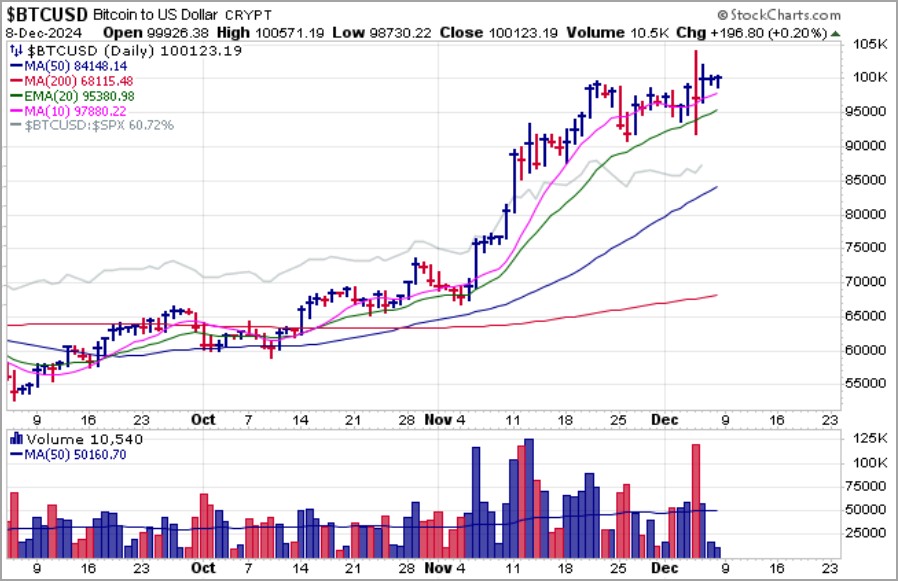

The big event of the week was clearly Bitcoin's ($BTCUSD) breakout through the $100,000 level on Thursday. That did not last long, however, as it then spun to the downside before posting a low of $91,741.97 as it shook out along 20-dema support and then closed Thursday just above 10-dma support. Another move through the $100k level was seen again on Friday as volume receded, but for now the short flag breakout is back in force as $BTCUSD holds tight along the $100k level all weekend long.

Crypto-related stocks that we have reported on over the past four weeks have had their share of ups and downs as they tend to magnify the volatility of $BTCUSD. Hut 8 Mining (HUT) has remained the most solidly trending name of the bunch, consistent with prior reports of ours, as it quickly recovered from a near failure on last week's flag breakout, shaking out at the 10-dma and recovering to new highs. If attempting to play these names, as long as the trend in $BTCUSD holds, one should seek to act opportunistically, looking to buy on pullbacks or shakeout as moving average support, as one can easily assess from studying these charts.

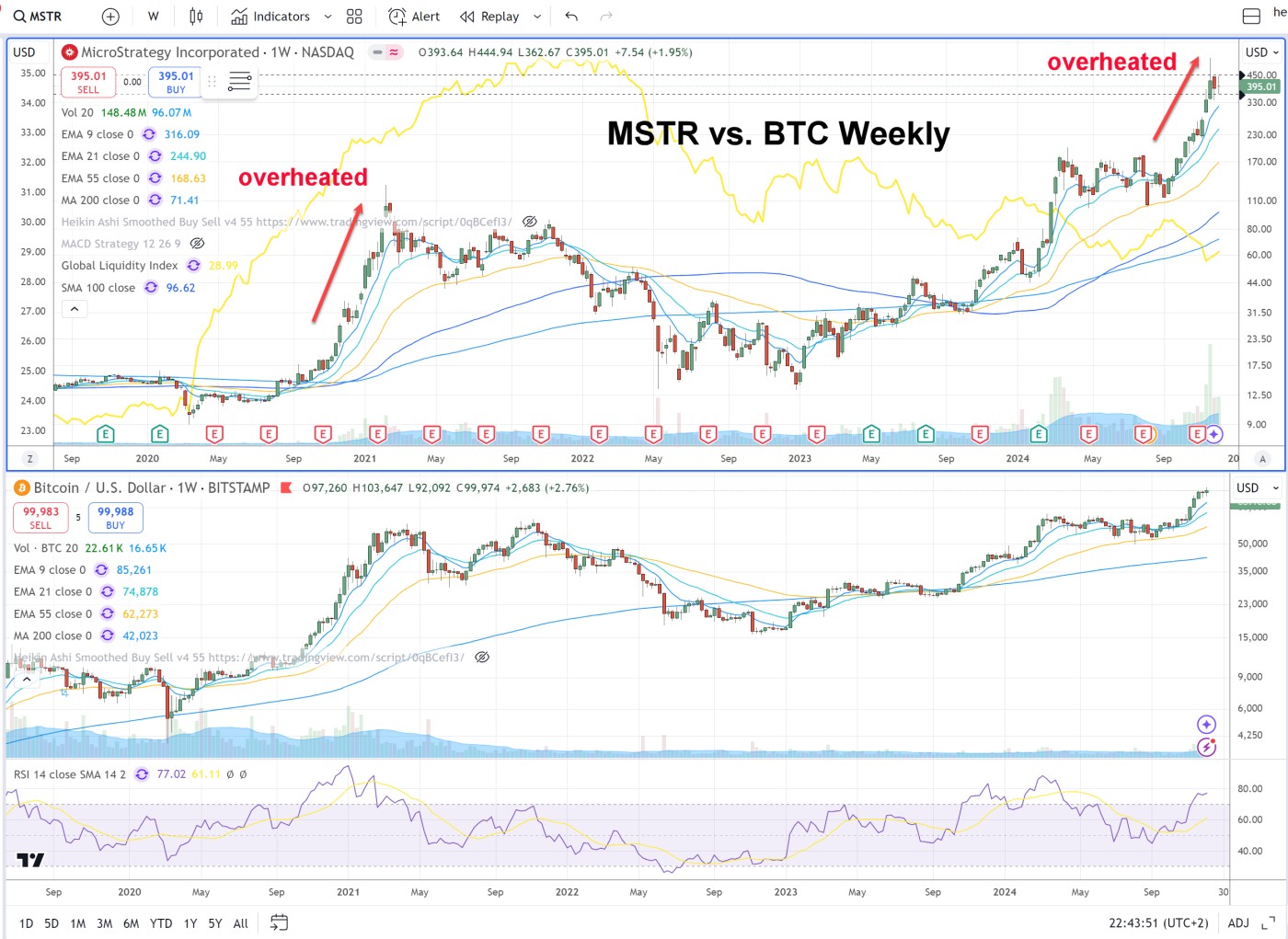

Microstrategy (MSTR) has been perhaps the most volatile of the Bitcoin-related stocks as what is essentially a hoarder of King Crypto. It is also representative of the speculative fever that can overcome the space from time to time as investors piled into this in November, despite the fact that its market capitalization valued its Bitcoin holdings at approximately 3 times the current price. Countering this, $MSTR announced that it issued more debt at 0% interest to purchase $5.4 billion worth of Bitcoin at an average cost of $97,862 per coin in November. MicroStrategy uses borrowed capital, or "intelligent leverage," to build its Bitcoin reserves. Saylor has devised a number of other ingenious income streams using BTC as the anchor such as capitalizing on the high volatility of MicroStrategy's stock which Saylor sees as an opportunity for quick trades. In consequence, expect a strong correlation between MSTR and BTC to continue as it has since 2020. That said, MSTR tends to overshoot on the upside during periods of froth as it did in early 2021, then while it continued to correlate with BTC, it had to digest its excess price climb so never returned to old highs later in 2021 despite BTC reaching new highs for a brief moment. It recently had such a period so will take some time to digest its recent runup and steep correction, but if history is any guide, it should continue to correlate with BTC so expect new highs from MSTR after perhaps much backing and filling even as BTC trends higher.

Over the past four weeks, money flows into crypto-currencies reached $11 billion in November, an all-time record. which implies that MSTR was responsible for half of the buying in November.

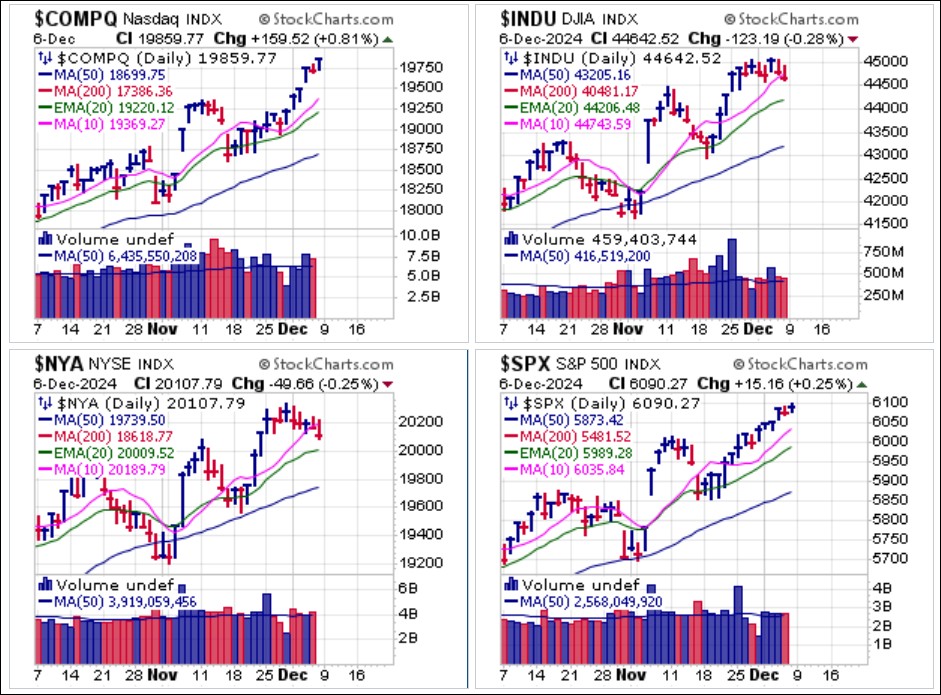

The six-digit breakout in $BTCUSD even overshadowed new highs in the NASDAQ Composite and the S&P 500 Indexes. After a benign jobs report on Friday, the tech-centric indexes moved higher. The S&P, while it did post a new closing high stalled and churned on Friday as the Dow and the NYSE Composite both rolled over and broke 10-dma support. This is representative of what is going on under the surface of the market as a handful of techs lead the tech-centric indexes higher while a number of economically sensitive groups, including industrial metals, transportation, including shippers and rails, oils, homebuilders, automakers, etc. roll over and play out mostly as short-sale targets.

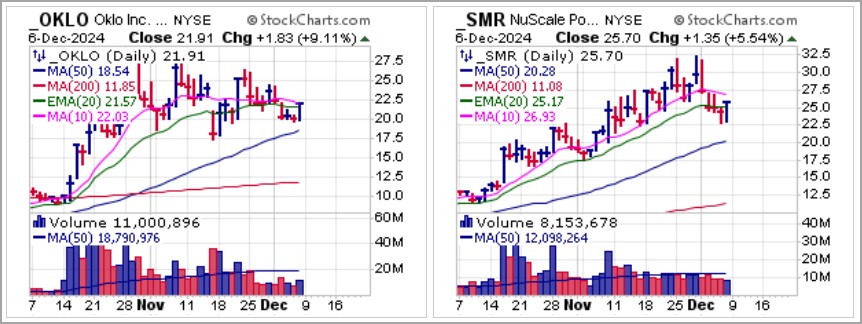

Both Oklo (OKLO) and NuScale Power (SMR), two small modular nuclear reactor makers that we have reported on several times previously, posted moving average undercut & rally (MAU&R) long entry triggers at their 20-demas. These would be actionable using the 20-dema as a selling guide. Keep in mind that these names tend to be volatile, so position-size accordingly.

AST Spacemobile (ASTS) has been basing for the past 16 weeks and may be trying to round out the lows of a new base. In this regard we would look for clues in the form of pocket pivots along the lows. On Friday, ASTS posted a pocket pivot as it cleared its 10-dma, 20-dema, and 50-dma. It has had two similarly strong moves through 50-dma resistance within this base, so we would look for this one to hold 50-dma support if it is to succeed in any meaningful way.

Strong action in techs like telecoms and cloud software names has given the market a bifurcated feel under the surface as other areas of the market flounder. This remains a challenging environment, and we can look forward to CPI and PPI inflation data reports on Wednesday and Thursday, respectively, as potential catalysts for the market this coming week.

The Market Direction Model (MDM) remains on a BUY signal.