Market Lab Report / Dr. K's Crypto-Corner

by Dr. Chris Kacher

The Metaversal Evolution Will Not Be Centralized™

Markets tumbled today on worries about Trump's upcoming tariffs which would proceed as planned for tariffs on Canada and Mexico. The market that was rangebound due to uncertainties about the economy, interest rates, inflation, and an overvalued situation is unforgiving. Shares of Nvidia fell even after the chip giant exceeded fourth-quarter estimates on the top and bottom lines. The AI play also issued strong guidance, reflecting continued demand driven by the artificial intelligence race. However, the company posted a decline in gross margins for the quarter and its smallest revenue beat in two years, raising questions about whether the bull market leader could keep its momentum going. A Bank of America analyst said, “The demand environment is exceptionally strong, and now you have a stock which is growing 50% to 60% a year ... and it’s trading at less than one times their earnings growth. If you look at the S&P 500 or if you look at the other [Magnificent Seven] stocks, they are trading at two times their earnings growth, so from that perspective we think Nvidia is very compellingly valued.”

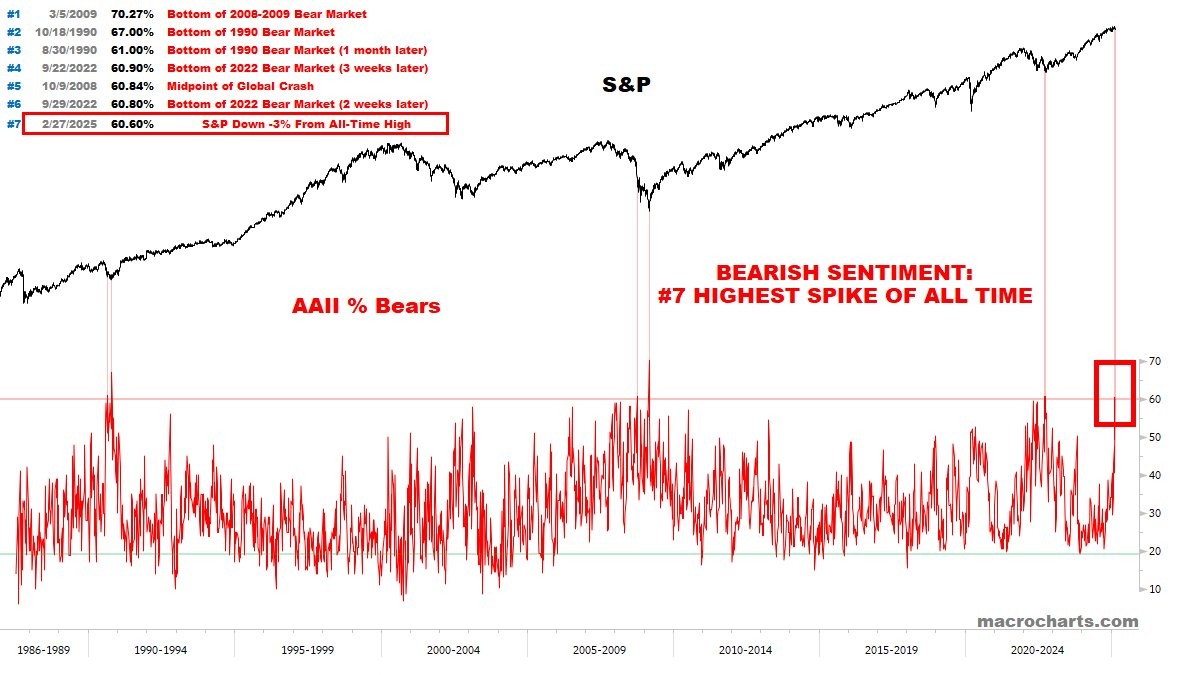

That said, bearish sentiment has spiked to levels seen near or at major market lows.

ISM vs global liquidity vs markets

The ISM Purchasing Managers Index (PMI) for manufacturing is the best indicator to dictate where we are in the business cycle. Above 50 suggests that the economy is in expansion, below 50 contraction. It recently surpassed 50 for the first time in 3 years. It also leads global liquidity which suggests markets and bitcoin should move higher sooner than later.

Global liquidity itself has been moving higher since the start of the year after it declined the last 3 months of 2024. (The black line is global liquidity. The orange line is BTC based on its percentage change in price over a moving 6 weeks. )

Bitcoin has a tendency to trade in sharp moves so every time things start to look ugly, it stabilizes which forms the lower parts of its base. This happened several times in 2024 as bitcoin formed a 9 month base.

Since bitcoin correlates well overall with global liquidity on a monthly basis, the current upswing in global liquidity led by the ISM PMI for manufacturing also suggests bitcoin is ready to trend higher. Of course, unusual events can break the correlation for a short while such as the Japanese yen carry trade disaster in Aug-2024 or when Germany and Mt. Gox sold several billion dollars in BTC in mid-2024, but the correlation nevertheless persists on at least a quarterly if not monthly basis.

Tariffs, AI, and unemployment

Currently, the tariffs issue which should ultimately be beneficial to the economy may initially drag markets lower as trade may be temporarily curbed. Also, unemployment is likely to spike as the Trump administration continues to lay off workers and AI makes a deeper impact on some traditional jobs made redundant from the technology. That said, new jobs created from technology have always more than replaced any jobs made redundant which is why the number of jobs always grows despite the advances in technology over the last century that make many old jobs redundant. Already, the number of new AI-related jobs where a near countless number of AI tools and platforms that need to be created then properly utilized to maximize efficiencies is growing exponentially. Therefore this house cleaning from DOGE firings of tens of thousands of federal workers and the transformation of a portion of old jobs into a greater number of new ones due to AI is necessary so any spike in unemployment is likely temporary.

But back to the ISM Purchasing Managers Index for manufacturing. For the last 20 years, the ISM manufacturing required record low interest rates and direct quantitative easing to stimulate the economy past the 50 mark. But this time, the ISM managed to move above 50 even though interest rates are on hold and direct quantitative easing is absent though stealth QE is impactful. That said, rates across central banks are likely to continue to move lower this year, but this assumes the rate of inflation does not accelerate. Even if inflation starts to move higher, growth from cutting edge technologies can prevent a recession.

In past cycles, there is something called the three steps and a stumble where the Fed hikes rates three times in the face of a moderate to strong economy during which time, the stock market continues higher. It is then on the third hike (roughly speaking) that markets finally derail as recession hits. So even if the inflation rate starts to tick higher, we are in a rising growth environment which would push us from phase 2 of the business cycle where we have growth with lower to moderating inflation to phase 3 where we have growth with higher inflation. This forces the Fed to hike rates to cool down the economy. Any uptick in the inflation rate could force the Fed to potentially hike rates, but bleeding edge technologies such as AI are creating enormous value at individual, corporate, and governmental levels.

AI tools, apps, and platforms are evolving at breakneck speeds.

- AI agent capabilities are expanding at a jaw-dropping pace and replacing entire teams and departments.

- Humanoid robots will become as affordable as a car lease and revolutionize manufacturing, healthcare, and the cost of everything we produce.

- Daily breakthroughs in longevity science are disrupting healthcare, drug development and the insurance industry.

- The mass adoption of AR/VR eyewear transforming how we learn, work and experience the physical world.

- And how all the other exponential technologies like 3D printing and quantum computing are merging and combining to solve the world’s toughest challenges.

QE, meanwhile, continues as stealth QE to fund unfunded liabilities like the massive expense on debt interest. CME FedWatch is pricing in one more rate cut this year.

Leading indicators like the Philly Fed survey are showing that the ISM PMI for manufacturing is about to make a big move higher in the coming months, plus it beat estimates.

But markets tanked last Friday due to the S&P Global US Services PMI which came in below expectations (49.7 vs est 52.8) into contraction territory as well as consumer sentiment (64.7 vs est 67.8). This was the first contraction in the services sector in over two years due to stagnation in new orders due to concern over tariffs, spending cuts, and easy money policies which spurs inflation. But as discussed, these issues could be temporary since they can lead to a stronger economy.

This is why the better gauge is the ISM Purchasing Managers Index for manufacturing which shows when it has bounced off lows as it did in late 2012, early 2016, early 2020, and earlier this year, Bitcoin trends higher overall. You can see in the chart how whenever ISM moved above 50, bitcoin trended higher. And it appears as if the ISM is just getting started.

Altcoins which have underperformed during risk-off periods tend to outperform bitcoin as the pace of global liquidity rises which then finds its way into the higher risk-on cryptocurrencies.

Of course, all of the above is the 50,000-foot view. At present, we see bitcoin and major averages trading in a chop and slop trendless manner with a downward bias, great for day and swing trades so being nimble is key.