One major point that most investors overlook when assessing any buyable gap-up move in a stock is that one does not have to try and buy the lowest price within the gap-up day's range. Assuming the range is not ridiculously wide (aside from the gap itself), taking an initial position using either a 7-8% stop or a likely tighter stop at the intra-day low of the gap-up day's trading range is well within the acceptable parameters for ANY trade, whether pocket pivot, standard base breakout, or buyable gap-up. Hence from this perspective the trade is like any other - what is different is that investors will tend to see the gap-up as making the trade more "risky" because the stock is "up there." This is a tough perception for the average investor to shake off, but this perception is not valid, as we know from studying buyable gap-ups. When they occur in some of the most fundamentally sound, leading stocks the odds are certainly in your favor, as the statistics prove out. As well, gap-ups can often lead to some large upside moves. So there are strong elements of both greed and fear in the trade, based on the "cosmetic" appearance of the trade.

Psychologically, it also appears that investors are most comfortable buying pocket pivot buy points within a leading stock's base. Why? Because it is perceived as "cheap" while it is still in the base, and investors like the idea of "cheating" or getting a "head start" on the stock. But pocket pivots don't necessarily lead to immediate, huge upside moves. They are often clues preceding a potential move, so some patience after buying the pocket pivot is necessary. Obviously, getting a head start and perhaps engaging in perceived "cheating" (although we don't see it this way since it is a statistically-proven concept hence is 100% legitimate - nobody is cheating at anything with pocket pivots) are some of the advantages that define why a pocket pivot is a useful tool, but when contrasted with a buyable gap-up one may find that from a risk/reward perspective it is not necessarily more or less advantageous than a buyable gap-up.

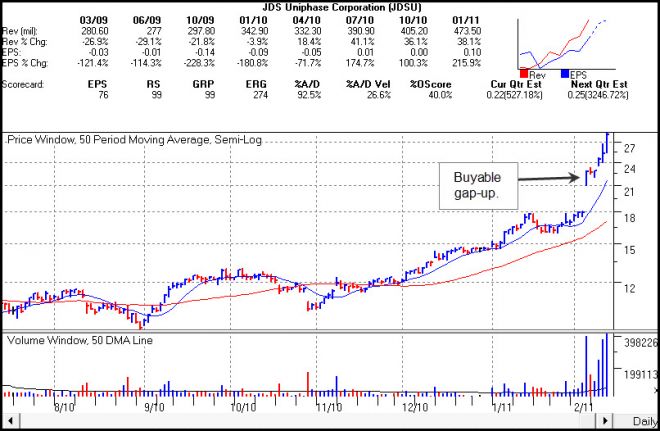

As an example, take a look at JDSU Uniphase Corp. (JDSU), which we flagged last weekend as a buyable gap-up. Interestingly, some members perceived this as a "late" alert, but that is entirely incorrect since the bottom line is that once the gap-up day occurs, it is buyable anywhere near or within that first-day's trading range. Over the next two days following the PPR alert that went out, the stock held in the 22-23 price area, giving one plenty of time to buy it if one was not focused on having to buy it right at the intra-day low of the gap-up day of six trading days ago. Investors for the most part seem to be blinded by "price bias," where they become overly concerned with buying the absolute lowest and hence "cheapest" price without considering the essence of what a powerful gap-up is telling you: that the stock likely wants to go significantly higher, and it is this move that one is playing for.

The same thing goes for a pocket pivot buy point, where one is simply using it as a low-risk initial entry point or add point (in the case of a continuation pocket pivot buy point) in the overal context of building a position in the stock as favorably as possible. There is no need to have to buy the pocket pivot the exact same day as one can always simply buy a stock on the basis of a pocket pivot the day after the move is observed. Thus investors should keep in mind the objectives of any buy point, which are simply to provide a sound entry-point with well-defined downside parameters for being stopped-out of the trade should it not work out while putting one in the position of being able to capitalize on what could pan out as an extended upside run. Hence becoming overly concerned with 1 or 2 point variations in one's entry price once the pocket pivot or gap-up buy signal is observed is not material to the process and should be avoided in one's thinking about the stock in question.