Should NVDA gap lower by a small amount, it is likely a buying opportunity as NVDA remains top dog for the foreseeable future. This bodes well for the other tech juggernauts such as AMZN, MSFT, and META who are buying up NVDA's chips. In consequence, the general market should also move higher after this brief pullback brought on by Fed Chairman Jerome Powell stating that the central bank is in no hurry to lower interest rates further, dampening expectations for rate cuts.

Below are the key takeaways from yesterday's NVDA conference call:

Financial Highlights

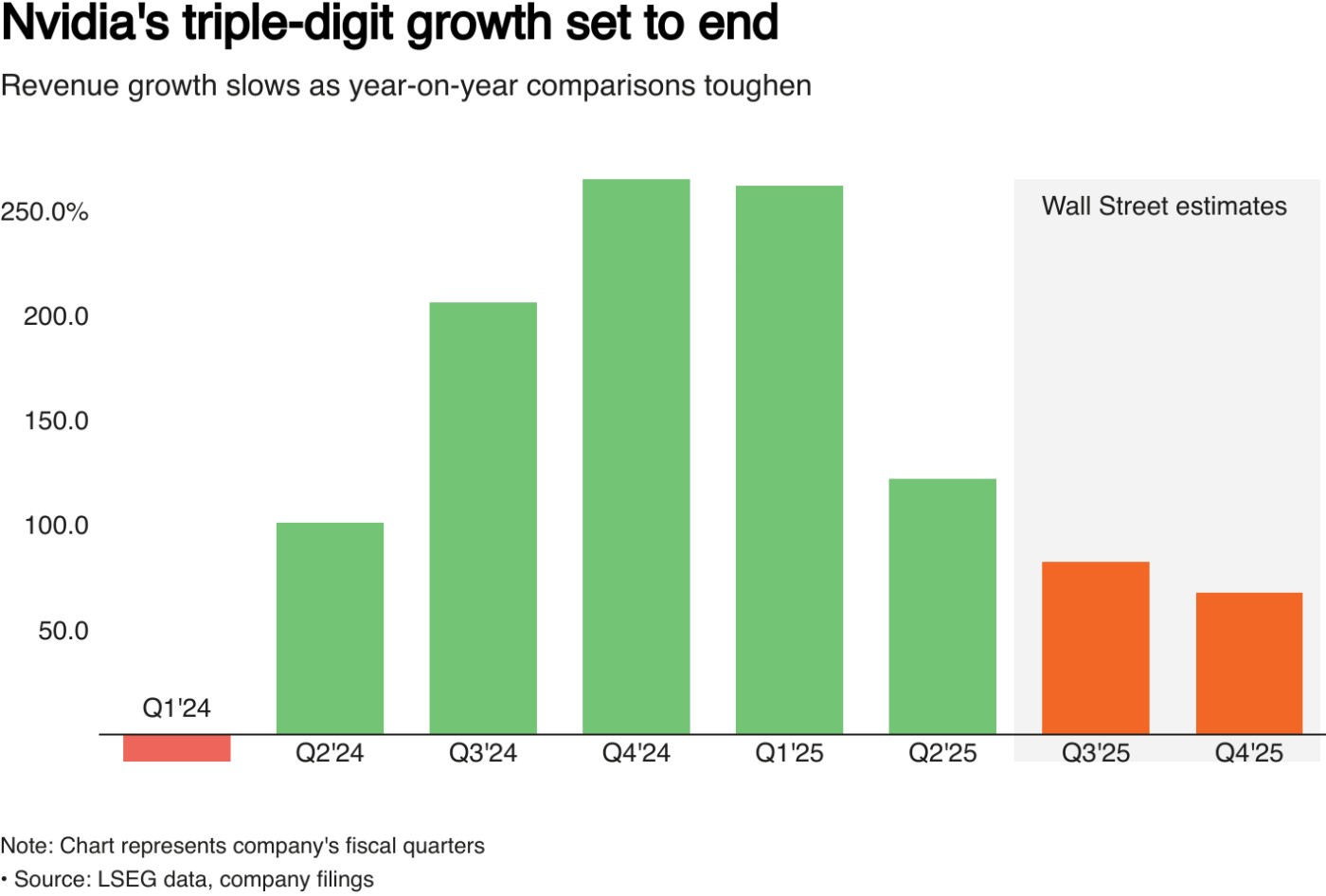

- Revenue: NVIDIA reported record revenue of $35.1 billion for Q3 FY2025, a 94% year-over-year increase and 17% sequential growth, surpassing its guidance of $32.5 billion23.

- Gross Margins: GAAP gross margin was 74.6%, while non-GAAP gross margin reached 75%. These figures reflect strong operational efficiency, although initial production costs for new products like Blackwell may temporarily pressure margins3.

- Data Center Revenue: This segment achieved $30.8 billion in revenue, up 112% year-over-year, fueled by robust demand for AI infrastructure from major tech companies such as Meta, Amazon, Alphabet, and Microsoft13.

- Gaming Revenue: Gaming revenue grew to $3.3 billion, marking a 15% year-over-year and 14% sequential increase3.

Key Product and Business Updates

- Blackwell GPUs: NVIDIA's latest Blackwell architecture is now in full production and has been described as a "game changer" for the industry. Early benchmarks indicate significant performance improvements. However, supply constraints are expected to persist into FY2026 due to high demand13.

- AI Enterprise Growth: Revenue from AI enterprise solutions is projected to more than double year-over-year. Annualized revenue from software services and support is expected to exceed $2 billion by year-end2.

- Hopper GPUs: Alongside Blackwell, the Hopper H200 GPUs are experiencing the fastest ramp in NVIDIA's history, further driving growth in the data center segment3.

Strategic Outlook

- NVIDIA expects Q4 FY2025 revenue of $37.5 billion (±2%), exceeding Wall Street's expectations of $36.9 billion. Gross margins are forecasted to stabilize in the low-to-mid 70s as Blackwell production scales12.

- The company is focused on addressing supply chain challenges to meet surging demand across its product lines.

- Significant opportunities are emerging in Sovereign AI initiatives and regional AI factories globally, which could further bolster growth3.

Risks and Challenges

- Supply Constraints: Limited availability of Blackwell GPUs and gaming products could impact near-term growth12.

- Export Restrictions: Competitive conditions in China due to export restrictions may influence future data center revenues from that region2.