Major market indexes continued to slump with the NASDAQ Composite posting six down days in a row. While last weekend's Iranian attack on Israel might have created some trepidation for the market, on Friday the situation appeared to have diminished significantly after Israel conducted a mostly theatrical retaliatory attack on Iran. Nevertheless, stocks continued to sell off with AI Meme and other big-stock techs taking the brunt of the selling as the NASDAQ Composite cascades lower with potential support levels still far below Friday's close.

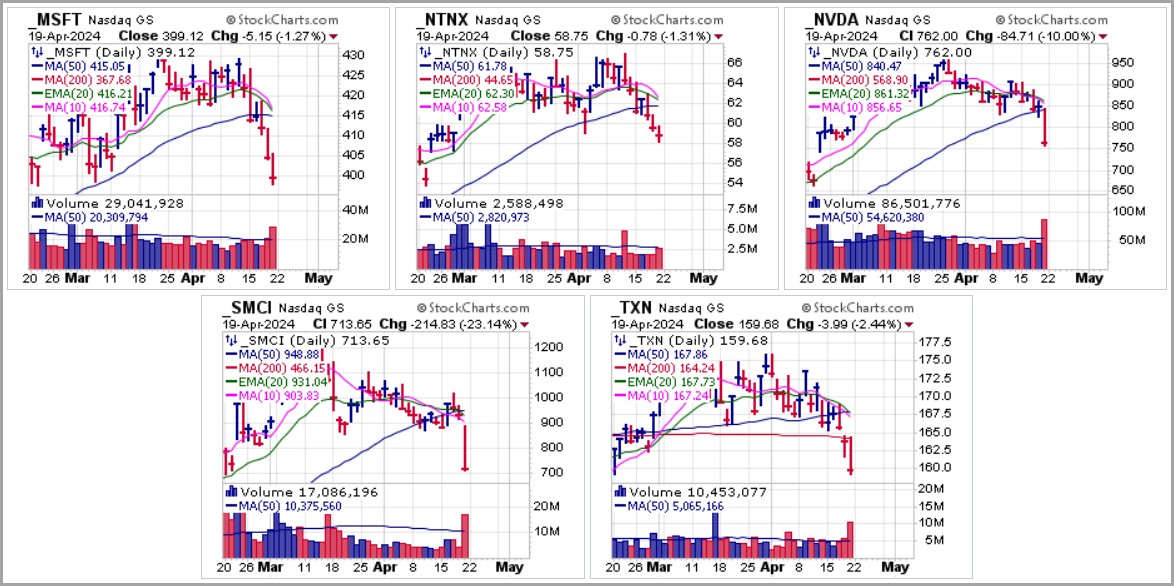

Big-stock techs have cascaded lower all week long, as the six representative names below show. These include AI Meme darlings Arm Holdings (ARM), Nvidia (NVDA) and Super Micro Computer (SMCI), all of which triggered short-sale entries earlier in the week at their 20-demas.

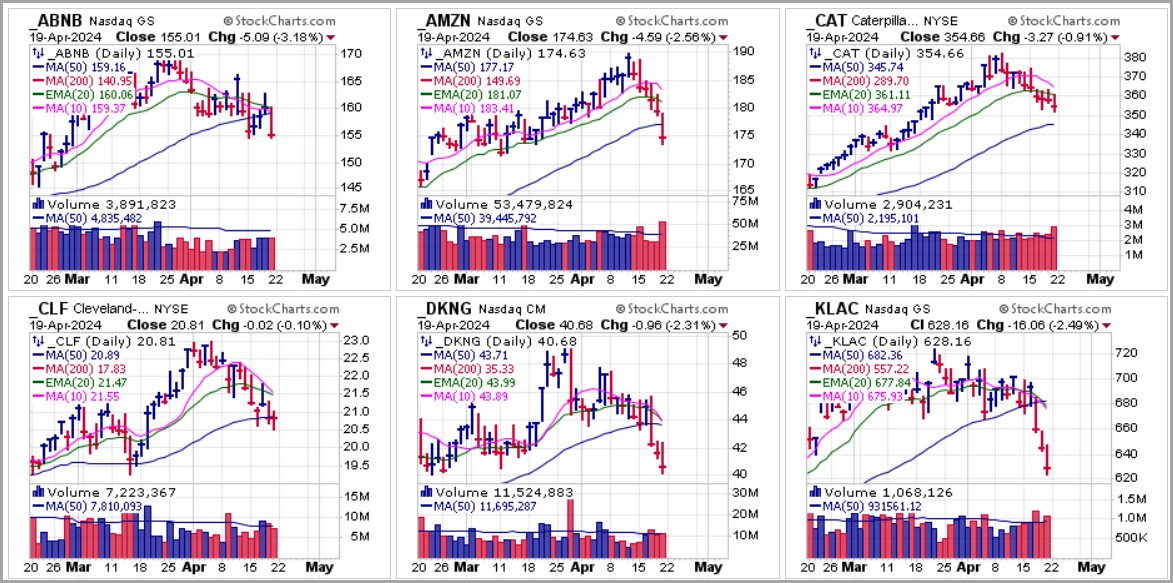

Big-stock techs have cascaded lower all week long, as the six representative names below show. These include AI Meme darlings Arm Holdings (ARM), Nvidia (NVDA) and Super Micro Computer (SMCI), all of which triggered short-sale entries earlier in the week at their 20-demas. On Wednesday we reported on a number of short-sale set-ups in Airbnb (ABNB), Amazon.com (AMZN), Caterpillar (CAT), Cleveland-Cliffs (CLF), DraftKings (DKNG), KLA Corp. (KLAC), Microsoft (MSFT), Nutanix (NTNX), Nvidia (NVDA), Super Micro Computer (SMCI) and Texas Instruments (TXN). By week's end the group looked like quite ugly, testimony to the breadth and ferocity of this past week's selling.

On Wednesday we reported on a number of short-sale set-ups in Airbnb (ABNB), Amazon.com (AMZN), Caterpillar (CAT), Cleveland-Cliffs (CLF), DraftKings (DKNG), KLA Corp. (KLAC), Microsoft (MSFT), Nutanix (NTNX), Nvidia (NVDA), Super Micro Computer (SMCI) and Texas Instruments (TXN). By week's end the group looked like quite ugly, testimony to the breadth and ferocity of this past week's selling.

Bitcoin ($BTCUSD) rallied on Friday ahead the much anticipated halving event. $BTCUSD also posted its second U&R long entry signal along the prior $60,782.80 low of March 20th. The halving event took place on Friday evening but so far has not resulted in any major price moves as $BTCUSD pushes towards 20-dema and then 50-dma resistance where it could very well play out as a short-sale entry following the U&R cover point along the March low. In the weeks following past halvings, Bitcoin typically underwent some correction in price before launching into a firm uptrend.

Bitcoin ($BTCUSD) rallied on Friday ahead the much anticipated halving event. $BTCUSD also posted its second U&R long entry signal along the prior $60,782.80 low of March 20th. The halving event took place on Friday evening but so far has not resulted in any major price moves as $BTCUSD pushes towards 20-dema and then 50-dma resistance where it could very well play out as a short-sale entry following the U&R cover point along the March low. In the weeks following past halvings, Bitcoin typically underwent some correction in price before launching into a firm uptrend.  Precious metals gold and silver also rallied into the end of the week as they diverged from stocks. Both remain below their highs of two Fridays ago, however, but remain solid for now.

Precious metals gold and silver also rallied into the end of the week as they diverged from stocks. Both remain below their highs of two Fridays ago, however, but remain solid for now. Bottom line: this market has become a broad minefield for the long side, and most positions have likely triggered trailing stops so we would expect that investors are now mostly in cash. Some may even be short at this point based on our Wednesday Short-Sale Set-Up reports and the fresh signal in the Market Direction Model, which switched to a SELL signal on Monday, April 15, 2024, well before the carnage that hit the market by week's end.

Bottom line: this market has become a broad minefield for the long side, and most positions have likely triggered trailing stops so we would expect that investors are now mostly in cash. Some may even be short at this point based on our Wednesday Short-Sale Set-Up reports and the fresh signal in the Market Direction Model, which switched to a SELL signal on Monday, April 15, 2024, well before the carnage that hit the market by week's end.