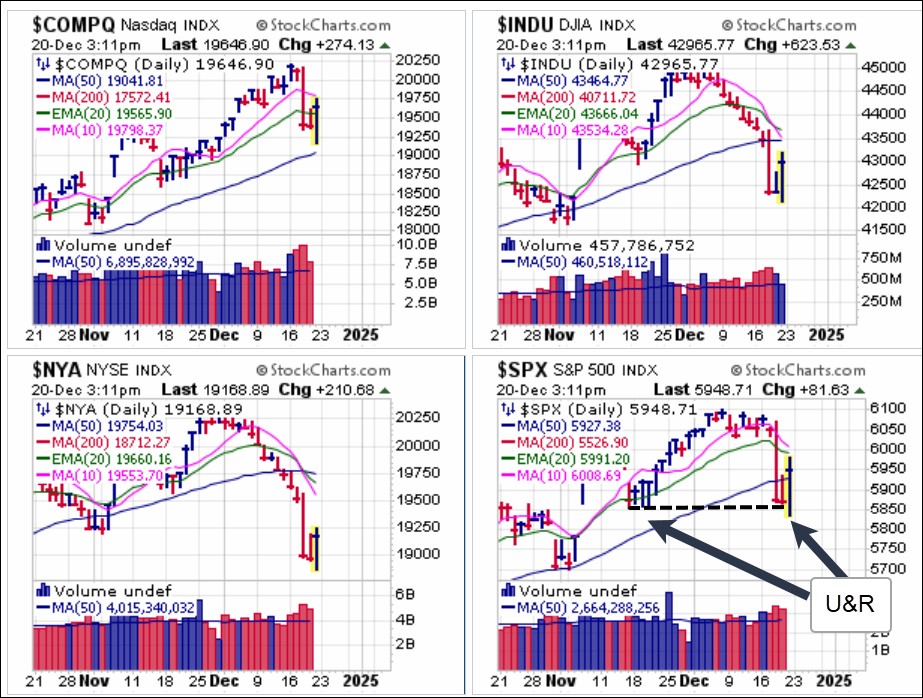

Major market indexes were smashed on Wednesday following the Fed's policy announcement that feature a hawkish rate cut with the Fed cutting rates 1/4% as expected, but lowering the number of rate cuts for 2025 to only two from a previous four. Fed Chairman Jerome Powell continued to beat a hawkish drum during his press conference, sending the NASDAQ Composite down a whopping 716.37 points and the Dow down 1,123.04 points on heavy selling volume

While the Dow had already been trending lower, along with the broad NYSE Composite Index, down for nine days in a row ahead of the Fed announcement, the NASDAQ literally fell out of bed after posting a new all-time high on Tuesday, closing that day at 20,109.06. Friday's year-end quadruple-witching saw the indexes engage in a very sharp, even violent oversold rally following a light PCE inflation number where both core and headline PCE posted 0.1% Month-over-Month moves vs. expectations of 0.2%. That said, the market was somewhat oversold heading into Friday as futures sold off hard overnight before the market found its feet and turned hard off the morning lows.

Friday's year-end quadruple-witching saw the indexes engage in a very sharp, even violent oversold rally following a light PCE inflation number where both core and headline PCE posted 0.1% Month-over-Month moves vs. expectations of 0.2%. That said, the market was somewhat oversold heading into Friday as futures sold off hard overnight before the market found its feet and turned hard off the morning lows.We have been warning in previous Focus List Review reports the market was showing extreme bifurcation as a handful of big-stock NASDAQ names led the tech-centric indexes to all-time highs while the less tech-centric indexes, such as the Dow and NYSE Composite below were already expressing the weakness seen in a variety of other areas of the market.

As we wrote last weekend, "The indexes illustrate to some extent the ever-narrowing market leadership that has become concentrated in a small handful of big-stock tech names while more economically-sensitive areas of the market like industrial metals, machinery, railroads, automakers, shippers, homebuilders, and oils, among others continue to trend lower."

The stock market's decidedly risk-off attitude on Wednesday spread into Bitcoin ($BTCUSD) as it sold down over 10% from its high of early in the week to test 50-dma support. It held support at the line, but has broken its pattern of holding 20-dema support. For now, the bloom may be off the rose as Big Crypto awaits concrete policy actions from the incoming Trump Administration once they come into power in late January. Meanwhile, 50-dma support may prove to be critical as any failure to hold the line could have seriously negative consequences.

Clearly, the market mood has turned cautionary amid a more hawkish Fed policy announcement on Wednesday while cross-currents remain, such as the light PCE inflation data seen on Friday. Things may slow down heading into the Christmas Holiday next Wednesday as we head into the final six trading days of 2024. For now, extreme caution is advised.

The Market Direction Model (MDM) remains on a BUY signal.