Market Lab Report

by Dr. Chris Kacher

The Web3 Evolution Will Not Be Centralized™

Recession almost here?

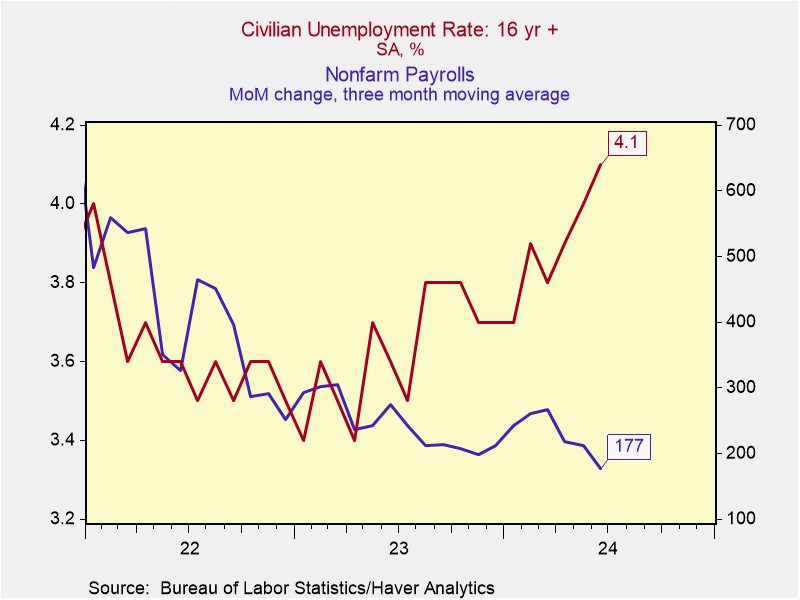

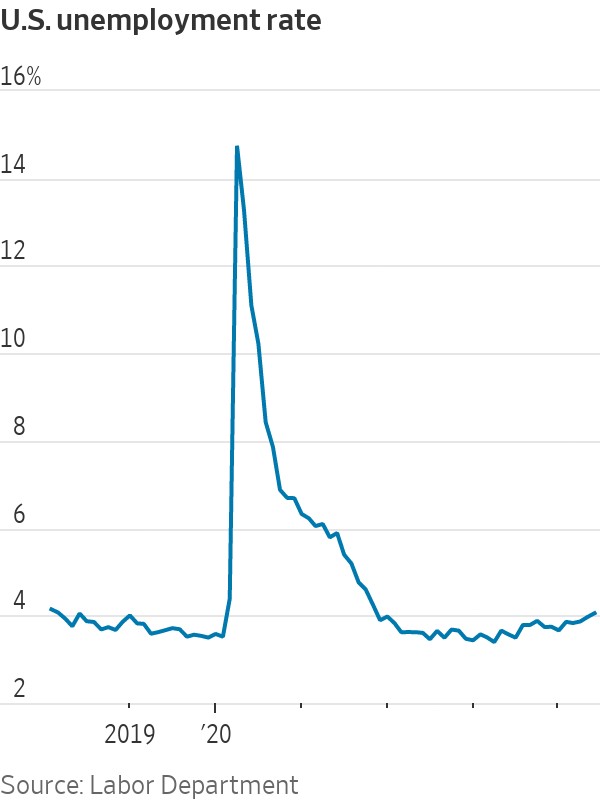

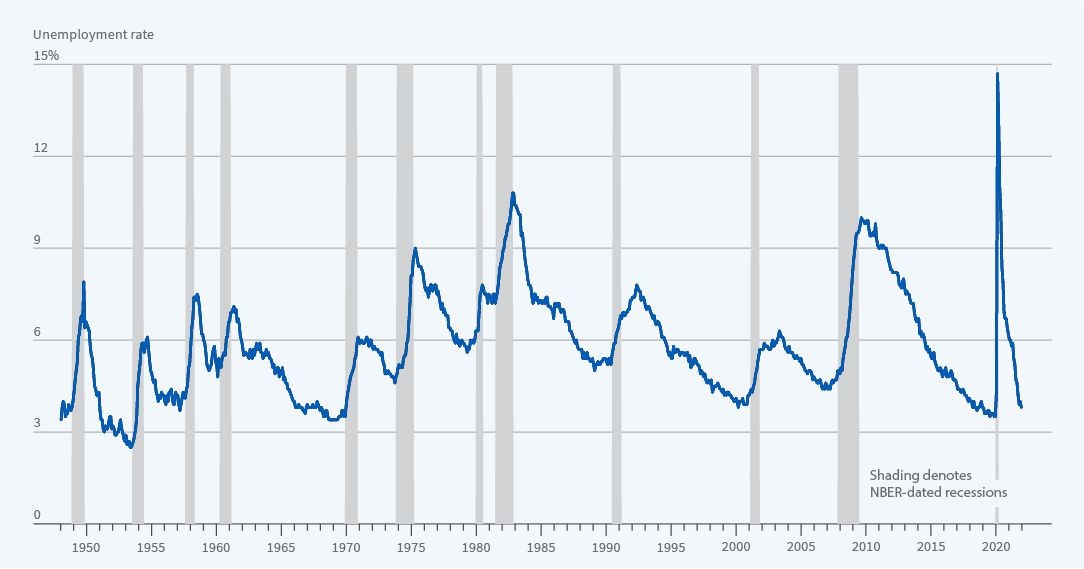

There are two indicators that historically point to recession being imminent (within the next couple of months). First, unemployment came in at 4.1% vs est 4.0%.

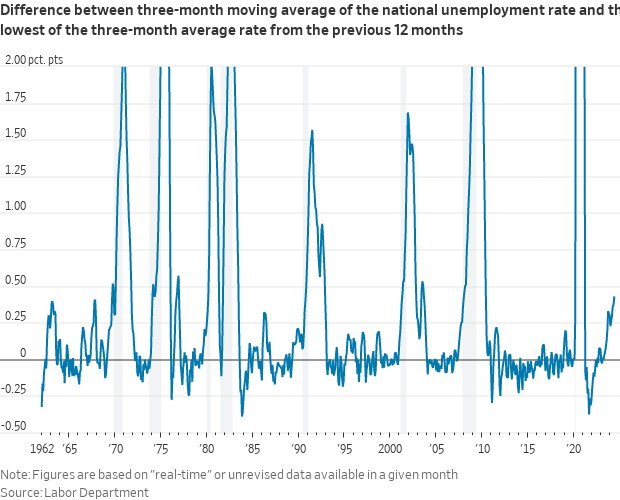

The Sahm Rule identifies signals related to the start of a recession when the three-month moving average of the national unemployment rate (U3) rises by 0.50 percentage points or more relative to its low during the previous 12 months. The unemployment rate rose from 3.96% in May to 4.05% in June. It is now up +0.22pp since March (3.83%). The Sahm rule shows the three-month average is up +0.42pp from the 12-month minimum of the same measure. This is getting quite close to the +0.5pp threshold.

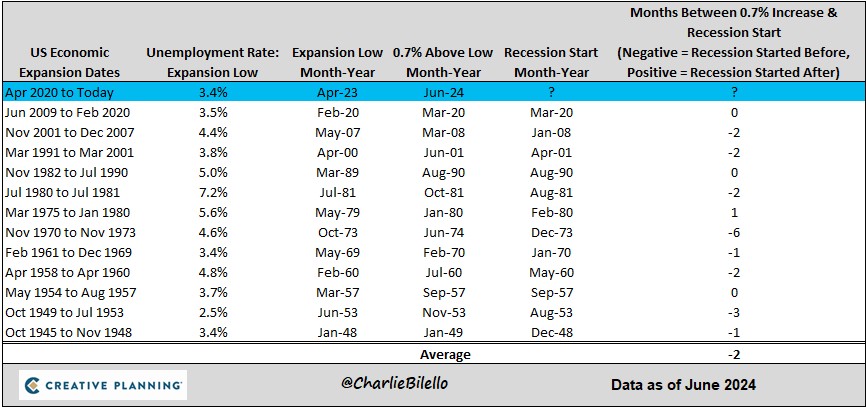

The US Unemployment Rate is now 0.7% above the cycle low from April 2023 (3.4%). Historically, that 0.7% move higher has occurred near the start of a recession.

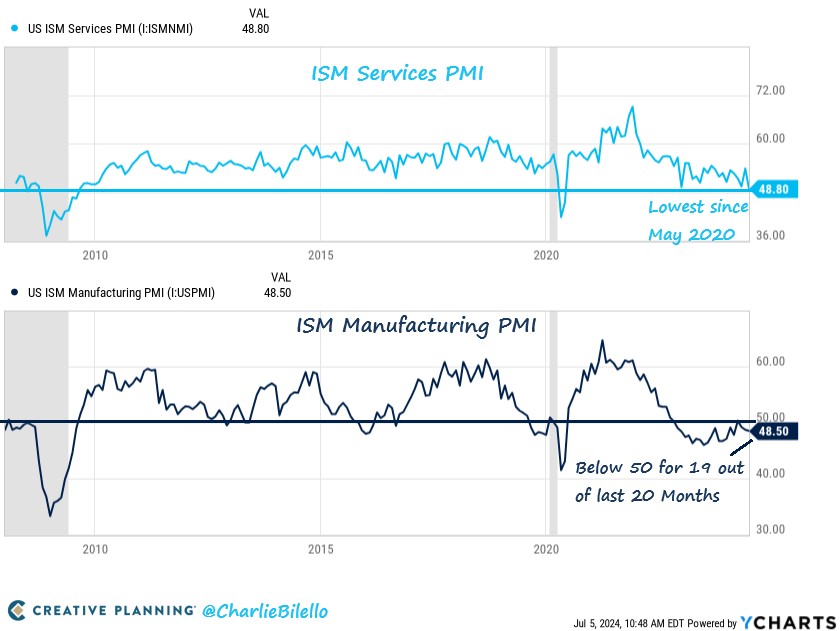

Another indication of a potential recession is the ISM Services PMI which came in below 50, its lowest level since May 2020. ISM Manufacturing PMI has been below 50 for 19 out of the last 20 months. Only periods w/ both PMIs below 50 at the same time:

Jul '08 - Jul '09 (Recession)

Apr-May 2020 (Recession)

Dec 2022 (stock and crypto markets had steep corrections in 2022 but then rallied in 2023)

2024 (stocks rallying so far)

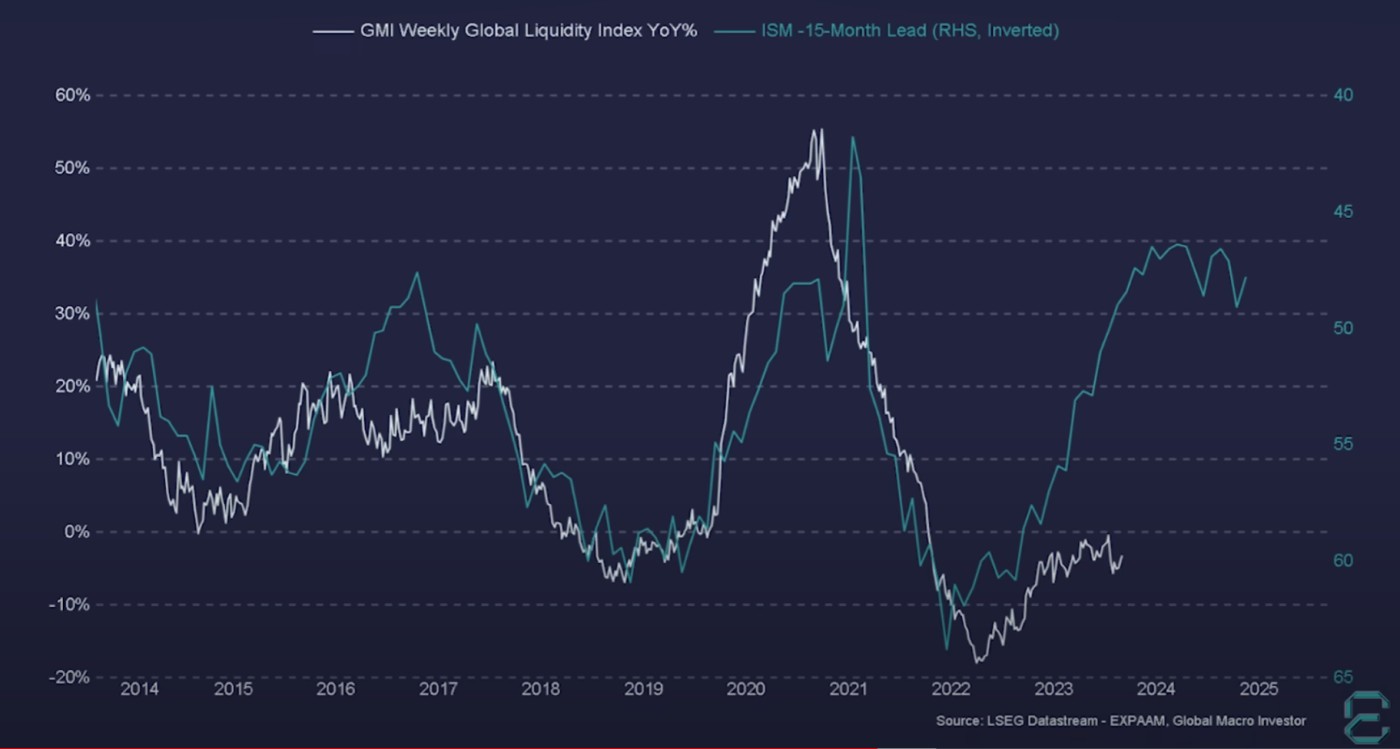

The counterargument is that as ISM falls, global liquidity increases. We also have $2 trillion for 2024 alone in stealth QE plus the Fed having to create more fiat to prevent major Japanese banks from selling US Treasuries.

Furthermore, the Fed is not shy about using QE in all its forms as needed to prevent or cut short a recession. They did this starting in late 2008 and March 2020. It would come as no surprise should stocks and Bitcoin grind their way higher in the coming months. Note how the US has not has a prolonged recession since the Great Financial Collapse in 2008 which ended in the first half of 2009.

That means this time is different so despite ISM and unemployment data suggesting recession, QE changes things.

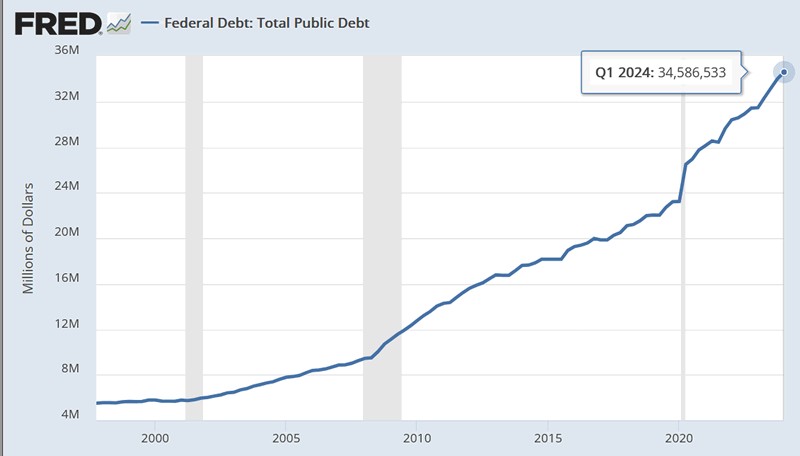

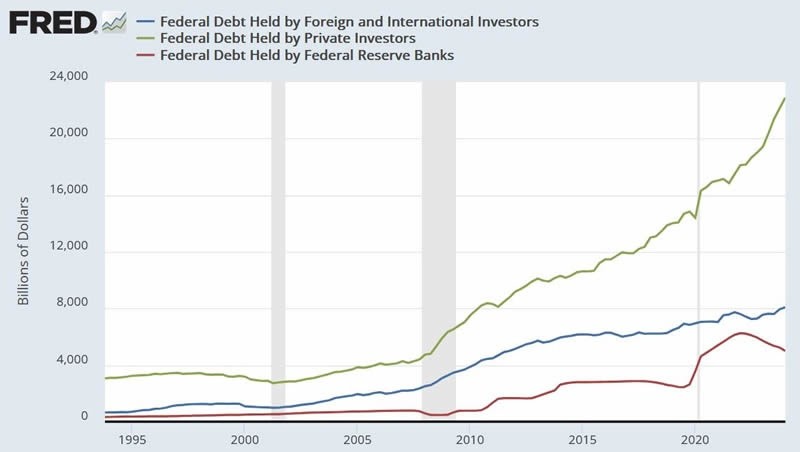

Total debt stands at $34.6 trillion. But who holds all this debt?

Foreigners hold $8 trillion and the Fed's balance sheet is at $7.5 trillion which includes other assets that the Fed has bought. Its balance sheet has shrunk since 2022 but has been outpaced by stealth QE mainly from federal debt held by private investors such as banks and institutions thus stock markets since Jan-2023 continue to rally with Bitcoin grinding higher, 3 steps ahead, 2 steps back.

Black swans notwithstanding, regardless of who wins the US presidential election, at least $8 trillion will be added to the US Federal debt mountain over the next 4 years. Expect the inflation megatrend to continue.

Meanwhile, the Fed will do their song and dance about cutting rates vs. keeping rates higher for longer. The former opens the door to a rebound in inflation if done too soon while the latter is problematic for the labor market, which is currently humming along but “not overheated.” Powell said, “We know that reducing policy restraint too soon or too much could stall or even reverse the progress we have seen on inflation."In other words, he needs to see more cooling before cutting rates. Thursday's CPI number came in under estimates across the board so this gives him room to cut sooner than later.