Market Lab Report / Dr. K's Crypto-Corner

by Dr. Chris Kacher

The Metaversal Evolution Will Not Be Centralized™

What central banks should do

Inflation: Now vs 1970s

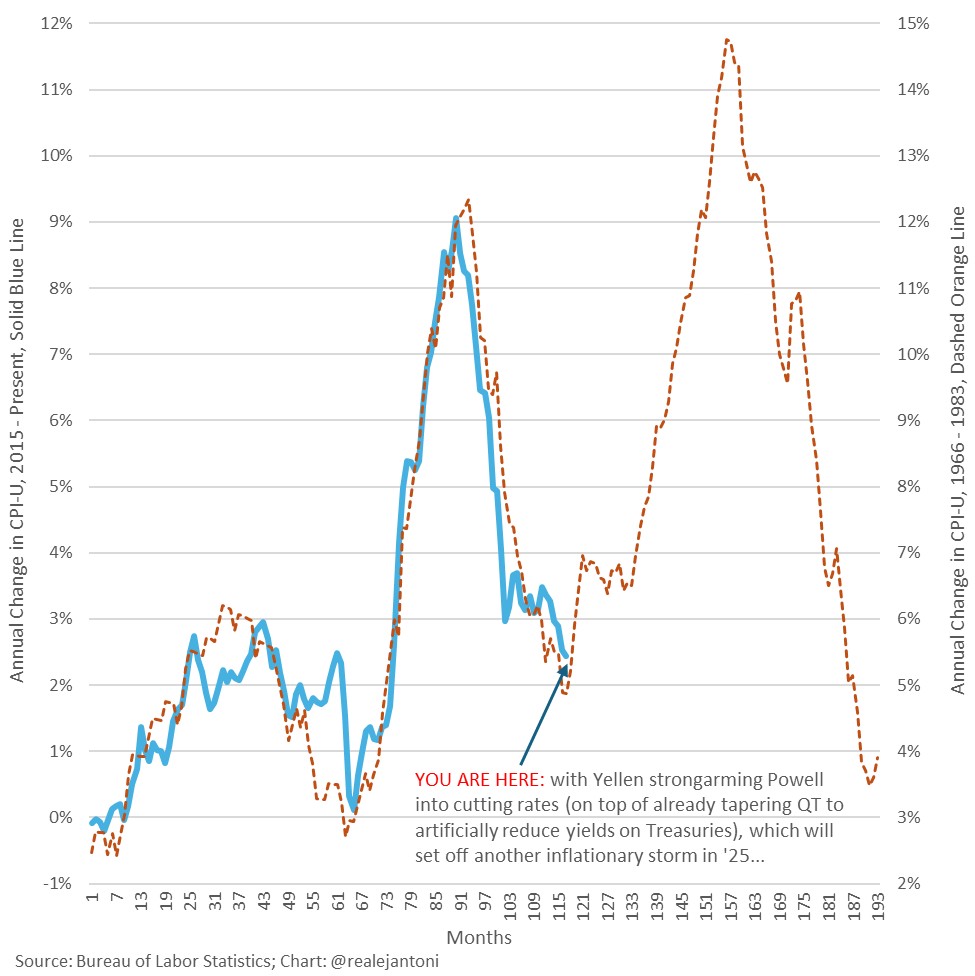

If we compare present day to the inflationary 1970s, we are within a year's time or less to embarking on a huge rise in inflation, especially with central banks such as Fed chair Powell cutting rates on top of already tapering QT in their attempt to reduce Treasury yields. But with Trump, we have another Reagan in office who in the early 1980s made huge cuts to government spending and waste which eventually boosted the economy into what became known as the roaring 80s. In similar fashion, today, we have DOGE spearheaded by Musk and Ramaswamy which will attempt to do a similar clean up act. They have AI at their disposal so can do a potentially more thorough job than Reagan at reducing spending.

In addition, back then, we didnt have QE but instead had Volcker as the strict fed chair who broke the back of inflation by hiking rates to unprecedented levels in the early 1980s which caused a deep recession between 1981-82. This time, Trump will likely pressure the Fed chair to keep lowering rates to boost the economy and businesses which may help Trump's pro-business regime expand faster. But this is not the 1980s. Today's record debt is massively greater than in the 1970s, so QE in all its forms will continue. It will be a game of whether enhanced government efficiencies and productivity from cutting edge tech such as AI can counter the growing levels of debt which spurs more stealth QE. Indeed, we have had QE morphine injections for many years which has bandaged over the illness while buying the patient a bit more time before they expire. But perhaps with AI, smaller government, lower taxes, and an all-Republican congress, the patient will have a near-death experience and be reborn. Stay tuned.

We also may avoid a giant war in the Middle East like the one that caused that second inflationary spike in the latter part of the 1970s with those long lines for gasoline at the pumps.

USD + bond yields staying higher for longer?

The US dollar and yields on long bonds jumped after the election since investors expect interest rates to stay higher for longer as economic growth reduces the need for rate cuts by the Federal Reserve. Moreover, geopolitical uncertainty regarding trade drives investors to move capital into US assets, including the dollar, as the US markets are viewed as more stable and liquid than alternatives. Powell's recent testimony that he may be slow to lower rates depending on the data sent markets lower. The CME FedWatch futures lowered the odds for a rate cut in December though the market still is predicting a 25 bps cut.