Market Lab Report / Dr. K's Crypto-Corner

by Dr. Chris Kacher

The Metaversal Evolution Will Not Be Centralized™

The trade wars have officially begun.

1. 25% tariffs on all good from Mexico to US

2. 25% tariffs on all goods except energy from Canada to US

3. 20% tariffs on many goods from China to US

4. 10% tariffs on energy from Canada to US

5. 25% retaliatory tariffs on up to $155B of goods from US to Canada

Tariffs against Canada at 25%, Mexico at 25%, and China at 10% are proceeding so that has created headwinds for the major averages though as discussed in prior reports, should be bullish for the economy in the long run. The effective average tariff rate in the US is set to rise to its highest since the Great Depression. Also possible are 25% tariffs on the European Union then await retaliatory tariff announcements. Meanwhile, AAII sentiment is at levels seen near or at major market lows though markets can go a bit lower before finding a major bottom as shown in 1990 and 2008.

Global liquidity / stealth QE also continues to pump and should reaccelerate sooner than later based on various metrics but this can have a lagging effect during which markets can continue to correct. https://www.virtueofselfishinvesting.com/reports/view/market-lab-report-ism-vs-global-liquidity-vs-markets

Trump wants Powell to lower rates. He can get this done by recession which always forces the Fed's hand. The initial impact of tariffs is reduced trade. The initial impact of DOGE (Department of Government Efficiency) is higher unemployment where Trump and DOGE have fired roughly 100,000 government employees and plans to cut up to 300,000 federal jobs by the end of 2025. Also, for every federal employee laid off, there are approximately two contractors whose jobs may also be at risk, potentially increasing total job losses to 1 million.A driver of US economic growth has been the government itself. Whether the spending is fraudulent or necessary, government spending creates economic activity. In addition, there is a money multiplier on government spending. This is why the Washington DC metropolitan area is one of the wealthiest in the country (96th percentile of U.S. cities for household income), due to numerous professional leeches extracting blood from the government which has a follow-on effect.

Stock and crypto markets could correct further given all of the above. Countering this is material growth from AI which boosts GDP as well as global liquidity. But both are unlikely to be sufficient at first since AI growth is exponentially steady while tariffs, layoffs, and cutting expenditures are sudden so can materially affect GDP, jobs, and unemployment in the short term. Global liquidity is less likely to materially accelerate until rates get cut more regularly.

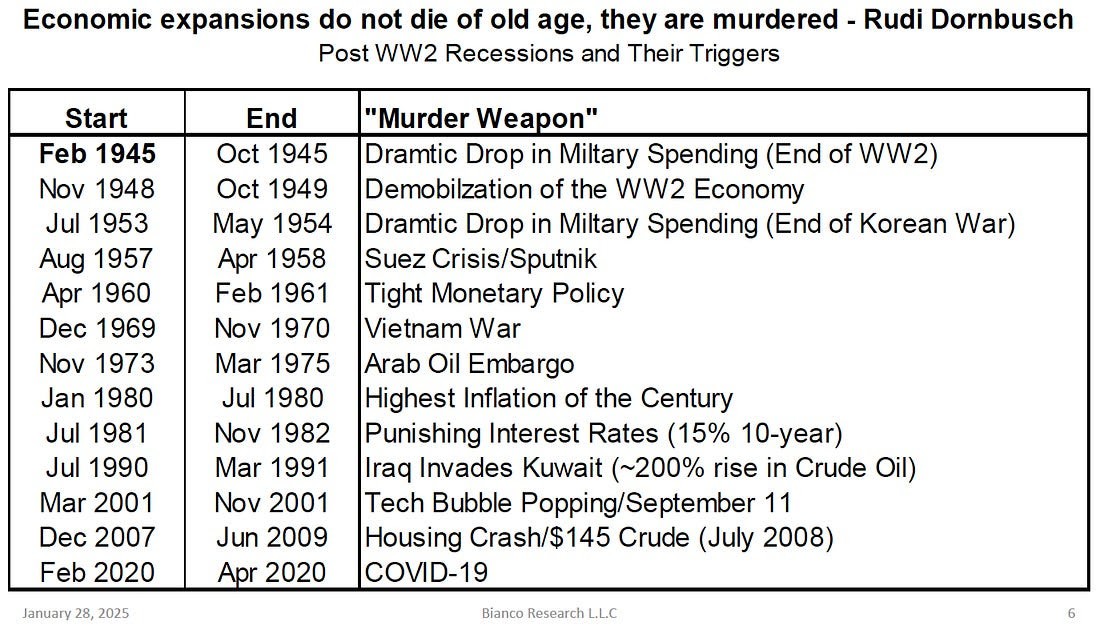

Past recessions

In past recessions, the Fed starts to lower rates in a hurry a bit too late to stave off recession which results in bear markets.

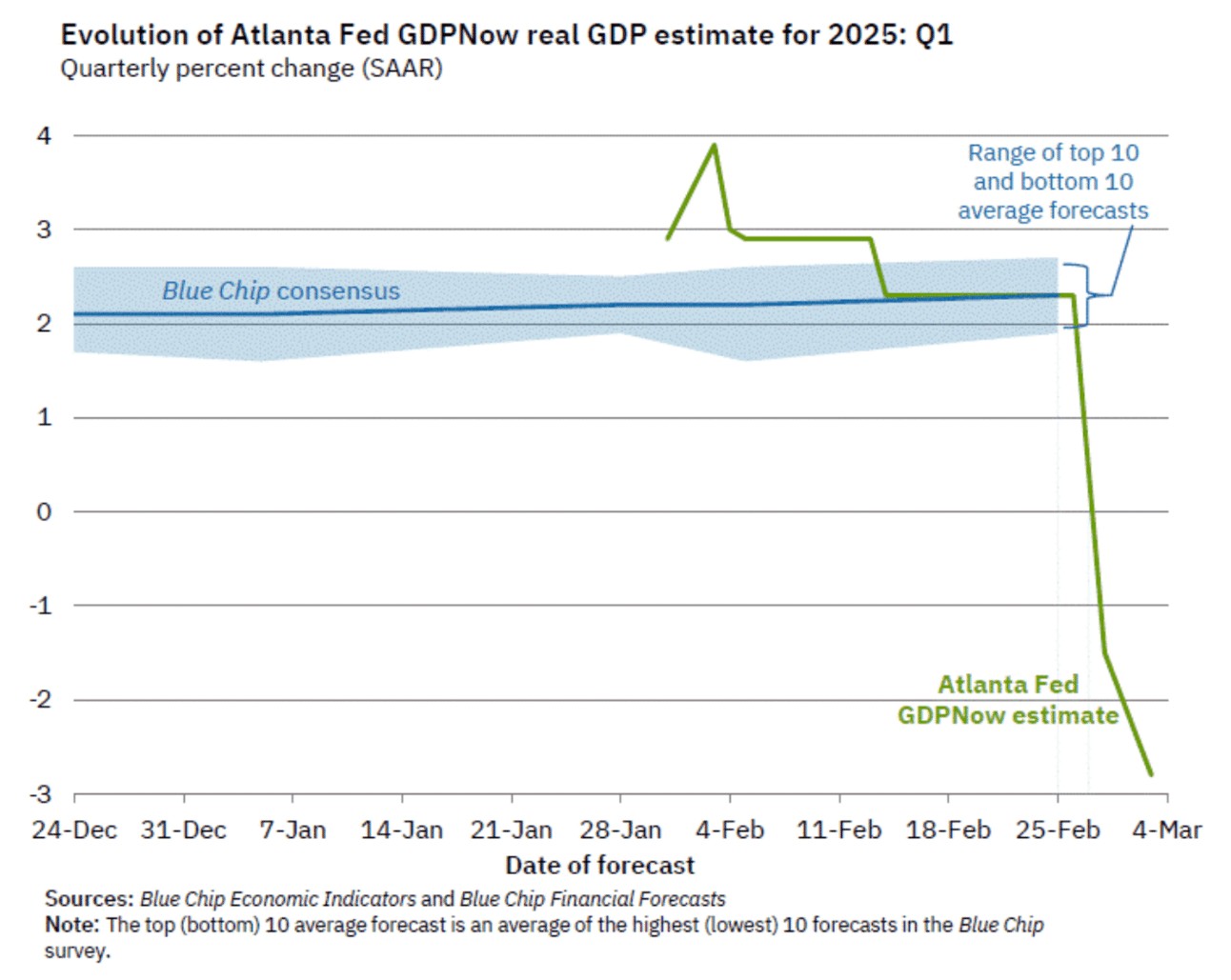

Currently, the Fed has ample room to move rates lower. The length of any recession-induced bear market will be guided by the speed at which the Fed lowers rates. If they lower them as fast as they did in 2020, markets will rebound very quickly. But this is less likely even should unemployment start to soar while GDP goes negative as both have done during prior recessions. The Atlanta Fed's GDPNow model predicts a contraction of -2.8% in the first quarter due to recent data showing weaker personal spending, consumer confidence, and net exports as well as a near 30% surge in imports driven by businesses stockpiling goods ahead of new tariffs.

Two quarters of negative GDP normally define a recession which would be spurred by the DOGE clean up and a weakening economy due to the initial impact of tariffs and unemployment. Note, the two quarters of negative GDP in 2022 was an aberration due to strong consumer spending and near record low unemployment.

Another catalyst for lower rates comes from the $2.08 trillion in US corporate debt and $10 trillion in US treasury debt that must be rolled over this year. If the US is on the cusp of or in the middle of a recession, rolling over these gargantuan sums of paper will be harmful at the current interest rate level. Therefore, the Fed must and will act.

Every 0.25% cut in Fed Funds equates to $100 billion of QE or money printing. The Fed therefore can create $1.7 trillion in QE if rates were to go all the way to zero but this is unlikely. But the Fed can stop QT which would inject $540 billion of liquidity, and US commercial banks can buy treasuries using infinite leverage known as the SLR exemption which adds up to about $0.5 to $1 trillion in QE.

So Rate Cut: $1.7tn + QT Stoppage: $0.54tn + QE Restart / SLR Exemption: $0.50tn to $1tn = $2.74tn to $3.24tn

This prevents taxes from being hiked which counters Ray Dalio's proposal of lowering rates 1%, cutting expenditures via DOGE, and raising taxes.CME FedWatch is now predicting 3 rate cuts for 2025 with the first one in June, up from just one rate cut. This number is likely to rise should the data show sharply weakening GDP and rising unemployment which is likely since DOGE will likely increase the likelihood of a US government spending slowdown-led recession which will spur the Fed to cut rates.

This, together with deregulation, DOGE, tax cuts, and a pro-business White House will reignite the bull market. But that time could be months away as it is dependent on liquidity at home and abroad.