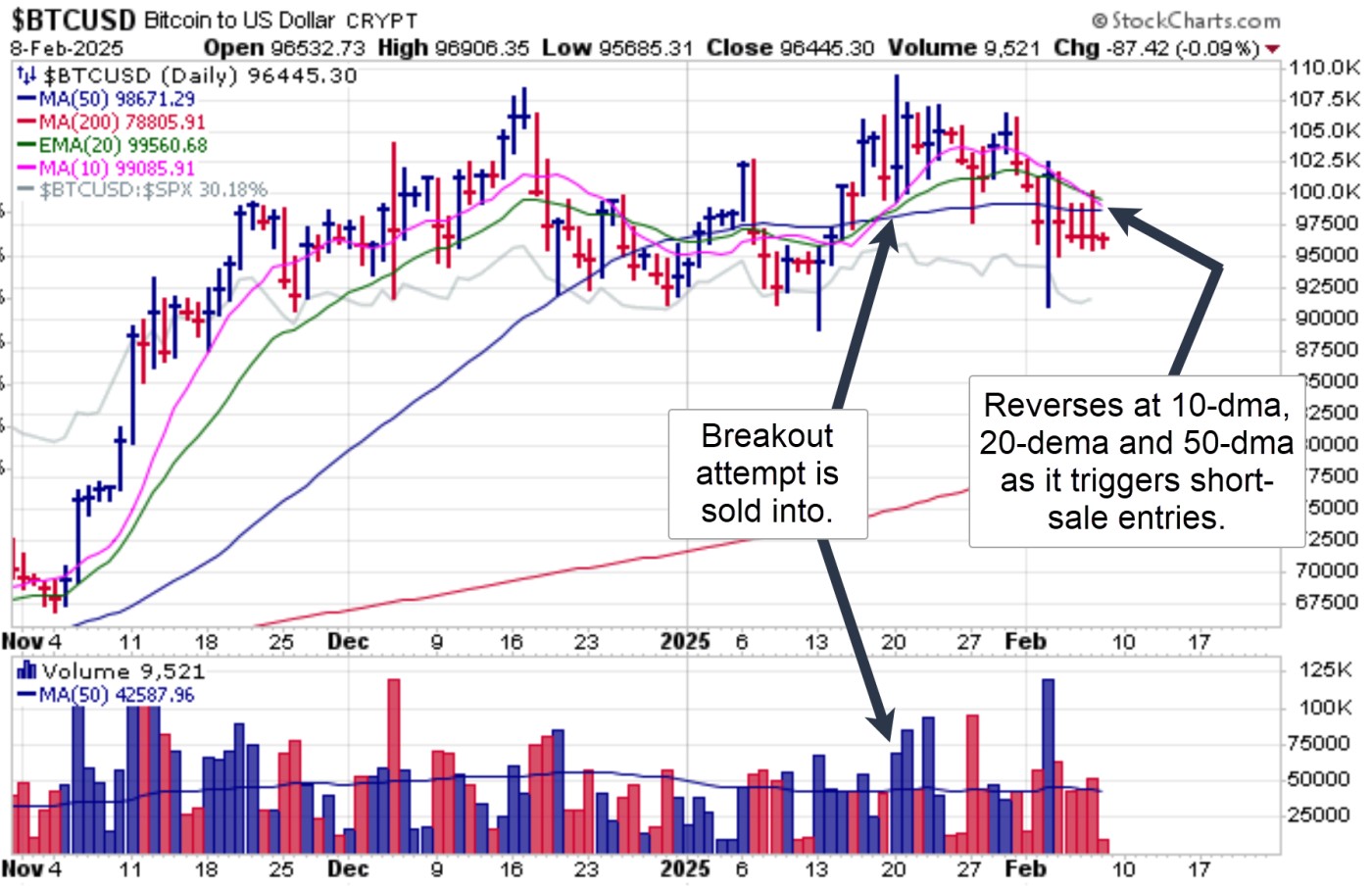

Bitcoin ($BTCUSD) holders are losing patience as the crypto-community awaits some sort of crypto-coddling legislative initiative from the new Trump Administration. So far, nothing concrete has been proposed, and so $BTCUSD is again acting like a late-stage failed-base (LSFB) short-sale set-up in progress. Following a failed breakout on January 20th, King Crypto is now starting to live below its 50-day moving average as it reversed Friday along the 10-dma, 20-dema, and finally the 50-dma before closing below the 50-day.

Bitcoin ($BTCUSD) holders are losing patience as the crypto-community awaits some sort of crypto-coddling legislative initiative from the new Trump Administration. So far, nothing concrete has been proposed, and so $BTCUSD is again acting like a late-stage failed-base (LSFB) short-sale set-up in progress. Following a failed breakout on January 20th, King Crypto is now starting to live below its 50-day moving average as it reversed Friday along the 10-dma, 20-dema, and finally the 50-dma before closing below the 50-day. The Magnificent Seven, Apple (AAPL), Amazon.com (AMZN), Alphabet (GOOGL),Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA), known as the Mag 7 for short, have become the Lag 7. Here we see five of the seven names breaking lower on Friday. AAPL triggered a short-sale entry as it reversed at 10-dma and 20-dema resistance on Friday while AMZN slashed through 20-dema support after earnings. GOOGL, which gapped down to the 50-dma on Wednesday after earnings, triggered another short-sale entry at the 50-dma on Friday.

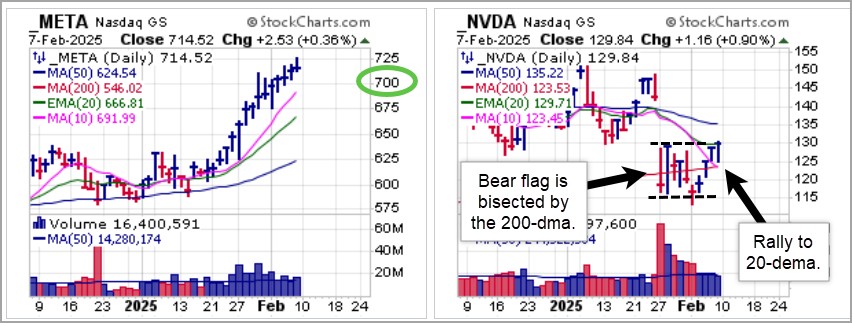

The Magnificent Seven, Apple (AAPL), Amazon.com (AMZN), Alphabet (GOOGL),Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA), known as the Mag 7 for short, have become the Lag 7. Here we see five of the seven names breaking lower on Friday. AAPL triggered a short-sale entry as it reversed at 10-dma and 20-dema resistance on Friday while AMZN slashed through 20-dema support after earnings. GOOGL, which gapped down to the 50-dma on Wednesday after earnings, triggered another short-sale entry at the 50-dma on Friday. The other two components of the Mag 7, Meta Platforms (META) and Nvidia (NVDA) both traded to the upside on Friday but only META remains in an uptrend, up 15 days in a row. NVDA rallied into its 20-dema and the top of a short two-week bear flag that is bisected by the 200-dma. META sits 2% above the $700 Century Mark and is theoretically within buying range of a Jesse Livermore Century Mark long entry using $700 as a selling guide. If it then busts the $700 Century Mark it would transform into a potential Livermore Century Mark short-sale entry trigger using the same Century Mark as a covering guide.

The other two components of the Mag 7, Meta Platforms (META) and Nvidia (NVDA) both traded to the upside on Friday but only META remains in an uptrend, up 15 days in a row. NVDA rallied into its 20-dema and the top of a short two-week bear flag that is bisected by the 200-dma. META sits 2% above the $700 Century Mark and is theoretically within buying range of a Jesse Livermore Century Mark long entry using $700 as a selling guide. If it then busts the $700 Century Mark it would transform into a potential Livermore Century Mark short-sale entry trigger using the same Century Mark as a covering guide. On Friday we reported on several semiconductor names as short-sale set-ups. Members should refer to the Short-Sale Set-Up report from that day, but among the names on which we reported we can see memory-chip makers Micron Technology (MU) and Western Digital Corp. (WDC) setting up as shorts on Friday as they reversed at or near 50-dma resistance. Both stocks were short entries at the 50-dma on Thursday as well, and then both triggered secondary short entries as they closed below their 20-dema on Friday.

On Friday we reported on several semiconductor names as short-sale set-ups. Members should refer to the Short-Sale Set-Up report from that day, but among the names on which we reported we can see memory-chip makers Micron Technology (MU) and Western Digital Corp. (WDC) setting up as shorts on Friday as they reversed at or near 50-dma resistance. Both stocks were short entries at the 50-dma on Thursday as well, and then both triggered secondary short entries as they closed below their 20-dema on Friday.  We reiterate: this is a difficult environment better suited to nimble swing-traders looking to capitalize on quick trading opportunities while intermediate-term, trend-following investors are likely better off standing aside for now.

We reiterate: this is a difficult environment better suited to nimble swing-traders looking to capitalize on quick trading opportunities while intermediate-term, trend-following investors are likely better off standing aside for now.The Market Direction Model (MDM) switched to a CASH/NEUTRAL signal on Friday, February 7, 2025.