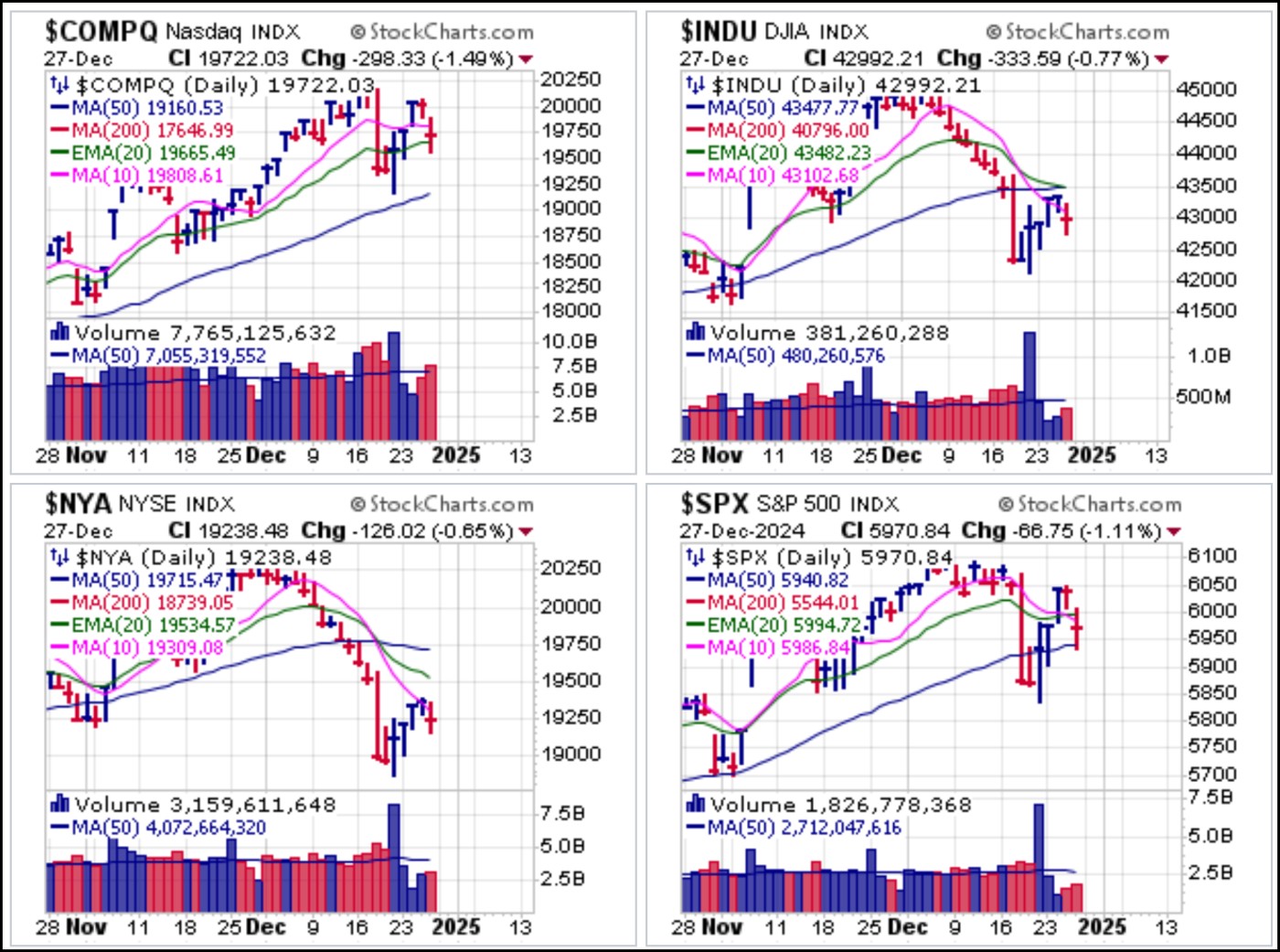

Major market indexes started the week off with a continuation of the Santa Claus Rally that began two Fridays ago on the final, quad-witching options expiration day of 2024 before succumbing to selling in the second half of the week. As we head into the final two trading days of 2024, the NASDAQ Composite and S&P 500, both with a more tech-centric flavor, are holding up at 20-dema support while the less tech-centric Dow and broad NYSE Composite languish well below their 50-day moving averages.

As the Fed has cut the Fed Funds Rate by a full 1% in the fourth quarter of 2024, the long end of the yield curve, as represented by the 10-Year Treasury Yield ($TNX) has rallied a full 1.00%.

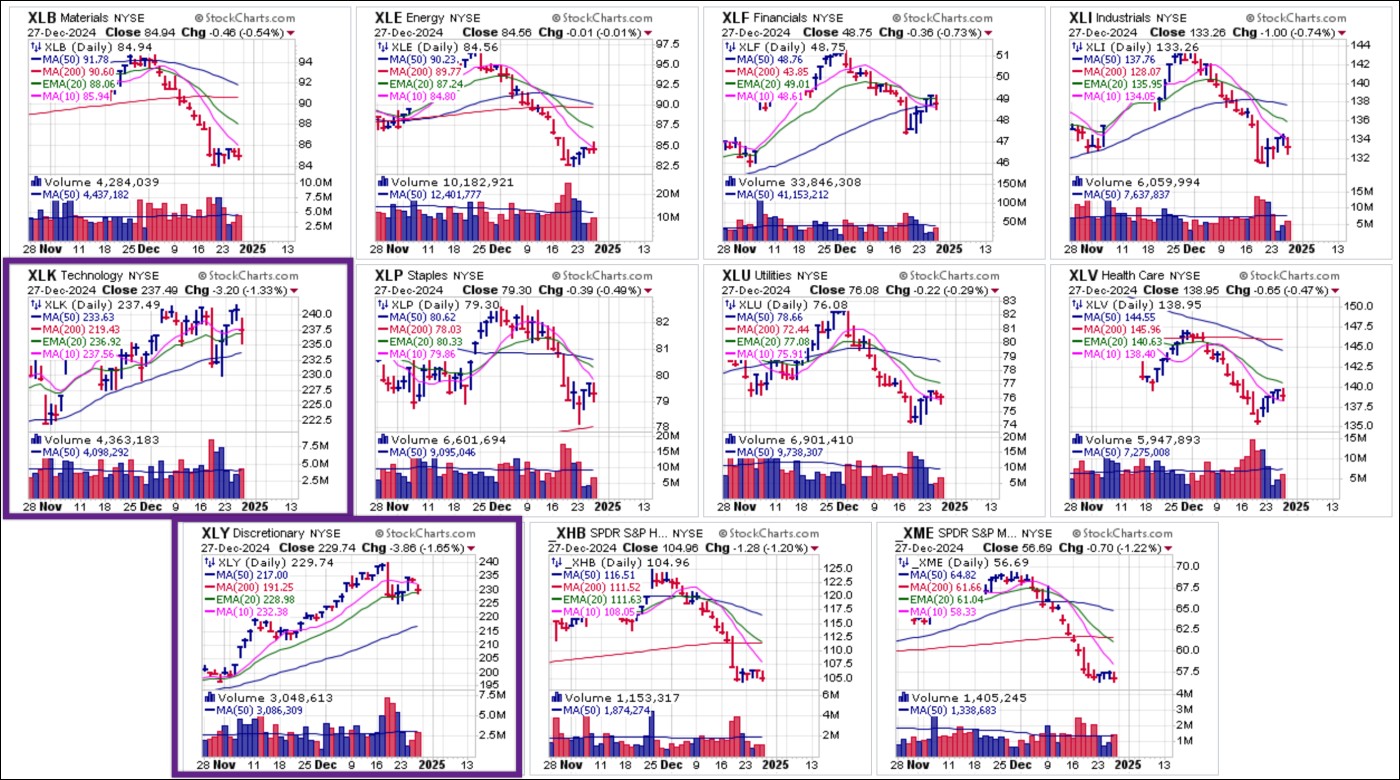

The sector ETF group chart below starkly illustrates the current state of the market - as big-stock techs and discretionary hold near recent highs, the rest of the market has been in a 4-5 week downtrend. As this extreme breadth divergence plays out the question becomes exactly how it resolves, or whether it ever resolves at all. One could argue that laggard groups shown below could rally as techs and discretionary roll over, creating a breadth inversion. As we begin the New Year this could be the critical question for the market to answer.

The sector ETF group chart below starkly illustrates the current state of the market - as big-stock techs and discretionary hold near recent highs, the rest of the market has been in a 4-5 week downtrend. As this extreme breadth divergence plays out the question becomes exactly how it resolves, or whether it ever resolves at all. One could argue that laggard groups shown below could rally as techs and discretionary roll over, creating a breadth inversion. As we begin the New Year this could be the critical question for the market to answer. Bitcoin ($BTCUSD) dropped below 50-dma support on Friday but remains above price support along the $91,000-$92,000 price zone and the neckline of a fractal head and shoulders formation. We would not draw firm conclusions either way, however, since price support can hold up better than moving average support where the moving average is rising sharply as it catches up with $BTCUSD's big move in November. A more likely scenario would be a period of basing as the market discovers precisely what pro-crypto policies the new Trump Administration will be able to push through once it is in power.

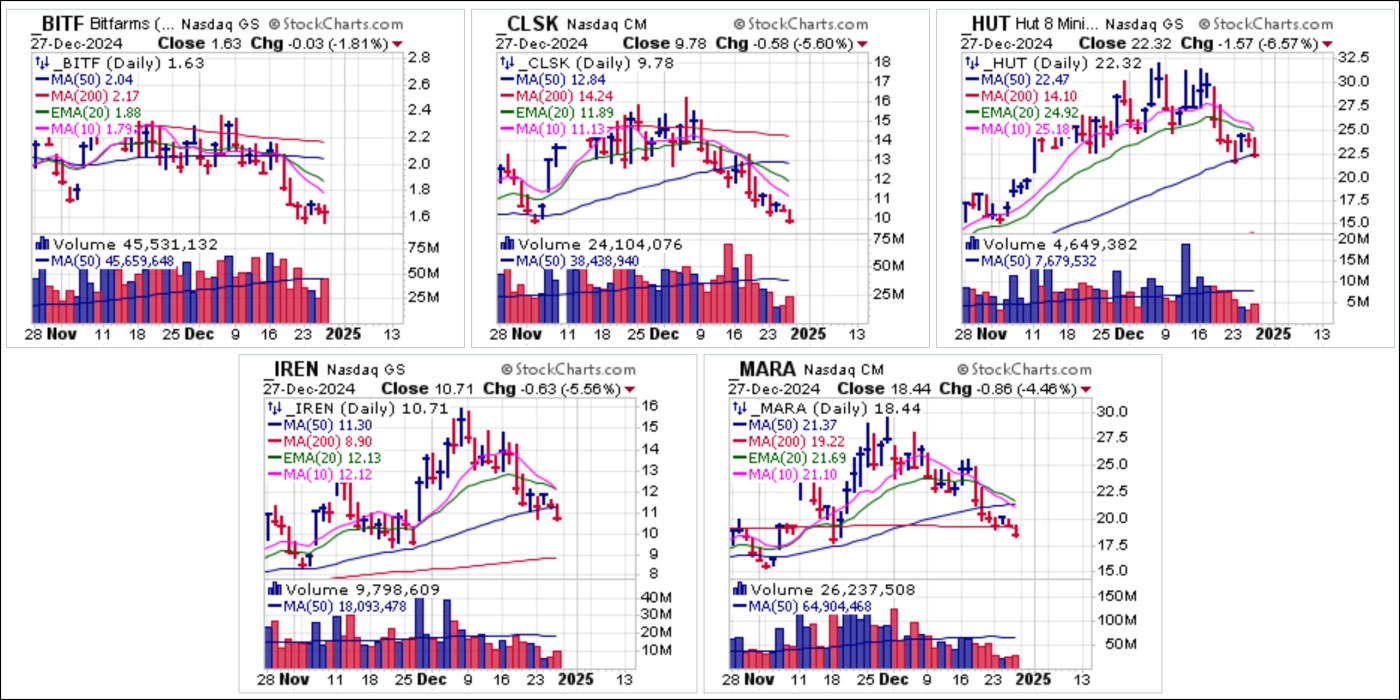

Bitcoin ($BTCUSD) dropped below 50-dma support on Friday but remains above price support along the $91,000-$92,000 price zone and the neckline of a fractal head and shoulders formation. We would not draw firm conclusions either way, however, since price support can hold up better than moving average support where the moving average is rising sharply as it catches up with $BTCUSD's big move in November. A more likely scenario would be a period of basing as the market discovers precisely what pro-crypto policies the new Trump Administration will be able to push through once it is in power. Crypto-related stocks which we reported on when $BTCUSD began its latest up leg following the election in early November have all died on the vine. Here we can see that Bitfarms Ltd. (BITF), CleanSpark (CLSK), and Marathon Digital Holdings (MARA) were all potential short-sale entry triggers at 50-dma resistance last week if one was not insistent on being a perma-bull in the space based solely on the price action of $BTCUSD which has performed far better. Relative to their own all-time highs, these names have lagged badly. Now we see Iris Energy (IREN) and Hut 8 Mining (HUT) both joining the other three below 50-dma support on Friday.

Crypto-related stocks which we reported on when $BTCUSD began its latest up leg following the election in early November have all died on the vine. Here we can see that Bitfarms Ltd. (BITF), CleanSpark (CLSK), and Marathon Digital Holdings (MARA) were all potential short-sale entry triggers at 50-dma resistance last week if one was not insistent on being a perma-bull in the space based solely on the price action of $BTCUSD which has performed far better. Relative to their own all-time highs, these names have lagged badly. Now we see Iris Energy (IREN) and Hut 8 Mining (HUT) both joining the other three below 50-dma support on Friday.

The Market Direction Model (MDM) remains on a BUY signal.