Hot CPI data on Wednesday sent the market reeling, but after what was perceived as less onerous PPI on Thursday came back slightly on lighter volume. On Friday, bad earnings from J.P. Morgan (JPM) and overnight news that Israel was expecting an attack from Iran within the next two days sent the market reeling to the downside once again. The NASDAQ Composite reversed back below its 10-dma and 20-dema while the S&P 500 reversed back below its 20-dema after running into 10-dma resistance on Thursday. On Friday it broke lower but held 50-dma support, at least for now.

Things look to get worse, however, by Monday morning after Iran launched an attack on Israel Saturday. Of some 300-odd attack drones, cruise missiles, and ballistic missiles launched towards Israel, only two made it to Israeli soil, a colossal failure. The question now is whether Israel will chalk this up as a victory with no need for further action or whether the unprecedented attack by Iran on Israeli from Iranian territory will provoke an escalation by Israel. At the time of this writing, the situation remains highly fluid.

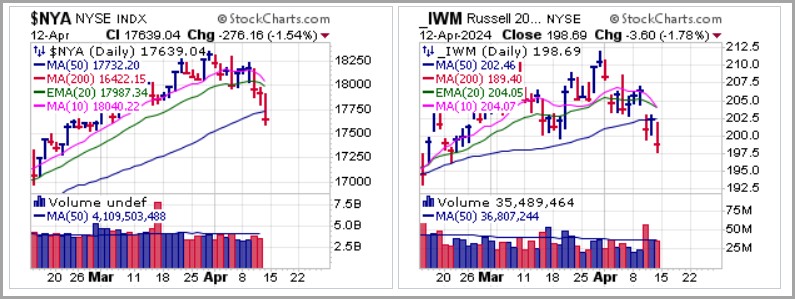

The broader market fared much worse this past week with the broader NYSE Composite and Russell 2000 Indexes splitting wide open at the end of a brutal week. The NYSE Composite was down three days in a row heading into the weekend as it busted 50-dma support while the small-cap Russell 2000 had gapped below its 50-dma on Wednesday and remained there on Thursday before breaking to lower lows again on Friday. Overall, very bearish action among the broader NYSE and small-cap names.

The broader market fared much worse this past week with the broader NYSE Composite and Russell 2000 Indexes splitting wide open at the end of a brutal week. The NYSE Composite was down three days in a row heading into the weekend as it busted 50-dma support while the small-cap Russell 2000 had gapped below its 50-dma on Wednesday and remained there on Thursday before breaking to lower lows again on Friday. Overall, very bearish action among the broader NYSE and small-cap names. Bitcoin ($BTCUSD) was slammed back below its 20-dema on Friday before finding support at the 50-dma. That triggered a short-sale entry as close to the 20-day line as possible while then using the line as a covering guide. On Saturday, the Iranian attack on Israel sent $BTCUSD careening 7% lower as it broke the 50-dma. By Sunday, at the time of this writing, it was attempting to recover after testing support at the mid-March low, but remains below what is now 50-dma resistance.

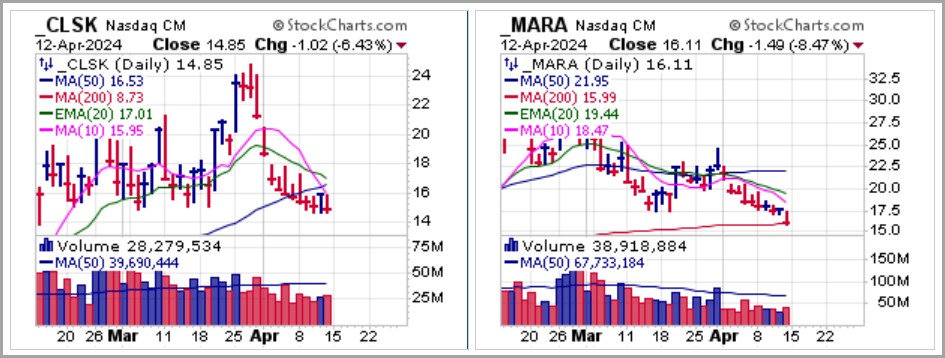

Bitcoin ($BTCUSD) was slammed back below its 20-dema on Friday before finding support at the 50-dma. That triggered a short-sale entry as close to the 20-day line as possible while then using the line as a covering guide. On Saturday, the Iranian attack on Israel sent $BTCUSD careening 7% lower as it broke the 50-dma. By Sunday, at the time of this writing, it was attempting to recover after testing support at the mid-March low, but remains below what is now 50-dma resistance. Crypto miners CleanSpark (CLSK) and Marathon Digital Holdings (MARA) failed on U&R attempts posted Thursday and broke to lower lows on Friday. These remain in downtrends since CLSK blew up in late March and MARA in late February. Bearish action all around for the crypto space to end the week.

Crypto miners CleanSpark (CLSK) and Marathon Digital Holdings (MARA) failed on U&R attempts posted Thursday and broke to lower lows on Friday. These remain in downtrends since CLSK blew up in late March and MARA in late February. Bearish action all around for the crypto space to end the week. Gold and silver as measured by the SPDR Gold Trust (GLD) and iShares Silver Trust (SLV) gapped higher on Friday on the Israel-Iran news but reversed in extremely bearish fashion as volume spiked higher in the extreme. It is likely that forced selling in the broader market took down gold and silver along with the precious metals related stocks as the market tide rushed out. Friday's action in both GLD and SLV appears to be signaling a clear near-term top in the metals after gold futures reached an intraday high of $2,448.80 an ounce and silver futures an intraday high of $29.90 an ounce before reversing in a pair of bearish reversals.

Gold and silver as measured by the SPDR Gold Trust (GLD) and iShares Silver Trust (SLV) gapped higher on Friday on the Israel-Iran news but reversed in extremely bearish fashion as volume spiked higher in the extreme. It is likely that forced selling in the broader market took down gold and silver along with the precious metals related stocks as the market tide rushed out. Friday's action in both GLD and SLV appears to be signaling a clear near-term top in the metals after gold futures reached an intraday high of $2,448.80 an ounce and silver futures an intraday high of $29.90 an ounce before reversing in a pair of bearish reversals. Big-Stock AI Meme favorites Nvidia (NVDA) and Super Micro Computer (SMCI) remain suspect. NVDA was able to regain its 20-dema on Thursday but volume was light and so we would watch for any reversal back below the 20-dema as a potential short-sale entry trigger. SMCI triggered a short entry at the 20-dema the prior week and is triggering a second short-sale entry as it fails along the 50-dma using the 50-day line as covering guide.

Big-Stock AI Meme favorites Nvidia (NVDA) and Super Micro Computer (SMCI) remain suspect. NVDA was able to regain its 20-dema on Thursday but volume was light and so we would watch for any reversal back below the 20-dema as a potential short-sale entry trigger. SMCI triggered a short entry at the 20-dema the prior week and is triggering a second short-sale entry as it fails along the 50-dma using the 50-day line as covering guide. With the situation in the Middle East still quite up in the air, any kind of pre-conceived trading plan for Monday morning is, quite frankly, impossible, until the extent of Israel's response, if any, is known. At that point, a tit-for-tat exchange between Israel and Iran could continue for an indefinite period of time, adding further uncertainty to the situation. Caution is advised on both sides of the market.

With the situation in the Middle East still quite up in the air, any kind of pre-conceived trading plan for Monday morning is, quite frankly, impossible, until the extent of Israel's response, if any, is known. At that point, a tit-for-tat exchange between Israel and Iran could continue for an indefinite period of time, adding further uncertainty to the situation. Caution is advised on both sides of the market.The Market Direction Model (MDM) switched to a CASH/NEUTRAL signal on Wednesday, April 10, 2024.