Market Lab Report / Dr. K's Crypto-Corner

by Dr. Chris Kacher

The Metaversal Evolution Will Not Be Centralized™

Trump has unleashed many pro-crypto policies as well as pushing for lower interest rates at home and abroad which will positively impact global liquidity. At the World Economic Forum, Trump said, “I’ll demand that interest rates drop immediately. They should be dropping all over the world. Interest rates should follow us all over." Alluding to Fed Chairman Jerome Powell, Trump continued, "I think I know interest rates much better than they do. I think I know it certainly much better than the one who’s primarily in charge of making that decision.” If Trump gets what he wants, this is bullish for stock and crypto markets.

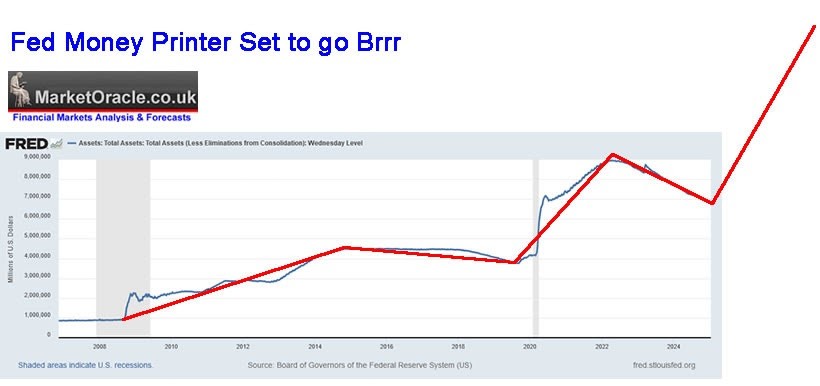

Going against Trump's wishes, Powell said he plans to keep rates fixed for now until he sees further evidence that justifies a change in rates. Nevertheless, the US ultimately has no choice but to continue to monetize their record levels of debt or else bond yields will rocket higher. They have been doing this through stealth QE which pays off debt interest so the US does not default. Meanwhile, the counterbalance to how much the central bank will need to print is the material productivity from AI. This will help boost GDP. It's essentially a race between how much GDP can rise vs inflation which can rise due to QE in all its forms.

So while Trump is calling for lower interest rates which will boost liquidity to spur growth, it can also stoke inflation. The tightrope the Fed has always had to walk is to decide how much liquidity is needed to keep GDP healthy but not so much as to spur inflation. The general direction of stocks, bitcoin, and various hard assets correlates with global liquidity.

Trump also launched “The Working Group” which “shall evaluate the potential creation and maintenance of a national digital asset stockpile and propose criteria for establishing such a stockpile, potentially derived from cryptocurrencies lawfully seized by the Federal Government through its law enforcement efforts.” The move helps Trump keep his word to be the first-ever “crypto president.” Indeed, a crypto council composed of key regulatory agencies like the SEC, CFTC and Treasury begins to build the framework for crypto in the US.

Yen carry trade

One headwind is that Japan hiked rates 25 basis points on January 24. There is a possibility of market turbulence due to the unwinding of yen carry trades, so we are closely monitoring USD/JPY and the Nikkei. Still, a complete collapse which came right after their last rate hike in July is less likely. Here's why:

- Reduced Scale of Carry Trades

- A significant portion (65-75%) of global carry trade positions have already been unwound following the Bank of Japan's (BOJ) rate hike in July 2024.

- This reduced scale means the potential impact of further unwinding is likely to be less severe.

- Market Awareness

- The recent market turmoil has heightened awareness of the risks associated with yen carry trades.

- Investors and traders are likely to be more cautious and prepared for potential rate hikes.

- Gradual Policy Approach

- The BOJ has shown a tendency for gradual policy changes, as evidenced by their cautious approach to raising rates.

- This gradual approach may allow markets to adjust more smoothly to future rate hikes.

- Global Economic Factors

- The impact of future rate hikes will depend on the broader global economic context, including U.S. monetary policy and economic indicators.

- If global economic conditions remain stable, the impact of a Japanese rate hike may be more contained.

- Remaining Carry Trade Positions

- While reduced, there are still significant carry trade positions that could be affected by further rate hikes.

- Market Sensitivity

- Global markets have shown sensitivity to changes in the yen's value and Japanese monetary policy.

- Interconnected Markets

- The unwinding of carry trades can affect multiple asset classes and regions simultaneously, potentially amplifying market movements.

Also of note is that when Japan hiked rates on July 31, 2024, it sent the USD-YEN pair down immediately then the day after, markets including the Nikkei quickly unravelled over the next 3 days with the third day being called a global crash. This time, the USD-YEN pair has not crashed and neither has the Nikkei or global markets.

AI issues

A new AI model from China, DeepSeek, has created market volatility after claiming to be more effective than OpenAI's ChatGPT in tests. Its mobile app is now #1 in the US and China, but instead of celebration, investors are concerned. The model was reportedly developed for under $6 million and open-sourced, raising questions about why US companies spend billions on AI and whether the US is losing its edge in AI supremacy. Skepticism surrounds DeepSeek's claims due to China's history of misleading financial markets and fraudulent corporate practices. While it’s possible DeepSeek achieved this on a low budget and did not use NVDA H100 chips, Elon Musk and others remain skeptical especially when compared to the massive investments by companies like OpenAI and Anthropic.

Nevertheless, if DeepSeek's claim of only using less powerful H800 chips is true, and since DeepSeek has made their work open source, others are already finding truth in their claim. Indeed, DeepSeek's innovation could be a net positive for society by making AI more accessible, driving economic growth, and increasing efficiency as per Jevons' paradox which says when a resource increases in efficiency, it creates an increase in consumption of that resource, not a decrease. DeepSeek would then have demonstrated that high-performing AI models can be built with fewer resources than previously thought necessary despite US export controls on H100 GPUs. As more high-quality language models become available for free, market forces will drive down prices across the industry.

DeepSeek claimed results are staggering:

- Training costs slashed from $100M to $5M

- GPU requirements slashed from 100,000 GPUs to 2,000 GPUs

- 95% reduction in API costs

- Runs on gaming GPUs instead of specialized hardware

- DeepSeek did this with a team <200 people, not thousands

And being open source, anyone can verify, build upon, and implement these innovations. It’s the democratization of AI at an unprecedented scale so even if DeepSeek is misrepresenting their success, another "DeepSeek" will eventually come from somewhere on the planet ending the "only-big-tech-can-play" era and shattering innovation barriers if they have not already been shattered. The playing field will have been leveled. This is always the way when it comes to bleeding edge technologies as long as governments don't try to create artificial monopolies which always stagnates innovation such as what the US government did for Bell Telephone in the 1930s. Telephony technology stagnated for decades while Bell Telephone carried this artificial monopoly.

Decentralizing AI technology

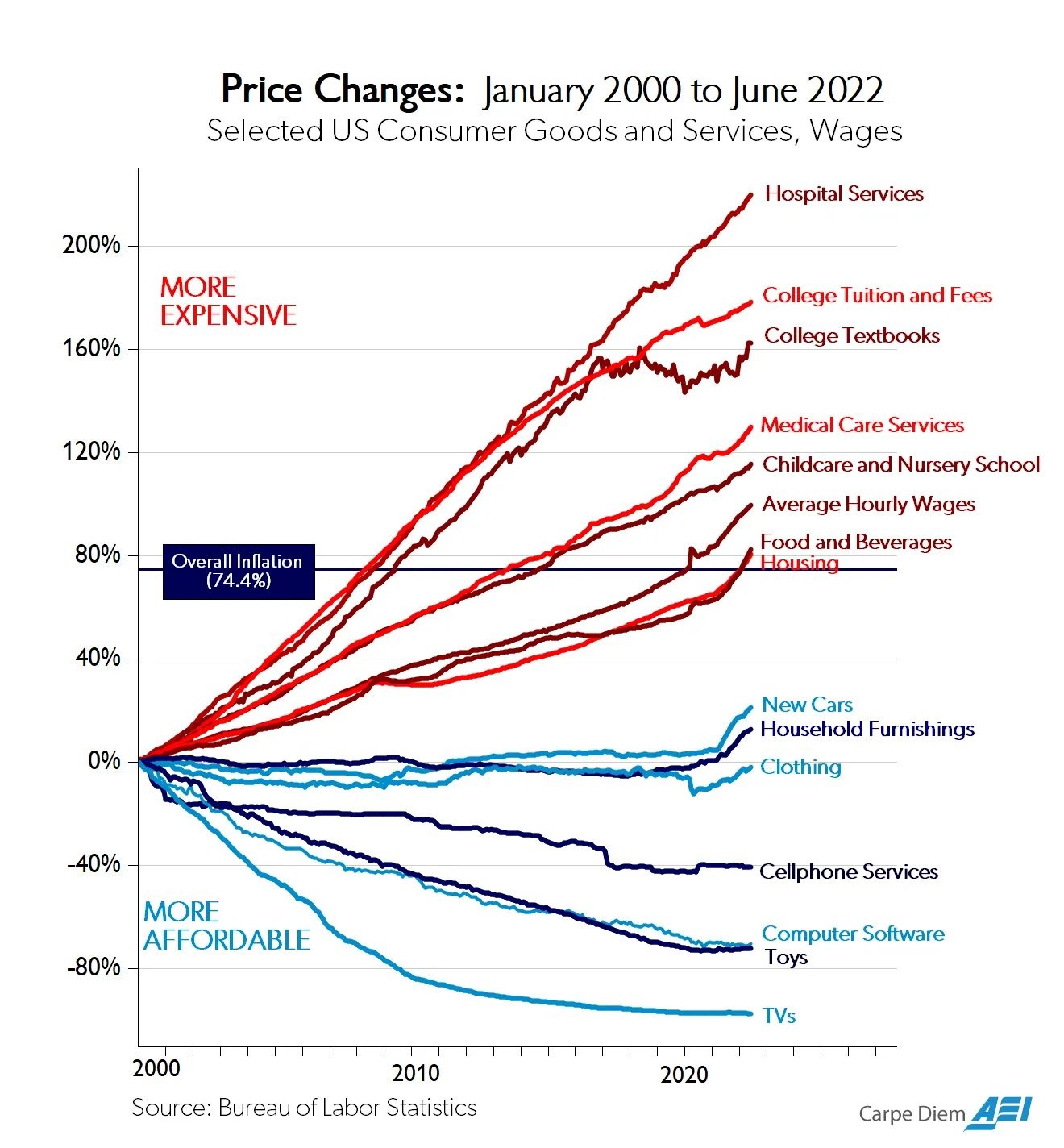

Open source is key to decentralizing AI technology which will hopefully prevent governments from materially controlling and outlawing competition. Government control is the reason as Marc Andreesson points out HERE why everything the government touches is ludicrously inflationary. Only mobile phones, flat screens, and computers remain deflationary.

Some may remember the chart I posted months ago about how regulatory capture causes inflation. Because of this, the price of healthcare, food, housing, and college tuition have soared. Essentially, all the things we need the most are price controlled by governments by being given artificial monopolies. In other words, competition is outlawed in these areas.

Andreesson posits that AI will be illegal for most of the economy where he writes, "We are heading into a world where a flat screen TV that covers your entire wall costs $100, and a four year college degree costs $1 million, and nobody has anything even resembling a proposal on how to systemically fix this. Why? The sectors in red such as healthcare, food, housing, and college tuition are heavily regulated and controlled and bottlenecked by the government and by those industries themselves. Those industries are monopolies, oligopolies, and cartels, with extensive formal government regulation as well as regulatory capture, price fixing, Soviet style price setting, occupational licensing, and every other barrier to improvement and change you can possibly imagine. Technological innovation in those sectors is virtually forbidden now."

Andreesson says that this is why AI will not cause overall unemployment to rise because it is soon to be illegal virtually across all of the economy. While Andreesson is a deep thinker, DeepSeek came out just after he posted these views on X. Open source decentralization is key to outdoing centralized government control. Decentralized evolutions such as web3 when overlaid with AI as I write about HERE is the way forward. The Network State as discussed in Balaji Srinivasan's book will quickly grow and evolve.

What will happen to NVDA? This will impact their business model of selling super-expensive GPUs with 90% margins but a huge win for the democratization of AI. Perhaps this is why we are seeing some of the Magnificent Seven stocks such as META and AMZN make new highs with GOOGL not far behind in the face of this news. Meanwhile, the industry focus is shifting from massive training where NVDA dominated to inference where more players will have competitive offerings. We sent a short sale set-up report on NVDA on Thursday.