Despite the volatile week where we saw the major market indexes swing to and fro in violent fashion, our more recent pocket pivot and buyable gap-up selections have been working quite well on the upside. Below are Trading Journal Notes from Gil and Dr. K regarding pocket pivot and buyable gap-up reports sent out this past week:

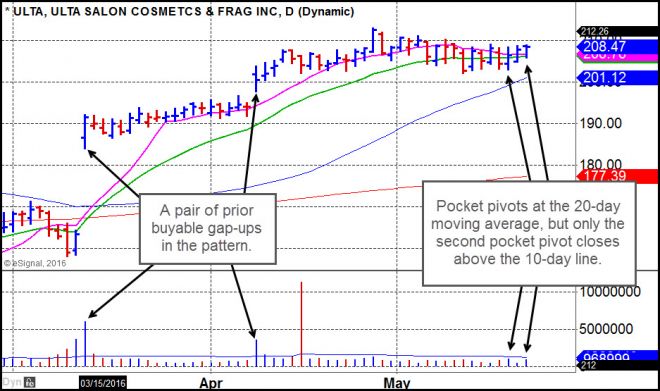

Ulta Salon & Fragrances (ULTA)

GM - ULTA continues to hold tight after a pair of buyable gap-ups earlier in the year. Two pocket pivot volume signatures showed up towards the end of the week, with the first one closing just below the 10-day line and the second one just above the line. Both did come up and off of the 20-day moving average. In my view, pocket pivots off of the 20-day line are valid, particularly within a very tight and constructive price range like ULTA's.

Dr. K - Tight, flat bases such as the one ULTA is exhibiting should resolve to the upside should the general market head higher. Such formations also have the added advantage of keeping one's stops extra tight relative to purchase price. Alternatively, one could use the 50-day moving average which is catching up with the base as support.

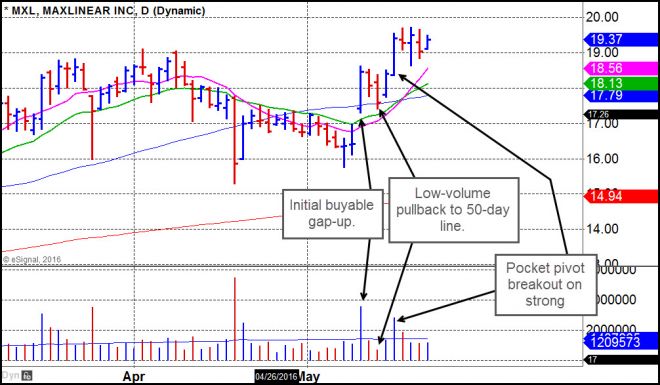

Maxlinear (MXL)

GM - MXL is a smaller stock, but so far has acted like a reliable leader over the past two weeks since we first reported on its buyable gap-up move following earnings and then followed up with a report alerting members to the very low-volume pullback into the 50-day moving average over the next two days. In fact, this pullback represented a very opportune and lower-risk entry point after the BGU. On Monday MXL broke out to a new high on strong volume that also qualifies as a pocket pivot breakout. Technically, MXL remains within buying range of this breakout.

Dr. K - MXL has traded constructively since its pocket pivot. It could therefore move higher from here, especially should the general market head higher. More conservative investors could wait until MXL pulls back to its 10-day moving average with the risk that they may miss the stock should it move higher before it does so.

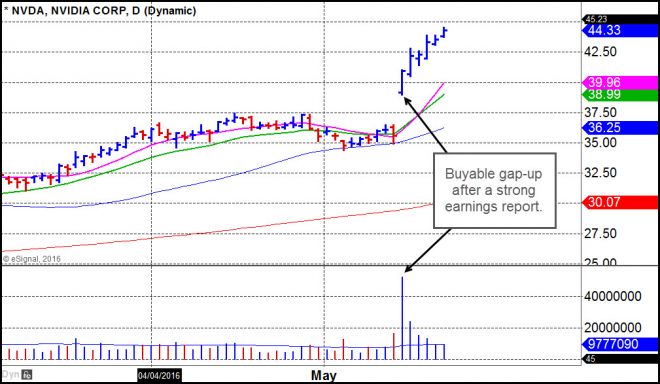

Nvidia (NVDA)

GM - NVDA has proven to be a powerful buyable gap-up that has continued to push higher even in the midst of a great deal of general market volatility this past week. That is certainly impressive action, but the stock has now moved over 10% beyond the initial buyable gap-up. Members who bought the BGU could consider taking a total or partial profit here as we give the 10-day moving average time to catch up to the stock.

Dr. K - NVDA being a semiconductor stock is prone to pullbacks. Its 10-day moving average is far from its current price so taking partial profits on this recent price strength may be prudent. Alternatively, one could put stops extra tight such as a move below Friday's low.

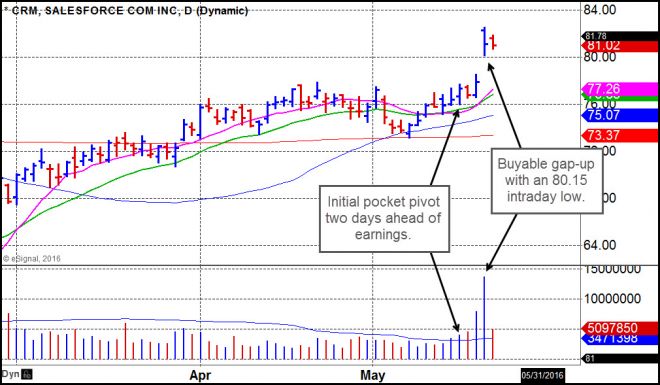

Salesforce.com (CRM)

GM - CRM's pocket pivot this past Monday, two days ahead of Wednesday's earnings report, turned out to be prescient. This sort of action reminds me of the "old days" when pocket pivots before an earnings report were often a clue that the report would be favorable and could be bought ahead of the report. That turned out to be the case with CRM as it once again gapped up after earnings, producing a buyable gap-up on Thursday using the 80.15 intraday low as a selling guide.

Dr. K - CRM has now gapped higher after its earnings reports six times in a row. While volume clues the day before earnings are reported dont work as well as they used to, sizing up a stock's price history immediately after earnings can help push the odds in your favor.