The country of Germany sold 15k of their 50k BTC so far. Mt Gox holders started to sell their $9 billion in BTC earlier this month. This selling pressure could continue for some time.

Yesterday's negative CPI print was the first time since the brief COVID-induced recession in early 2020. This underscores the danger of an economy that may weaken too quickly which, if such were the case, would force the Fed to reduce rates in a hurry potentially leading straight into a recession as has happened before, unless of course they fire off the QE-guns. 2020 was the only time since 2008 that we have had a recession. It was the shortest recession on record because the Fed came to the rescue with QE in March 2020.

On the plus side, global liquidity started to rise though the overall trend remains down. Stealth QE from the Fed remains strong. Bitcoin miners also seemed to have capitulated so miner selling pressure should diminish.

Bitcoin is struggling at its 9ema and 55ema. When it comes to cryptocurrencies, I find the 9ema, 21ema, and 55ema slightly better guides than the traditional 10dma, 21ema, 50dma for stocks including those stocks or ETFs that correlate with BTC.

Vehicles that correlate with Bitcoin can be shorted.

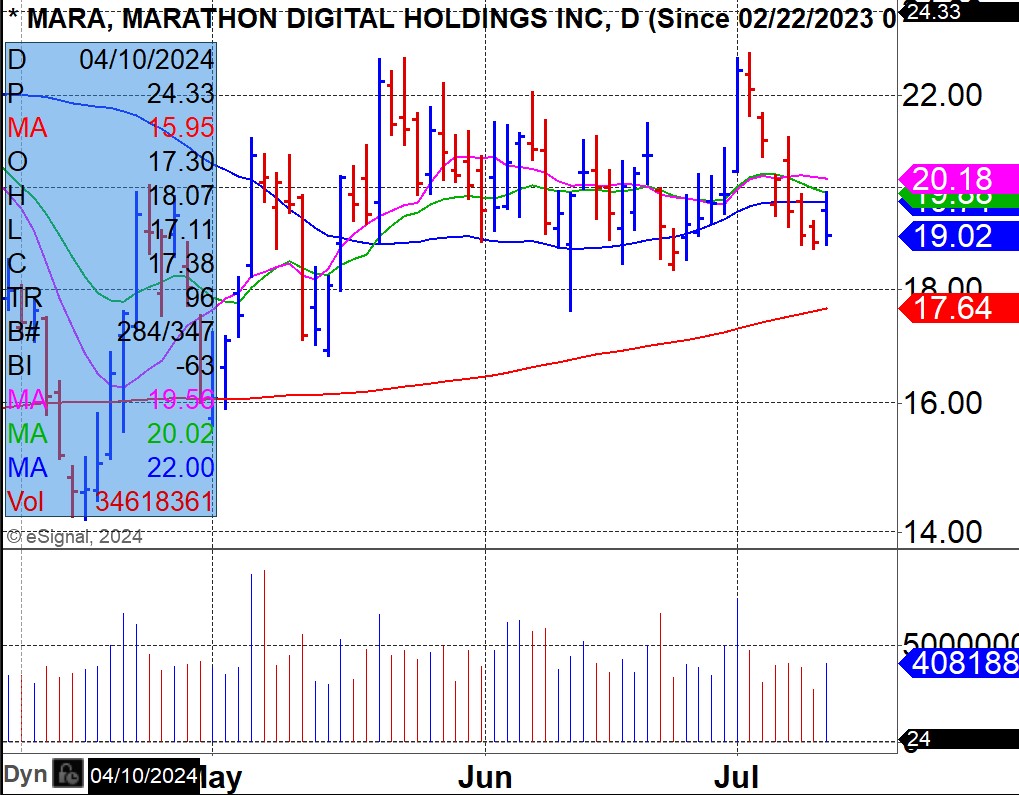

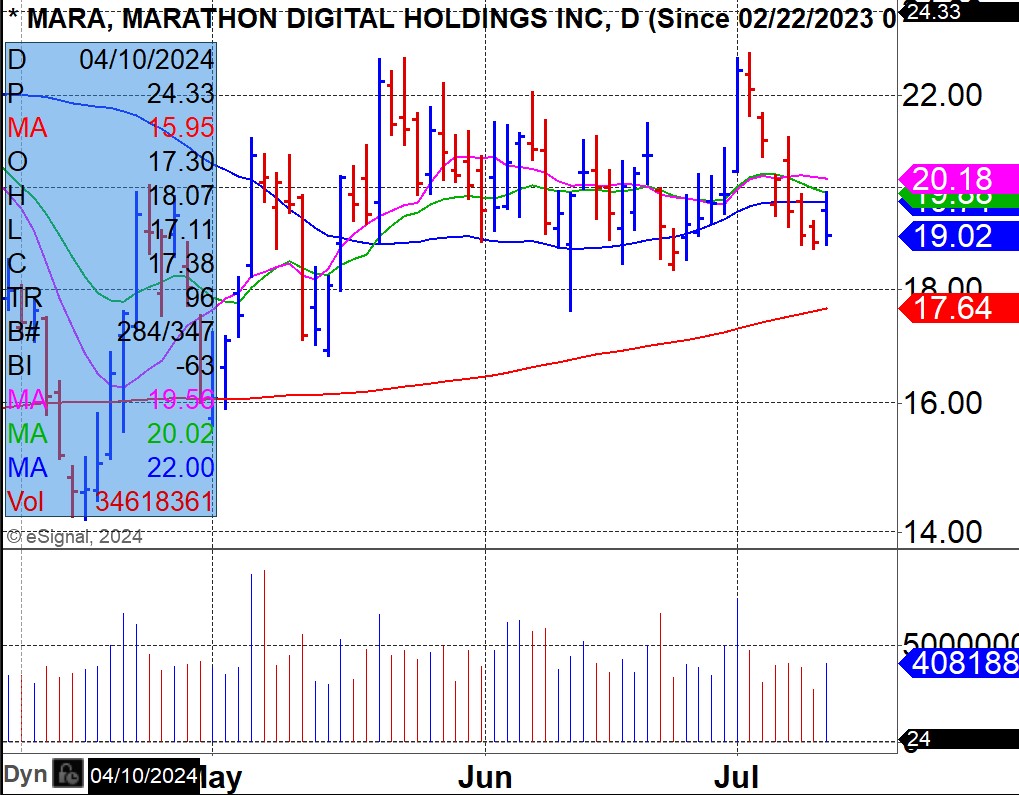

MARA has been lagging CLSK and was rejected at its 10dma and 50dma on higher volume.

COIN was rejected at its 10dma, 21ema, and 50dma on higher volume.

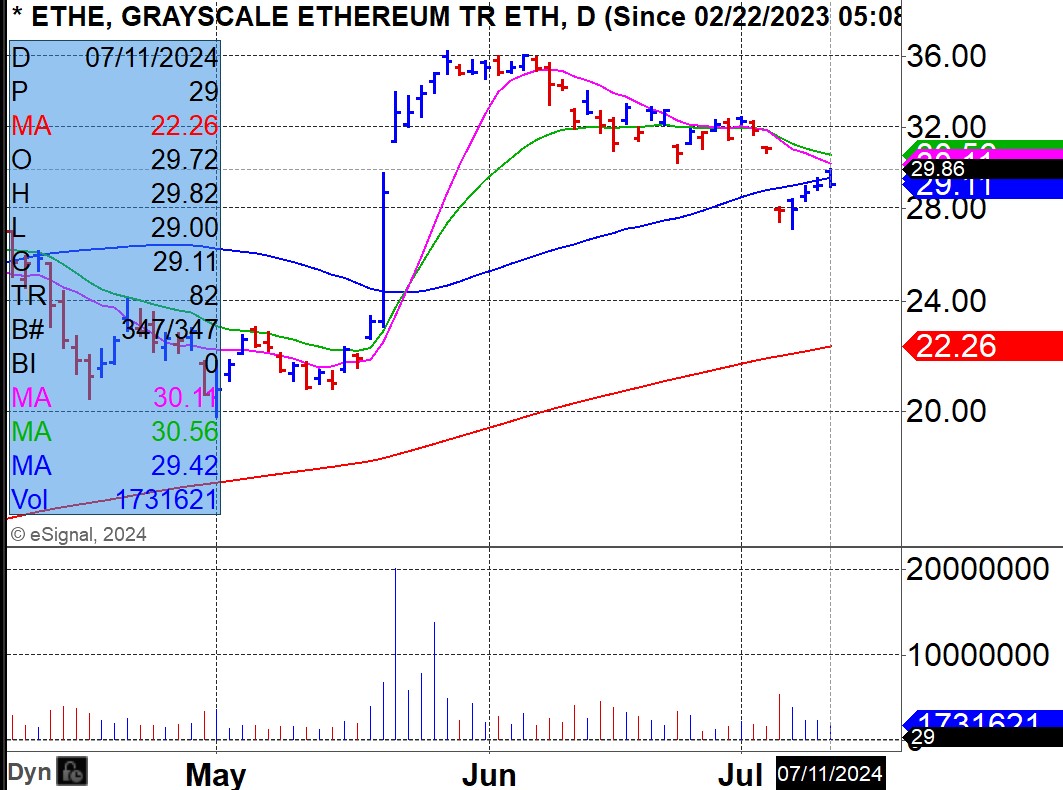

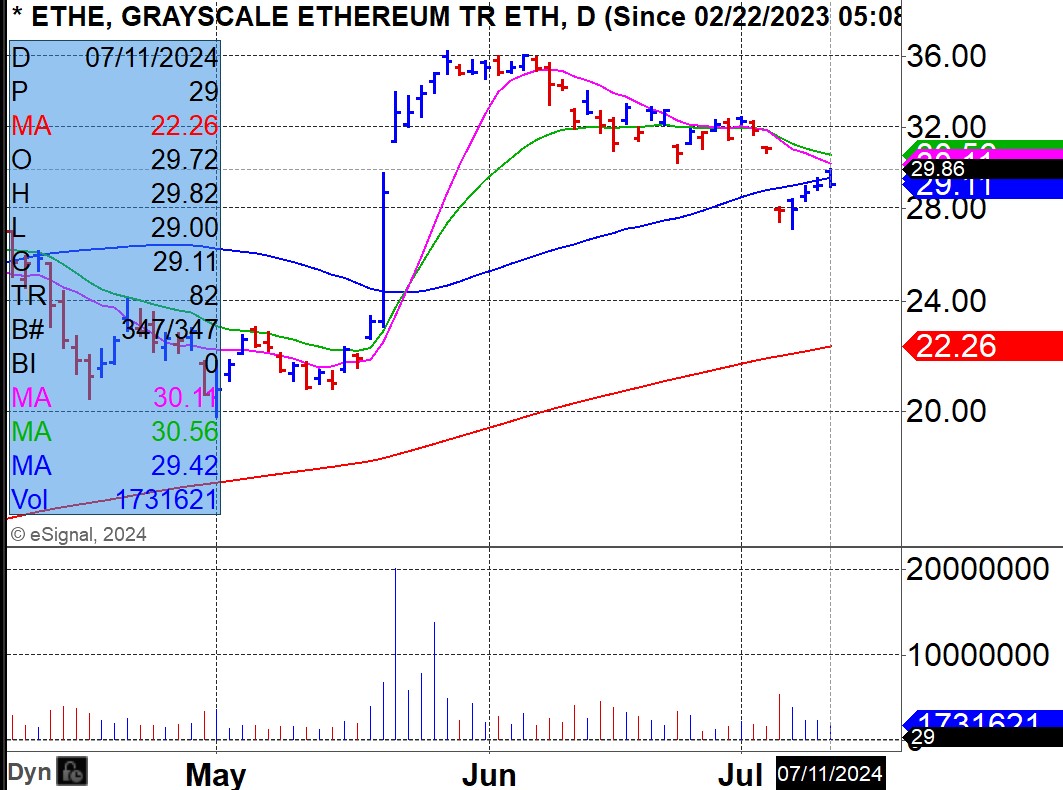

ETHE which correlates fairly well with BTC was rejected at its 50dma at it attempted to rally over the last few days on lighter volume.

For all of the above, use a break above moving average resistance as your stop loss cover point.

This information is provided by MoKa Investors, LLC DBA Virtue of Selfish Investing (VoSI) is issued solely for informational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. Information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of available data. VoSI reports are intended to alert VoSI members to technical developments in certain securities that may or may not be actionable, only, and are not intended as recommendations. Past performance is not a guarantee, nor is it necessarily indicative, of future results. Opinions expressed herein are statements of our judgment as of the publication date and are subject to change without notice. Entities including but not limited to VoSI, its members, officers, directors, employees, customers, agents, and affiliates may have a position, long or short, in the securities referred to herein, and/or other related securities, and may increase or decrease such position or take a contra position. Additional information is available upon written request. This publication is for clients of Virtue of Selfish Investing. Reproduction without written permission is strictly prohibited and will be prosecuted to the full extent of the law. ©2024 MoKa Investors, LLC DBA Virtue of Selfish Investing. All rights reserved.