by Dr. Chris Kacher

Rate cuts

The European Central Bank lowered interest rates by 0.25% to 4.25% for the first time in five years. Spurring the move were seven straight months of cooling inflation across the old continent. The day before, Canada cut its interest rates by 25 bps. The trend towards lower rates has begun. It is surprising they are doing this ahead of the US Federal Reserve rate cut which may mean recession is incoming in the EU and Canada.

This puts pressure on the US Fed to lower rates. Treasury bond yields and the dollar have been falling suggesting the Fed will lower rates sooner than later. CME FedWatch now predicts two more 25 bps rate cuts this year with the next one this September. Further, oil prices have been slumping which suggests the demand for goods is slowing.

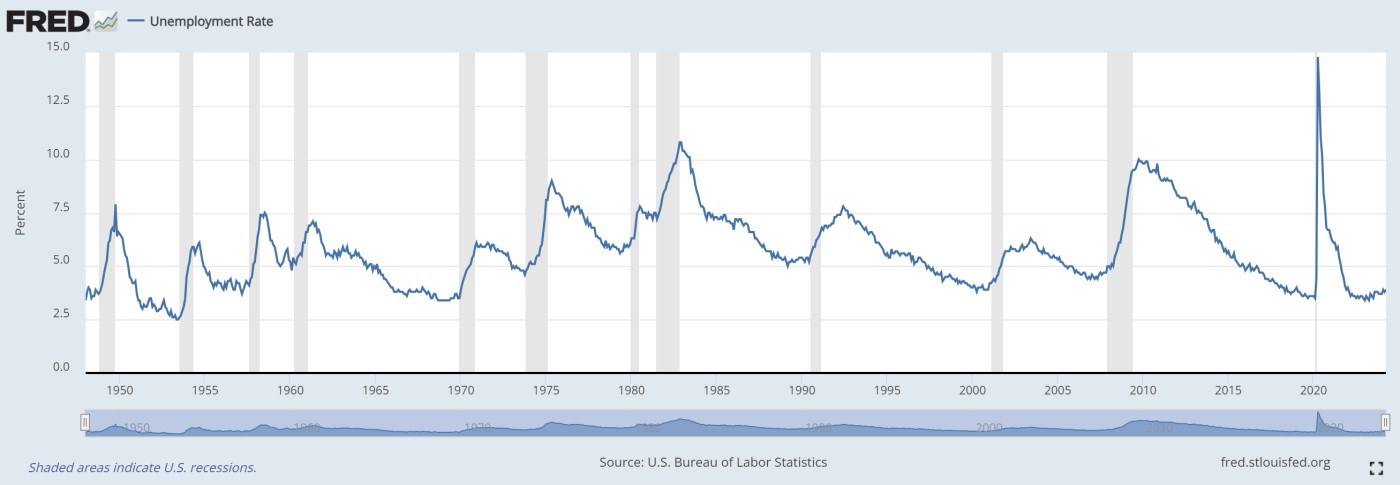

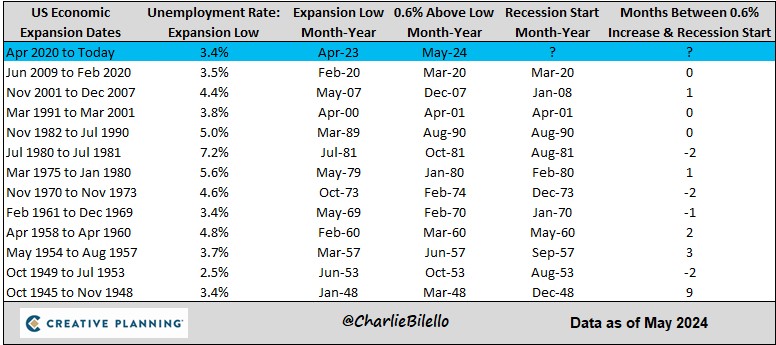

On the jobs front, earnings came in above expectations at 0.4% MoM vs est 0.3% while unemployment ticked higher to 4.0% from 3.9%. Both are negatives as data push towards a possible recession. The data shown below only shows the 3.9% data in April, not the 4.0% in May. You can see a mild uptrend in unemployment often presages recessions.

The unemployment rate is now 0.6% above the cycle low from April 2023 (3.4%). Historically, that 0.6% move higher has occurred near the start of a recession. But this time, stealth QE is prodigious and continuous thus may continue to prop markets. Further, the “wealth effect” which includes the massive gains in home values and stocks has helped stave off a recession. It will be key to keep a close eye on future unemployment rates to see if they can hold steady. In prior times, unemployment starts to quickly rise.

Payrolls had a huge beat 272K vs est 180k but full-time workers: -625k, part-time workers: +286k. Even if the market fails to take into account the huge drop in full-time workers, the big beat could be positive since on Feb 2, nonfarm payrolls expanded by 353,000 for the month, better than the Dow Jones estimate for 185,000 causing markets to rally. That said, the unemployment rate held at 3.7%, against the estimate for 3.8%.

One big problem in keeping rates high is the weak yen. If the yen isn’t strengthened, China may devalue its yuan to match the weakness of its chief export competitor Japan. US Treasuries would then get sold which would hurt Pax Americana as rates would then rise as the Fed must create more fiat to buy them. At the same time, rates need to stay where they are because lower rates mean more inflation which would disfavor Biden the incumbent.

The key variables work for or against each other which clouds the picture. If the Fed lowers rates ahead of the election, this could be good or bad for Biden. It is good in that it favors more inflation and higher stock prices which is good for Biden. It is bad in that it stokes inflation. But since the election is in November, lower rates would likely help Biden win. On the other hand, Trump is pro-crypto which wins a sizeable number of voters as crypto becomes institutionalized.

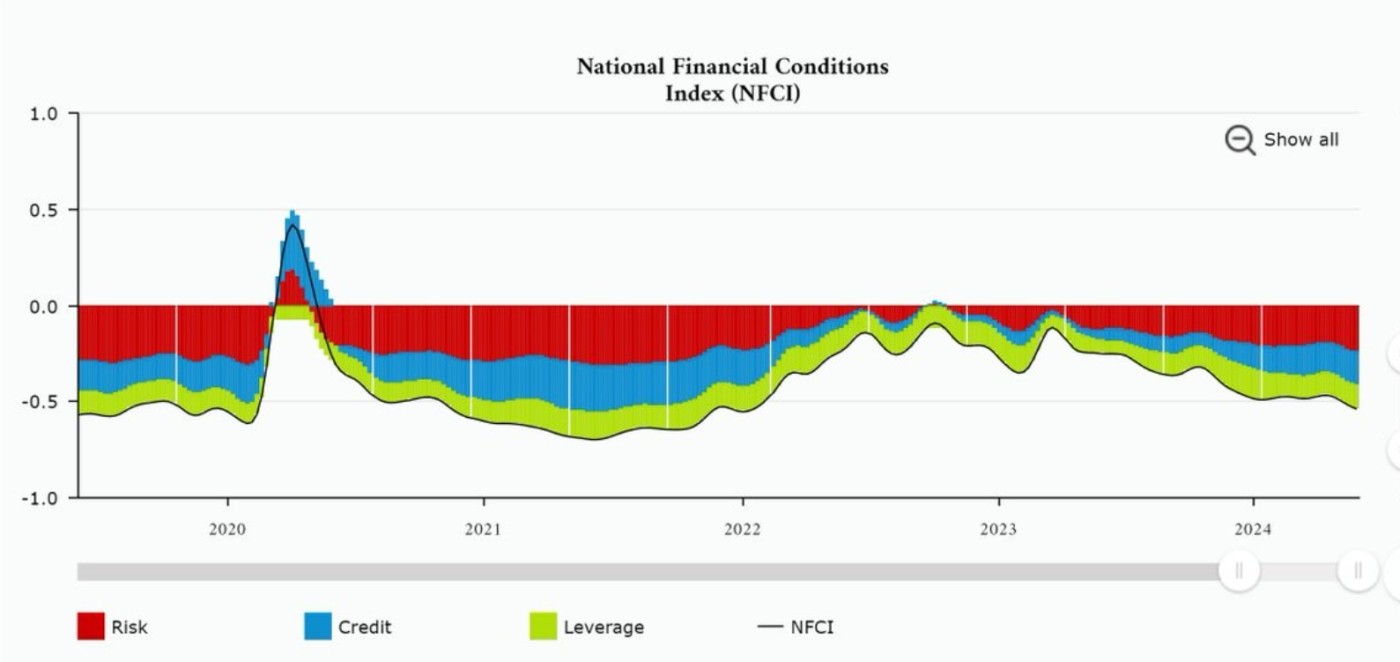

Ultimately, lower global rates mean more global liquidity and a new uptrend in M2 which correlates well with stocks and cryptocurrencies. As the mega-inflation trend which started in 2009 continues, the bull may have legs yet if we dont slip into recession wherein QE is not launched to shorten its length much as the Fed did in March 2020. The National Financial Conditions Index continues to trend lower due to stealth QE despite the Fed claiming conditions have been kept tight. But then, the Fed has often made inaccurate statements and baseless predictions.

Wednesday's CPI came in cool at 0.1% below expectations across the board for both normal and core MoM and YoY. The tally has been a series of 3 hot CPI reports, one cool CPI report, one cool PCE report, and one hot nonfarm payrolls report where both wages and unemployment came in 0.1% above estimates.

Investors focused on the Fed’s economic projections for the rest of the year, the so-called dot plot which signalled only one more rate cut for 2024 which was bearish for markets as they expected two more cuts. Despite the election year and today's cool CPI report, Powell was hawkish overall during his testimony. This suggests rates will stay higher for longer but due to stealth QE, stocks and Bitcoin could grind higher anyway. Indeed, while major stock market indices sold off at first, they rallied near the end of the day to close roughly midrange.

We must not forget that M2 is starting to grow once again:

US treasury debt issuance is also soaring not just because of the growing US debt mountain fed by an annual $1.7 trillion deficit but also some $9 trillion of debt is maturing that requires refinancing for which the US requires more stealth QE. Expect higher consumer and asset prices most every nation is inflating their own respective debt bubbles with maturing debt that needs to be constantly rolled over. All aboard the inflation mega-trend train via stealth QE. That said, this ride could get very bumpy along the way due to the tug-o-war between a market being led by the fewest names yet, a slowing economy, and interest rate pressures that stay higher for longer, or worse, catches the Fed on their backfoot forcing them to lower rates in a hurry as recession sets in.