Market Lab Report

by Dr. Chris Kacher

The Web3 Evolution Will Not Be Centralized™

Will the real inflation please stand up?

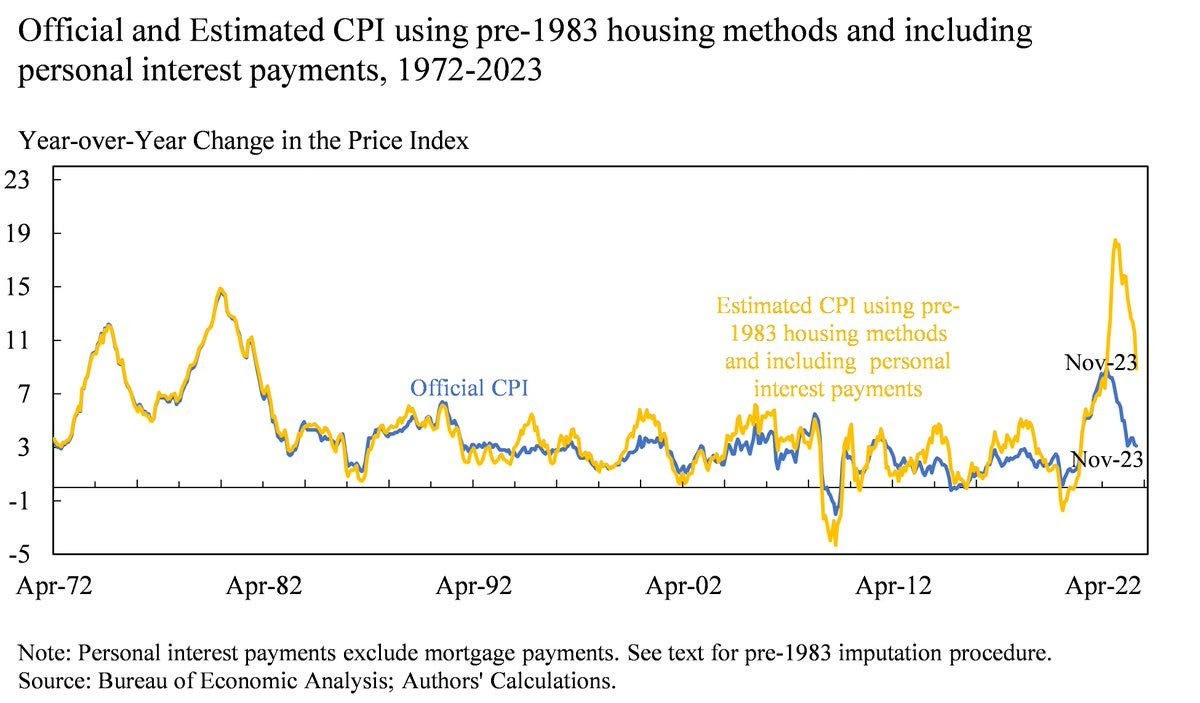

Former Secretary of the Treasury Larry Summers said that increasing interest rates drastically accelerated the true inflation rate. Borrowing costs including personal interest/car payments and mortgage costs are no longer included in the CPI. When factoring in these costs, actual inflation spikes to 18% instead of 9%.

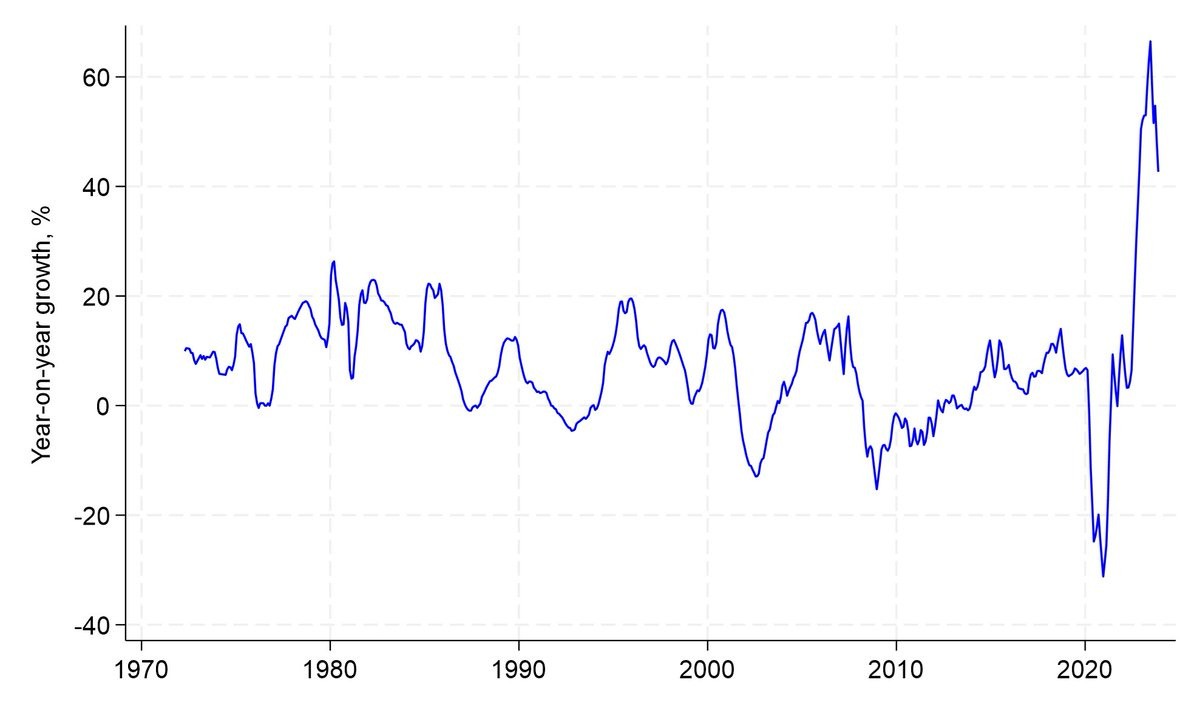

Personal interest payments increased by more than 50 percent in 2023.

The headline CPI number may have come down, but these interest payments have no relief in sight. The Fed is making decisions based on doctored data, so don't expect their decisions to be in everyone's best interest.

Bitcoin bear?

The bears are saying lack of global liquidity, rates higher for longer, and incoming recession due to unemployment data and high rates suggest Bitcoin has put in a major top.

The bulls are saying Bitcoin spot ETFs, incoming Ethereum spot ETFs, increased institutional exposure, the Fed tapering the taper, and ongoing stealth QE will keep the price of Bitcoin rising overall. The current pullback is so far smaller than what occurred during prior cycles when Bitcoin corrected within the context of a bull market. Bitcoin's correction is due largely to capitulating Bitcoin miners combined with overextended futures trying to catch the bottom. Once these are cleared out, history suggests Bitcoin will find its floor and start higher once again. Currently, it looks as if Bitcoin leveraged futures positions were largely wiped out when Bitcoin hit $58,400 on Monday briefly before bouncing. Bitcoin miners also look as if the weakest ones have been weeded out. So perhaps Bitcoin has seen a major low.

Robin Brooks, a Senior Fellow at the Brookings Institute, is one of many who said Bitcoin is done once the Fed started hiking rates in a hurry in 2022. In early 2023, he said Bitcoin was just another bubble asset that blows up when the Fed hikes rates.

But since then, interest rates continued to rise overall as shown by the yield on the 10-year Treasury, yet Bitcoin has more than doubled in price. QE rules the day as it lifts stocks, real estate, precious metals, and Bitcoin.

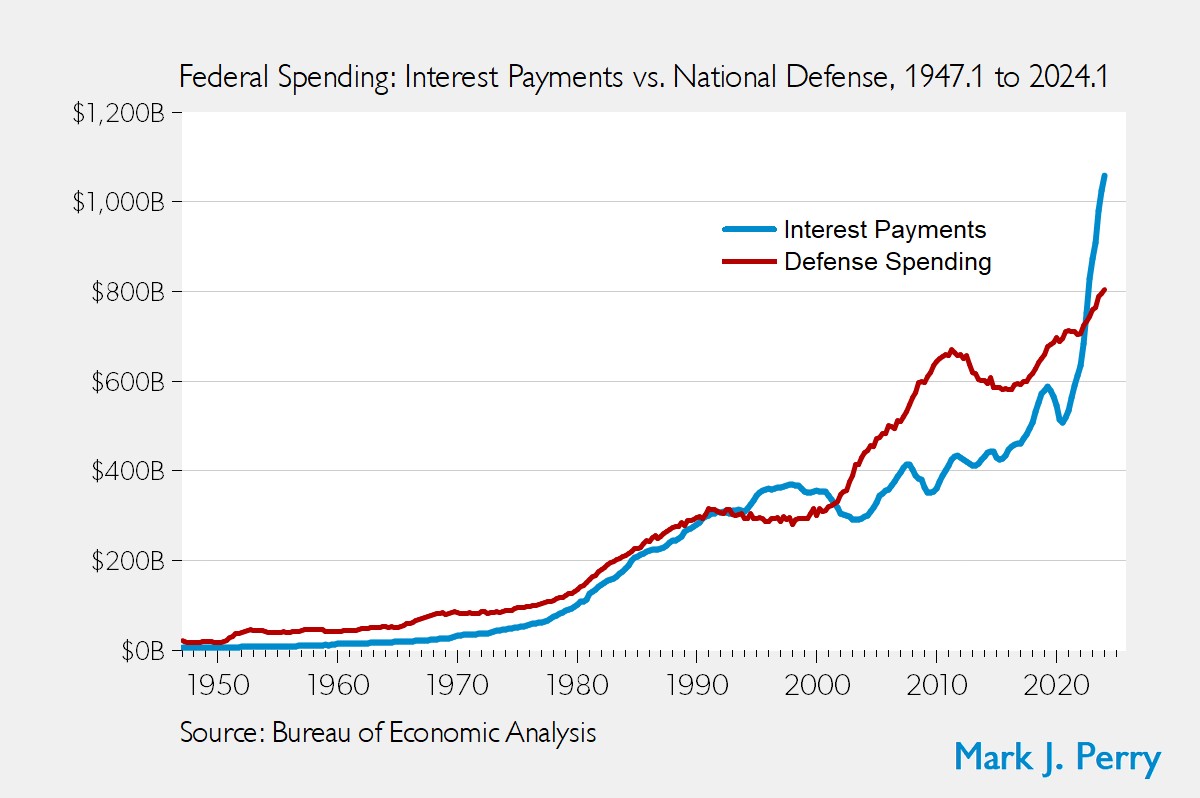

I've written about how interest payments on US debt has well surpassed that of the entire defense spending of the US. The graphic I will send showcases this nicely. We are currently at $1.1 trillion in debt interest payments vs. $800 bil in defense spending. In 2020, we were at $500 billion in debt interest payments vs. $700 bil in defense spending.

The trajectory of interest payments will continue higher as debt will not reverse. The only way out is global war which implies the big reset and a new sovereign currency such as Bitcoin or the dollar co-existing with Bitcoin. Alternatively, we could grow our way out via bleeding edge technologies such as AI and blockchain which can dramatically increase utility and production as I've written about in prior reports.