Market Lab Report / Dr. K's Crypto-Corner

by Dr. Chris Kacher

The Metaversal Evolution Will Not Be Centralized™

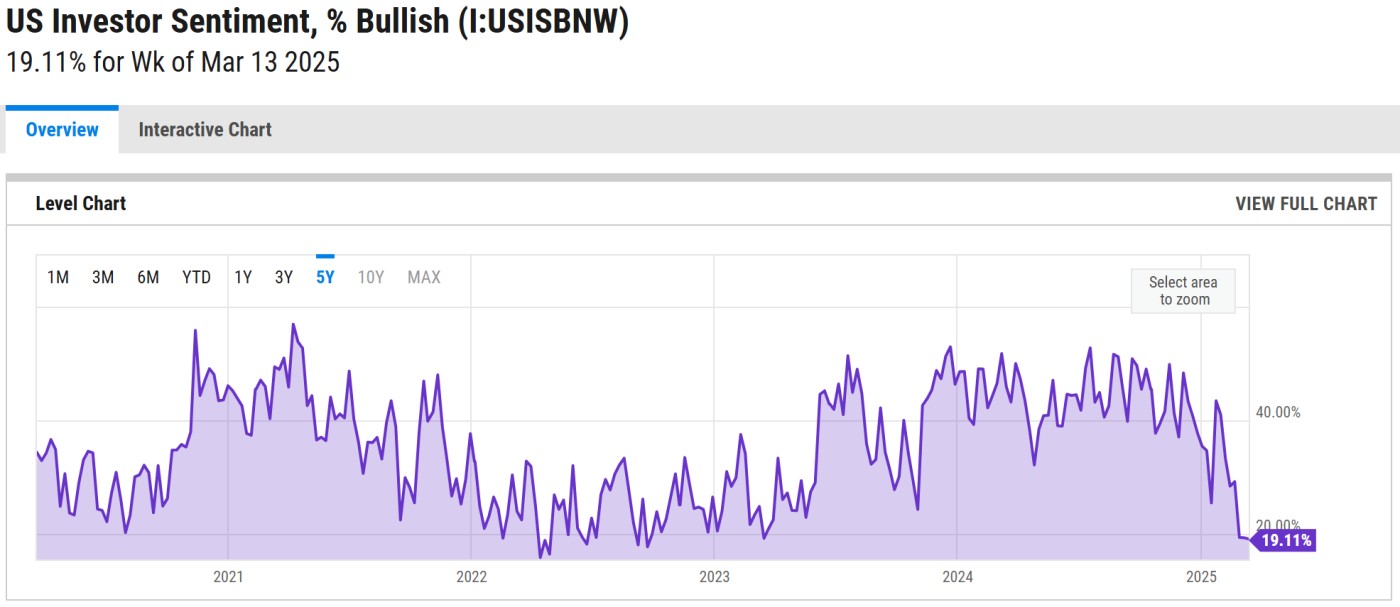

The same can be noted for other sentiment indicators such as AAII sentiment which were also spiking in early 2022. While AAII sentiment is at levels seen near or at major market lows, markets can go lower before finding a major bottom as shown in 1990, 2008, and 2022.

The question is whether or not the current bounce is a major low or a temporary stop before markets head lower. This will be determined by the severity of Trump's tariffs, whether he further softens any of them from here, earnings weakness which has become more noticeable in part due to the tariffs, and how this all impacts inflation and GDP which will affect the Fed's decision on rates which, in turn, affects global liquidity, an overall driver of markets. The market took Powell's testimony as bullish when he said any tariff-related price increases would be transitory, then said QT would be reduced $20 billion a month, and that he expects two more rate cuts this year. CME's FedWatch is expecting 2 or 3 more cuts with odds roughly split between the two. While the Fed projects a weaker economy, real GDP of 1.7% is hardly recessionary, given that it’s averaged just over 2.6% for the past 40 years.

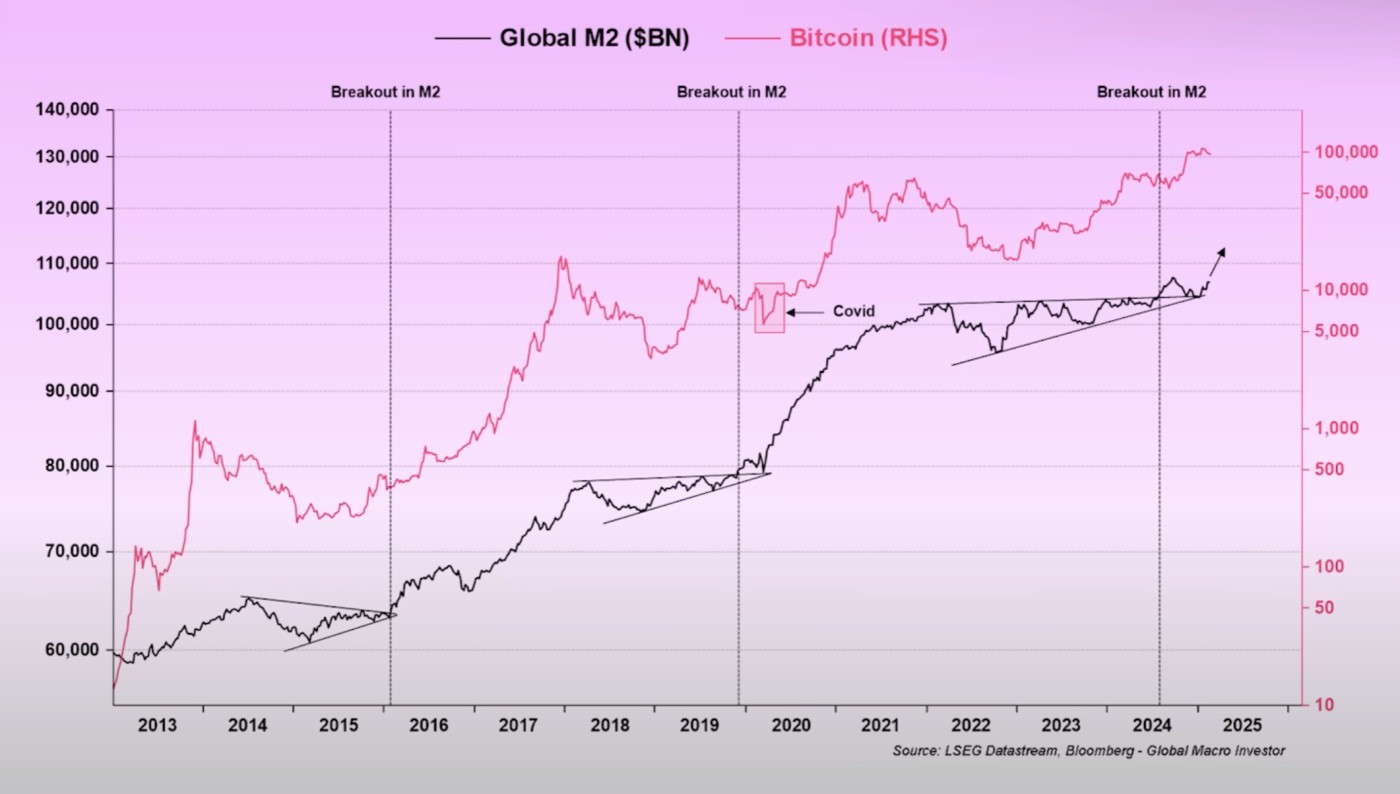

Bitcoin and stocks may have found a major low due to a number of indicators such as Global M2 which has been in an uptrend.

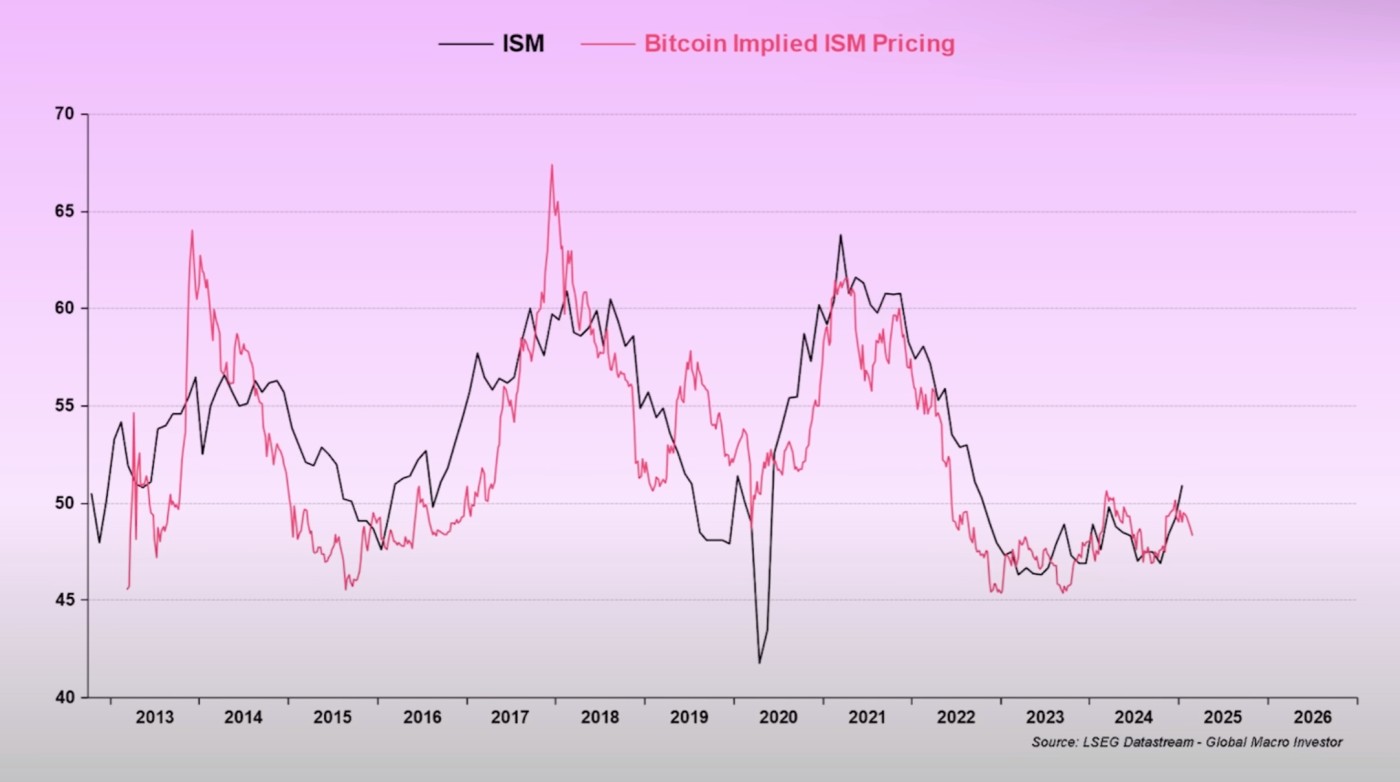

We also have ISM manufacturing which has been in an uptrend since late 2024. It tends to correlate well with the price of bitcoin.

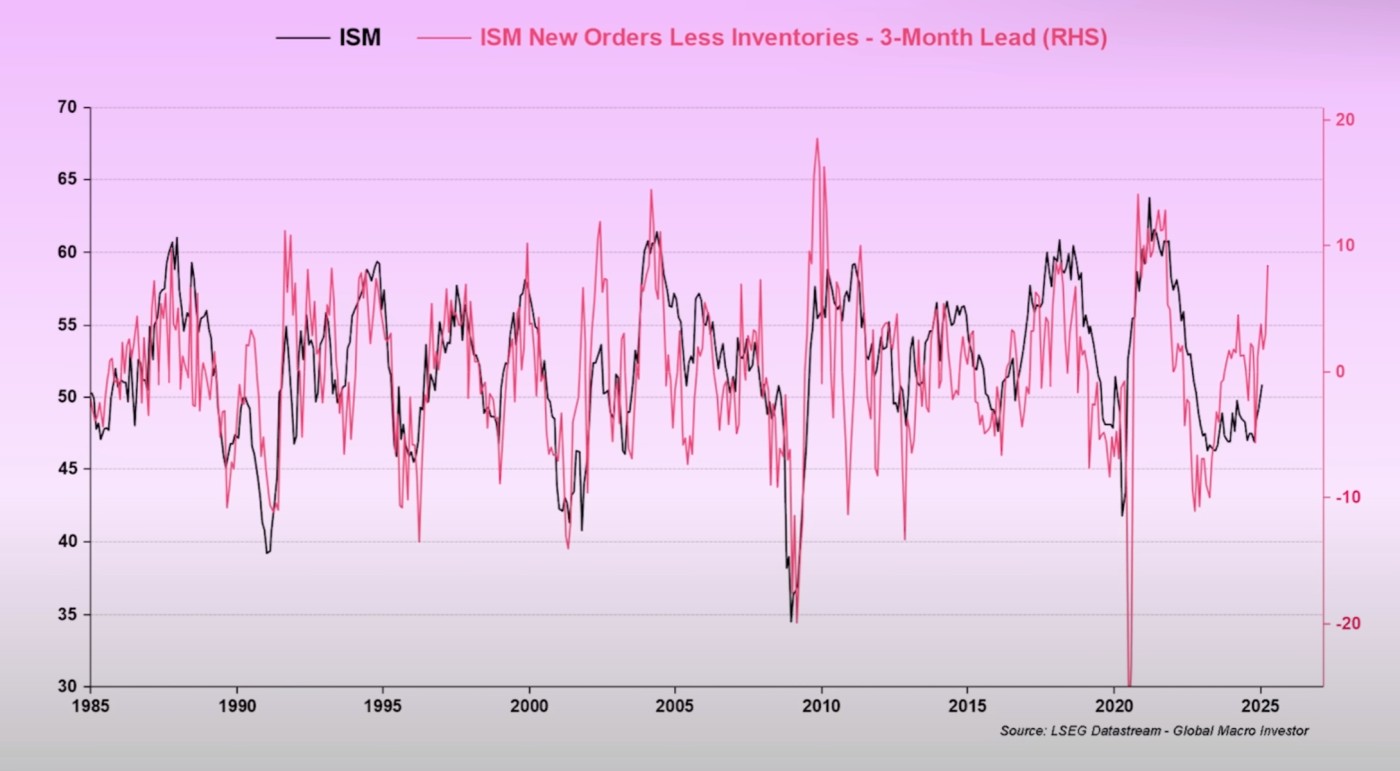

We can see that ISM new orders less inventories with its 3-month lead time implies higher ISM manufacturing prices ahead.

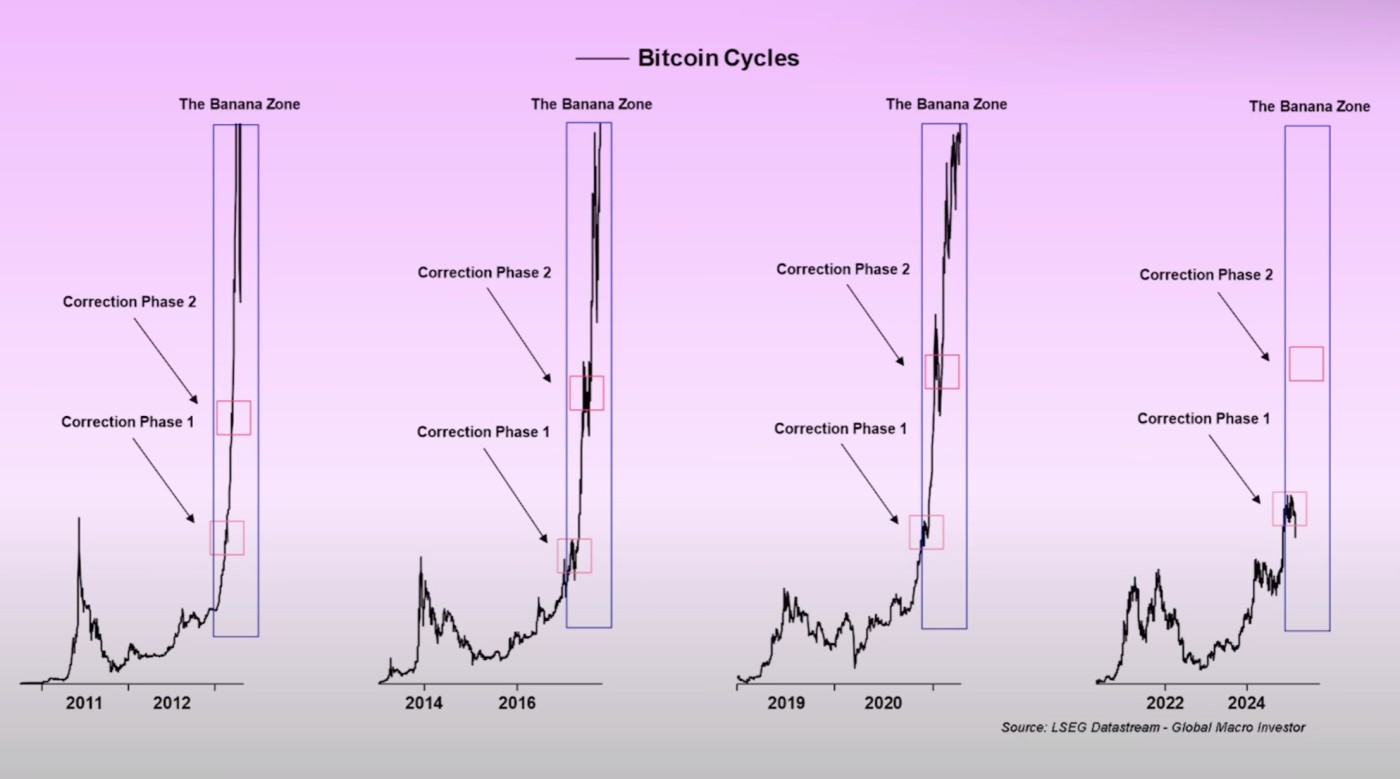

Bitcoin's cycles have held true so far. But then, bitcoin has never been through a normal recession. Should recession hit, all bets are off. In that case, expect a deeper and longer correction phase.

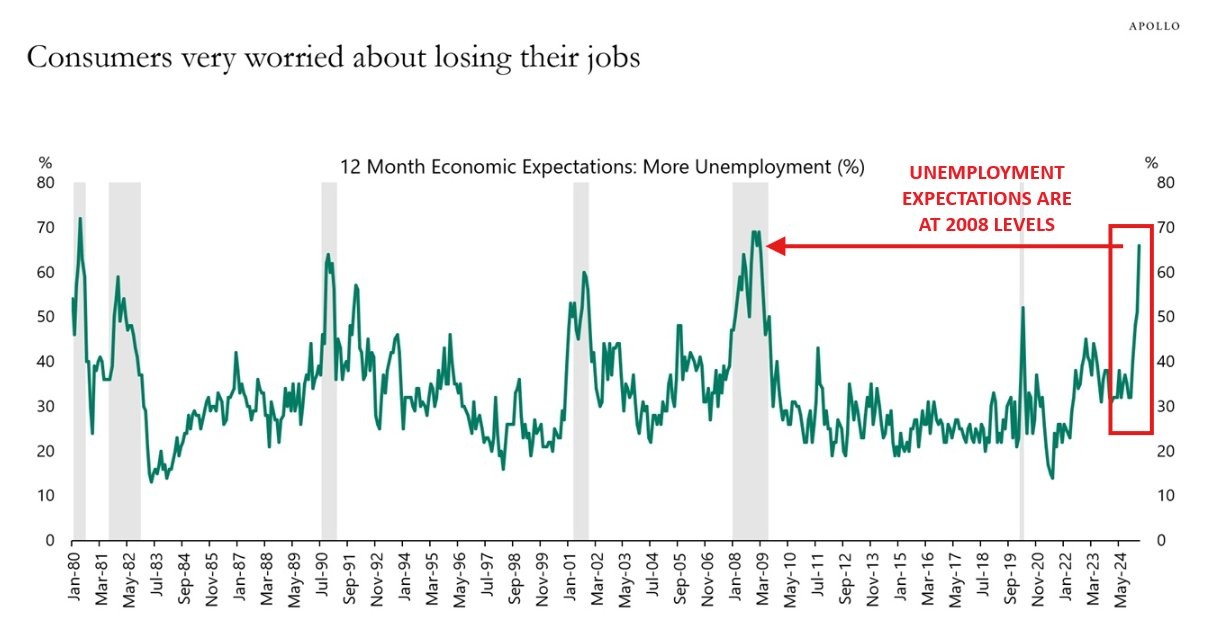

Meanwhile, unemployment expectations in the US are now above 2020 levels and at their highest since 2008. Such peaks occurred during the last six recessions. In 2024, a poll showed that a whopping 56% of Americans thought the US was in a recession. But keep in mind that the Fed did not have QE at its deposal prior to 2008, the last real recession.

With the Fed adopting an easier money approach and more rate cuts on the way, global liquidity should get another boost. But markets in the meantime currently remain in downtrends and may stay volatile, so, as always, we will use the price/volume action of major indices and leading stocks to guide the way. At present, such action is bearish but sentiment was recently at extremes so could result in improved price/volume action in the coming days. Stay tuned.