Analysts are forecasting Super Micro's annual revenue will jump to $25 billion by 2026, more than triple the $7 billion recorded in the fiscal year that just ended. Super Micro is the top performing stock in the S&P 500 this year, rising 246%.

NVDA also has deep moats despite strong competitors banding together to attempt to dethrone NVDA's AI-centric chip technology.

Elon Musk recently noted, “I’ve never seen any technology advance faster than this, the AI compute coming online appears to be increasing by a factor of 10x every 6 months.” Then in early March 2024, in response to Ray Kurzweil, Elon tweeted: “AI will probably be smarter than any single human next year. By 2029, AI is probably smarter than all humans combined.”

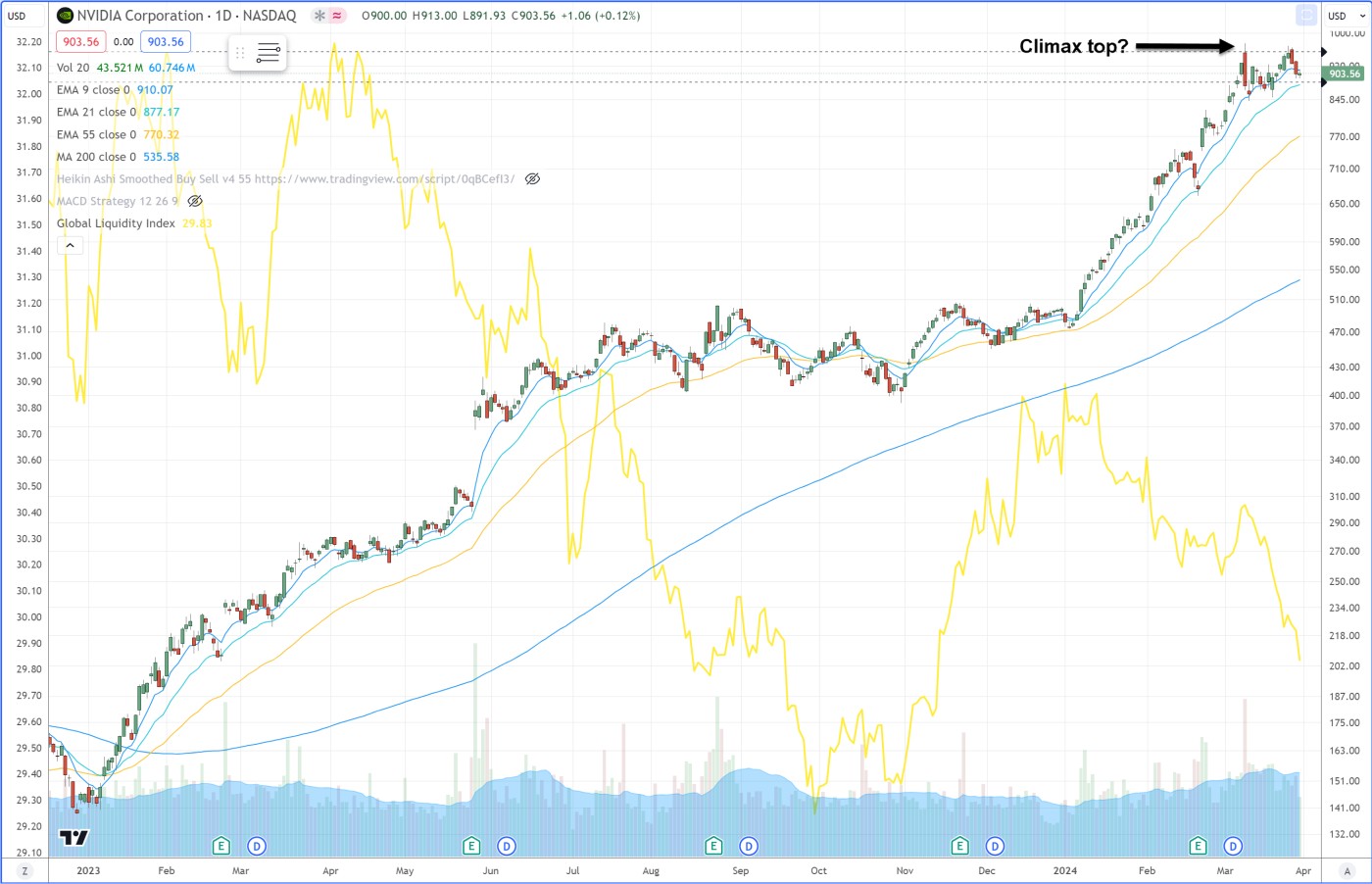

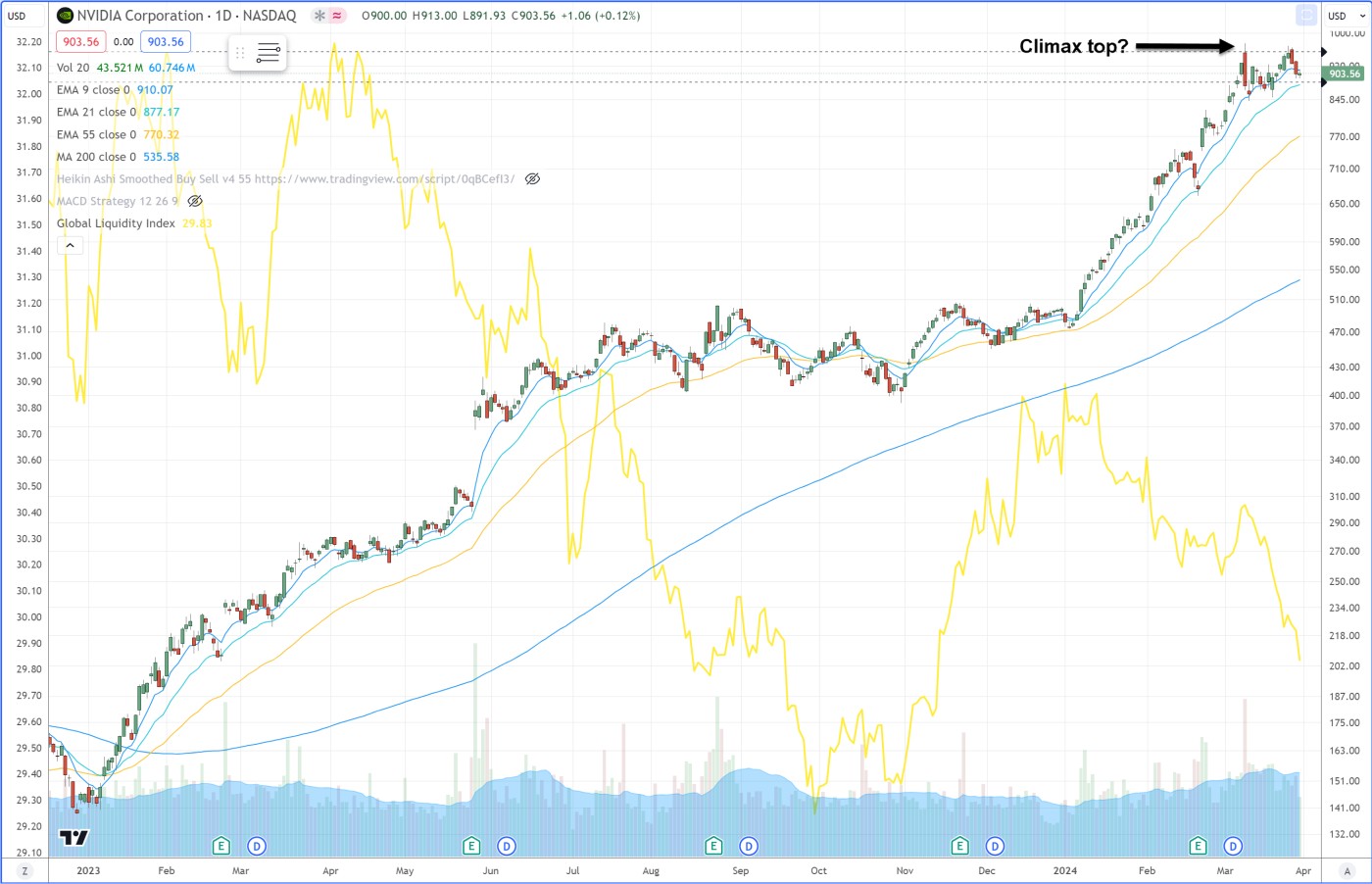

Both companies recently had what looked like potential major climax tops.

But as we said, just as with other companies such as with Syntex, the birth control drug company back in 1963, in rare occasion, a company can have a climax top during its overall run. Syntex had such a climax top in 1963 then went on to continue its uptrend into its real climax top later that same year. Note that its first climax top earlier in 1963 was caused by the general market in correction. Everything is relative. Many investors sold at that point, scared out of their positions. But Syntex held strong as opposed to major climax tops where the stock gets more volatile than at any time during its long uptrend.

In the case of both NVDA and SMCI, both appear to be holding fairly strong so watch for potential pocket pivots, undercut & rallies, or volume dry-ups as entry points for each in the days ahead. Of course, dont be wedded to the bull or bear side but remain flexible at all times. Both companies are extremely overvalued so any misstep in AI would likely cause a sharp selloff.

This information is provided by MoKa Investors, LLC DBA Virtue of Selfish Investing (VoSI) is issued solely for informational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. Information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of available data. VoSI reports are intended to alert VoSI members to technical developments in certain securities that may or may not be actionable, only, and are not intended as recommendations. Past performance is not a guarantee, nor is it necessarily indicative, of future results. Opinions expressed herein are statements of our judgment as of the publication date and are subject to change without notice. Entities including but not limited to VoSI, its members, officers, directors, employees, customers, agents, and affiliates may have a position, long or short, in the securities referred to herein, and/or other related securities, and may increase or decrease such position or take a contra position. Additional information is available upon written request. This publication is for clients of Virtue of Selfish Investing. Reproduction without written permission is strictly prohibited and will be prosecuted to the full extent of the law. ©2025 MoKa Investors, LLC DBA Virtue of Selfish Investing. All rights reserved.