Market Lab Report / Dr. K's Crypto-Corner

by Dr. Chris Kacher

The Metaversal Evolution Will Not Be Centralized™

Among his proposals so far:

=A 25% tariff on Mexico and Canada

=Gradually raising tariffs between 2-5% a month

=Blanket 10-20% tariffs on all US imports

=A 60% tariff on goods coming from China

Some believe the cost of higher tariffs include potentially higher prices for American consumers, but if tariffs lead to expanded capacity in the US, that could be disinflationary.

Some also believe Trump's deregulatory stance with less government will increase GDP while slowing inflation.

The NFIB Small Business Optimism Index climbed in December to its highest reading since October 2018, with respondents reporting more hopefulness for the new administration versus the prior.

Liquidity

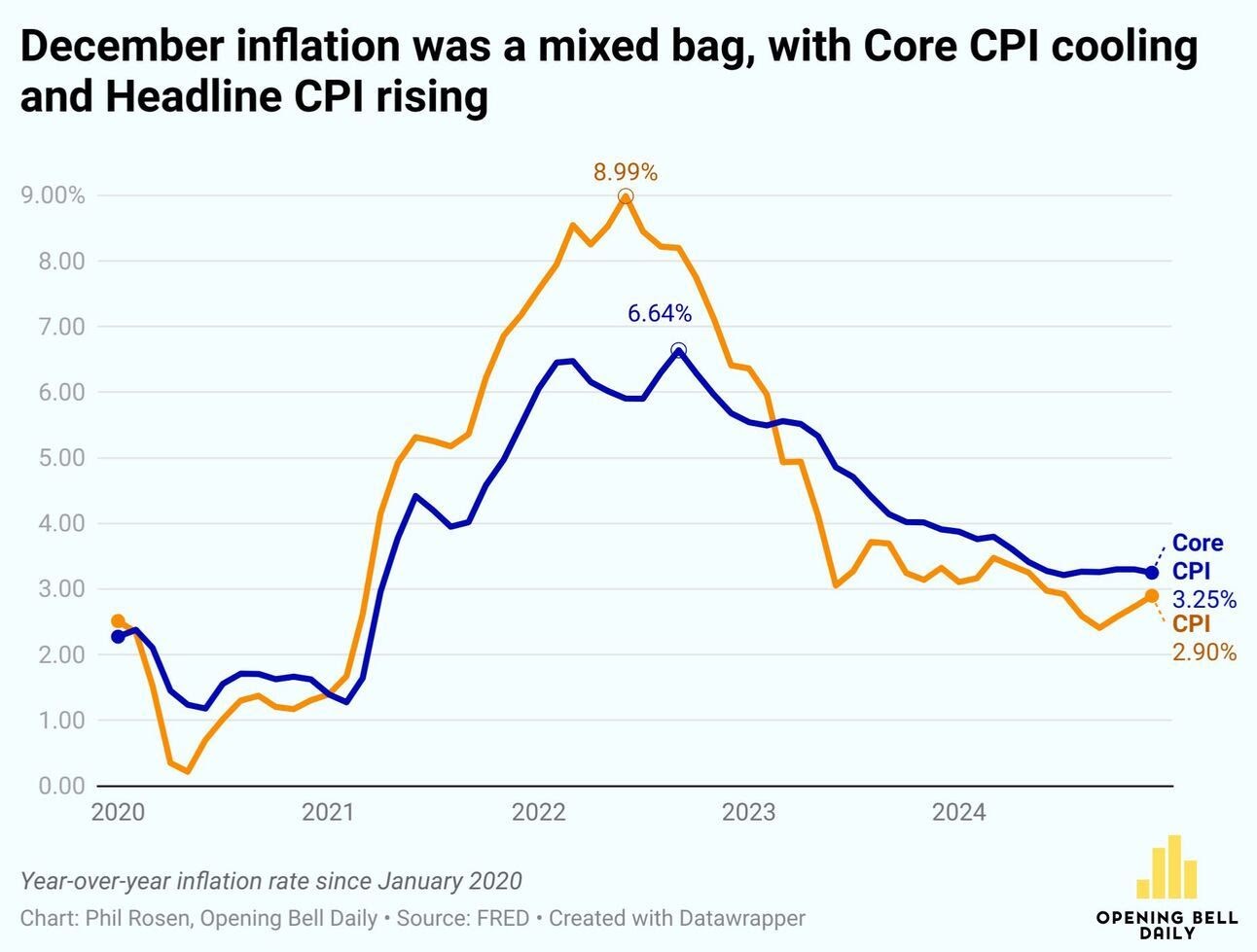

When it comes to liquidity, the hidden stealth QE stimulus is on the decline. The RRP (Reverse Repo facility) is nearing depletion but the Fed has a big bag of tricks. Expect the rate of inflation to guide interest rates. All three measures of inflation (CPI, PPI, PCE) at the core level have come in 0.1% under estimates. That said, inflation is still not necessarily falling but steadying. Future data will determine whether inflation continues to fall, steady, or rise and this will determine the pace of rate cuts. CME FedWatch currently predicts one rate cut this year.

Since the picture based on the data remain unclear, markets remain in a somewhat choppy phase. But technicals suggest a mild bias towards the upside based on strength in financials such as GS, MS, and BAC as well as with some of the Magnificent 7. AMZN, GOOG, META, and NVDA continue to trade sideways near their highs.

Q&A

Q: It feels like Bitcoin is on the cusp of a massive-breakout in adoption. Normally we expect tighter liquidity to translate into risk-off and lower stocks and crypto, but what if a sell-off in the larger equity market, and specifically MAG7 lead to money rotating into BTC and related equities like MSTR and COIN rather than correlating with everything going down?

It certainly doesn't feel like folks want to rush into long treasuries for the typical recession trade. Also, big cap financials are relatively healthy which does not precede recessions.

A: MAG7 and BTC-related are all risk-on. Both will either rise or fall together. I dont see BTC breaking away from the pack at this time. It is still too soon.

We will get a rise in global liquidity though perhaps a weaker rise this year, black swans notwithstanding. Stealth QE remains a huge force given excessive debt on many levels, thus the tug-o-war between the slowing of rate cuts which slow liquidity vs stealth liquidity which continues to rise but is just a question of how fast. Acceleration or deceleration in global liquidity will guide the markets.