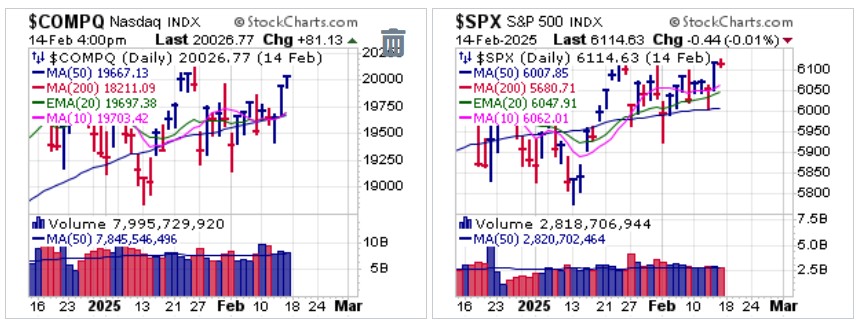

Major market indexes have rallied back up to prior December and/or January highs, but the market remains in a trendless, choppy range.

The upside movement has mostly been led by NASDAQ 100 names, as the equal-weighted S&P 500 Index shows that outside of a handful of big-stock NASDAQ and tech names, the broader S&P continues to lag.

The SPDR Sector Select Technology (XLK) ETF reflects the choppy nature of the influential tech sector as it mostly swings up and down in a relatively wide range. Whether this is enough to spark a new general market uptrend remains unclear at best, doubtful at worst.

The SPDR Sector Select Technology (XLK) ETF reflects the choppy nature of the influential tech sector as it mostly swings up and down in a relatively wide range. Whether this is enough to spark a new general market uptrend remains unclear at best, doubtful at worst.

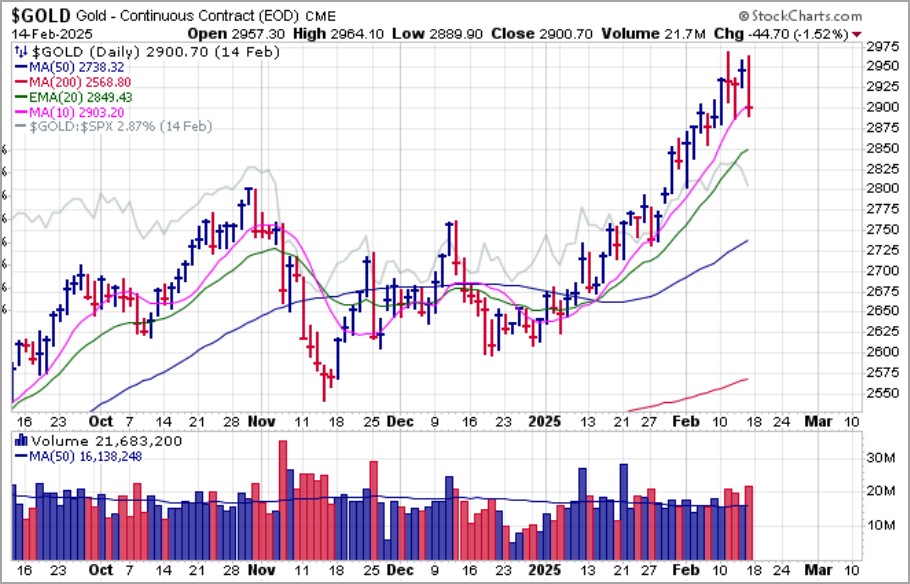

Gold posted fresh all-time highs this past week with the near-term futures contract hitting $2968.50 an ounce on Tuesday. It is now quite extended in a near vertical run throughout the young New Year so far. Calls for an audit of Fort Knox amid doubts that the alleged 4,850 metric tons of gold stored by the U.S. does not exist are growing. All we know for sure is that past audits of Ft. Knox amounted to little more than a photo opportunity back in 1974 where only 5% of the total amount of gold allegedly owned by the U.S. was shown on camera. This should be an interesting story to follow as calls for an audit grow. Technically, we would look for support in the 2850-2900 range.

Meanwhile, Bitcoin ($BTCUSD) has lost upside momentum as the Trump Administration appears to have lost interest in pursuing crypto-related legislation. It is now living below its 50-dma but overall remains in a very long and choppy sideways pattern that can also be interpreted as a late-stage failed-base following the failed breakout of mid-January as we discussed last week. Whatever the case, it will likely need a catalyst if it is to eventually and decisively clear to new highs. Barring that, it certainly gives the appearance of a short-sale here just below what is now 50-dma resistance as any long entry set-ups remain absent for now.

With the market remaining quite choppy and trendless, it is difficult to pound the table on anything, long or short. Most set-ups results in short moves in one direction or the other, but for the most part sustained trends fail to materialize. This is also reflected by the choppy index action. Thus, in an environment where there is little to do, especially with any conviction, then one should do little unless one wishes to engage in very short-term swing-trading, even day-trading. There are certainly times when patience is a virtue, a virtue of selfish investing, we could say, and mid-February 2025 appears to be one of them.

The Market Direction Model (MDM) switched to a BUY signal on Friday, February 14, 2025.