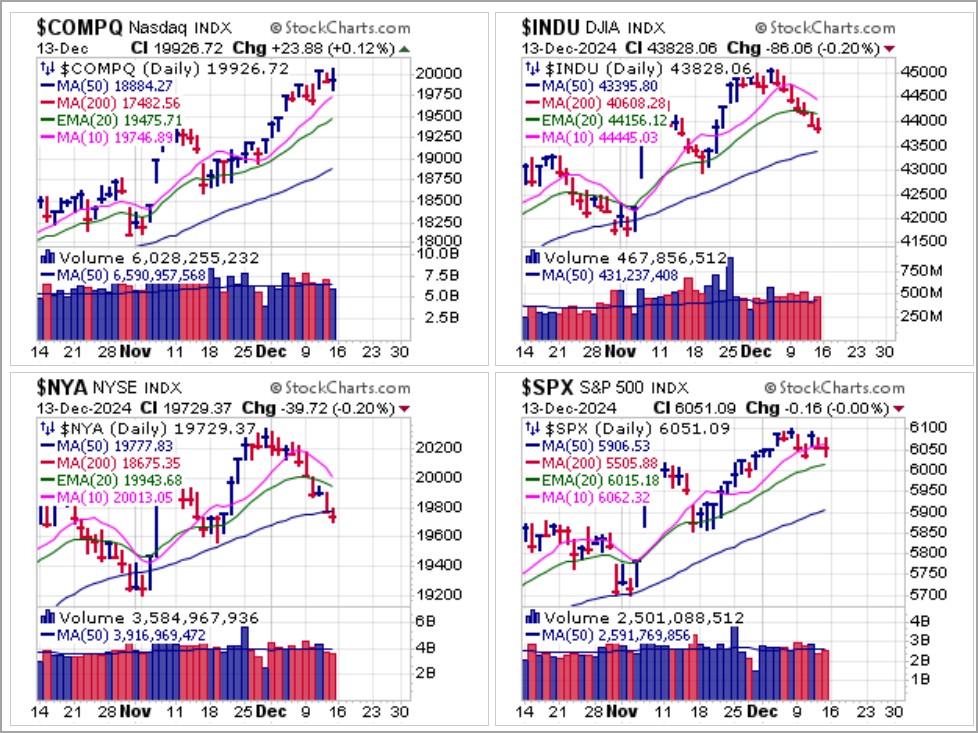

Major market indexes finished the week in bifurcated fashion as the tech-centric NASDAQ Composite cleared the 20,000 level for the first time on Wednesday but fell back below by week's end as it stalled and churned on Friday. The S&P 500, which is less tech-centric but still carries a large tech weighting, stalled and churned along 10-dma support before closing below it. The broader market as represented by the NYSE Composite Index has been trending lower for the past two weeks and closed below 50-dma support on Friday in a bearish development, while the Dow posted its seventh straight down day on Friday to close further below 20-dema support.

The indexes illustrate to some extent the ever-narrowing market leadership that has become concentrated in a small handful of big-stock tech names while more economically-sensitive areas of the market like industrial metals, machinery, railroads, automakers, shippers, homebuilders, and oils, among others continue to trend lower.

CPI data on Wednesday came in as expected at 0.3% on both the headline and core numbers while Thursday's PPI slightly rattled the market as headline PPI printed 0.4% vs. expectations of a 0.3% Month-over-Month number. Despite the Fed's attempts to spin it as disinflation, price levels continue to rise as inflation persists. Yet, they are still expected to lower interest rates by 1/4% when they release their latest policy announcement this Wednesday.

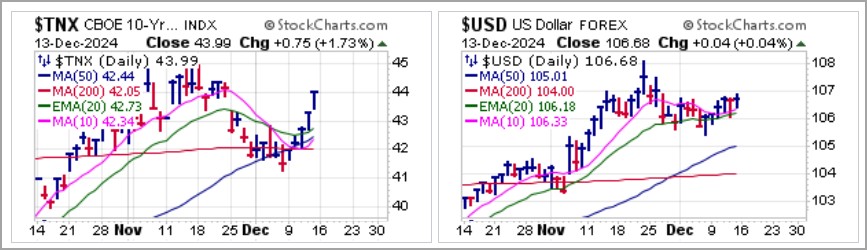

While short-term rates moved lower in anticipation of the coming rate cut, longer-term interest rates like the 10-Year Treasury Yield ($TNX) appear to be anticipating higher inflation going forward as the $TNX has rebounded to 4.399%. This has also kept the U.S. Dollar ($USD) buoyant along 20-dema support.

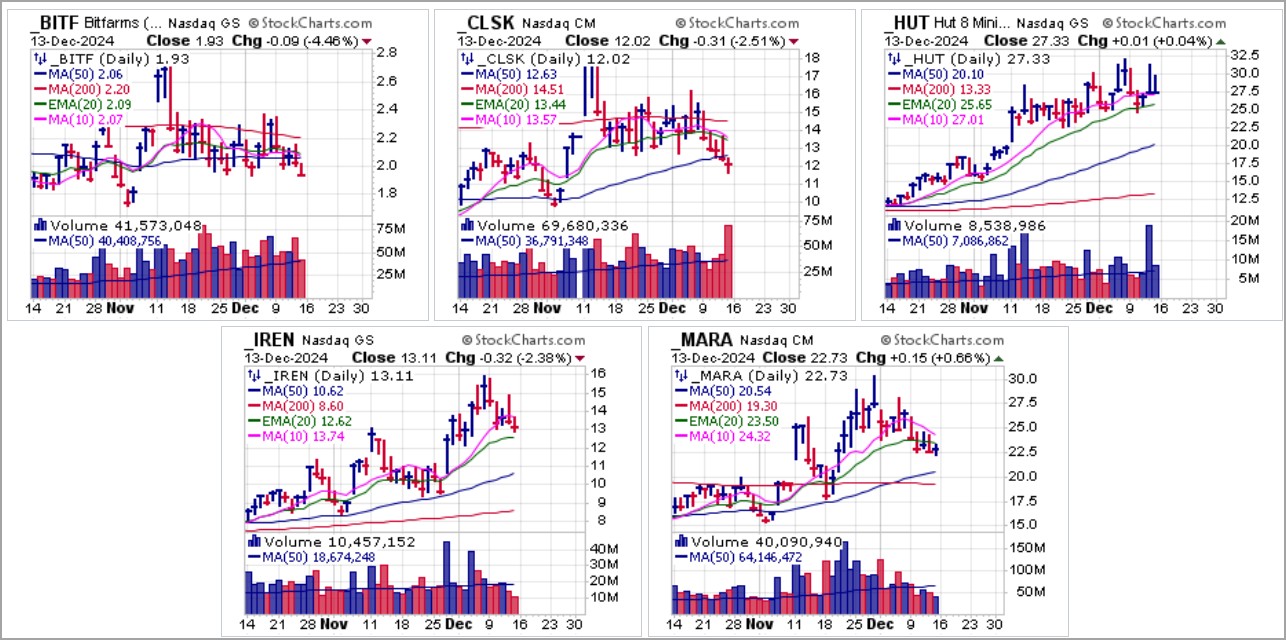

Much of the excitement over Bitcoin ($BTCUSD) after the election on hopes of a crypto-friendly administration coming into the White House has dissipated, as $BTCUSD hangs along the $100,000 level. This past week it has slowly crept back up to the intraday highs of two weeks ago as volume declines in what is essentially wedging action. For now, King Crypto continues to hold 10-dma and 20-dema support as the uptrend remains intact.

Much of the excitement over Bitcoin ($BTCUSD) after the election on hopes of a crypto-friendly administration coming into the White House has dissipated, as $BTCUSD hangs along the $100,000 level. This past week it has slowly crept back up to the intraday highs of two weeks ago as volume declines in what is essentially wedging action. For now, King Crypto continues to hold 10-dma and 20-dema support as the uptrend remains intact.

As $BTCUSD remains solidly above the $100,000, crypto stocks we have reported on over the past several weeks have become something of a hot mess. Among these five, below, we can see that Bitfarms Ltd. (BITF), CleanSpark (CLSK) and Marathon Digital Holdings (MARA) have triggered short-sale entries as they break below moving average support. It has been much easier to make money directly in $BTCUSD rather than playing around with these stocks which tend to behave in erratic fashion. Meanwhile, Hut 8 Mining (HUT) is attempting to hold a recent flag breakout, but should it break 20-dema support it could morph into a short-sale target, as would also be the case for Iris Energy (IREN) as it moves towards 20-dema support, so can be watched for.

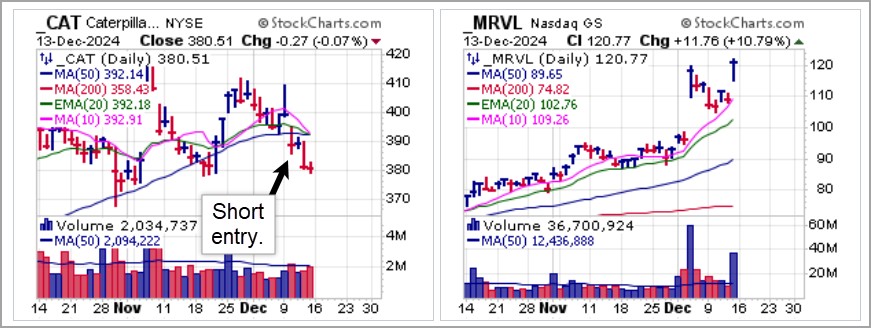

This has been a difficult environment as we sometimes get the impression that pocket pivots on the long side and short-sale set-ups tend to have a short half-life, failing or reversing relatively quickly as the market environment remains somewhat choppy and sloppy beneath the surface. We did catch a couple this week, one short and one long, however, when we reported on Caterpillar (CAT) as a short-sale entry as it dropped below 50-dma support and Marvell Technology (MRVL) as U&R long set-up along its prior BGU intraday low on Thursday, and the stock reacted strongly to Broadcom (AVGO) earnings on Friday with a continuation move higher.

On Monday we reported on silver via the iShares Silver Trust (SLV) as a big-volume pocket pivot along the 50-dma. That move stalled but the pocket pivot remained in force as the SLV posted two more similarly stalling pocket pivots at the 50-dma over the next two days on strong volume. On Thursday, the upside surprise in headline PPI put pressure on both gold and silver as they broke sharply lower, sending the SLV on a test of the prior October and November lows.

This remains a difficult environment as the market bifurcates between a handful of big-stock techs and everything else. We have seen this before where the inflation megatrend marches on dragging up big tech and major tech-focused indices, leaving the rest to lag behind. The broad selling in more economically-sensitive areas of the market is quite stark in some sectors which have effectively been in a bear market for the past two to three weeks.

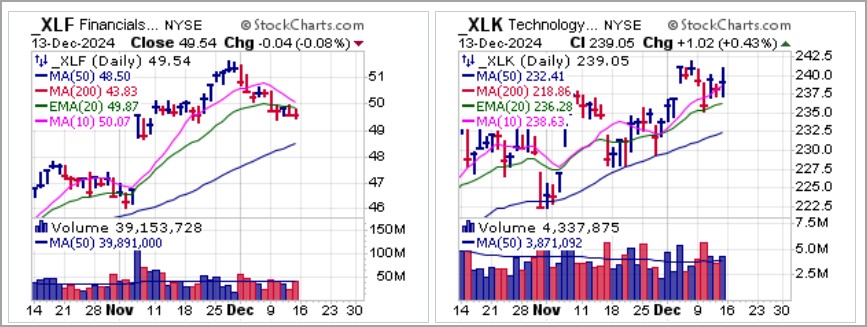

Will techs begin to lose their grip as one of the better-performing areas of the market since the election? Financials have been another strong-performer on hopes of banking deregulation, but we note that the SPDR Select Sector Financials (XLF) ETF is now starting to show signs of rolling over as it dips and holds below 20-dema support.

Wednesday could be a pivotal day for the market as we learn whether the Fed is now done with its current easing cycle which has been something of a paradox of sorts as they have lowered rates amid what they claim out of the other side of their mouth is a strong economy. The action in economically-sensitive areas of the market would seem to argue otherwise, leaving the possibilities open for Wednesday. We advise vigilance and caution.

The Market Direction Model (MDM) remains on a BUY signal.